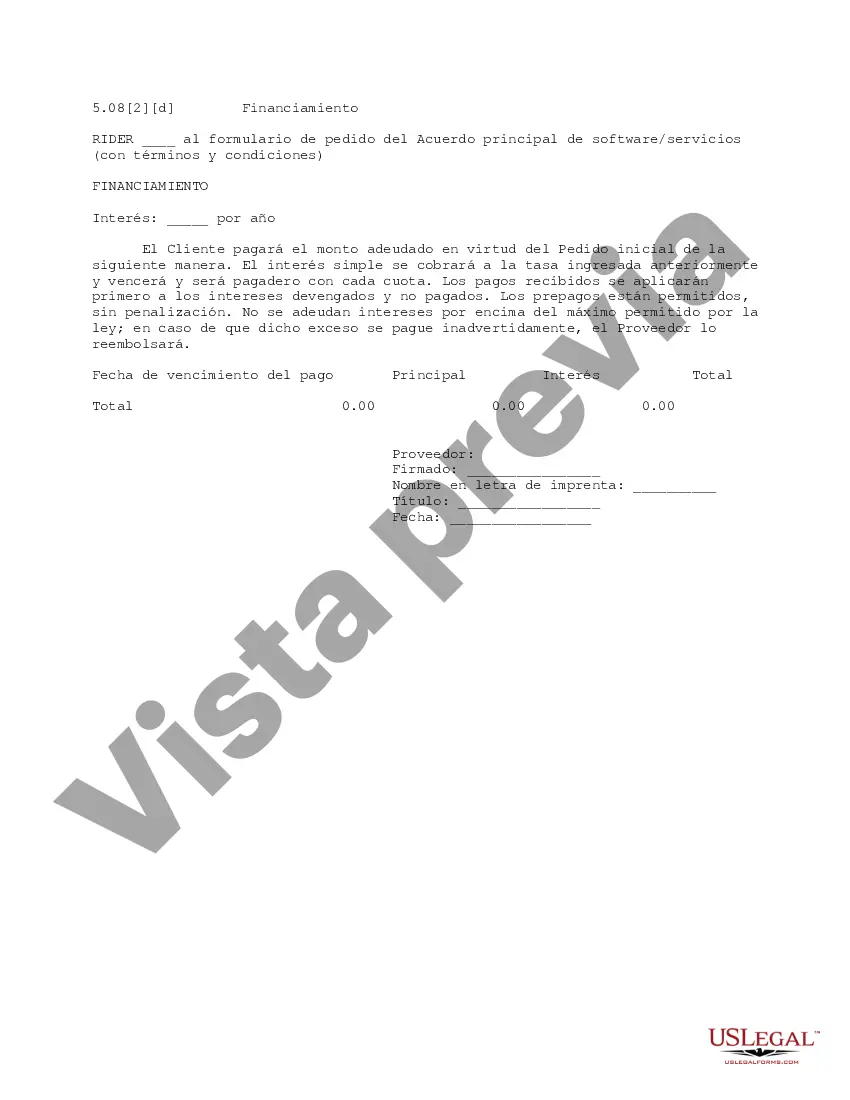

This is a financing agreement addendum to the software/services master agreement order form. It includes terms on interest and prepayments.

Sacramento California Financing refers to the various financial services and options available in the city of Sacramento, California to support individuals, businesses, and organizations in meeting their financial needs. Whether it is funding for personal expenses or capital for business ventures, Sacramento offers a range of financing opportunities tailored to different circumstances. 1. Personal Financing: Sacramento provides numerous options for personal financing, enabling individuals to acquire funds for various purposes. This can include loans, credit cards, and mortgage financing provided by banks, credit unions, and other financial institutions. 2. Small Business Financing: Sacramento is known for its vibrant entrepreneurial community, and thus, offers diverse options for small business financing. This includes traditional bank loans, lines of credit, Small Business Administration (SBA) loans, microloans, and grants provided by various state and local government programs or organizations dedicated to supporting small businesses. 3. Real Estate Financing: Sacramento California has a thriving real estate market, leading to numerous financing options for both residential and commercial properties. These include traditional mortgages, Helots (Home Equity Line of Credit), construction loans, hard money loans, bridge financing, and even crowdfunding platforms specific to real estate investments. 4. Green Financing: As a city committed to sustainability, Sacramento offers green financing options aimed at promoting environmentally friendly initiatives. Homeowners and businesses in Sacramento can access energy-efficient loans, PACE (Property Assessed Clean Energy) financing, and grants to fund renewable energy installations, energy-efficient renovations, and water conservation projects. 5. Government Financing Programs: Sacramento provides access to various government-sponsored financing programs. These can include low-interest loans, job creation grants, tax credits, and incentives offered by local, state, and federal agencies supporting economic development initiatives, affordable housing programs, infrastructure improvements, and community revitalization projects. 6. Venture Capital: As the capital of California, Sacramento attracts venture capital firms and angel investors interested in funding promising startups and high-growth businesses. Sacramento-based entrepreneurs often access venture capital funding to fuel their innovative ideas and propel their businesses to the next level. 7. Non-profit Financing: Sacramento hosts a thriving non-profit sector that focuses on social welfare and community development. Financing options for non-profits include grants, donations, endowments, and specialized loans that cater to their unique financial needs. Overall, Sacramento California Financing encompasses a wide range of financial services and options for individuals, businesses, and organizations, aiming to support their financial goals, growth, and development. Whether it's personal, business, real estate, green initiatives, or government-sponsored programs, Sacramento offers a diverse array of financing opportunities to meet the diverse needs of its residents and foster economic prosperity.Sacramento California Financing refers to the various financial services and options available in the city of Sacramento, California to support individuals, businesses, and organizations in meeting their financial needs. Whether it is funding for personal expenses or capital for business ventures, Sacramento offers a range of financing opportunities tailored to different circumstances. 1. Personal Financing: Sacramento provides numerous options for personal financing, enabling individuals to acquire funds for various purposes. This can include loans, credit cards, and mortgage financing provided by banks, credit unions, and other financial institutions. 2. Small Business Financing: Sacramento is known for its vibrant entrepreneurial community, and thus, offers diverse options for small business financing. This includes traditional bank loans, lines of credit, Small Business Administration (SBA) loans, microloans, and grants provided by various state and local government programs or organizations dedicated to supporting small businesses. 3. Real Estate Financing: Sacramento California has a thriving real estate market, leading to numerous financing options for both residential and commercial properties. These include traditional mortgages, Helots (Home Equity Line of Credit), construction loans, hard money loans, bridge financing, and even crowdfunding platforms specific to real estate investments. 4. Green Financing: As a city committed to sustainability, Sacramento offers green financing options aimed at promoting environmentally friendly initiatives. Homeowners and businesses in Sacramento can access energy-efficient loans, PACE (Property Assessed Clean Energy) financing, and grants to fund renewable energy installations, energy-efficient renovations, and water conservation projects. 5. Government Financing Programs: Sacramento provides access to various government-sponsored financing programs. These can include low-interest loans, job creation grants, tax credits, and incentives offered by local, state, and federal agencies supporting economic development initiatives, affordable housing programs, infrastructure improvements, and community revitalization projects. 6. Venture Capital: As the capital of California, Sacramento attracts venture capital firms and angel investors interested in funding promising startups and high-growth businesses. Sacramento-based entrepreneurs often access venture capital funding to fuel their innovative ideas and propel their businesses to the next level. 7. Non-profit Financing: Sacramento hosts a thriving non-profit sector that focuses on social welfare and community development. Financing options for non-profits include grants, donations, endowments, and specialized loans that cater to their unique financial needs. Overall, Sacramento California Financing encompasses a wide range of financial services and options for individuals, businesses, and organizations, aiming to support their financial goals, growth, and development. Whether it's personal, business, real estate, green initiatives, or government-sponsored programs, Sacramento offers a diverse array of financing opportunities to meet the diverse needs of its residents and foster economic prosperity.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.