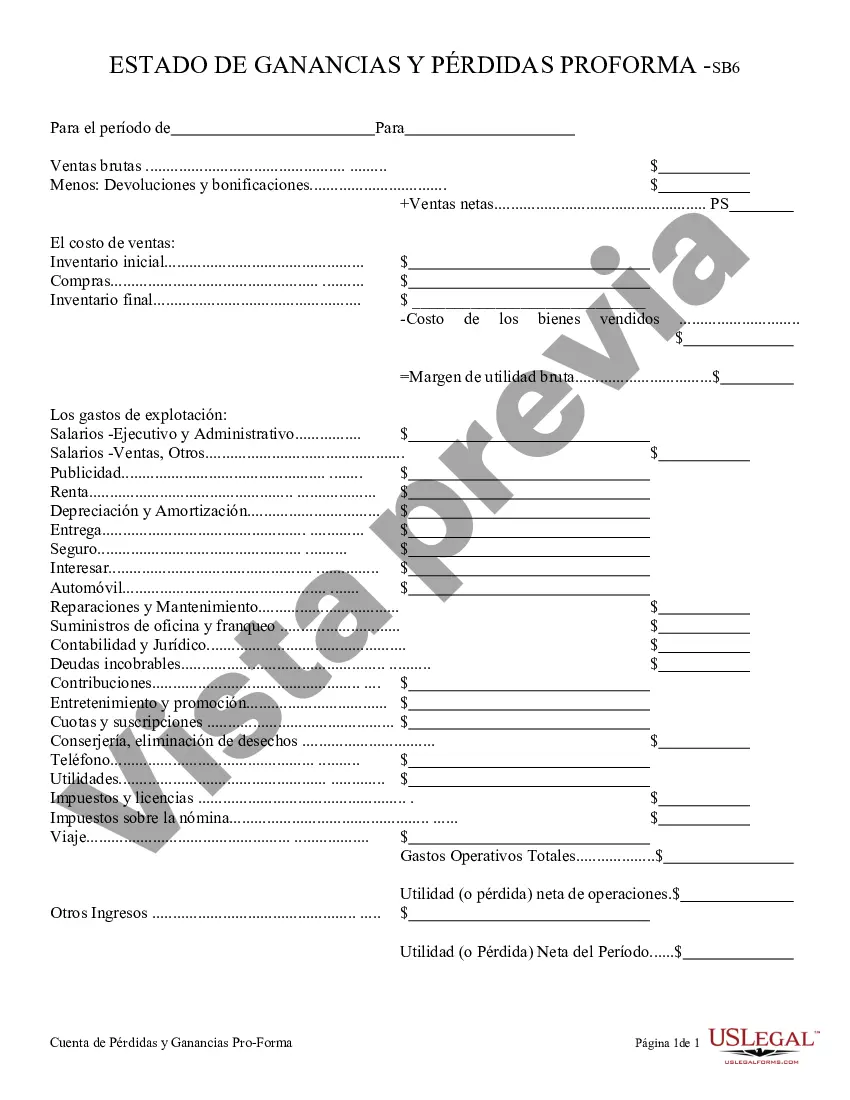

Salt Lake Utah Profit and Loss Statement is a financial document that provides a detailed overview of the financial performance and profitability of a business or organization in Salt Lake City, Utah. It analyzes the revenues, costs, and expenses incurred during a specific period, typically a month, quarter, or year. The statement is commonly used by businesses, investors, lenders, and stakeholders to assess the financial health and viability of a company. Keywords: Salt Lake Utah, Profit and Loss Statement, financial performance, profitability, revenues, costs, expenses, business, organization, Salt Lake City, Utah, financial health, viability. Types of Salt Lake Utah Profit and Loss Statements: 1. Monthly Profit and Loss Statement: This type of statement is prepared on a monthly basis, providing a snapshot of the company's financial performance and profitability for that specific month. It breaks down the revenue, expenses, and net income for the given month, allowing for quick evaluation of monthly financial results. 2. Quarterly Profit and Loss Statement: This statement covers a three-month period and provides a more comprehensive analysis of the business's financial performance. It offers a broader overview of revenue generation, cost management, and profitability trends over a quarter. This type of statement is widely used for monitoring performance goals and making strategic business decisions. 3. Yearly Profit and Loss Statement: Also known as an annual statement, this document offers a comprehensive review of the company's financial performance over a full fiscal year. It summarizes revenue, expenses, gains, and losses incurred throughout the year, providing a complete picture of the business's profitability. This statement is crucial for long-term analysis, financial planning, and preparation of tax returns. 4. Comparative Profit and Loss Statement: This type of statement compares the financial performance of a business over different periods, typically year-on-year or quarter-on-quarter. It enables businesses to identify trends, patterns, and fluctuations in revenues, costs, expenses, and net income. Comparisons help gauge the company's growth, efficiency, and overall financial progress. 5. Department-wise Profit and Loss Statement: In larger organizations with multiple departments, this type of statement provides an analysis of each department's individual financial performance and contribution to the company's overall profitability. It helps identify areas of strength and weakness, facilitates resource allocation, and assists in decision-making for department-specific initiatives. In conclusion, the Salt Lake Utah Profit and Loss Statement is a crucial financial tool that provides a comprehensive overview of a business's financial performance in Salt Lake City, Utah. It allows for the assessment of revenues, costs, expenses, and overall profitability over different periods. Different types of statements, such as monthly, quarterly, yearly, comparative, and department-wise, serve specific purposes and aid in decision-making processes. Businesses can utilize these statements to track financial health, analyze trends, and make informed decisions to optimize performance and profitability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out Salt Lake Utah Declaración De Ganancias Y Pérdidas?

Whether you plan to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Salt Lake Profit and Loss Statement is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Salt Lake Profit and Loss Statement. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Profit and Loss Statement in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!