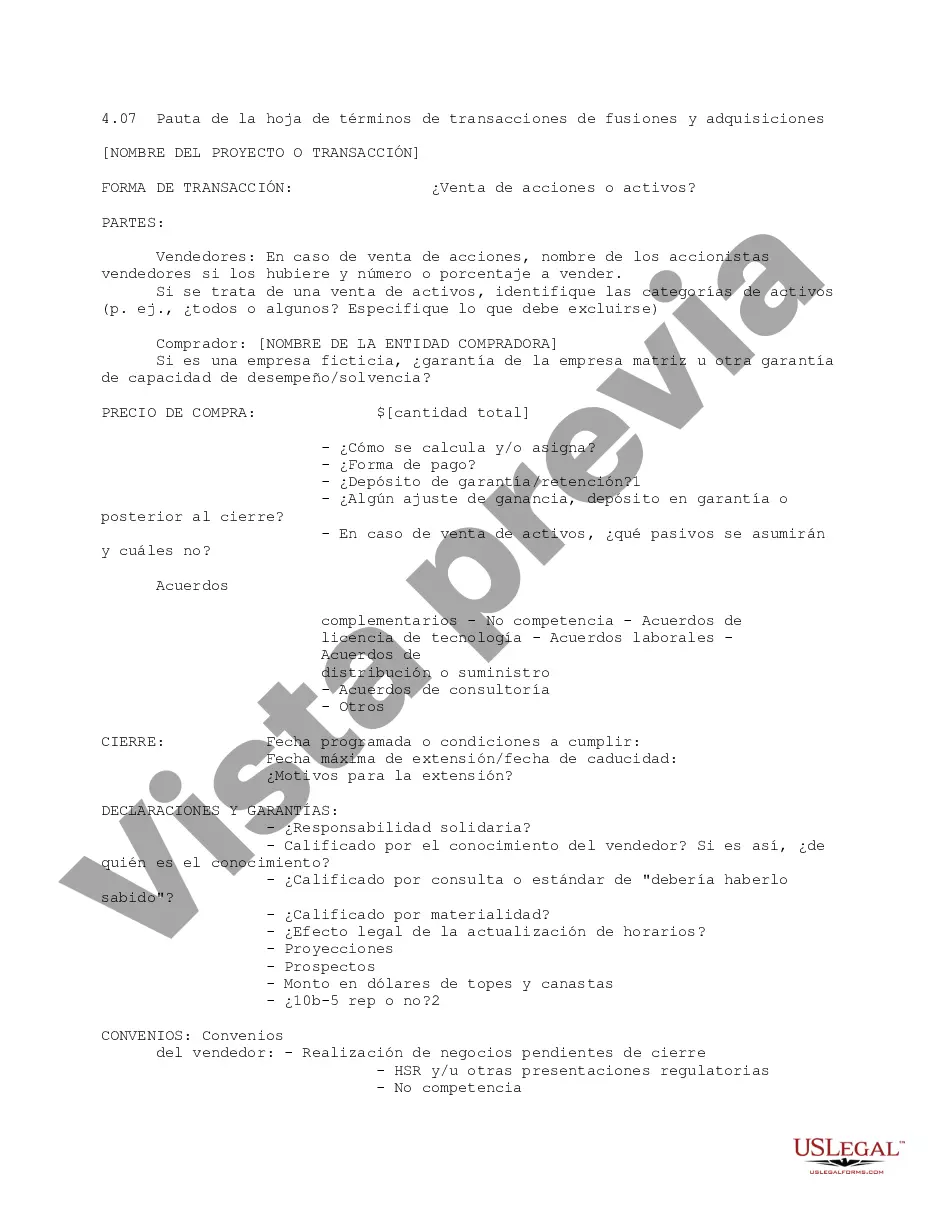

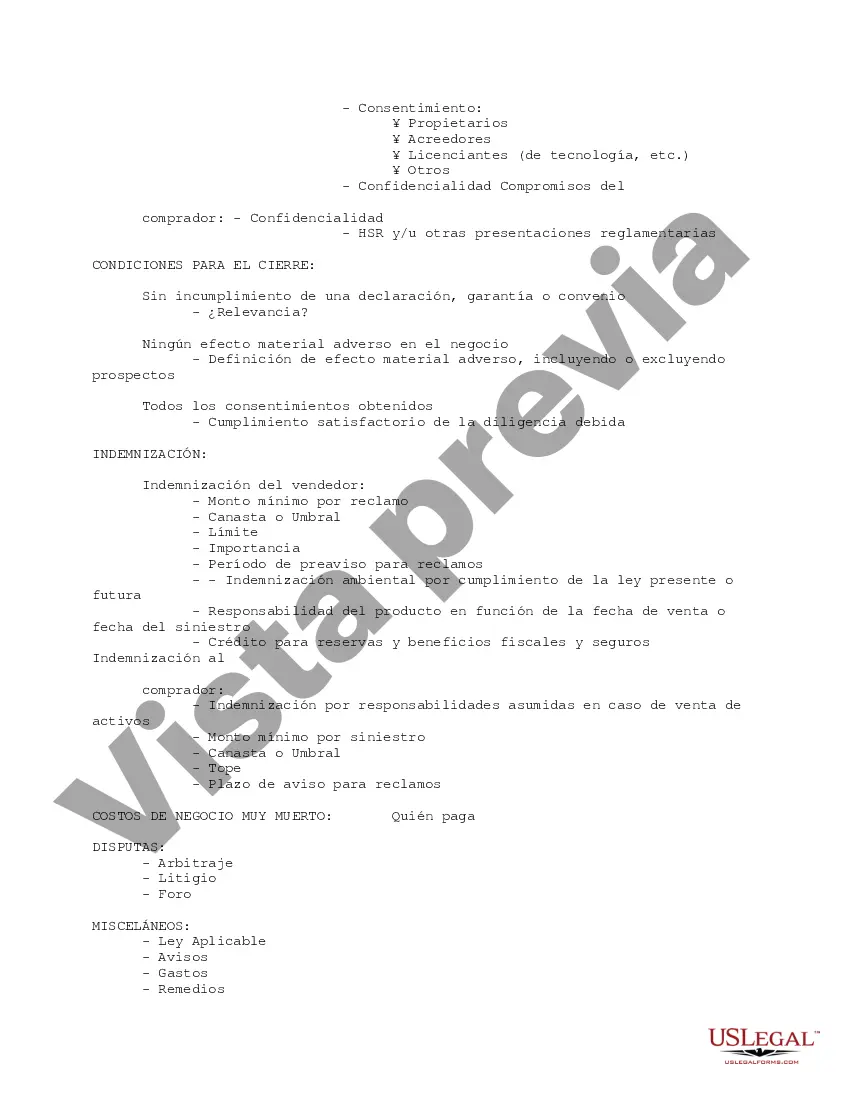

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Nassau, New York M&A Transaction Term Sheet Guideline refers to a comprehensive document that outlines the terms, conditions, and considerations involved in a merger or acquisition (M&A) transaction conducted in Nassau, New York. This guideline functions as a framework that governs the negotiation and execution of M&A deals, serving as a crucial reference point for businesses and legal professionals involved in such transactions. The Nassau, New York M&A Transaction Term Sheet Guideline typically includes essential elements such as: 1. Parties Involved: Clearly identifies the acquiring company (buyer) and the target company (seller) involved in the M&A transaction. 2. Transaction Structure: Outlines the proposed structure of the deal, whether it is an asset purchase, stock purchase, merger, or another form of transaction. 3. Purchase Price and Consideration: Specifies the purchase price and the consideration offered, which may include cash, stock, debt assumption, or a combination thereof. 4. Conditions Precedent: Enumerates the conditions that must be fulfilled before the deal can proceed, including regulatory approvals, due diligence, financing arrangements, and consent from key stakeholders. 5. Representations and Warranties: Sets forth the statements, guarantees, and assurances made by both parties about their respective businesses, financials, legal compliance, and other relevant aspects. 6. Due Diligence: Outlines the scope, timeline, and process of conducting due diligence on the target company, allowing the buyer to thoroughly assess its assets, liabilities, contracts, intellectual property, and other critical factors. 7. Confidentiality and Exclusivity: Includes provisions to protect the confidentiality of sensitive information shared during the negotiation process and may grant the buyer exclusivity for a specified time to complete the transaction. 8. Termination: Lays out the circumstances under which either party may terminate the agreement, such as a breach of representations, failure to meet conditions precedent, or mutual consent. 9. Indemnification: Addresses the allocation of potential liabilities arising from the transaction, including post-closing claims for breaches of warranties, negligence, or other legal issues. 10. Governing Law and Dispute Resolution: Determines the jurisdiction whose laws will govern the agreement and outlines the preferred method for resolving disputes, such as arbitration or litigation. While there may not be distinct types of Nassau, New York M&A Transaction Term Sheet Guidelines, it is crucial to customize the document to suit the specific nature of each transaction and the unique requirements of the parties involved. The guideline may vary based on the industries, complexity, and size of the deal, but the core elements mentioned above generally remain consistent.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.