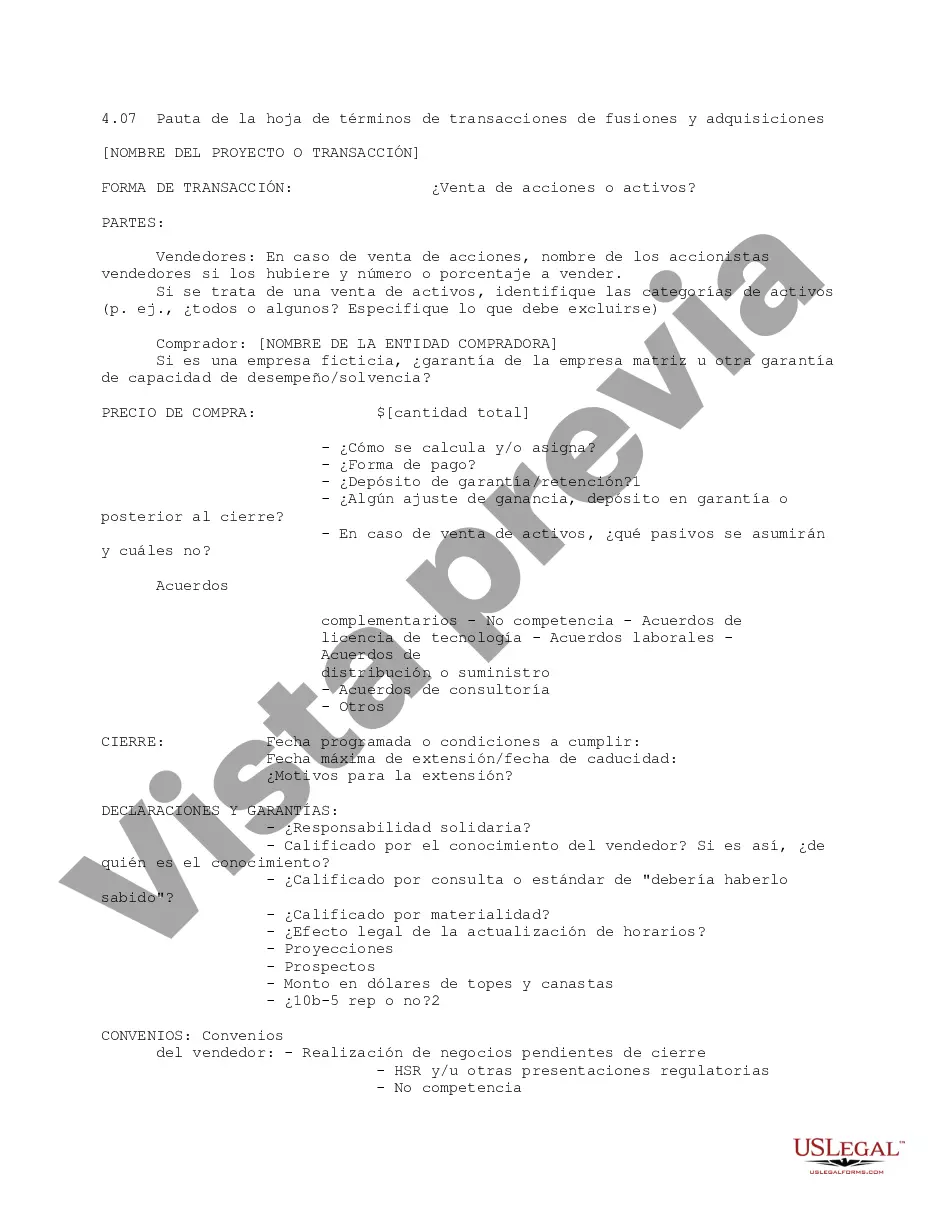

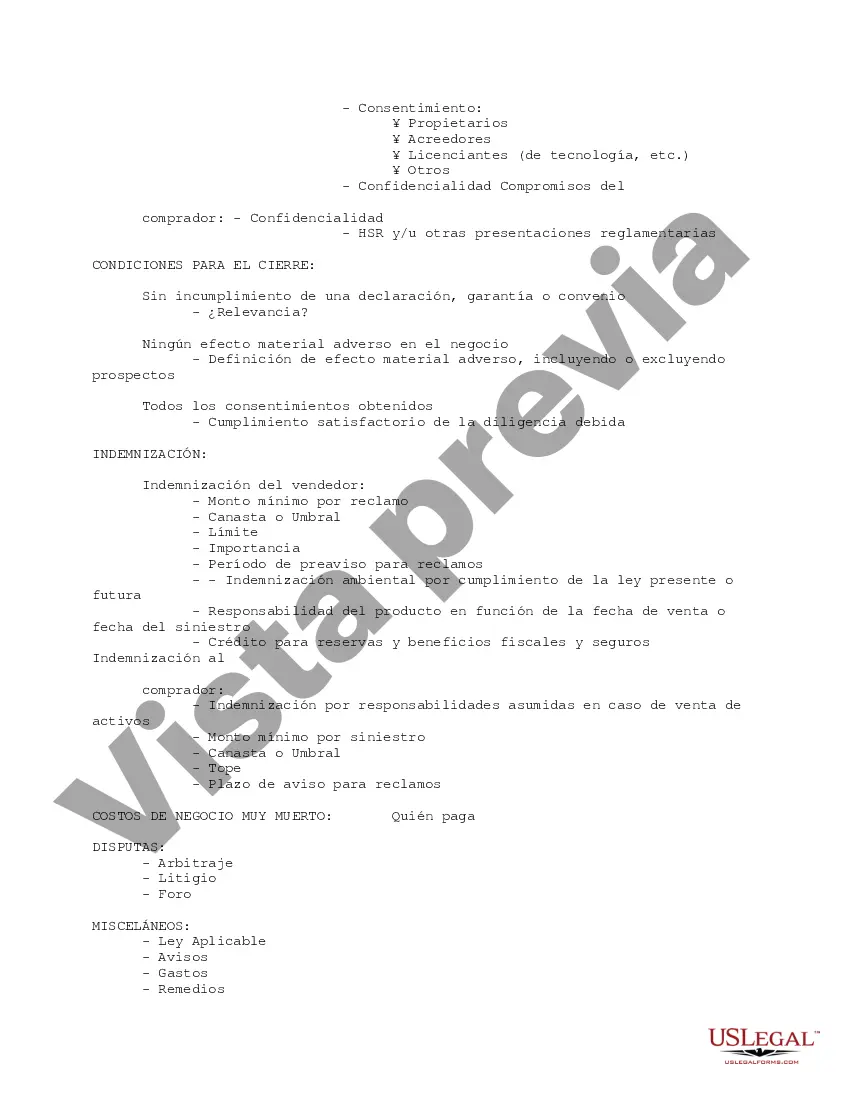

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Maricopa, Arizona M&A Transaction Term Sheet Guideline The Maricopa, Arizona M&A Transaction Term Sheet Guideline is a comprehensive document that outlines the key terms and conditions of a merger or acquisition (M&A) transaction taking place in Maricopa, Arizona. It serves as an important tool for both the buyer and the seller to understand and negotiate the terms of the deal. This guideline provides clarity and legal protection by addressing key aspects of the transaction before an extensive legal agreement is drafted. Some key components typically included in the Maricopa, Arizona M&A Transaction Term Sheet Guideline are: 1. Introduction: This section provides a brief overview of the parties involved in the transaction, highlighting their roles and responsibilities. 2. Transaction Structure: It outlines the proposed structure of the deal, such as whether it will be a merger, acquisition, asset purchase, or stock purchase. This section also includes any conditions or restrictions that may apply. 3. Purchase Consideration: This section details the agreed value or consideration for the transaction and specifies the type of consideration, such as cash, stock, or a combination of both. 4. Closing Conditions: It outlines the conditions that both parties must fulfill before the deal can be closed. These may include regulatory approvals, third-party consents, or the completion of due diligence. 5. Representations and Warranties: This section covers the representations and warranties made by both the buyer and the seller regarding the accuracy of the provided information, financial statements, and compliance with laws and regulations. 6. Indemnification: It specifies the indemnification obligations of both parties, including any limitations, timeframes, or potential caps on liability arising from breaches of warranties or representations. 7. Confidentiality and Exclusivity: This section addresses the confidentiality obligations of the parties and the exclusivity of the negotiation period. It ensures that sensitive information shared during the process remains confidential and restricts both parties from negotiating with other potential buyers or sellers simultaneously. 8. Termination: It includes the provisions that allow either party to terminate the transaction under specific circumstances, such as a material breach, failure to obtain necessary approvals, or failure to meet closing conditions. Different types of Maricopa, Arizona M&A Transaction Term Sheet Guidelines can be tailored based on the specific industry, company size, or nature of the transaction. For example, there may be separate guidelines for real estate transactions, technology-related acquisitions, or cross-border deals. The key elements mentioned above, however, remain essential across all types of M&A transactions in Maricopa, Arizona.Maricopa, Arizona M&A Transaction Term Sheet Guideline The Maricopa, Arizona M&A Transaction Term Sheet Guideline is a comprehensive document that outlines the key terms and conditions of a merger or acquisition (M&A) transaction taking place in Maricopa, Arizona. It serves as an important tool for both the buyer and the seller to understand and negotiate the terms of the deal. This guideline provides clarity and legal protection by addressing key aspects of the transaction before an extensive legal agreement is drafted. Some key components typically included in the Maricopa, Arizona M&A Transaction Term Sheet Guideline are: 1. Introduction: This section provides a brief overview of the parties involved in the transaction, highlighting their roles and responsibilities. 2. Transaction Structure: It outlines the proposed structure of the deal, such as whether it will be a merger, acquisition, asset purchase, or stock purchase. This section also includes any conditions or restrictions that may apply. 3. Purchase Consideration: This section details the agreed value or consideration for the transaction and specifies the type of consideration, such as cash, stock, or a combination of both. 4. Closing Conditions: It outlines the conditions that both parties must fulfill before the deal can be closed. These may include regulatory approvals, third-party consents, or the completion of due diligence. 5. Representations and Warranties: This section covers the representations and warranties made by both the buyer and the seller regarding the accuracy of the provided information, financial statements, and compliance with laws and regulations. 6. Indemnification: It specifies the indemnification obligations of both parties, including any limitations, timeframes, or potential caps on liability arising from breaches of warranties or representations. 7. Confidentiality and Exclusivity: This section addresses the confidentiality obligations of the parties and the exclusivity of the negotiation period. It ensures that sensitive information shared during the process remains confidential and restricts both parties from negotiating with other potential buyers or sellers simultaneously. 8. Termination: It includes the provisions that allow either party to terminate the transaction under specific circumstances, such as a material breach, failure to obtain necessary approvals, or failure to meet closing conditions. Different types of Maricopa, Arizona M&A Transaction Term Sheet Guidelines can be tailored based on the specific industry, company size, or nature of the transaction. For example, there may be separate guidelines for real estate transactions, technology-related acquisitions, or cross-border deals. The key elements mentioned above, however, remain essential across all types of M&A transactions in Maricopa, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.