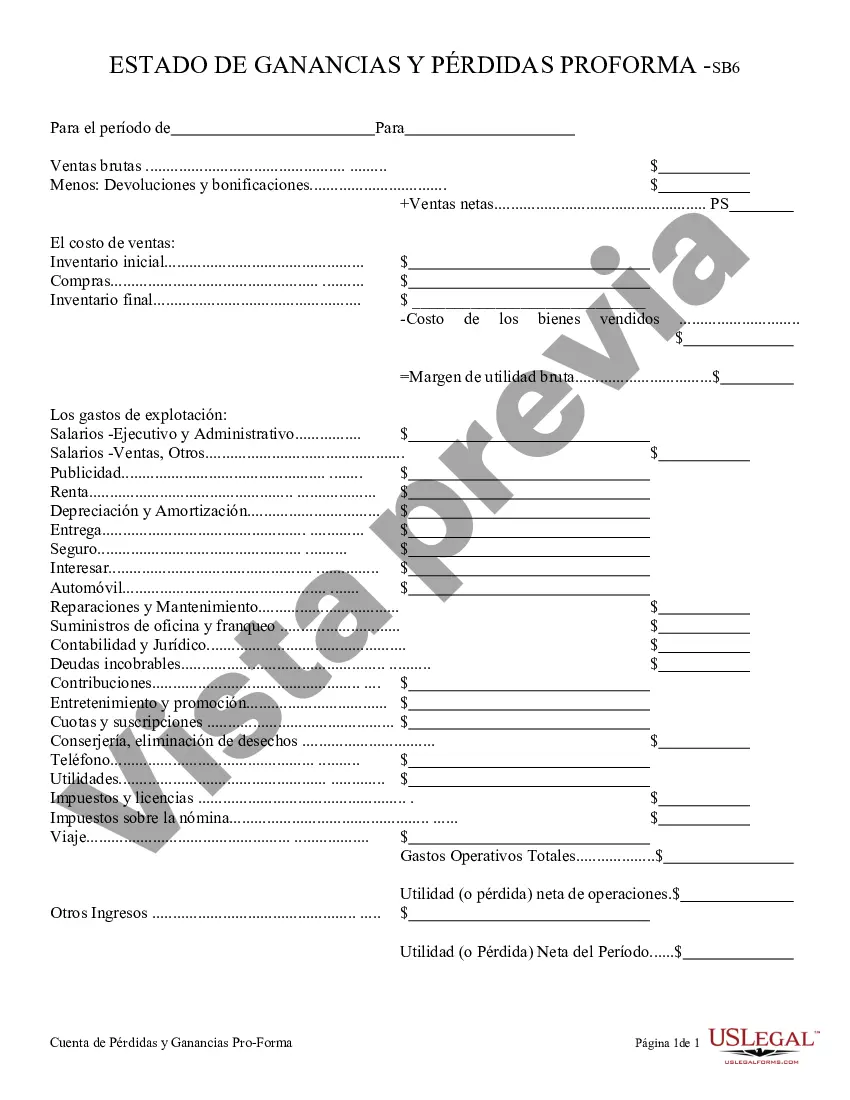

Maricopa, Arizona Profit and Loss Statement is a financial document that provides a detailed summary of a business's revenue, costs, and expenses over a specific period. This statement is commonly used by businesses in Maricopa, Arizona to assess their financial performance and determine their profitability. The Maricopa, Arizona Profit and Loss Statement, also known as an income statement or P&L statement, is crucial for business owners, stakeholders, and investors as it helps them understand the financial health of the company. By analyzing the revenue, costs, and expenses, businesses can identify areas of opportunity, make informed decisions, and take necessary actions to improve their profitability. There are various types of Maricopa, Arizona Profit and Loss Statements that can be generated depending on the specific needs of a business. Common types include: 1. Monthly Profit and Loss Statement: This type of statement is prepared on a monthly basis and reflects the financial performance of the business for that particular month. It provides a detailed breakdown of revenue, costs, and expenses incurred during that period. 2. Quarterly Profit and Loss Statement: This statement is generated every quarter and provides a comprehensive overview of the financial performance over three months. It helps businesses identify trends, monitor their progress, and make necessary adjustments. 3. Annual Profit and Loss Statement: This statement is created at the end of the fiscal year and summarizes the financial results of the business over the entire year. It presents a comprehensive picture of the business's revenue, costs, and expenses and is often used for tax purposes, financial reporting, and strategic planning. 4. Comparative Profit and Loss Statement: This type of statement compares the financial performance of the business over different periods, such as comparing the current year's results to the previous year. It helps businesses identify changes, trends, and areas of improvement or concern. In conclusion, the Maricopa, Arizona Profit and Loss Statement is a critical financial document that provides a detailed breakdown of a business's revenue, costs, and expenses. It helps businesses assess their financial performance, make informed decisions, and take necessary actions to improve profitability. Different types of statements, such as monthly, quarterly, annual, and comparative, can be generated based on the specific needs of the business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out Maricopa Arizona Declaración De Ganancias Y Pérdidas?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Maricopa Profit and Loss Statement.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Maricopa Profit and Loss Statement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Maricopa Profit and Loss Statement:

- Ensure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Maricopa Profit and Loss Statement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!