This is a corporate policy document designed to meet the standards of the Foreign Corrupt Practices Act, a provision of the Securities and Exchange Act of 1934. FCPA generally prohibits payments by companies and their representatives to foreign (i.e., non-U.S.) government and quasi-government officials to secure business.

Maricopa, Arizona Foreign Corrupt Practices Act (CPA) Corporate Policy is a set of guidelines and regulations that organizations operating within Maricopa, Arizona must adhere to when conducting business internationally. The CPA is a United States federal law that aims to prevent bribery and corrupt practices by companies involved in international business transactions. Compliance with this policy ensures that companies maintain ethical standards and promotes fair competition in the global marketplace. The Maricopa Arizona CPA Corporate Policy covers several key aspects relating to international business practices, including bribery, gifts and entertainment, political contributions, and monitoring of third-party intermediaries. This policy applies to both Maricopa-based companies engaging in international business and foreign companies with operations in Maricopa, Arizona. There are different types of Maricopa Arizona CPA Corporate Policy, depending on the industry and specific requirements of the company. Some common variations include: 1. Maricopa Arizona CPA Corporate Policy for Manufacturing Companies: This policy focuses on addressing the unique challenges faced by manufacturing companies involved in international business, such as supply chain management, agent relationships, and government interactions. 2. Maricopa Arizona CPA Corporate Policy for Financial Institutions: This policy caters to the compliance requirements of financial institutions operating internationally, including banks, insurance companies, and investment firms. It covers issues related to customer transactions, securities trading, and anti-money laundering. 3. Maricopa Arizona CPA Corporate Policy for Energy Companies: This policy is designed specifically for companies operating in the energy sector, including oil, gas, and renewable energy. It addresses the complex international business dealings commonly associated with energy projects, such as contracts with foreign governments, environmental compliance, and joint ventures. 4. Maricopa Arizona CPA Corporate Policy for Pharmaceutical and Healthcare Companies: This policy focuses on the unique challenges of pharmaceutical and healthcare companies involved in international operations, including interactions with healthcare professionals, clinical trials, and regulatory compliance. In conclusion, the Maricopa Arizona CPA Corporate Policy is essential for companies engaging in international business from Maricopa, Arizona. It sets guidelines to prevent corruption, bribery, and unethical practices, promoting fair competition and upholding ethical standards across various industries. It is crucial for companies to adopt industry-specific versions of this policy to ensure comprehensive compliance.

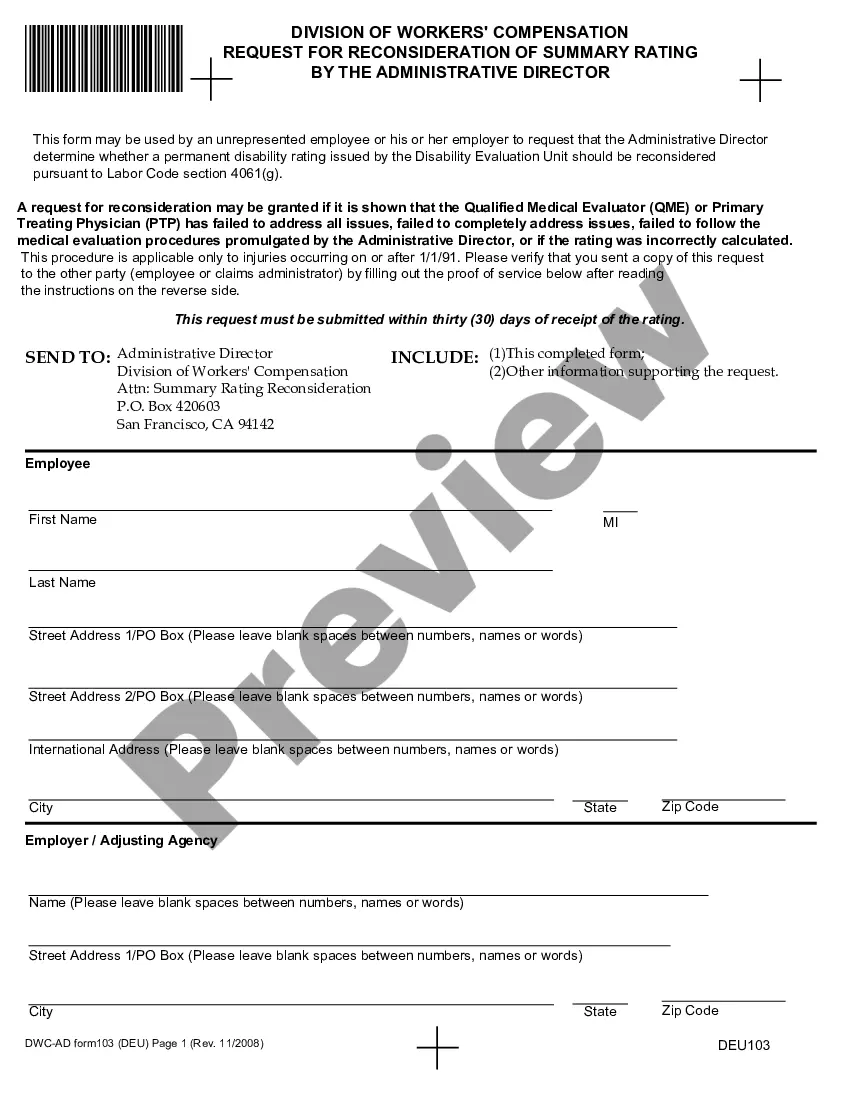

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.