A Miami-Dade Florida Profit and Loss Statement (P&L Statement) is a financial document that provides a detailed summary of the revenues, costs, and expenses incurred by a business or organization in the Miami-Dade County, Florida area during a specific accounting period. This statement is crucial for determining the profitability and financial health of a company or project. The main sections of a Miami-Dade Florida Profit and Loss Statement typically include: 1. Revenue: This section outlines all sources of income generated by the business, such as sales, services rendered, or rental income. Keywords: income, sales, revenue, earnings, turnover. 2. Cost of Goods Sold (COGS): COGS represents the expenses directly associated with producing or delivering goods or services. It includes the cost of raw materials, labor, and manufacturing overheads. Keywords: COGS, production cost, direct cost, expenses. 3. Operating Expenses: This section encompasses all costs incurred during regular business operations, excluding COGS. These expenses include rent, utilities, salaries, marketing expenses, office supplies, and maintenance costs. Keywords: operating expenses, overhead expenses, administrative expenses, non-production expenses. 4. Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue. It represents the profitability of a company's core operations before considering other operating expenses. Keywords: gross profit, gross income, contribution margin. 5. Operating Income: Operating income is obtained by subtracting the operating expenses from the gross profit. It reflects the profitability of a business after accounting for both COGS and operating expenses. Keywords: operating income, operating profit, EBIT (earnings before interest and taxes). 6. Other Income/Expenses: This section includes any non-operating income (interest income, investment gains) or expenses (interest paid, losses from investments) that are not directly related to the core business activities. Keywords: non-operating income, other income, non-operating expenses, extraordinary items. 7. Net Income: Net income, also known as the bottom line or profit, is the final figure obtained by subtracting other income/expenses from the operating income. It represents the overall profitability of the business after considering all revenues and expenses. Keywords: net income, profit, earnings, bottom line, net profit. Some different types of Miami-Dade Florida Profit and Loss Statements may include budgeted P&L statements, forecasting P&L statements, comparative P&L statements, and consolidated P&L statements for businesses with multiple branches or subsidiaries. Overall, a Miami-Dade Florida Profit and Loss Statement serves as a vital tool for businesses in the area to assess their financial performance, identify areas of improvement, plan budgets, attract investors, and make informed decisions to enhance profitability and sustainability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Declaración de ganancias y pérdidas - Profit and Loss Statement

State:

Multi-State

County:

Miami-Dade

Control #:

US-SB-6

Format:

Word

Instant download

Description

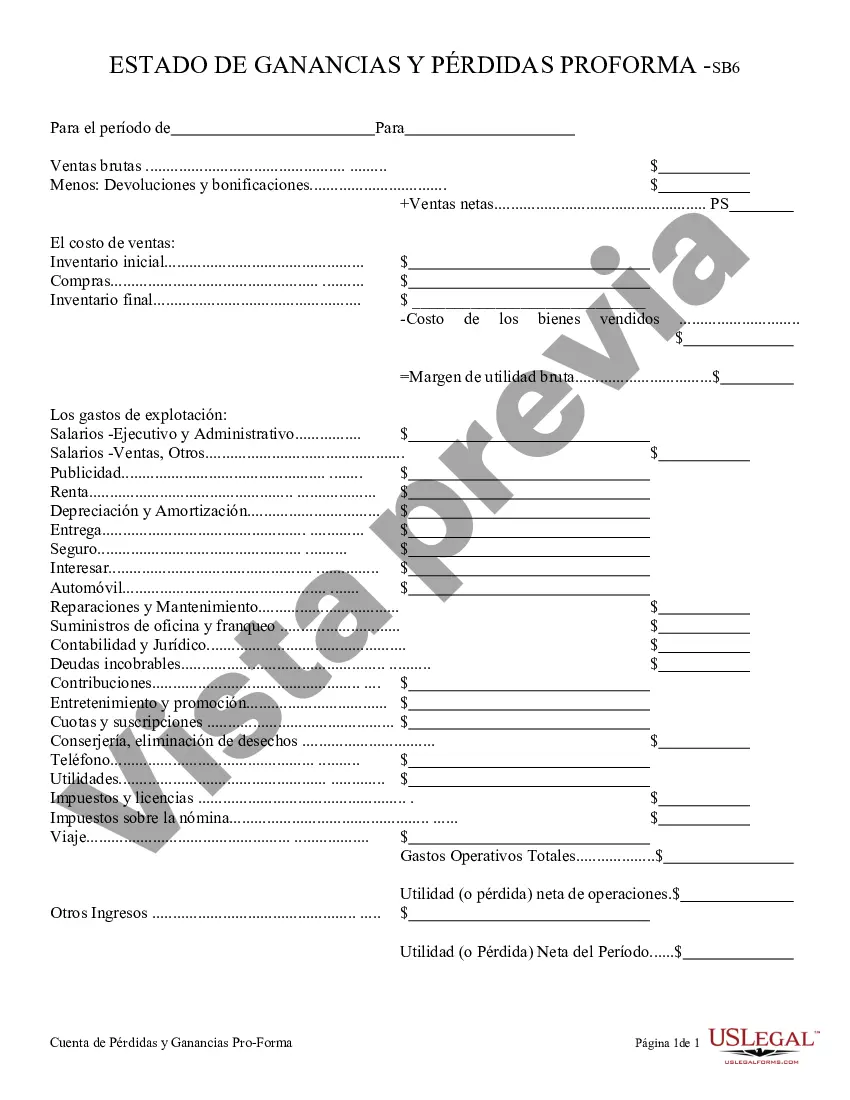

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor.

A Miami-Dade Florida Profit and Loss Statement (P&L Statement) is a financial document that provides a detailed summary of the revenues, costs, and expenses incurred by a business or organization in the Miami-Dade County, Florida area during a specific accounting period. This statement is crucial for determining the profitability and financial health of a company or project. The main sections of a Miami-Dade Florida Profit and Loss Statement typically include: 1. Revenue: This section outlines all sources of income generated by the business, such as sales, services rendered, or rental income. Keywords: income, sales, revenue, earnings, turnover. 2. Cost of Goods Sold (COGS): COGS represents the expenses directly associated with producing or delivering goods or services. It includes the cost of raw materials, labor, and manufacturing overheads. Keywords: COGS, production cost, direct cost, expenses. 3. Operating Expenses: This section encompasses all costs incurred during regular business operations, excluding COGS. These expenses include rent, utilities, salaries, marketing expenses, office supplies, and maintenance costs. Keywords: operating expenses, overhead expenses, administrative expenses, non-production expenses. 4. Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue. It represents the profitability of a company's core operations before considering other operating expenses. Keywords: gross profit, gross income, contribution margin. 5. Operating Income: Operating income is obtained by subtracting the operating expenses from the gross profit. It reflects the profitability of a business after accounting for both COGS and operating expenses. Keywords: operating income, operating profit, EBIT (earnings before interest and taxes). 6. Other Income/Expenses: This section includes any non-operating income (interest income, investment gains) or expenses (interest paid, losses from investments) that are not directly related to the core business activities. Keywords: non-operating income, other income, non-operating expenses, extraordinary items. 7. Net Income: Net income, also known as the bottom line or profit, is the final figure obtained by subtracting other income/expenses from the operating income. It represents the overall profitability of the business after considering all revenues and expenses. Keywords: net income, profit, earnings, bottom line, net profit. Some different types of Miami-Dade Florida Profit and Loss Statements may include budgeted P&L statements, forecasting P&L statements, comparative P&L statements, and consolidated P&L statements for businesses with multiple branches or subsidiaries. Overall, a Miami-Dade Florida Profit and Loss Statement serves as a vital tool for businesses in the area to assess their financial performance, identify areas of improvement, plan budgets, attract investors, and make informed decisions to enhance profitability and sustainability.