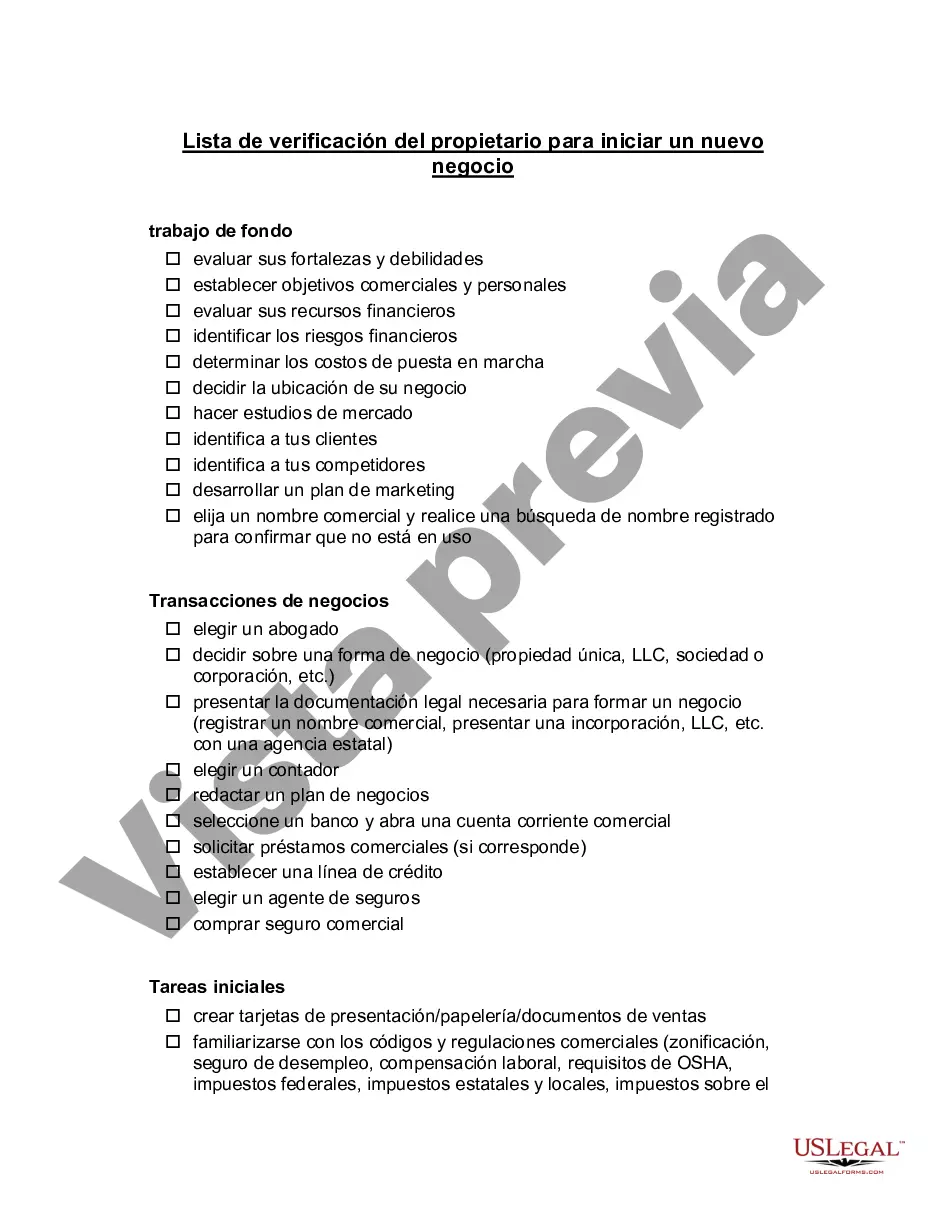

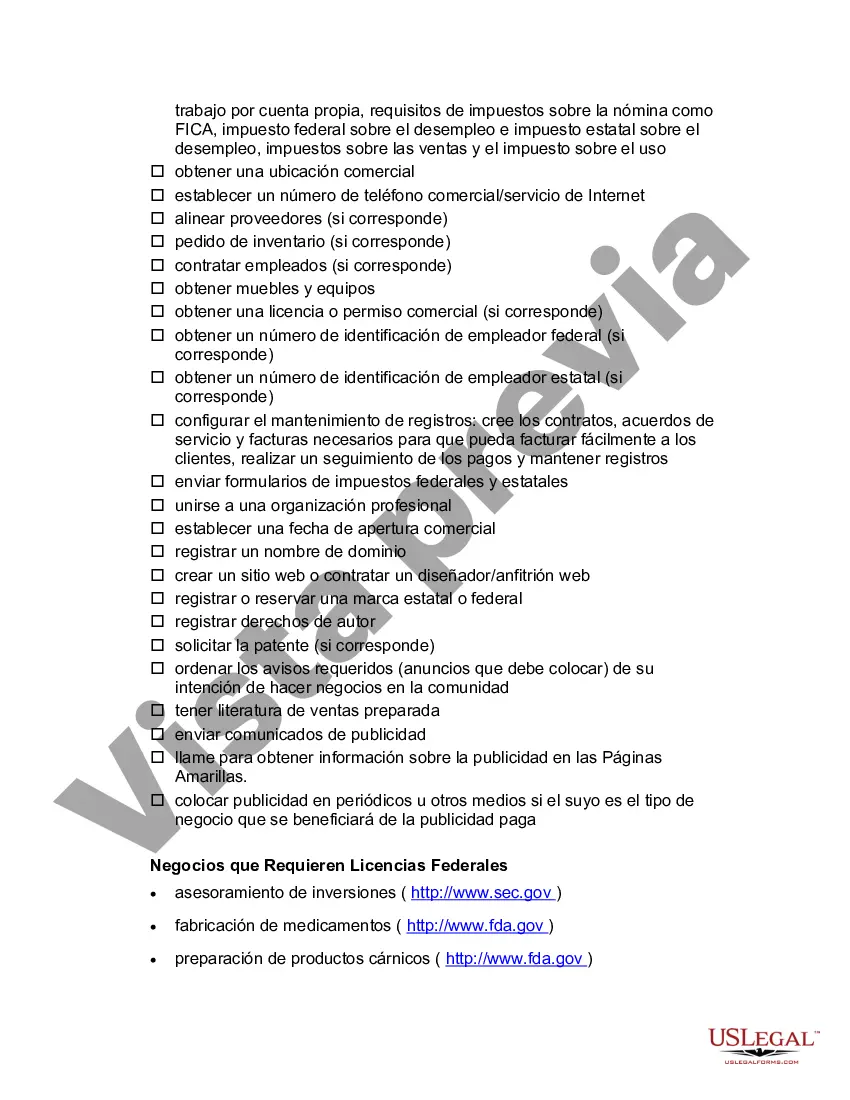

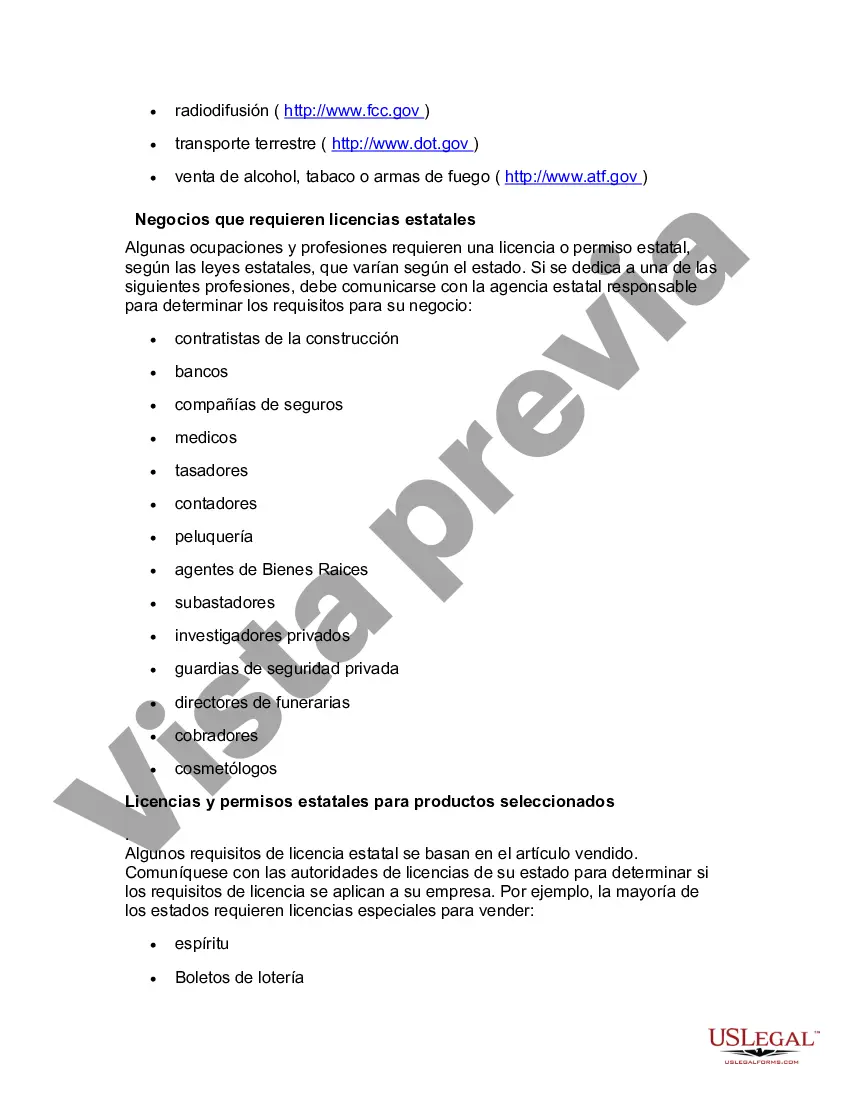

This form is a handy checklist for the owner of a new business to use as a helpful tool in forming a new business. The form covers the stages of background planning, initial business transactions, and initial tasks that need to be accomplished to get the business up and running smoothly.

Hennepin County, located in the state of Minnesota, offers several valuable resources and checklists to guide individuals through the process of starting up a new business. These checklists provide entrepreneurs with step-by-step guidance and information on various legal, financial, and operational considerations. Below are some key components that you can include in a detailed description of Hennepin Minnesota Checklist for Starting Up a New Business, incorporating relevant keywords: 1. Business Plan Development: — Developing a comprehensive business plan is crucial for any new venture. Hennepin County offers a checklist to help entrepreneurs identify key components to include, such as market analysis, marketing strategies, operational plans, and financial projections. 2. Entity Formation: — When starting a new business, one must consider the legal structure of the entity. Hennepin County provides a checklist outlining the steps to register a business as a sole proprietorship, partnership, limited liability company (LLC), or corporation. The checklist covers aspects like choosing a business name, registering with the Secretary of State's office, and obtaining necessary permits and licenses. 3. Regulatory Compliance: — Compliance with local, state, and federal regulations is critical for a new business. Hennepin County's checklist outlines the permits and licenses required for specific industries, including zoning requirements, health department permits, and professional licenses. 4. Tax Obligations: — Understanding and fulfilling tax obligations are crucial for new businesses. Hennepin County provides a tax checklist that covers federal, state, and local tax requirements, including obtaining an employer identification number (EIN), registering for state sales tax, and filing necessary tax returns. 5. Employment and Workforce Development: — If a business plans to hire employees, Hennepin County offers resources on various employment-related factors. This checklist includes obtaining workers' compensation insurance, understanding labor laws, and registering for unemployment insurance through the Minnesota Department of Employment and Economic Development (DEED). 6. Financing and Funding: — Hennepin County provides an overview of potential financing options and grants available to new businesses. This checklist delves into accessing traditional bank loans, grants, small business assistance programs, and resources for minority-owned or women-owned businesses. 7. Market Research and Networking: — Conducting market research and establishing a strong network is vital for the success of any business. Hennepin County's checklist recommends joining local Chambers of Commerce, attending business networking events, and utilizing free resources available through organizations such as SCORE (Service Corps of Retired Executives) and the Small Business Administration (SBA). By incorporating relevant keywords, such as starting a new business, Hennepin County, Minnesota, checklist, business plan, entity formation, regulatory compliance, permits and licenses, tax obligations, employment, financing, market research, and networking, you can create a detailed description that targets individuals looking to start a new business in Hennepin County, Minnesota.Hennepin County, located in the state of Minnesota, offers several valuable resources and checklists to guide individuals through the process of starting up a new business. These checklists provide entrepreneurs with step-by-step guidance and information on various legal, financial, and operational considerations. Below are some key components that you can include in a detailed description of Hennepin Minnesota Checklist for Starting Up a New Business, incorporating relevant keywords: 1. Business Plan Development: — Developing a comprehensive business plan is crucial for any new venture. Hennepin County offers a checklist to help entrepreneurs identify key components to include, such as market analysis, marketing strategies, operational plans, and financial projections. 2. Entity Formation: — When starting a new business, one must consider the legal structure of the entity. Hennepin County provides a checklist outlining the steps to register a business as a sole proprietorship, partnership, limited liability company (LLC), or corporation. The checklist covers aspects like choosing a business name, registering with the Secretary of State's office, and obtaining necessary permits and licenses. 3. Regulatory Compliance: — Compliance with local, state, and federal regulations is critical for a new business. Hennepin County's checklist outlines the permits and licenses required for specific industries, including zoning requirements, health department permits, and professional licenses. 4. Tax Obligations: — Understanding and fulfilling tax obligations are crucial for new businesses. Hennepin County provides a tax checklist that covers federal, state, and local tax requirements, including obtaining an employer identification number (EIN), registering for state sales tax, and filing necessary tax returns. 5. Employment and Workforce Development: — If a business plans to hire employees, Hennepin County offers resources on various employment-related factors. This checklist includes obtaining workers' compensation insurance, understanding labor laws, and registering for unemployment insurance through the Minnesota Department of Employment and Economic Development (DEED). 6. Financing and Funding: — Hennepin County provides an overview of potential financing options and grants available to new businesses. This checklist delves into accessing traditional bank loans, grants, small business assistance programs, and resources for minority-owned or women-owned businesses. 7. Market Research and Networking: — Conducting market research and establishing a strong network is vital for the success of any business. Hennepin County's checklist recommends joining local Chambers of Commerce, attending business networking events, and utilizing free resources available through organizations such as SCORE (Service Corps of Retired Executives) and the Small Business Administration (SBA). By incorporating relevant keywords, such as starting a new business, Hennepin County, Minnesota, checklist, business plan, entity formation, regulatory compliance, permits and licenses, tax obligations, employment, financing, market research, and networking, you can create a detailed description that targets individuals looking to start a new business in Hennepin County, Minnesota.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.