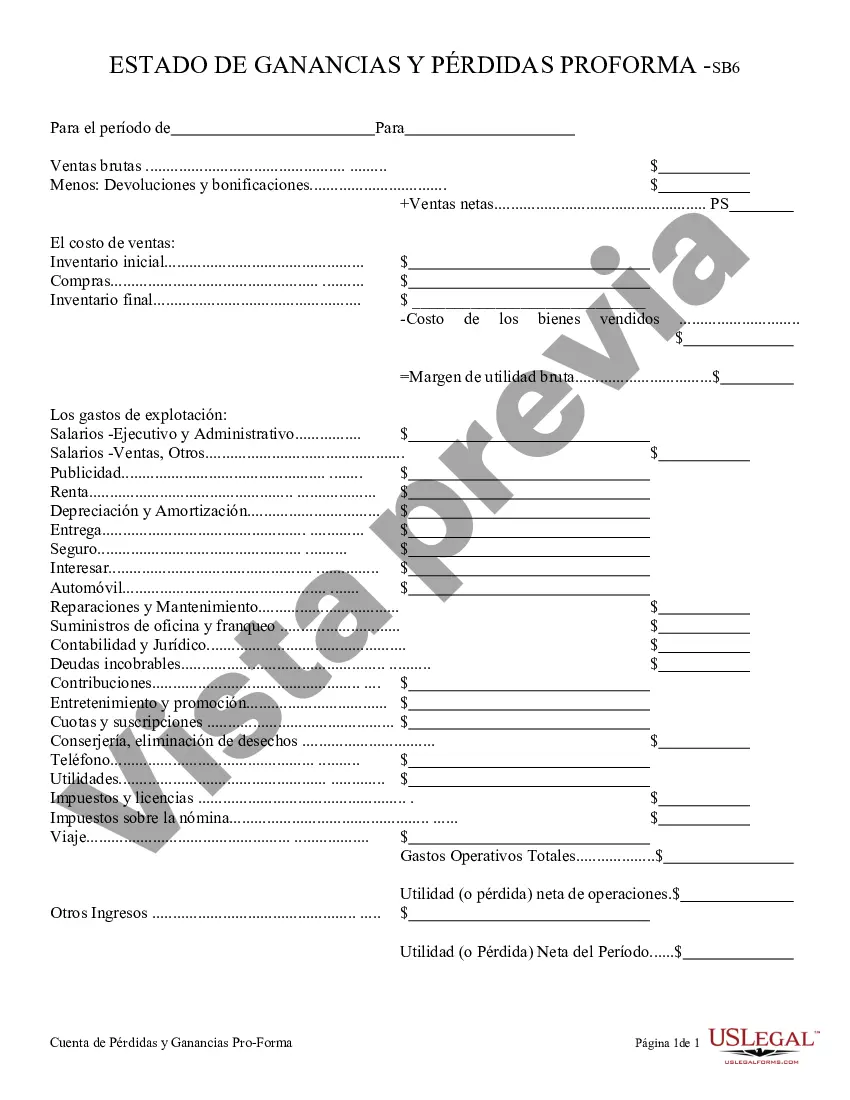

A San Diego California Profit and Loss Statement, also known as an income statement, is a financial report that provides a detailed overview of a business's revenues, costs, and expenses over a specific period of time. It reflects the company's ability to generate profit by increasing revenues, optimizing expenses, and managing costs effectively. The San Diego California Profit and Loss Statement typically consists of various key components, including revenue, cost of goods sold (COGS), gross profit, operating expenses, operating income, and net income. These components help businesses analyze their financial performance, identify areas of improvement, and make informed decisions for future growth. Revenue is the total income generated from the sale of goods or services provided by the business. It includes sales revenue, service revenue, and any other sources of income. The COGS represent the direct expenses directly associated with producing the goods or services sold, including raw materials, labor costs, and manufacturing overhead. Gross profit is calculated by subtracting COGS from the revenue, indicating the profitability of the core business operations. Operating expenses include indirect costs such as salaries, rent, utilities, marketing expenses, and other administrative expenses necessary to run the business. The operating income is determined by deducting operating expenses from the gross profit. Finally, the net income is computed by subtracting taxes and non-operating expenses from the operating income. It represents the final profit generated by the business after accounting for all expenses, taxes, and interest. The San Diego California Profit and Loss Statement is an essential financial tool for businesses located in San Diego, California, as it helps them monitor financial health, evaluate the effectiveness of their business strategies, and make data-driven decisions. By analyzing the revenue and expenses in detail, businesses can identify areas of improvement, optimize their operations, and enhance profitability. While there are no specific types of San Diego California Profit and Loss Statements, businesses may customize their statements to suit their specific needs. This customization could include additional categories or segments of revenue and expenses based on industry-specific requirements or organizational structure. However, regardless of the customization, the underlying purpose of the profit and loss statement remains the same — to provide an overview of financial performance and guide strategic decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out San Diego California Declaración De Ganancias Y Pérdidas?

Preparing paperwork for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft San Diego Profit and Loss Statement without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid San Diego Profit and Loss Statement on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the San Diego Profit and Loss Statement:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any use case with just a couple of clicks!