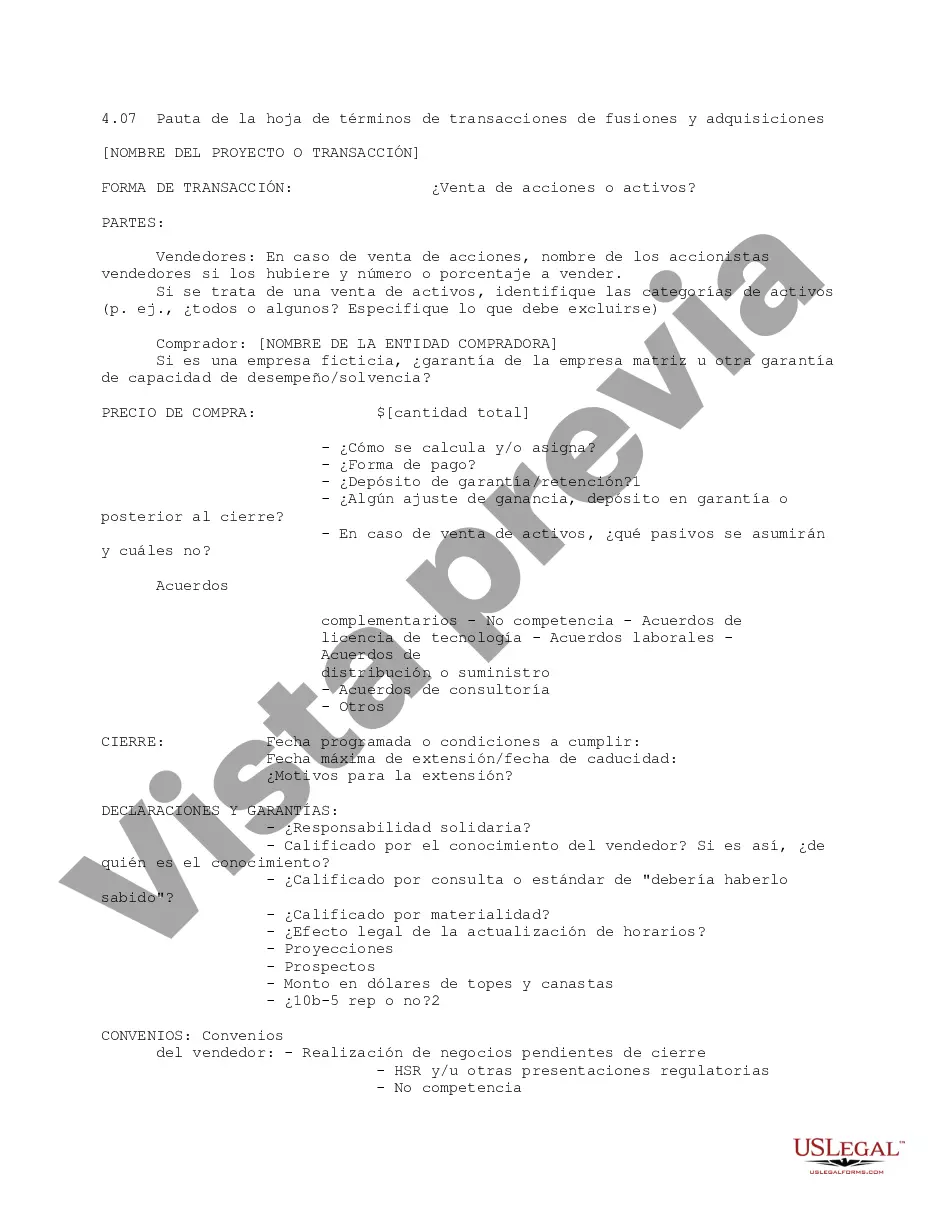

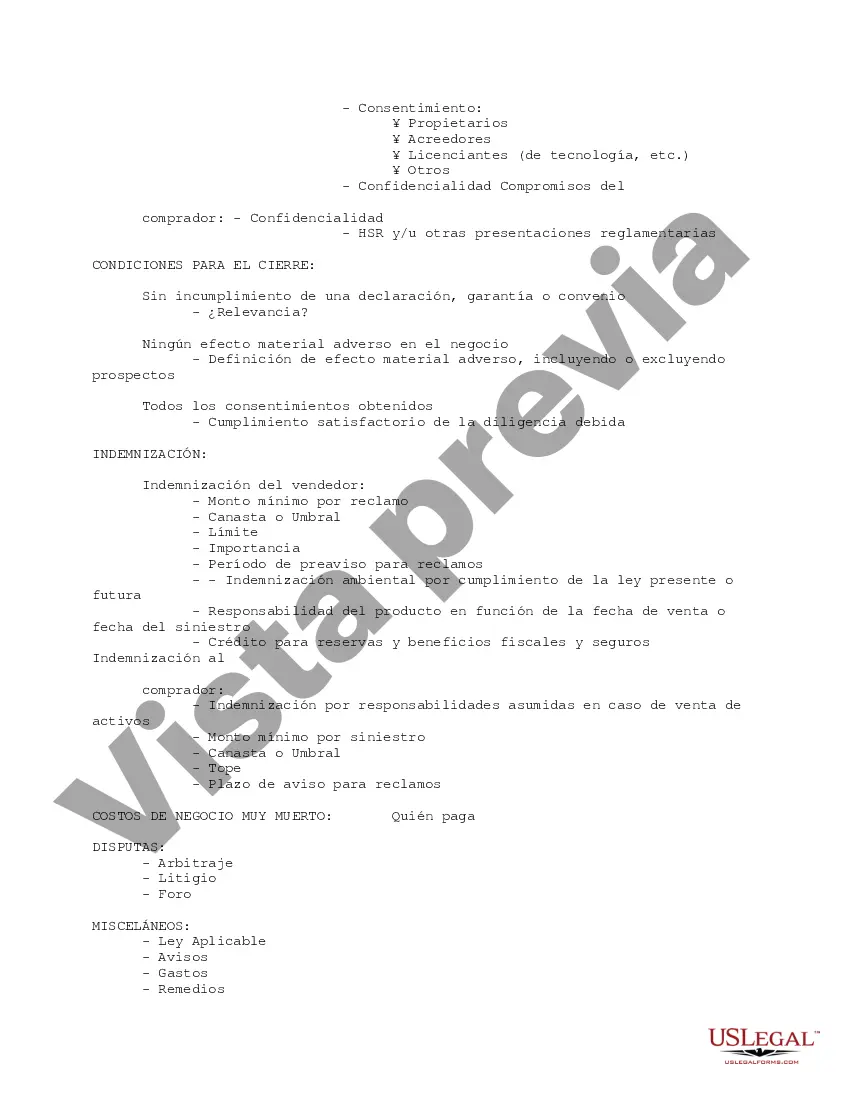

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Travis Texas M&A Transaction Term Sheet Guideline is a comprehensive document that outlines the framework and details of a merger or acquisition (M&A) transaction in Travis, Texas. This guideline serves as a blueprint for parties involved in an M&A deal, providing them with a structured outline of key terms, conditions, and provisions that need to be addressed during the transaction process. The Travis Texas M&A Transaction Term Sheet Guideline serves as a common starting point for negotiations between the buyer and seller. It helps facilitate a clear understanding of each party's expectations, objectives, and responsibilities, minimizing misunderstandings and potential conflicts throughout the transaction. The specific content and structure of the Travis Texas M&A Transaction Term Sheet Guideline may vary depending on the nature and complexity of the deal. However, it typically covers the following key areas: 1. Introduction and Background: This section provides an overview of the transaction, including the identities of the buyer and seller, the purpose of the deal, and any relevant background information. 2. Transaction Structure: This part outlines the proposed structure of the transaction, whether it is an asset purchase, stock purchase, merger, or any other type of M&A deal. 3. Purchase Price and Payment Terms: This section outlines the agreed-upon purchase price, including any adjustments or contingencies, and specifies how and when the payment will be made. 4. Due Diligence: The guideline may include provisions related to the due diligence process, including access to books, records, and other relevant information, as well as any confidentiality requirements. 5. Representations and Warranties: Parties involved in the transaction typically provide assurances about the accuracy and completeness of certain information. This section specifies the representations and warranties that will be expected from both parties. 6. Conditions Precedent: The term sheet may outline certain conditions that need to be fulfilled before the transaction can proceed, such as obtaining regulatory approvals or securing financing. 7. Closing and Termination: This section specifies the conditions and procedures for closing the transaction, as well as any provisions for termination or breach of the term sheet. It's important to note that there may be various types of Travis Texas M&A Transaction Term Sheet Guidelines, as they can be tailored to specific industries, deal sizes, or legal requirements. Some examples could include technology industry-specific term sheets, real estate M&A term sheets, or private equity-backed acquisition term sheets. In summary, the Travis Texas M&A Transaction Term Sheet Guideline is a crucial document in any M&A deal in Travis, Texas. It ensures that all parties involved have a clear understanding of the intended transaction terms, fostering a smoother and more efficient negotiation and closing process.Travis Texas M&A Transaction Term Sheet Guideline is a comprehensive document that outlines the framework and details of a merger or acquisition (M&A) transaction in Travis, Texas. This guideline serves as a blueprint for parties involved in an M&A deal, providing them with a structured outline of key terms, conditions, and provisions that need to be addressed during the transaction process. The Travis Texas M&A Transaction Term Sheet Guideline serves as a common starting point for negotiations between the buyer and seller. It helps facilitate a clear understanding of each party's expectations, objectives, and responsibilities, minimizing misunderstandings and potential conflicts throughout the transaction. The specific content and structure of the Travis Texas M&A Transaction Term Sheet Guideline may vary depending on the nature and complexity of the deal. However, it typically covers the following key areas: 1. Introduction and Background: This section provides an overview of the transaction, including the identities of the buyer and seller, the purpose of the deal, and any relevant background information. 2. Transaction Structure: This part outlines the proposed structure of the transaction, whether it is an asset purchase, stock purchase, merger, or any other type of M&A deal. 3. Purchase Price and Payment Terms: This section outlines the agreed-upon purchase price, including any adjustments or contingencies, and specifies how and when the payment will be made. 4. Due Diligence: The guideline may include provisions related to the due diligence process, including access to books, records, and other relevant information, as well as any confidentiality requirements. 5. Representations and Warranties: Parties involved in the transaction typically provide assurances about the accuracy and completeness of certain information. This section specifies the representations and warranties that will be expected from both parties. 6. Conditions Precedent: The term sheet may outline certain conditions that need to be fulfilled before the transaction can proceed, such as obtaining regulatory approvals or securing financing. 7. Closing and Termination: This section specifies the conditions and procedures for closing the transaction, as well as any provisions for termination or breach of the term sheet. It's important to note that there may be various types of Travis Texas M&A Transaction Term Sheet Guidelines, as they can be tailored to specific industries, deal sizes, or legal requirements. Some examples could include technology industry-specific term sheets, real estate M&A term sheets, or private equity-backed acquisition term sheets. In summary, the Travis Texas M&A Transaction Term Sheet Guideline is a crucial document in any M&A deal in Travis, Texas. It ensures that all parties involved have a clear understanding of the intended transaction terms, fostering a smoother and more efficient negotiation and closing process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.