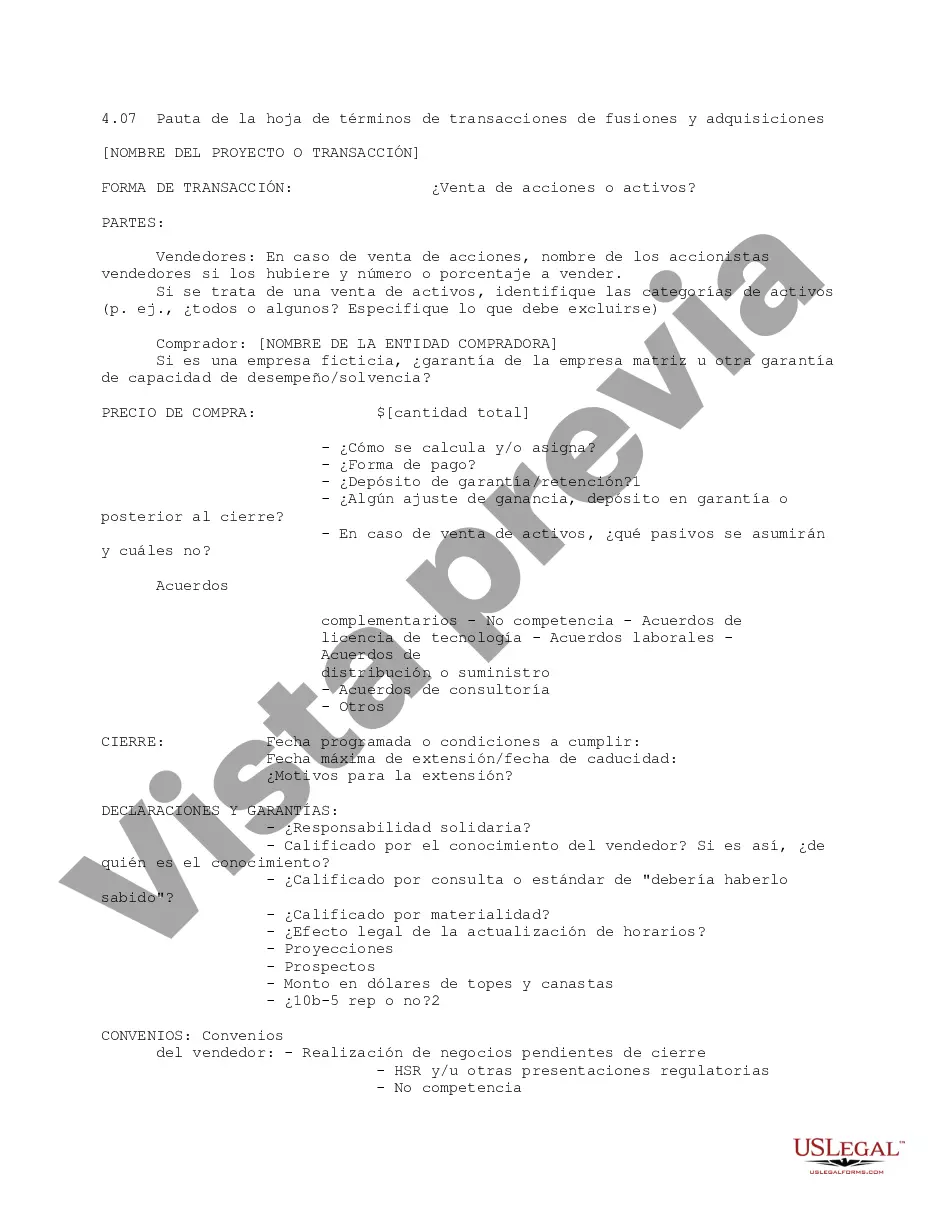

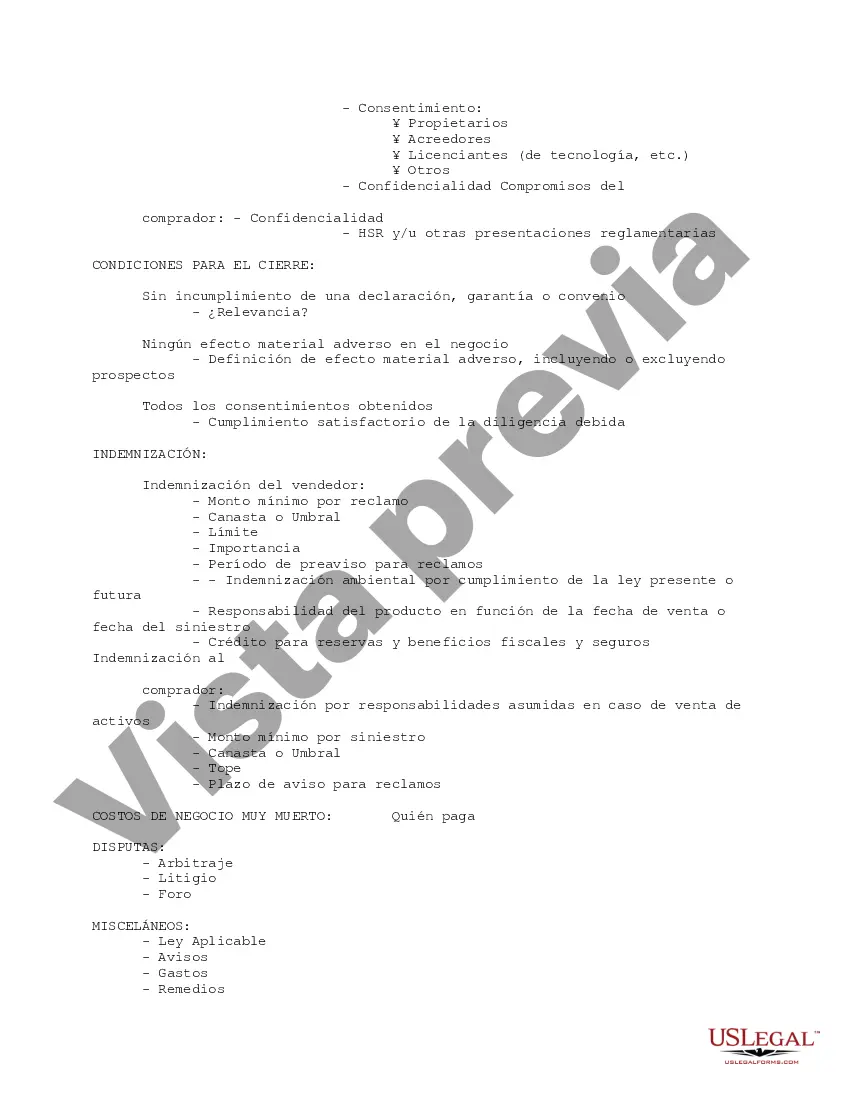

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Hennepin Minnesota M&A Transaction Term Sheet Guideline refers to the comprehensive document that outlines the key terms and conditions of a merger and acquisition (M&A) agreement specific to Hennepin County in Minnesota. This guideline serves as a foundation for negotiating and finalizing the terms of the transaction between the buyer and the seller. It provides clarity and transparency regarding the deal structure and terms, facilitating effective communication between the parties involved. The Hennepin Minnesota M&A Transaction Term Sheet Guideline covers various important aspects of the transaction, including: 1. Parties Involved: It identifies the acquiring company and the target company being merged or acquired, along with their legal names, addresses, and contact information. 2. Transaction Overview: This section provides a brief summary of the M&A deal, highlighting the type of transaction (e.g., merger, acquisition, asset purchase), the intended purpose, and the anticipated timeline for completion. 3. Purchase Price and Consideration: The guideline specifies the agreed-upon purchase price, including any adjustments, contingent payments, or earn-outs. It outlines the form of consideration, such as cash, stock, or a combination of both. 4. Payment Terms: This section outlines the payment schedule, detailing any upfront payments, milestone-based payments, or deferred payments, along with the associated due dates and conditions. 5. Transaction Structure: The guideline elucidates the chosen transaction structure, whether it is a stock purchase, asset purchase, or merger. It also provides information about any relevant tax implications, regulatory requirements, and necessary approvals. 6. Conditions Precedent: It enumerates the conditions that must be met before the transaction can be completed, such as obtaining regulatory approvals, third-party consents, or other necessary clearances. 7. Representations and Warranties: This section outlines the specific representations and warranties made by the buyer and the seller. It includes items related to the target company's financials, legal compliance, intellectual property, contracts, and other material aspects of the business. 8. Indemnification Provisions: The guideline delineates the terms and limitations regarding indemnification for any breaches of representations and warranties or other specified liabilities that may arise from the transaction. 9. Confidentiality and Non-Disclosure: It includes provisions to ensure the confidentiality of sensitive information exchanged during the due diligence process and throughout the negotiation phase. 10. Governing Law: The guideline specifies the governing law and jurisdiction in case of any disputes arising from the transaction. Different types of Hennepin Minnesota M&A Transaction Term Sheet Guidelines may exist depending on the specific industry, size of the companies involved, or other unique characteristics of the transaction. For example, there may be separate guidelines for technology companies, healthcare organizations, or real estate ventures. However, these guidelines generally follow the standard structure and content.Hennepin Minnesota M&A Transaction Term Sheet Guideline refers to the comprehensive document that outlines the key terms and conditions of a merger and acquisition (M&A) agreement specific to Hennepin County in Minnesota. This guideline serves as a foundation for negotiating and finalizing the terms of the transaction between the buyer and the seller. It provides clarity and transparency regarding the deal structure and terms, facilitating effective communication between the parties involved. The Hennepin Minnesota M&A Transaction Term Sheet Guideline covers various important aspects of the transaction, including: 1. Parties Involved: It identifies the acquiring company and the target company being merged or acquired, along with their legal names, addresses, and contact information. 2. Transaction Overview: This section provides a brief summary of the M&A deal, highlighting the type of transaction (e.g., merger, acquisition, asset purchase), the intended purpose, and the anticipated timeline for completion. 3. Purchase Price and Consideration: The guideline specifies the agreed-upon purchase price, including any adjustments, contingent payments, or earn-outs. It outlines the form of consideration, such as cash, stock, or a combination of both. 4. Payment Terms: This section outlines the payment schedule, detailing any upfront payments, milestone-based payments, or deferred payments, along with the associated due dates and conditions. 5. Transaction Structure: The guideline elucidates the chosen transaction structure, whether it is a stock purchase, asset purchase, or merger. It also provides information about any relevant tax implications, regulatory requirements, and necessary approvals. 6. Conditions Precedent: It enumerates the conditions that must be met before the transaction can be completed, such as obtaining regulatory approvals, third-party consents, or other necessary clearances. 7. Representations and Warranties: This section outlines the specific representations and warranties made by the buyer and the seller. It includes items related to the target company's financials, legal compliance, intellectual property, contracts, and other material aspects of the business. 8. Indemnification Provisions: The guideline delineates the terms and limitations regarding indemnification for any breaches of representations and warranties or other specified liabilities that may arise from the transaction. 9. Confidentiality and Non-Disclosure: It includes provisions to ensure the confidentiality of sensitive information exchanged during the due diligence process and throughout the negotiation phase. 10. Governing Law: The guideline specifies the governing law and jurisdiction in case of any disputes arising from the transaction. Different types of Hennepin Minnesota M&A Transaction Term Sheet Guidelines may exist depending on the specific industry, size of the companies involved, or other unique characteristics of the transaction. For example, there may be separate guidelines for technology companies, healthcare organizations, or real estate ventures. However, these guidelines generally follow the standard structure and content.

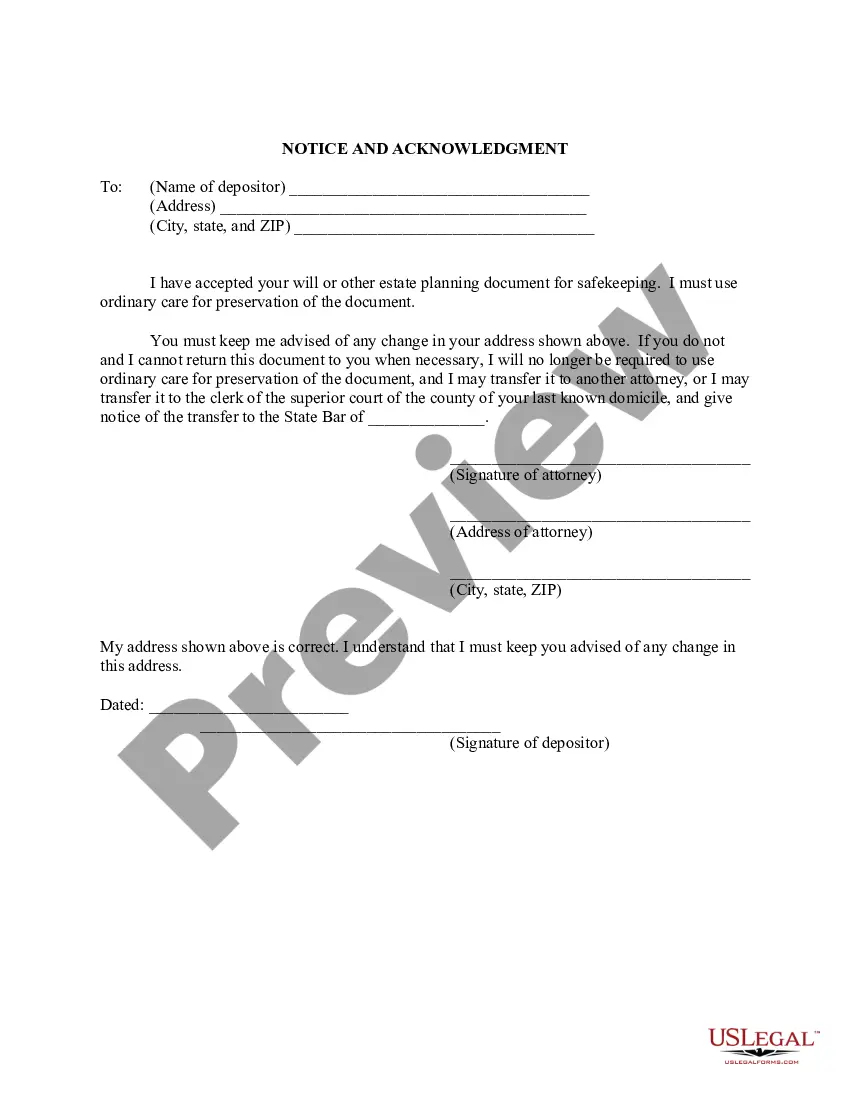

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.