Sacramento California Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

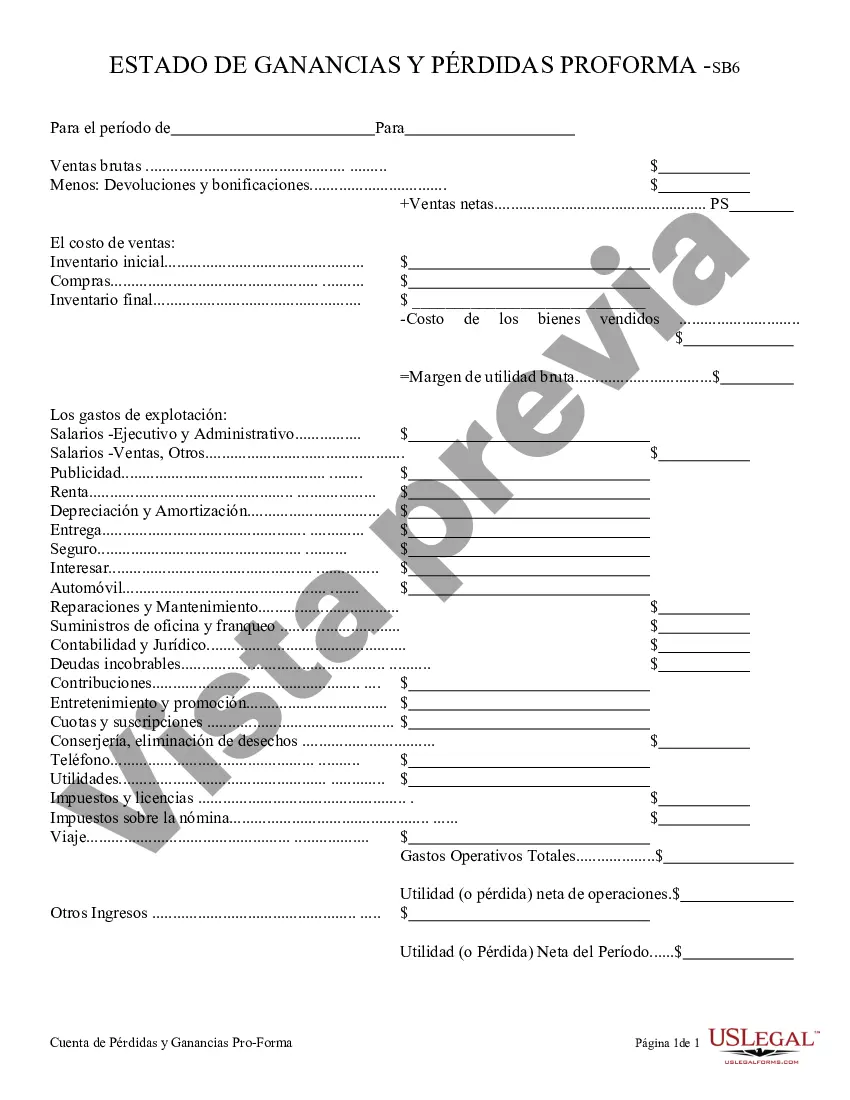

How to fill out Sacramento California Declaración De Ganancias Y Pérdidas?

Creating documents, like Sacramento Profit and Loss Statement, to manage your legal affairs is a difficult and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for different cases and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Sacramento Profit and Loss Statement form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Sacramento Profit and Loss Statement:

- Ensure that your template is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the Sacramento Profit and Loss Statement isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start using our service and get the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Los tipos de deducciones detalladas Impuestos sobre ingresos locales o estatales o los impuestos a las ventas. Impuestos a la propiedad. Gastos medicos y dentales que excedan el 7.5% de tu Ingreso Bruto Ajustado (AGI por sus siglas en ingles) Donaciones caritativas.

Las deducciones personales son las siguientes: - Honorarios medicos, dentales y gastos hospitalarios.- Gastos funerarios.-Donativos.- Intereses reales efectivamente pagados en el ejercicio.- Aportaciones complementarias de retiro.- Primas de seguros de gastos medicos.- Transporte escolar.

Salud. Honorarios a enfermeras.Analisis, estudios clinicos.Compra o alquiler de aparatos para el restablecimiento o rehabilitacion del paciente.Protesis.Compra de lentes opticos graduados para corregir efectos visuales.

Las deducciones personales tienen su fundamento en el articulo 151 de la Ley del Impuesto Sobre la renta (LISR) y son las siguientes: 27a2 Honorarios medicos, dentales y por servicios profesionales en materia de psicologia y nutricion, siempre y cuando sean prestados por personas con titulo profesional.

¿Que gastos se pueden deducir? Salud Gastos medicos, dentales, nutricion y psicologia, todos ellos ejercidos por personal con titulo legalmente establecido. Gastos hospitalarios, medicinas, analisis, estudios, gastos en optica, protesis o primas en seguro de gastos medicos.

En la mayoria de los casos, el casino retendra el 25 por ciento de tus ganancias para los impuestos por apuestas del IRS antes de pagarte.

Si eres persona fisica, conoce que cosas son deducibles de impuestos en tu declaracion: Servicios medicos, dentales, nutricion y psicologia. Gastos por hospitalizacion y medicinas en hospitales. Estudios clinicos o analisis.

Gastos personales libres de impuestos: De seguridad social. - Honorarios medicos, dentales, psicologia, nutricion y otros gastos hospitalarios.De asistencia social. - Donativos no onerosos ni remunerativos. Ahorro. - Intereses reales pagados por creditos hipotecarios.Educacion. 9.- Colegiaturas.

Las deducciones detalladas incluyen montos que usted pago en impuestos estatales y locales sobre ingresos o ventas, impuestos sobre bienes inmuebles, impuestos sobre bienes muebles, intereses hipotecarios y perdidas por desastres por un desastre declarado por el gobierno federal.

Gastos personales libres de impuestos: De seguridad social. - Honorarios medicos, dentales, psicologia, nutricion y otros gastos hospitalarios.De asistencia social. - Donativos no onerosos ni remunerativos. Ahorro. - Intereses reales pagados por creditos hipotecarios.Educacion. 9.- Colegiaturas.