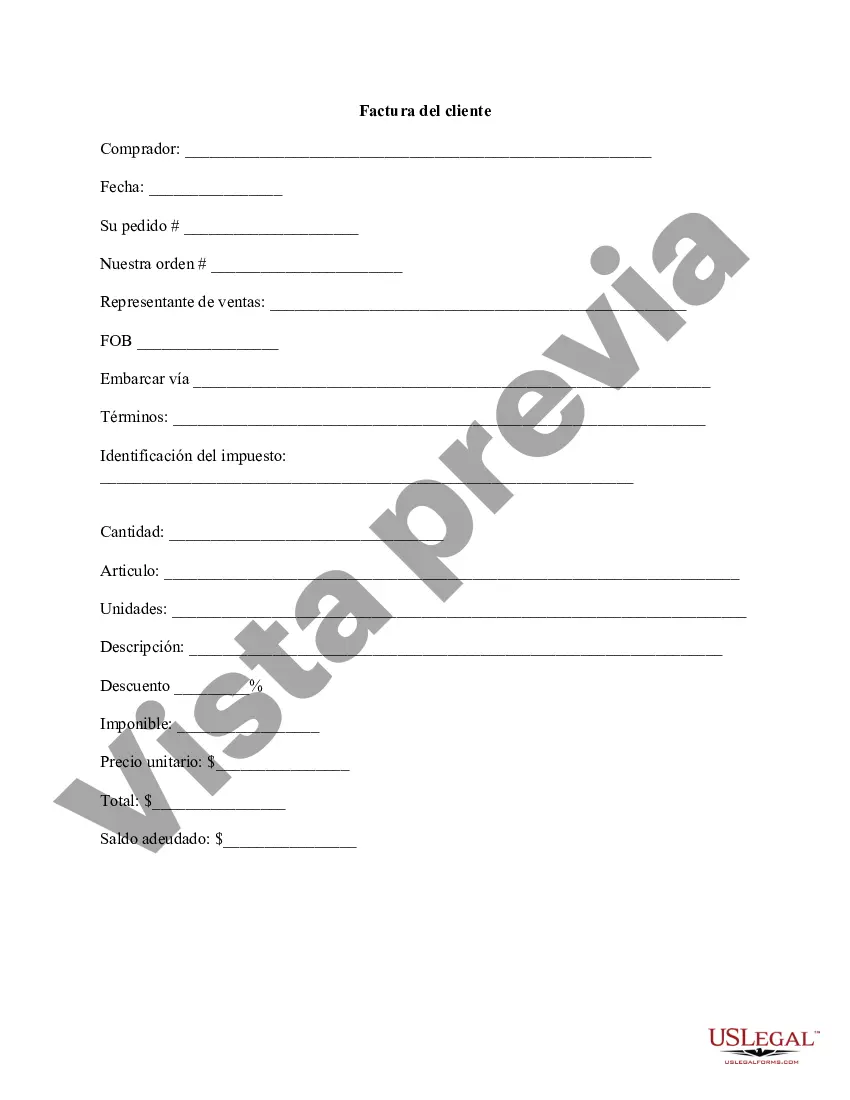

This is an invoice in Word format that allows you to itemize the product or service by quantity, description, and price. It includes shipping information and costs, taxes, as well as sections for notes and additional information. The top portion can be customized with your company logo and address, and contains a customer number, date, invoice number, and billing and shipping addresses.

Clark Nevada Customer Invoice Template is a customizable document used by businesses in Clark County, Nevada, to create professional and accurate invoices for their customers. This template is designed to streamline the invoicing process, ensuring that all necessary information is included and organized in a clear and concise manner. With the Clark Nevada Customer Invoice Template, businesses can effortlessly generate invoices that meet the legal requirements of the county while also showcasing their own branding. This template allows for easy customization, enabling businesses to add their logo, contact information, payment terms, and other relevant details to create a personalized invoice. The Clark Nevada Customer Invoice Template includes various sections to ensure all essential information is included. These sections typically consist of: 1. Business Information: This section allows businesses to include their name, address, phone number, email, and website details. It provides customers with the necessary information to contact the business if needed. 2. Customer Information: Here, businesses can enter their customer's name, address, contact details, and any other relevant information. 3. Invoice Details: This section includes the invoice number, date of issuance, and due date. It also allows businesses to include a purchase order number or other references for easier tracking. 4. Itemized List: In this section, businesses can itemize the products or services provided, including descriptions, quantities, unit prices, and the total amount for each item. 5. Subtotal, Taxes, and Discounts: The template provides space to calculate the subtotal amount, any applicable taxes, discounts, or additional charges. This ensures transparency and accuracy in the final invoice total. 6. Payment Terms: This section outlines the acceptable methods of payment, due dates, and any late payment penalties or incentives offered. 7. Terms and Conditions: Here, businesses can include any additional terms and conditions related to the sale, warranty information, or return policies. 8. Notes: This section allows for any special instructions or additional messages to be conveyed to the customer. Different types of Clark Nevada Customer Invoice Templates may exist to cater to specific industries or businesses. Some common variations include: 1. Professional Services Invoice Template: Suited for businesses providing consulting, marketing, legal, or other professional services. 2. Product Sales Invoice Template: Designed for businesses involved in selling tangible products. 3. Contractor Invoice Template: Tailored for contractors or construction-related businesses to invoice clients for services rendered. In conclusion, the Clark Nevada Customer Invoice Template is a flexible and customizable tool that helps businesses in Clark County, Nevada, create professional invoices accurately and efficiently. It ensures compliance with legal requirements while maintaining a professional image and providing clear information to customers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.