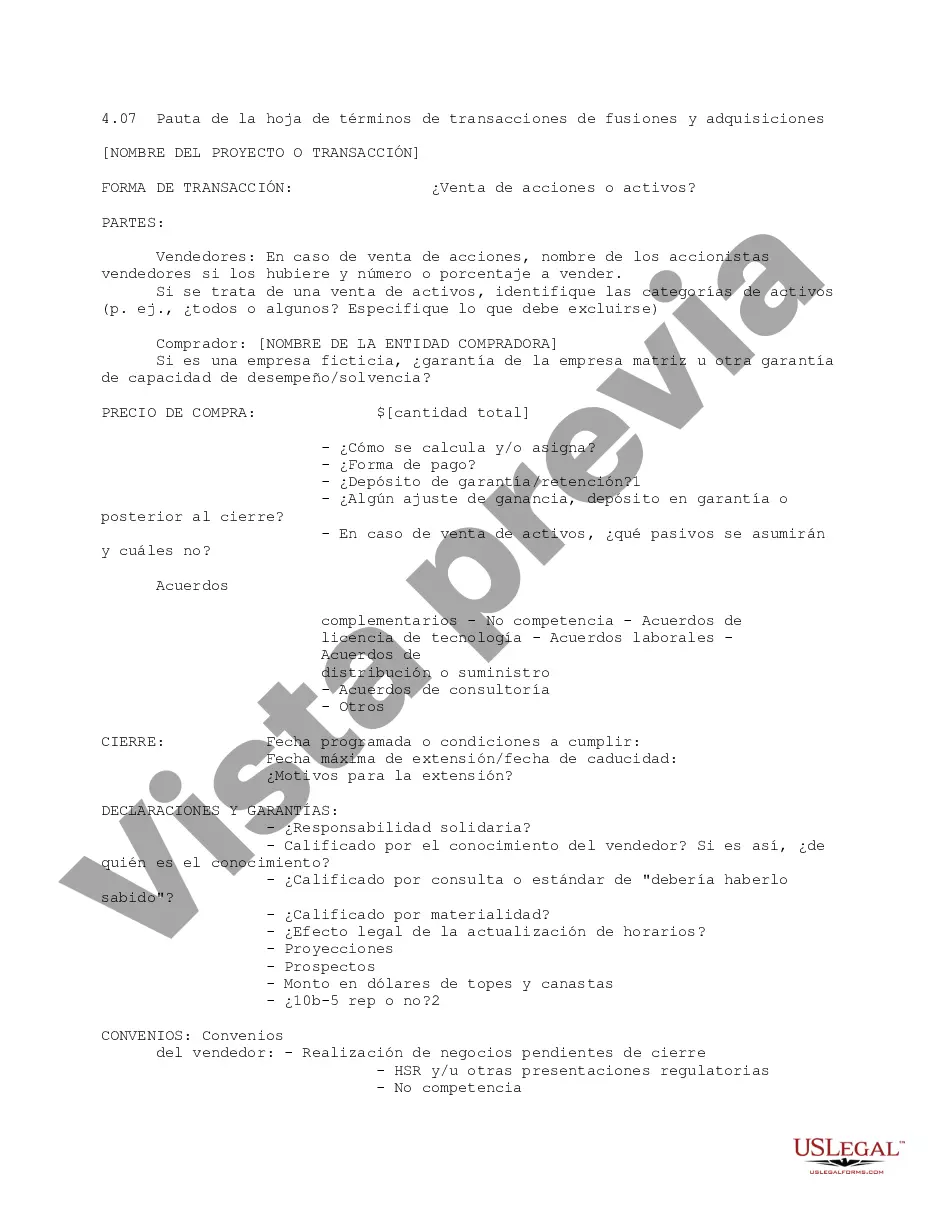

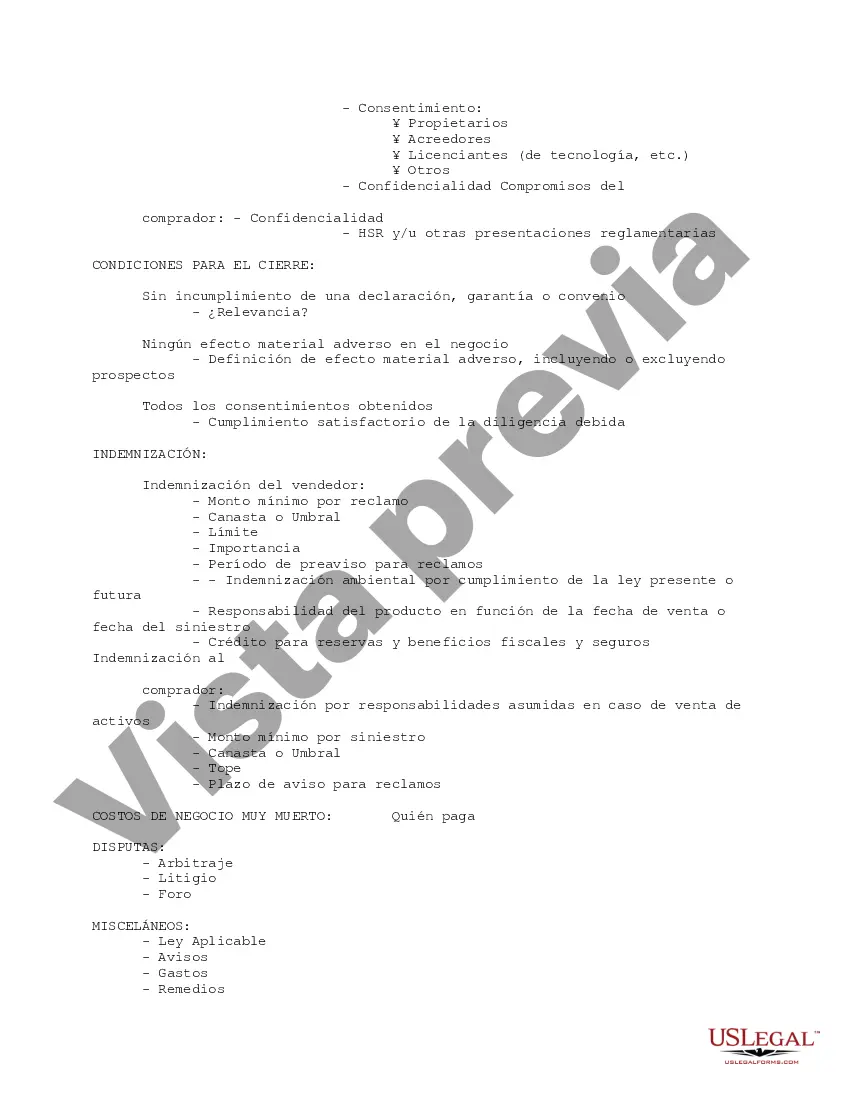

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

San Jose, California M&A Transaction Term Sheet Guideline is a comprehensive document used in mergers and acquisitions (M&A) to outline the terms and conditions of the proposed transaction. This guideline provides a detailed description of the key elements and provisions that should be included in a term sheet in the context of M&A transactions specific to the San Jose, California region. The primary purpose of the term sheet is to establish a framework for negotiations and serve as a blueprint for the definitive agreements that will govern the transaction. It is a crucial document that outlines the proposed structure, terms, and conditions of the deal, enabling both parties to understand the major issues and details involved before entering into a more comprehensive legal agreement. Some essential components typically covered in the San Jose, California M&A Transaction Term Sheet Guideline include: 1. Parties: The term sheet should clearly identify the parties involved in the transaction, including the buyer(s) and the seller(s), as well as any additional stakeholders. 2. Transaction Structure: This section outlines whether the transaction will be structured as a stock purchase, asset purchase, merger, or another form of acquisition. 3. Purchase Price and Payment Terms: The term sheet should specify the total purchase price, the currency, and the payment structure, including any conditions or adjustments. 4. Due Diligence: It is necessary to outline the scope and timeframe for conducting due diligence on the target company, allowing the buyer to assess the target's financial, legal, and operational aspects. 5. Representations and Warranties: The term sheet should provide an overview of the seller's representations and warranties, ensuring the buyer's protection against any undisclosed liabilities or misrepresentations. 6. Conditions to Closing: This section lists the conditions that must be fulfilled before the transaction can be completed, including regulatory approvals, third-party consents, or financing. 7. Confidentiality and Exclusivity: The term sheet may include provisions for maintaining confidentiality throughout the transaction process and grant exclusivity to the buyer for a specified period, preventing the seller from negotiating with other potential buyers. 8. Termination: This part outlines the circumstances under which either party has the right to terminate the deal before its completion, along with the associated penalties or obligations. 9. Governing Law and Dispute Resolution: The term sheet may specify the governing law of the agreement and the preferred method for resolving any disputes that may arise. Different types or variations of San Jose, California M&A Transaction Term Sheet Guidelines may exist depending on specific sectors or industries within the region. For example, there might be specialized term sheet guidelines for tech companies, healthcare companies, or real estate transactions in San Jose, California. These specialized guidelines would include sector-specific provisions and considerations to address the unique complexities and regulations associated with those industries within the region.San Jose, California M&A Transaction Term Sheet Guideline is a comprehensive document used in mergers and acquisitions (M&A) to outline the terms and conditions of the proposed transaction. This guideline provides a detailed description of the key elements and provisions that should be included in a term sheet in the context of M&A transactions specific to the San Jose, California region. The primary purpose of the term sheet is to establish a framework for negotiations and serve as a blueprint for the definitive agreements that will govern the transaction. It is a crucial document that outlines the proposed structure, terms, and conditions of the deal, enabling both parties to understand the major issues and details involved before entering into a more comprehensive legal agreement. Some essential components typically covered in the San Jose, California M&A Transaction Term Sheet Guideline include: 1. Parties: The term sheet should clearly identify the parties involved in the transaction, including the buyer(s) and the seller(s), as well as any additional stakeholders. 2. Transaction Structure: This section outlines whether the transaction will be structured as a stock purchase, asset purchase, merger, or another form of acquisition. 3. Purchase Price and Payment Terms: The term sheet should specify the total purchase price, the currency, and the payment structure, including any conditions or adjustments. 4. Due Diligence: It is necessary to outline the scope and timeframe for conducting due diligence on the target company, allowing the buyer to assess the target's financial, legal, and operational aspects. 5. Representations and Warranties: The term sheet should provide an overview of the seller's representations and warranties, ensuring the buyer's protection against any undisclosed liabilities or misrepresentations. 6. Conditions to Closing: This section lists the conditions that must be fulfilled before the transaction can be completed, including regulatory approvals, third-party consents, or financing. 7. Confidentiality and Exclusivity: The term sheet may include provisions for maintaining confidentiality throughout the transaction process and grant exclusivity to the buyer for a specified period, preventing the seller from negotiating with other potential buyers. 8. Termination: This part outlines the circumstances under which either party has the right to terminate the deal before its completion, along with the associated penalties or obligations. 9. Governing Law and Dispute Resolution: The term sheet may specify the governing law of the agreement and the preferred method for resolving any disputes that may arise. Different types or variations of San Jose, California M&A Transaction Term Sheet Guidelines may exist depending on specific sectors or industries within the region. For example, there might be specialized term sheet guidelines for tech companies, healthcare companies, or real estate transactions in San Jose, California. These specialized guidelines would include sector-specific provisions and considerations to address the unique complexities and regulations associated with those industries within the region.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.