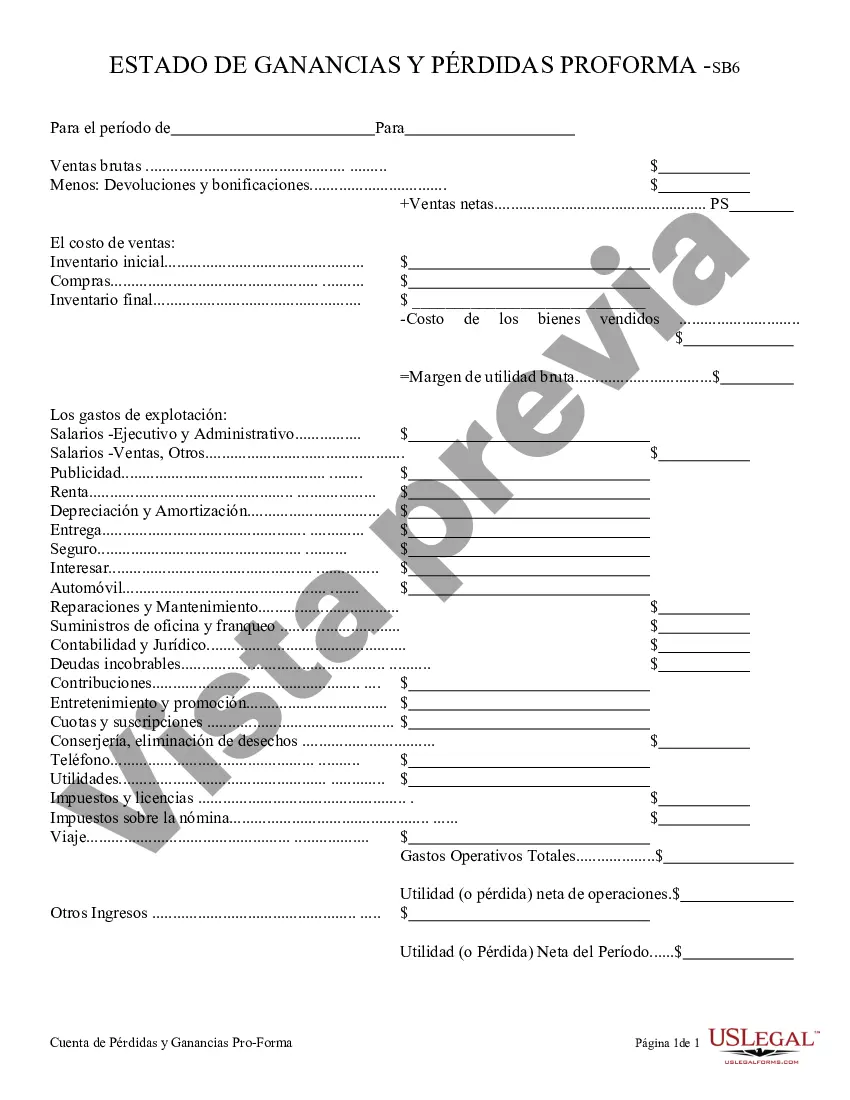

A San Antonio Texas Profit and Loss Statement is a financial document that provides a detailed overview of the income, expenses, and resulting profit or loss of a business operating in San Antonio, Texas. This statement, also known as an income statement, is used by businesses to evaluate their financial performance over a specific period, usually monthly, quarterly, or annually. It is an essential tool for businesses in San Antonio to monitor and analyze their financial success and make informed decisions about their operations and strategies. The San Antonio Texas Profit and Loss Statement typically consists of several key components. The revenue section represents the income generated by the business from sales of goods or services. It includes revenue from various sources, such as product sales, service fees, rental income, or commissions. The cost of goods sold (COGS) section accounts for the direct costs associated with producing or delivering the goods or services sold, including raw materials, manufacturing costs, or direct labor expenses. Operating expenses are another component of the San Antonio Texas Profit and Loss Statement. These expenses include salaries and wages of employees, rent, utilities, marketing and advertising costs, insurance, office supplies, maintenance and repairs, taxes, and other general administration expenses. These costs are necessary for the day-to-day operations of the business. Gross profit is calculated by subtracting the COGS from the revenue, reflecting the profitability of the business's core operations. Operating profit or operating income is determined by subtracting the operating expenses from the gross profit. This figure indicates the profitability of the business operations before considering interest expenses, taxes, or other non-operating items. Other income and expenses may be included in the San Antonio Texas Profit and Loss Statement, such as interest income, interest expenses, gains or losses from the sale of assets, and income taxes. These items are not directly related to the core operations of the business but impact the overall financial performance. It is important to note that different types of businesses in San Antonio may have specific variations of the Profit and Loss Statement. For example, service-based businesses may not have a COGS section since they do not sell tangible products. Instead, they may have a separate section for service-related expenses. Retail businesses may have additional sections for inventory purchases or returns and allowances. In summary, a San Antonio Texas Profit and Loss Statement is a comprehensive financial document that outlines the revenue, expenses, and resulting profit or loss of a business operating in San Antonio. It helps businesses assess their financial health, identify areas for improvement, and make informed decisions to optimize profitability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out San Antonio Texas Declaración De Ganancias Y Pérdidas?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like San Antonio Profit and Loss Statement is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the San Antonio Profit and Loss Statement. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Profit and Loss Statement in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!