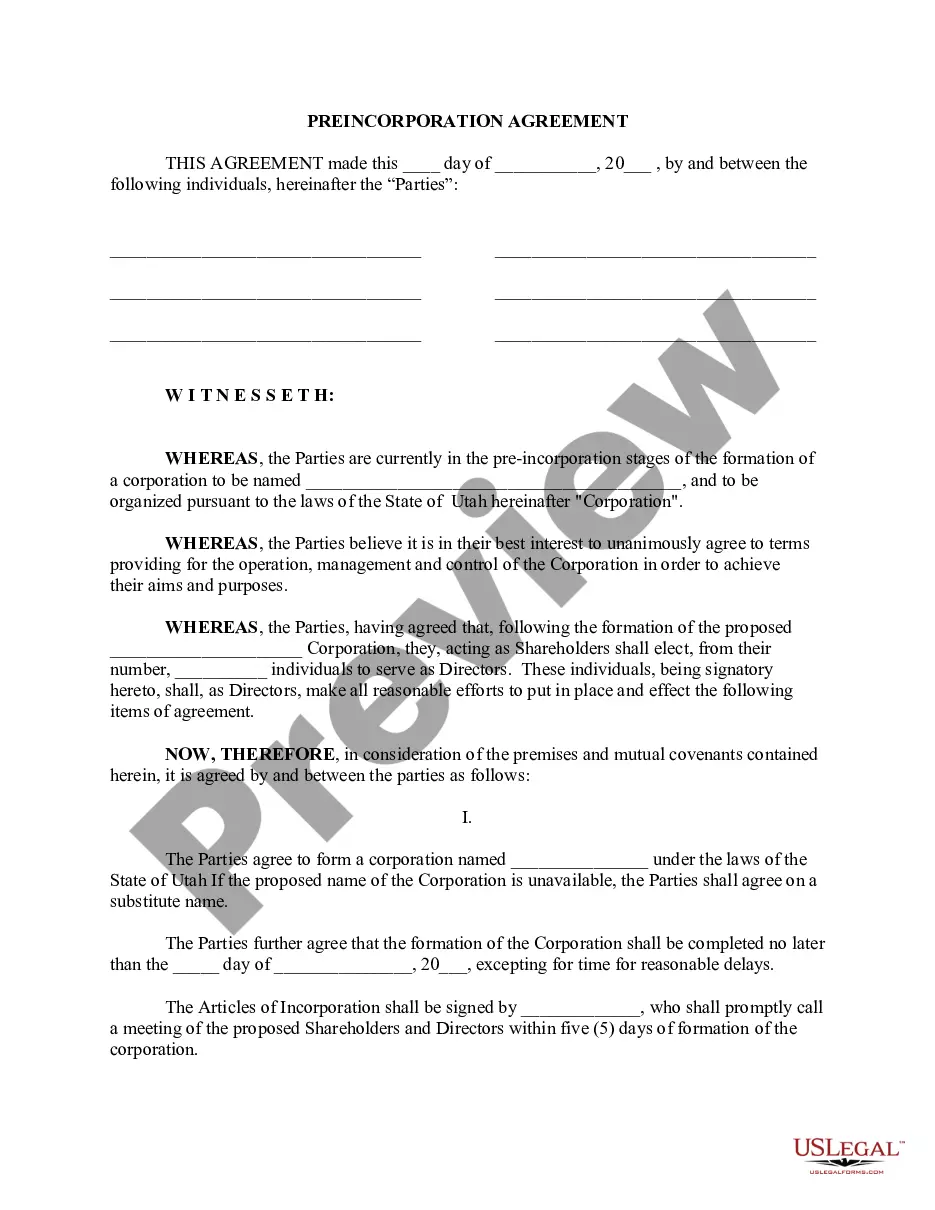

This is aletter of intent for stock acquisition. It can be used by the counsel for either the seller or purchaser and confirms the discussions to date between the seller and the purchaser. It discusses all matters in principal and binding agreements between the two parties.

Dallas, Texas Simple Letter of Intent for Stock Acquisition provides a thorough and concise framework for initiating a stock acquisition transaction in the vibrant city of Dallas, Texas. This document outlines the intent of the buyer to acquire shares or controlling interest in a company located within the Dallas area, facilitating smooth and transparent negotiations between parties involved. When drafting a Dallas, Texas Simple Letter of Intent for Stock Acquisition, it is essential to include relevant keywords such as: 1. Stock Acquisition: This phrase captures the core essence of the letter, highlighting the buyer's intention to acquire company shares or controlling interest. 2. Dallas, Texas: Mentioning the specific location, Dallas, Texas, emphasizes the geographic focus and ensures the letter is tailored to the regulations and business environment of this bustling city. 3. Letter of Intent: This legal document outlines the preliminary agreement between the buyer and the seller, expressing their intent to engage in stock acquisition discussions. 4. Buyer: This refers to the individual or entity seeking to acquire company shares or controlling interest in Dallas, Texas. 5. Seller: The party currently holding the shares or controlling interest and considering their sale or transfer. 6. Negotiations: This keyword underlines the importance of open and transparent discussions between the buyer and seller regarding the terms and conditions of the stock acquisition. 7. Controlling Interest: If the buyer aims to acquire a controlling interest, this term signifies the majority ownership in the target company, allowing the buyer to influence its decisions. Different types of Dallas, Texas Simple Letter of Intent for Stock Acquisition include: 1. Asset Purchase: This type of letter pertains to the buyer's interest in purchasing specific assets belonging to the target company, whether it is equipment, real estate, intellectual property, or other valuable assets. 2. Merger or Acquisition: If the buyer intends to merge with or acquire an entire company rather than just purchasing shares, a different version of the Simple Letter of Intent for Stock Acquisition will be necessary. 3. Partial Acquisition: In some cases, the buyer may only seek to acquire a certain percentage of shares or controlling interest in the target company, requiring a modified letter of intent to reflect this partial acquisition. By utilizing relevant keywords and understanding the various types of Dallas, Texas Simple Letter of Intent for Stock Acquisition, individuals and businesses can effectively communicate their intentions and initiate productive negotiations in this dynamic city.Dallas, Texas Simple Letter of Intent for Stock Acquisition provides a thorough and concise framework for initiating a stock acquisition transaction in the vibrant city of Dallas, Texas. This document outlines the intent of the buyer to acquire shares or controlling interest in a company located within the Dallas area, facilitating smooth and transparent negotiations between parties involved. When drafting a Dallas, Texas Simple Letter of Intent for Stock Acquisition, it is essential to include relevant keywords such as: 1. Stock Acquisition: This phrase captures the core essence of the letter, highlighting the buyer's intention to acquire company shares or controlling interest. 2. Dallas, Texas: Mentioning the specific location, Dallas, Texas, emphasizes the geographic focus and ensures the letter is tailored to the regulations and business environment of this bustling city. 3. Letter of Intent: This legal document outlines the preliminary agreement between the buyer and the seller, expressing their intent to engage in stock acquisition discussions. 4. Buyer: This refers to the individual or entity seeking to acquire company shares or controlling interest in Dallas, Texas. 5. Seller: The party currently holding the shares or controlling interest and considering their sale or transfer. 6. Negotiations: This keyword underlines the importance of open and transparent discussions between the buyer and seller regarding the terms and conditions of the stock acquisition. 7. Controlling Interest: If the buyer aims to acquire a controlling interest, this term signifies the majority ownership in the target company, allowing the buyer to influence its decisions. Different types of Dallas, Texas Simple Letter of Intent for Stock Acquisition include: 1. Asset Purchase: This type of letter pertains to the buyer's interest in purchasing specific assets belonging to the target company, whether it is equipment, real estate, intellectual property, or other valuable assets. 2. Merger or Acquisition: If the buyer intends to merge with or acquire an entire company rather than just purchasing shares, a different version of the Simple Letter of Intent for Stock Acquisition will be necessary. 3. Partial Acquisition: In some cases, the buyer may only seek to acquire a certain percentage of shares or controlling interest in the target company, requiring a modified letter of intent to reflect this partial acquisition. By utilizing relevant keywords and understanding the various types of Dallas, Texas Simple Letter of Intent for Stock Acquisition, individuals and businesses can effectively communicate their intentions and initiate productive negotiations in this dynamic city.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.