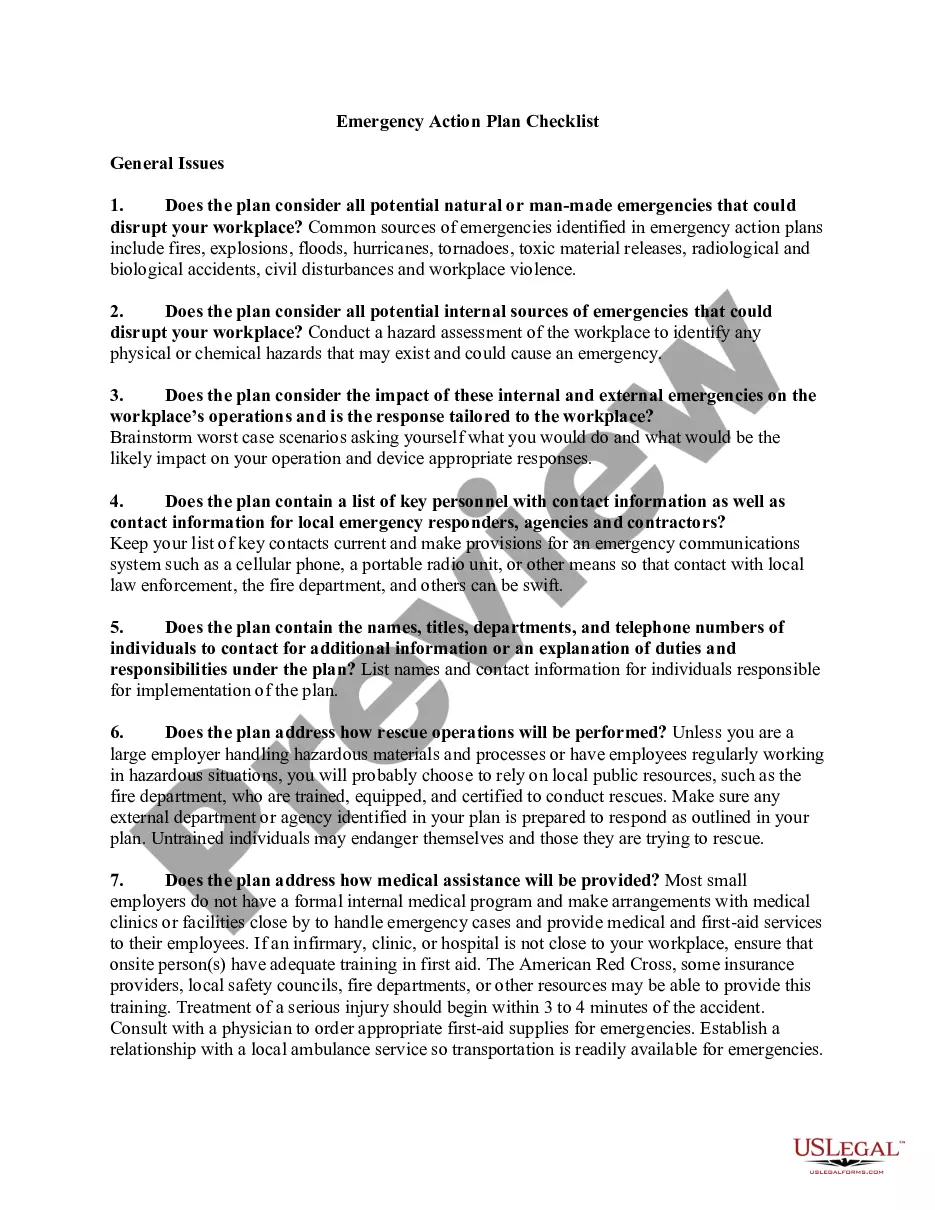

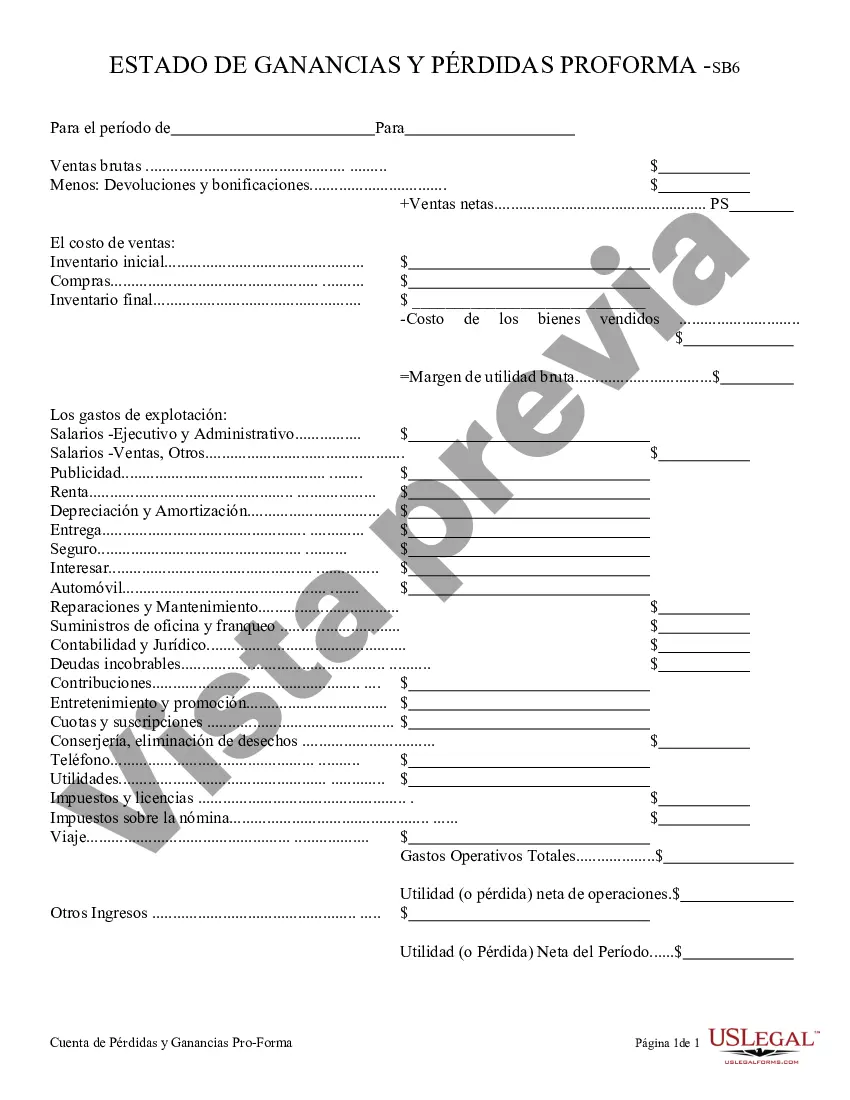

Palm Beach, Florida is a well-known coastal town located in Palm Beach County, Florida. Renowned for its picturesque beaches and luxurious lifestyle, Palm Beach attracts not only tourists but also businesses and investors from all over the world. When it comes to managing businesses effectively, understanding financial statements like the Profit and Loss Statement is essential. A Palm Beach Florida Profit and Loss Statement, also known as an income statement or P&L statement, is a vital financial document that summarizes a company's revenues, costs, and expenses over a specific period. It offers valuable insights into the financial performance of a business, enabling owners, investors, and stakeholders to assess its profitability. Keywords: Palm Beach Florida, Profit and Loss Statement, P&L statement, income statement, financial performance, revenues, costs, expenses, profitability. Common types of Palm Beach Florida Profit and Loss Statements may include: 1. Annual Statement: This type of P&L statement provides an overview of a company's financial performance over an entire year. It typically includes revenue and expense details across various categories, such as sales, operating expenses, cost of goods sold, and net income. 2. Quarterly Statement: A quarterly P&L statement highlights a company's financial performance over a specific three-month period. It breaks down revenues, costs, and expenses to give a more detailed analysis of the company's financial health. 3. Year-to-Date Statement: A year-to-date P&L statement compiles the financial data from the start of the fiscal year to the current date. This statement is useful for tracking a company's financial progress throughout the year. 4. Comparative Statement: A comparative P&L statement facilitates a year-over-year or period-over-period comparison of a company's financial performance. It allows businesses to identify trends and patterns, enabling them to make informed decisions. 5. Projected Statement: A projected P&L statement estimates a company's future financial performance based on anticipated revenues, costs, and expenses. It aids in forecasting profitability and helps in setting realistic financial goals. Regardless of the specific type, Palm Beach Florida Profit and Loss Statements serve as crucial tools for businesses in Palm Beach and beyond. These financial statements offer detailed insights into a company's revenues, costs, and expenses, enabling owners to assess profitability, identify areas of improvement, and make informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out Palm Beach Florida Declaración De Ganancias Y Pérdidas?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Palm Beach Profit and Loss Statement suiting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Palm Beach Profit and Loss Statement, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Palm Beach Profit and Loss Statement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Palm Beach Profit and Loss Statement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!