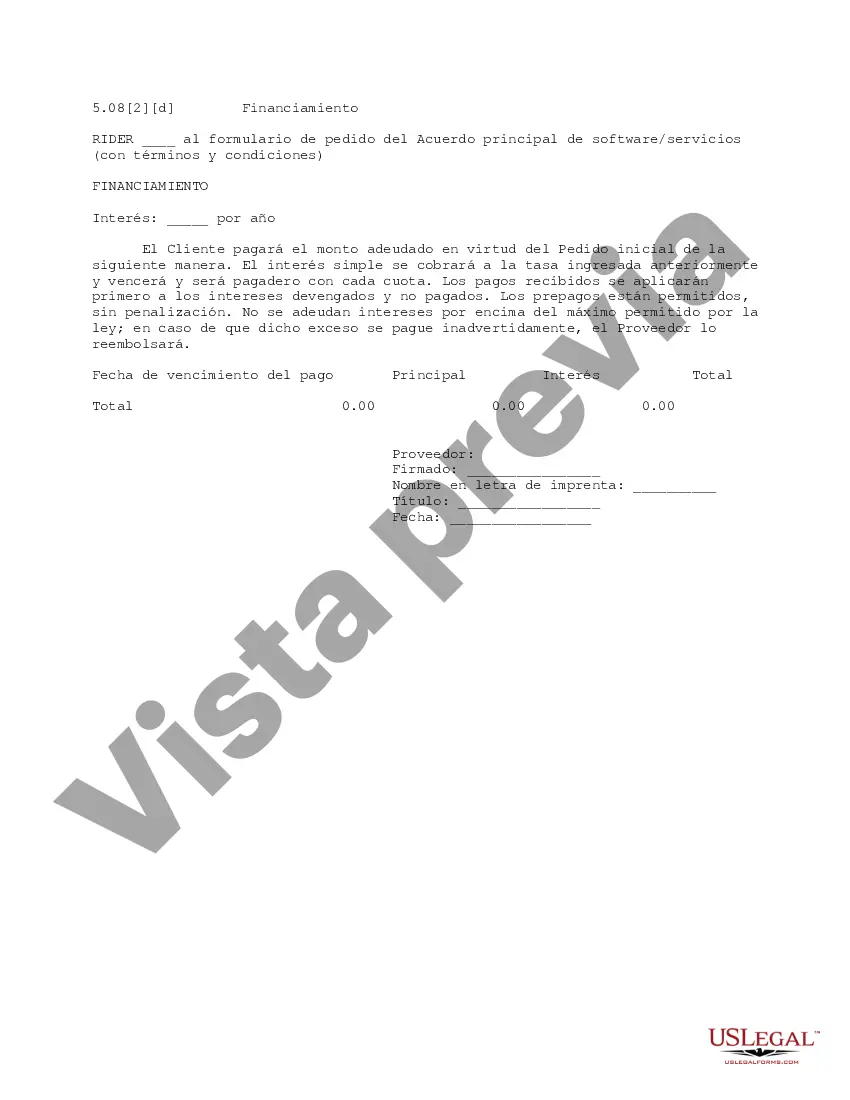

This is a financing agreement addendum to the software/services master agreement order form. It includes terms on interest and prepayments.

Suffolk New York Financing is a comprehensive financial service offered in Suffolk County, New York, aimed at helping individuals and businesses meet their financial needs. Whether you are looking to fund a personal project, expand your business, purchase a property, or make necessary investments, Suffolk New York Financing offers various types of financing options to cater to different requirements. 1. Personal Loans: Suffolk New York Financing provides personal loans to individuals looking for financial assistance for personal reasons such as debt consolidation, unexpected expenses, home improvements, or education. These loans offer flexible repayment terms, competitive interest rates, and the convenience of online applications. 2. Business Loans: For small, medium, or large enterprises in Suffolk County, Suffolk New York Financing offers business loans that can finance startups, expansions, equipment purchases, inventory management, working capital, and more. These loans are designed to meet the unique financial needs of businesses, ensuring a smooth cash flow and fostering growth. 3. Mortgage Financing: Suffolk New York Financing offers mortgage loans to help individuals and families fulfill their dream of homeownership in the county. Whether you are a first-time homebuyer or looking to refinance an existing mortgage, Suffolk New York Financing provides various mortgage options with competitive interest rates and personalized assistance throughout the application process. 4. Commercial Real Estate Loans: For businesses looking to acquire, develop, or invest in commercial real estate properties in Suffolk County, Suffolk New York Financing offers specialized commercial real estate loans. These loans can be used for purchasing office spaces, retail areas, industrial properties, and more, providing businesses with the necessary capital to thrive. 5. Equipment Financing: Suffolk New York Financing understands the importance of having state-of-the-art equipment for businesses to stay competitive. To facilitate equipment purchases, they offer equipment financing options tailored to the needs of different industries. Whether it's machinery, technology, vehicles, or specialized equipment, businesses can access the funds required to acquire essential assets. 6. Lines of Credit: Suffolk New York Financing provides lines of credit to both individuals and businesses in need of flexible financing solutions. A line of credit allows borrowers to access a predetermined credit limit whenever needed, making it an ideal choice for managing cash flow, business operations, or unexpected expenses. In summary, Suffolk New York Financing offers a wide range of financial solutions to meet the diverse needs of individuals and businesses in Suffolk County. Whether one requires personal loans, business loans, mortgage financing, commercial real estate loans, equipment financing, or lines of credit, Suffolk New York Financing aims to provide competitive rates, flexible terms, and impeccable customer service to help individuals and businesses achieve their financial goals.Suffolk New York Financing is a comprehensive financial service offered in Suffolk County, New York, aimed at helping individuals and businesses meet their financial needs. Whether you are looking to fund a personal project, expand your business, purchase a property, or make necessary investments, Suffolk New York Financing offers various types of financing options to cater to different requirements. 1. Personal Loans: Suffolk New York Financing provides personal loans to individuals looking for financial assistance for personal reasons such as debt consolidation, unexpected expenses, home improvements, or education. These loans offer flexible repayment terms, competitive interest rates, and the convenience of online applications. 2. Business Loans: For small, medium, or large enterprises in Suffolk County, Suffolk New York Financing offers business loans that can finance startups, expansions, equipment purchases, inventory management, working capital, and more. These loans are designed to meet the unique financial needs of businesses, ensuring a smooth cash flow and fostering growth. 3. Mortgage Financing: Suffolk New York Financing offers mortgage loans to help individuals and families fulfill their dream of homeownership in the county. Whether you are a first-time homebuyer or looking to refinance an existing mortgage, Suffolk New York Financing provides various mortgage options with competitive interest rates and personalized assistance throughout the application process. 4. Commercial Real Estate Loans: For businesses looking to acquire, develop, or invest in commercial real estate properties in Suffolk County, Suffolk New York Financing offers specialized commercial real estate loans. These loans can be used for purchasing office spaces, retail areas, industrial properties, and more, providing businesses with the necessary capital to thrive. 5. Equipment Financing: Suffolk New York Financing understands the importance of having state-of-the-art equipment for businesses to stay competitive. To facilitate equipment purchases, they offer equipment financing options tailored to the needs of different industries. Whether it's machinery, technology, vehicles, or specialized equipment, businesses can access the funds required to acquire essential assets. 6. Lines of Credit: Suffolk New York Financing provides lines of credit to both individuals and businesses in need of flexible financing solutions. A line of credit allows borrowers to access a predetermined credit limit whenever needed, making it an ideal choice for managing cash flow, business operations, or unexpected expenses. In summary, Suffolk New York Financing offers a wide range of financial solutions to meet the diverse needs of individuals and businesses in Suffolk County. Whether one requires personal loans, business loans, mortgage financing, commercial real estate loans, equipment financing, or lines of credit, Suffolk New York Financing aims to provide competitive rates, flexible terms, and impeccable customer service to help individuals and businesses achieve their financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.