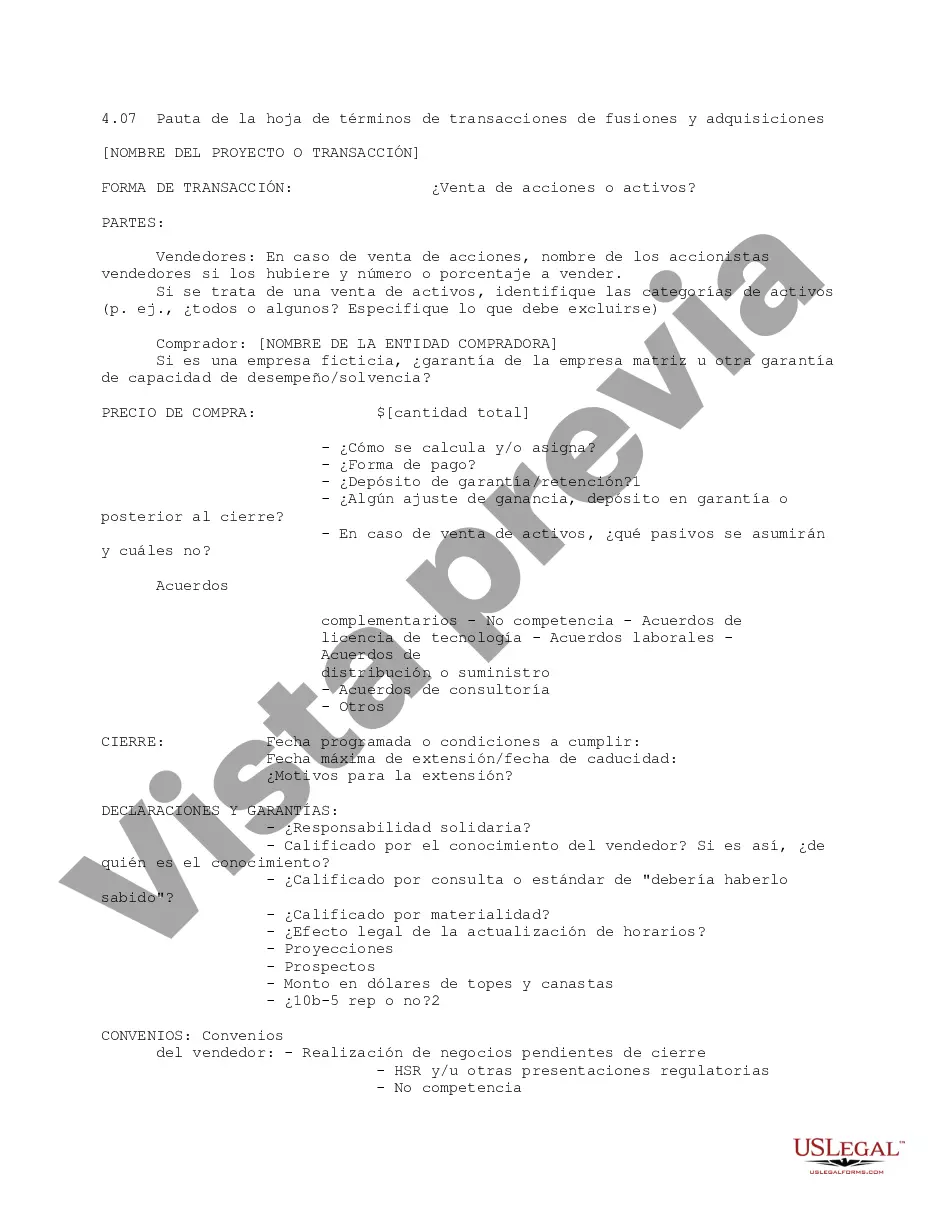

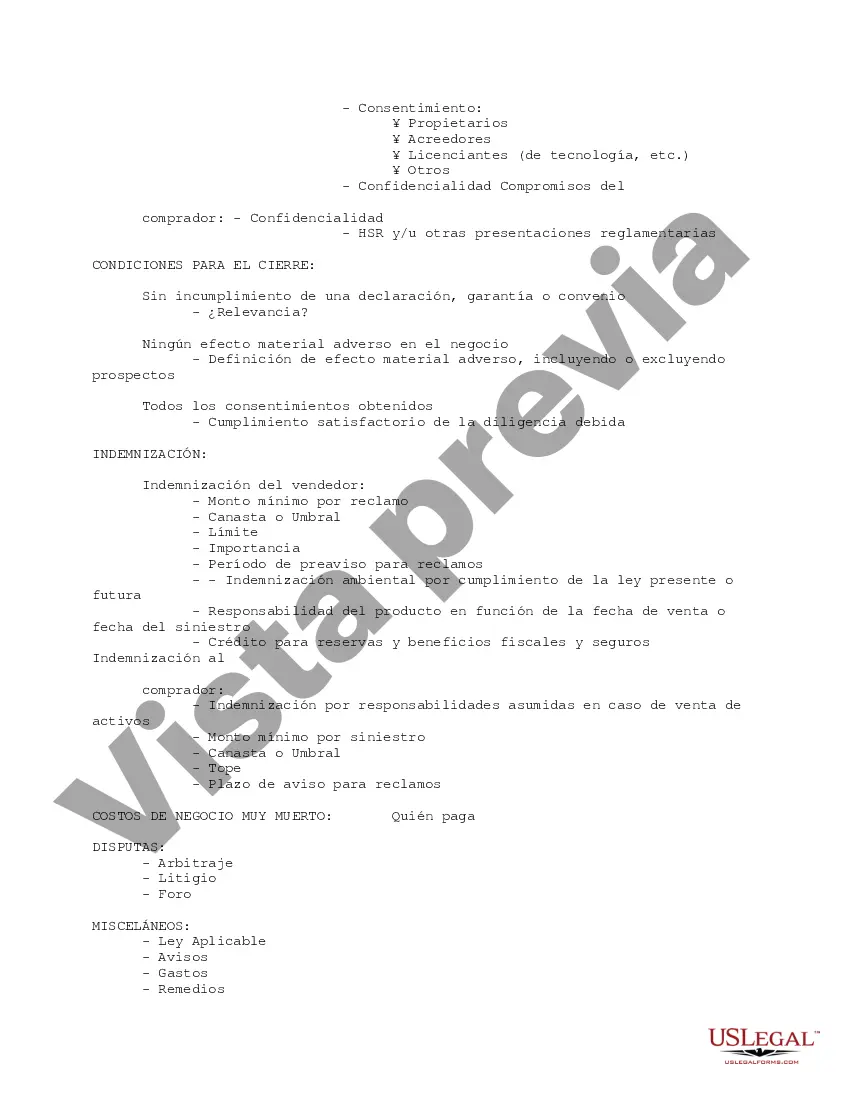

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Kings New York M&A Transaction Term Sheet Guideline is a comprehensive and detailed document that serves as a roadmap for parties engaged in mergers and acquisitions (M&A) transactions in the New York region. This guideline outlines the key terms and conditions that should be included in a term sheet, which is an important preliminary agreement that sets the foundation for the subsequent transaction negotiations and definitive agreements. The Kings New York M&A Transaction Term Sheet Guideline covers various aspects of the M&A process, ensuring that both parties are aligned on critical terms before proceeding with further negotiations. It provides a clear framework to streamline the deal-making process and minimize misunderstandings or disputes later on. Key areas covered in this guideline include valuation, consideration, deal structure, transaction timeline, due diligence, and post-closing obligations. Different types of Kings New York M&A Transaction Term Sheet Guideline may exist based on specific industry or deal characteristics. These variations accommodate the unique needs of different sectors, such as technology, finance, healthcare, real estate, and manufacturing. Additionally, the guideline may differ based on the type of M&A transaction, such as mergers, acquisitions, leveraged buyouts, joint ventures, or asset purchases. The Kings New York M&A Transaction Term Sheet Guideline emphasizes the importance of including important provisions, such as confidentiality, non-compete agreements, exclusivity, representations and warranties, indemnification, termination rights, and dispute resolution mechanisms. It aims to protect the interests of both buyers and sellers while facilitating a transparent and efficient negotiation process. By adhering to the Kings New York M&A Transaction Term Sheet Guideline, parties involved in M&A transactions can establish a solid foundation for further negotiations and increase the chances of a successful deal closure. This guideline serves as a valuable resource for M&A professionals, legal advisors, entrepreneurs, and investors in the New York region.Kings New York M&A Transaction Term Sheet Guideline is a comprehensive and detailed document that serves as a roadmap for parties engaged in mergers and acquisitions (M&A) transactions in the New York region. This guideline outlines the key terms and conditions that should be included in a term sheet, which is an important preliminary agreement that sets the foundation for the subsequent transaction negotiations and definitive agreements. The Kings New York M&A Transaction Term Sheet Guideline covers various aspects of the M&A process, ensuring that both parties are aligned on critical terms before proceeding with further negotiations. It provides a clear framework to streamline the deal-making process and minimize misunderstandings or disputes later on. Key areas covered in this guideline include valuation, consideration, deal structure, transaction timeline, due diligence, and post-closing obligations. Different types of Kings New York M&A Transaction Term Sheet Guideline may exist based on specific industry or deal characteristics. These variations accommodate the unique needs of different sectors, such as technology, finance, healthcare, real estate, and manufacturing. Additionally, the guideline may differ based on the type of M&A transaction, such as mergers, acquisitions, leveraged buyouts, joint ventures, or asset purchases. The Kings New York M&A Transaction Term Sheet Guideline emphasizes the importance of including important provisions, such as confidentiality, non-compete agreements, exclusivity, representations and warranties, indemnification, termination rights, and dispute resolution mechanisms. It aims to protect the interests of both buyers and sellers while facilitating a transparent and efficient negotiation process. By adhering to the Kings New York M&A Transaction Term Sheet Guideline, parties involved in M&A transactions can establish a solid foundation for further negotiations and increase the chances of a successful deal closure. This guideline serves as a valuable resource for M&A professionals, legal advisors, entrepreneurs, and investors in the New York region.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.