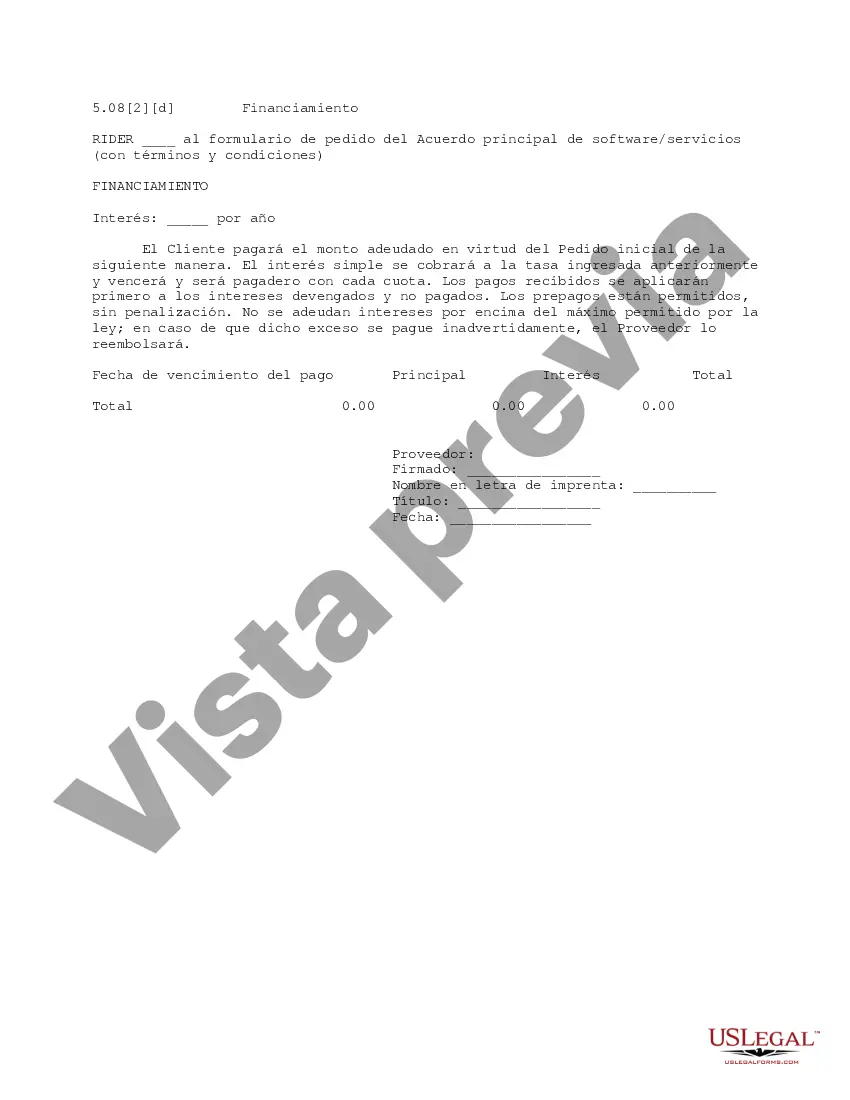

This is a financing agreement addendum to the software/services master agreement order form. It includes terms on interest and prepayments.

Montgomery Maryland Financing is a comprehensive financial system that caters to the various financial needs of individuals and businesses in Montgomery County, Maryland. It offers a range of services, including loans, credit lines, mortgages, and investments, provided by local financial institutions, banks, and credit unions. One of the most popular types of Montgomery Maryland Financing is personal loans. These are unsecured loans typically used for expenses such as home renovations, debt consolidation, medical emergencies, or other personal purposes. Personal loans have a fixed interest rate and repayment term, allowing borrowers to plan their finances effectively. Business financing options in Montgomery Maryland include loans and lines of credit specifically tailored to meet the capital requirements of local companies. Small businesses can obtain working capital loans to manage day-to-day operations, while larger enterprises can access long-term loans for expansion or equipment purchase. Moreover, businesses in Montgomery Maryland can benefit from lines of credit that offer flexible access to funds, allowing them to cover unexpected expenses or manage fluctuations in cash flow. Another prominent financing option is mortgage loans, enabling individuals and families to purchase their dream homes in Montgomery County. Montgomery Maryland provides competitive interest rates and flexible terms for both first-time homebuyers and existing homeowners looking to refinance their mortgage. Various loan programs are available, including government-backed loans like FHA or VA loans, as well as conventional loans. For investment purposes, Montgomery Maryland offers a wide array of financial vehicles such as mutual funds, stocks, bonds, and retirement accounts. Investment advisors and brokerage firms in the area provide expert guidance to help individuals make informed investment decisions based on their financial goals and risk tolerance. In summary, Montgomery Maryland Financing encompasses personal loans, business financing, mortgage loans, and investment opportunities. With its diverse range of financial services, residents and businesses in Montgomery County have access to suitable financing options tailored to their specific needs. Whether it be building a business, purchasing a home, managing personal expenses, or growing wealth through investments, Montgomery Maryland Financing provides a comprehensive framework to support the financial aspirations of the community.Montgomery Maryland Financing is a comprehensive financial system that caters to the various financial needs of individuals and businesses in Montgomery County, Maryland. It offers a range of services, including loans, credit lines, mortgages, and investments, provided by local financial institutions, banks, and credit unions. One of the most popular types of Montgomery Maryland Financing is personal loans. These are unsecured loans typically used for expenses such as home renovations, debt consolidation, medical emergencies, or other personal purposes. Personal loans have a fixed interest rate and repayment term, allowing borrowers to plan their finances effectively. Business financing options in Montgomery Maryland include loans and lines of credit specifically tailored to meet the capital requirements of local companies. Small businesses can obtain working capital loans to manage day-to-day operations, while larger enterprises can access long-term loans for expansion or equipment purchase. Moreover, businesses in Montgomery Maryland can benefit from lines of credit that offer flexible access to funds, allowing them to cover unexpected expenses or manage fluctuations in cash flow. Another prominent financing option is mortgage loans, enabling individuals and families to purchase their dream homes in Montgomery County. Montgomery Maryland provides competitive interest rates and flexible terms for both first-time homebuyers and existing homeowners looking to refinance their mortgage. Various loan programs are available, including government-backed loans like FHA or VA loans, as well as conventional loans. For investment purposes, Montgomery Maryland offers a wide array of financial vehicles such as mutual funds, stocks, bonds, and retirement accounts. Investment advisors and brokerage firms in the area provide expert guidance to help individuals make informed investment decisions based on their financial goals and risk tolerance. In summary, Montgomery Maryland Financing encompasses personal loans, business financing, mortgage loans, and investment opportunities. With its diverse range of financial services, residents and businesses in Montgomery County have access to suitable financing options tailored to their specific needs. Whether it be building a business, purchasing a home, managing personal expenses, or growing wealth through investments, Montgomery Maryland Financing provides a comprehensive framework to support the financial aspirations of the community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.