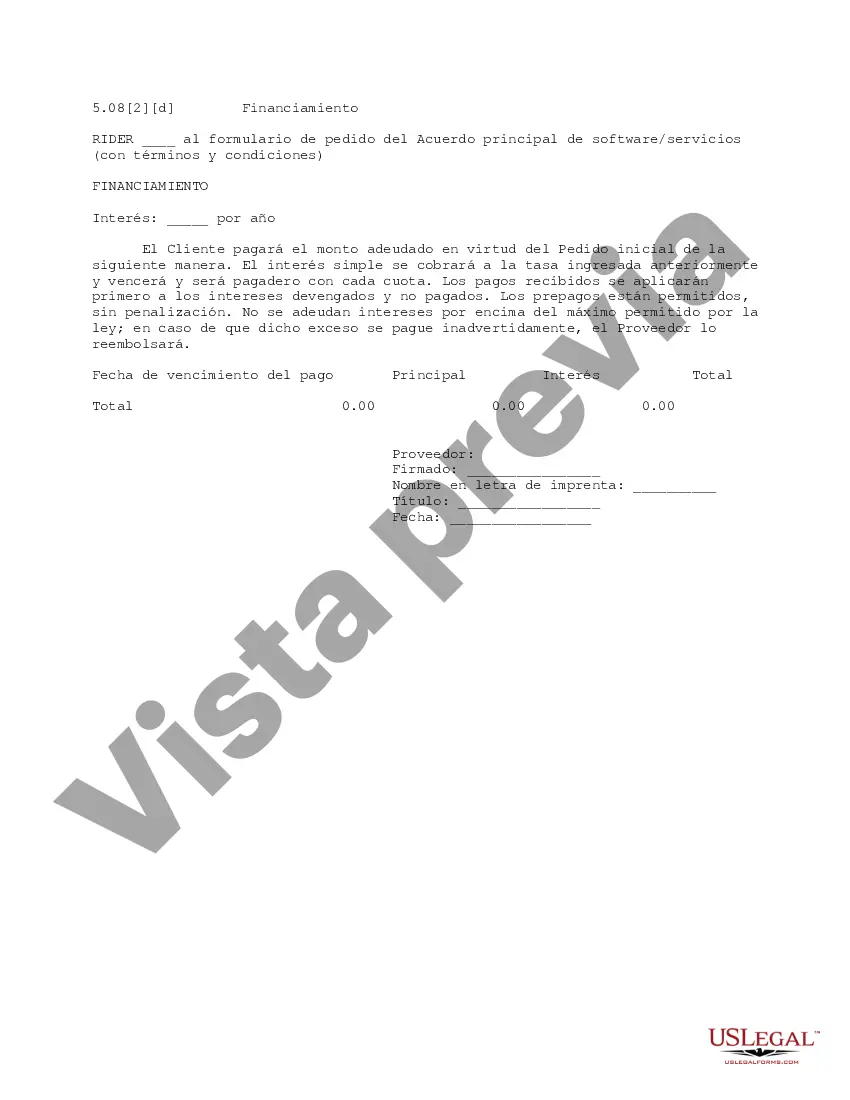

This is a financing agreement addendum to the software/services master agreement order form. It includes terms on interest and prepayments.

Fulton County, Georgia, offers a range of financing options and services to individuals, businesses, and organizations within its jurisdiction. Fulton Georgia Financing refers to various forms of financial assistance provided by the county government to support economic development, education, infrastructure projects, and other community initiatives. Here is a breakdown of different types of Fulton Georgia Financing: 1. Small Business Loans: Fulton County offers low-interest loans and grants to small businesses and startups. These funds can be used for business expansion, working capital, equipment purchase, or other allowable expenses. Fulton County Small Business Loan Program aims to stimulate local entrepreneurship and foster job creation. 2. Microloans: The county provides microloans for entrepreneurs who may not qualify for traditional bank loans. These smaller loans can be utilized for various business needs, such as marketing, inventory, or equipment upgrades. Microloans often come with flexible repayment terms and lower interest rates, enabling small business owners to access much-needed capital. 3. Infrastructure Financing: Fulton County supports infrastructure development through financing initiatives. This includes loans for public works projects like road construction, bridge repairs, water systems, and other critical infrastructure enhancements. The county collaborates with local governments, nonprofits, and private entities to fund and implement these projects. 4. Housing Loans and Grants: Fulton County offers housing loans and grants to eligible individuals and families for affordable housing purposes. These programs aim to assist low-income households in acquiring safe and decent housing or making necessary repairs/upgrades to their existing homes. The funding can be used for down payments, mortgage assistance, rehabilitation, energy-efficiency improvements, and more. 5. Education Financing: Fulton County promotes educational opportunities by providing financial resources through scholarships, grants, and other assistance programs. These initiatives support students pursuing higher education, vocational training, and other educational endeavors. The county also collaborates with educational institutions to fund specialized programs and promote workforce development. 6. Community Development Block Grants (CBG): Fulton County receives federal CBG funds to address community development needs. These grants are allocated to support infrastructure projects, affordable housing, public facilities, and social service programs within the county. The funds aim to enhance the quality of life for vulnerable populations, revitalize neighborhoods, and foster economic growth. Overall, Fulton Georgia Financing encompasses a comprehensive set of financial programs and resources designed to support the local community's diverse needs. Whether you are an individual seeking housing assistance, a small business owner in need of capital, or a community organization looking to enhance social services, Fulton County offers various financing options to help achieve your goals.Fulton County, Georgia, offers a range of financing options and services to individuals, businesses, and organizations within its jurisdiction. Fulton Georgia Financing refers to various forms of financial assistance provided by the county government to support economic development, education, infrastructure projects, and other community initiatives. Here is a breakdown of different types of Fulton Georgia Financing: 1. Small Business Loans: Fulton County offers low-interest loans and grants to small businesses and startups. These funds can be used for business expansion, working capital, equipment purchase, or other allowable expenses. Fulton County Small Business Loan Program aims to stimulate local entrepreneurship and foster job creation. 2. Microloans: The county provides microloans for entrepreneurs who may not qualify for traditional bank loans. These smaller loans can be utilized for various business needs, such as marketing, inventory, or equipment upgrades. Microloans often come with flexible repayment terms and lower interest rates, enabling small business owners to access much-needed capital. 3. Infrastructure Financing: Fulton County supports infrastructure development through financing initiatives. This includes loans for public works projects like road construction, bridge repairs, water systems, and other critical infrastructure enhancements. The county collaborates with local governments, nonprofits, and private entities to fund and implement these projects. 4. Housing Loans and Grants: Fulton County offers housing loans and grants to eligible individuals and families for affordable housing purposes. These programs aim to assist low-income households in acquiring safe and decent housing or making necessary repairs/upgrades to their existing homes. The funding can be used for down payments, mortgage assistance, rehabilitation, energy-efficiency improvements, and more. 5. Education Financing: Fulton County promotes educational opportunities by providing financial resources through scholarships, grants, and other assistance programs. These initiatives support students pursuing higher education, vocational training, and other educational endeavors. The county also collaborates with educational institutions to fund specialized programs and promote workforce development. 6. Community Development Block Grants (CBG): Fulton County receives federal CBG funds to address community development needs. These grants are allocated to support infrastructure projects, affordable housing, public facilities, and social service programs within the county. The funds aim to enhance the quality of life for vulnerable populations, revitalize neighborhoods, and foster economic growth. Overall, Fulton Georgia Financing encompasses a comprehensive set of financial programs and resources designed to support the local community's diverse needs. Whether you are an individual seeking housing assistance, a small business owner in need of capital, or a community organization looking to enhance social services, Fulton County offers various financing options to help achieve your goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.