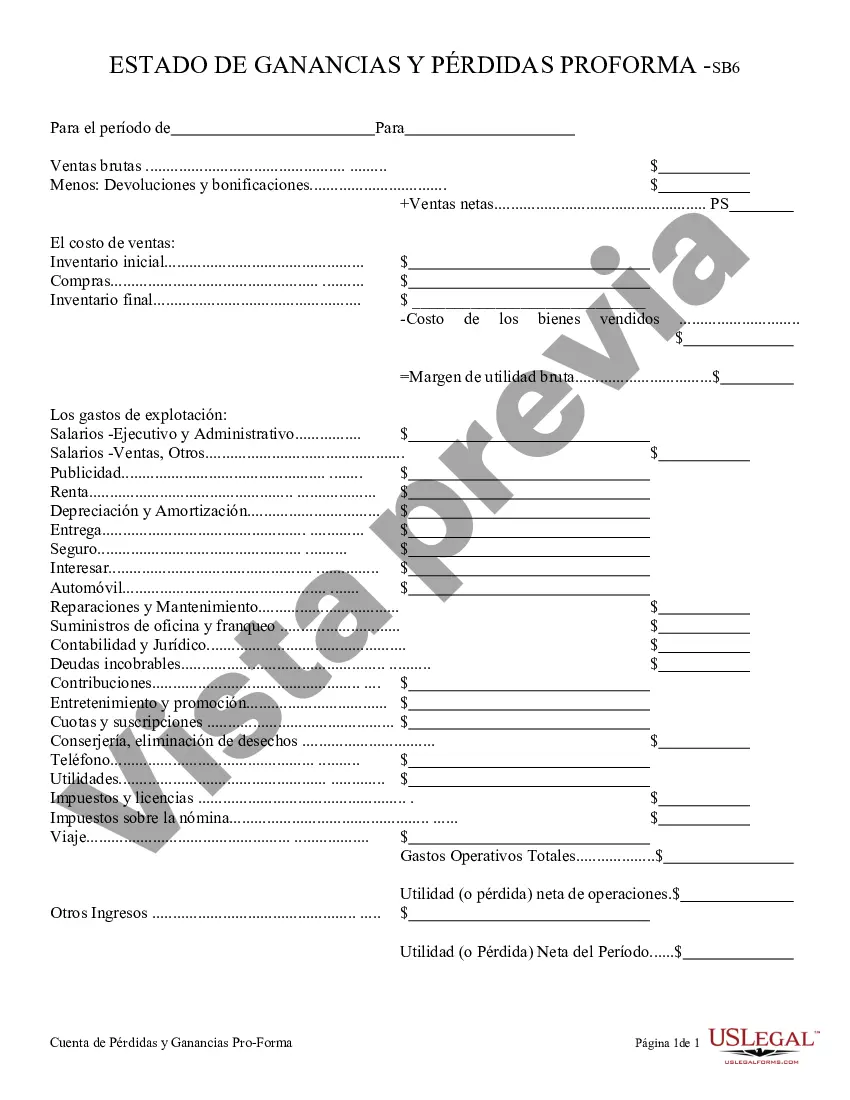

A Phoenix, Arizona Profit and Loss Statement is a financial report that provides a comprehensive overview of a company's revenues, expenses, gains, and losses over a specified period of time. It is commonly used by businesses in Phoenix, Arizona, to assess their financial health and track their profitability. This statement, also known as an Income Statement or Statement of Earnings, summarizes the company's operational performance and is a vital tool for making informed business decisions. The primary components of a Phoenix, Arizona Profit and Loss Statement include: 1. Revenue: This section records all the income generated from the sale of goods or services offered by the company. It encompasses sales revenue, service revenue, rental income, and any other sources of income specific to the business operating in Phoenix, Arizona. 2. Cost of Goods Sold (COGS): COGS refers to the direct expenses incurred to produce or acquire the goods or services sold by the company. It includes the costs of raw materials, direct labor, and manufacturing overhead. For service-oriented businesses, this section might include direct labor and external costs directly associated with delivering the service. 3. Gross Profit: Gross profit is calculated by subtracting the COGS from the total revenue. It reflects the profitability of the core business operations and serves as an indicator of the efficiency of the company's production or service delivery processes. 4. Operating Expenses: This section encompasses all the expenses incurred to support the company's ongoing operations, such as salaries and wages, rent, utilities, marketing costs, and administrative expenses. It provides insights into the costs associated with running the business in Phoenix, Arizona. 5. Operating Income: Operating income is obtained by subtracting the total operating expenses from the gross profit. It represents the profit derived from the company's core operations before considering interest, taxes, and other non-operating items. 6. Other Income and Expenses: This section includes any revenue or expense not directly related to the regular business operations, such as interest income, interest expenses, gains or losses from the sale of assets, and other miscellaneous revenues or expenses. 7. Net Income/Loss: The final section of the Profit and Loss Statement is the net income or loss, which is obtained by subtracting the total other income and expenses from the operating income. Net income reflects the overall profitability of the company after considering all sources of revenue, expenses, gains, and losses. In Phoenix, Arizona, there are no specific types of Profit and Loss Statements exclusive to the region. However, businesses operating in different industries or sectors may use variations of the statement tailored to their specific needs. Some examples include retail profit and loss statements, service industry profit and loss statements, manufacturing profit and loss statements, and restaurant profit and loss statements. Having an accurate and updated Phoenix, Arizona Profit and Loss Statement helps businesses assess financial performance, identify areas of improvement, and make critical decisions related to pricing, expenses, and investments. It assists business owners, stakeholders, and potential investors in evaluating the profitability and sustainability of a company in the Phoenix, Arizona market.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out Phoenix Arizona Declaración De Ganancias Y Pérdidas?

Preparing documents for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Phoenix Profit and Loss Statement without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Phoenix Profit and Loss Statement by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Phoenix Profit and Loss Statement:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!