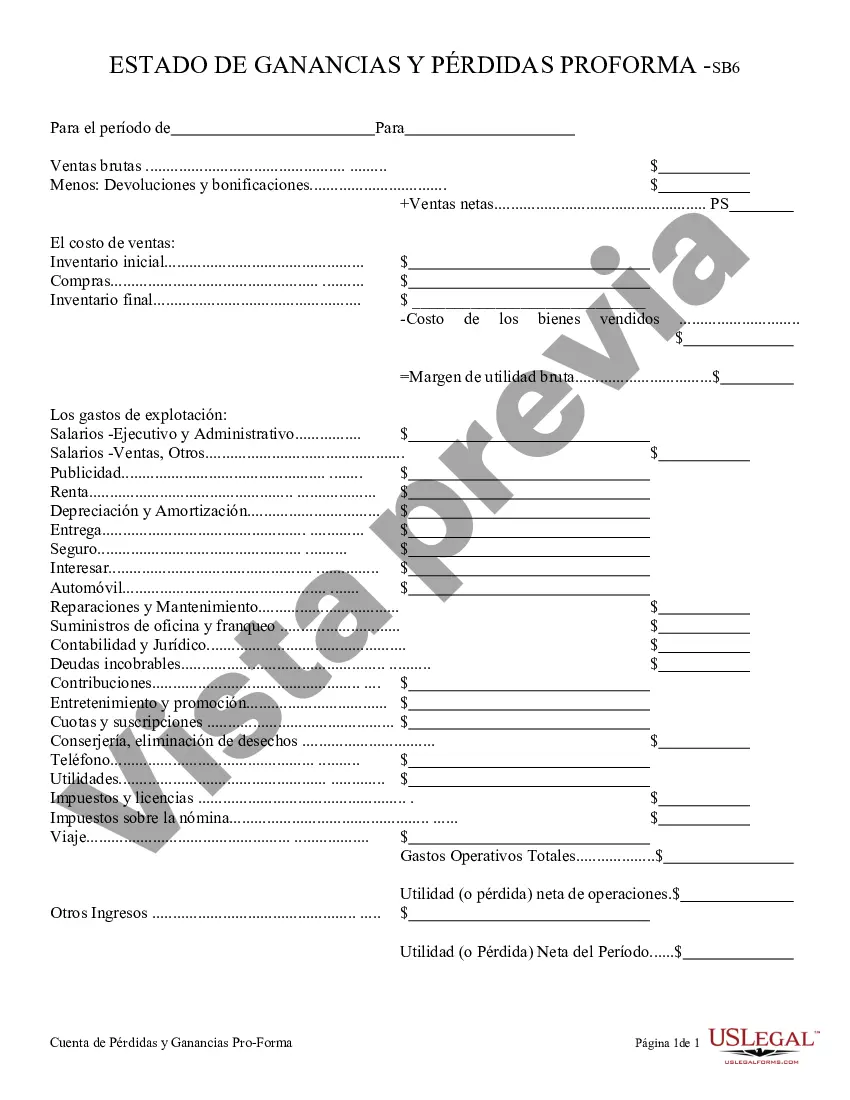

Santa Clara California Profit and Loss Statement is a financial document that summarizes the revenues, costs, and expenses of a business or organization operating in Santa Clara, California. It provides an overview of the company's financial performance over a specific period, usually monthly, quarterly, or annually. This statement helps business owners, investors, and stakeholders analyze the profitability and operational efficiency of the entity. Keywords: Santa Clara, California, profit and loss statement, financial document, revenues, costs, expenses, financial performance, profitability, operational efficiency, business owners, investors, stakeholders. There are several types of Santa Clara California Profit and Loss Statements based on the nature, size, and reporting requirements of the business or organization. Below are some examples: 1. Single-step Profit and Loss Statement: This statement presents revenues and gains separately from expenses and losses, providing a simple and straightforward analysis of net income or loss. 2. Multiple-step Profit and Loss Statement: This type of statement includes multiple sections and subtotals to provide a detailed analysis of various revenue sources, operating expenses, and non-operating gains or losses. It allows for better understanding of profitability by providing intermediate calculations such as gross profit, operating income, and net income. 3. Comparative Profit and Loss Statement: This statement compares multiple periods, enabling businesses to track changes in revenue, expenses, and net income over time. It allows for trend analysis and identification of key areas of growth or concern. 4. Departmental Profit and Loss Statement: For larger organizations with multiple departments or segments, this statement provides a breakdown of revenues, costs, and expenses for each department individually. It helps in identifying the most profitable sections and those requiring adjustments. 5. Project-based Profit and Loss Statement: Ideal for businesses engaged in project-based work, this type of statement tracks revenues, costs, and expenses related to specific projects or contracts. It allows for monitoring project profitability and managing resources efficiently. In conclusion, the Santa Clara California Profit and Loss Statement is a crucial financial document that provides a comprehensive overview of a business's financial performance in the Santa Clara region. By understanding and analyzing this statement, businesses can make informed decisions, manage costs, and maximize profitability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Declaración de ganancias y pérdidas - Profit and Loss Statement

Description

How to fill out Santa Clara California Declaración De Ganancias Y Pérdidas?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, finding a Santa Clara Profit and Loss Statement meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. In addition to the Santa Clara Profit and Loss Statement, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Santa Clara Profit and Loss Statement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Santa Clara Profit and Loss Statement.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!