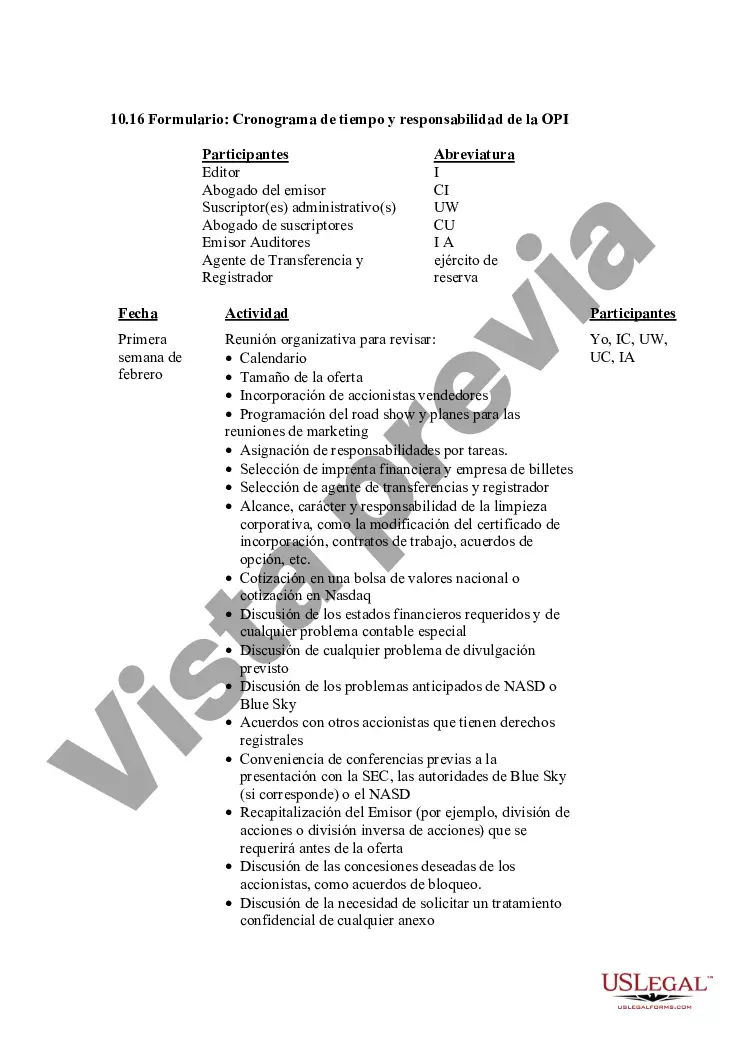

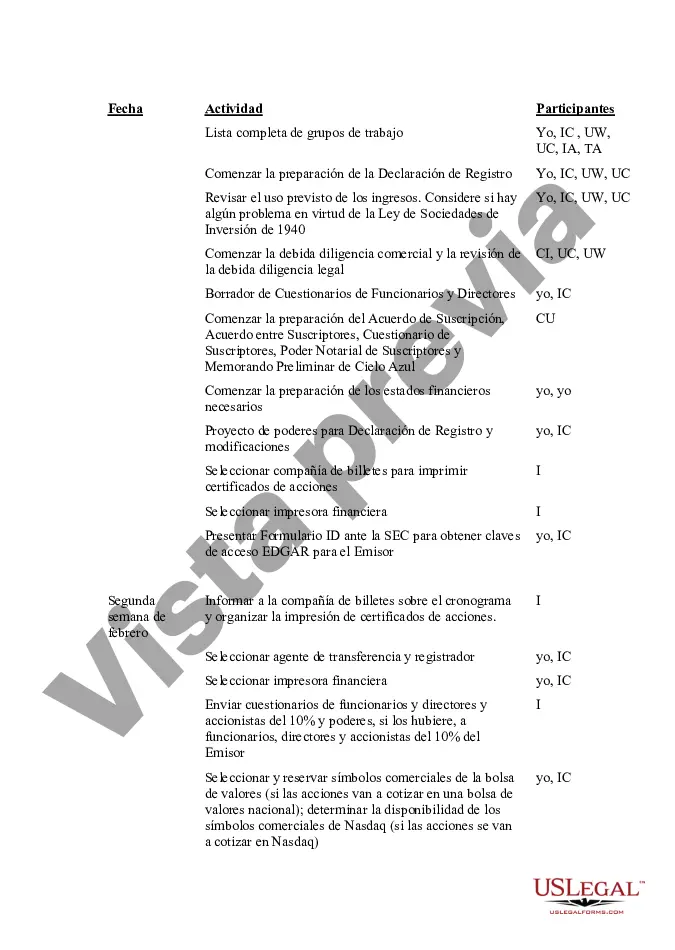

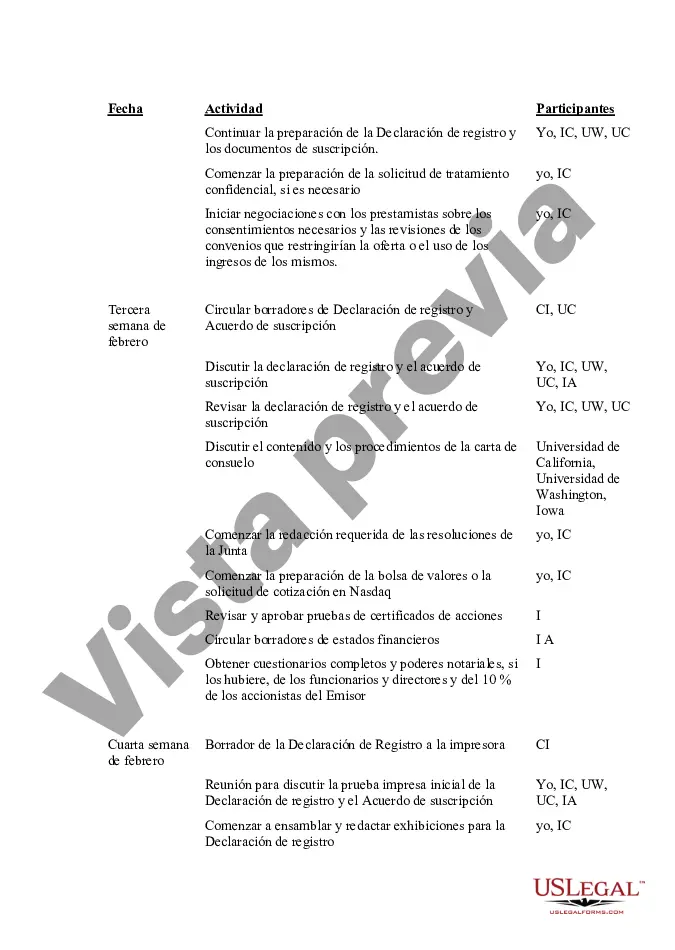

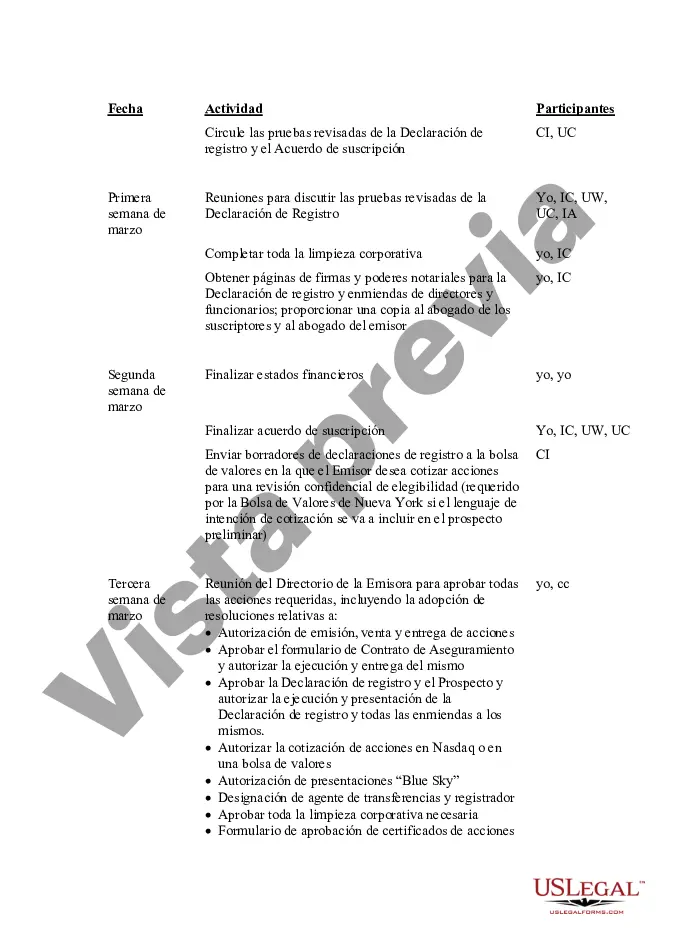

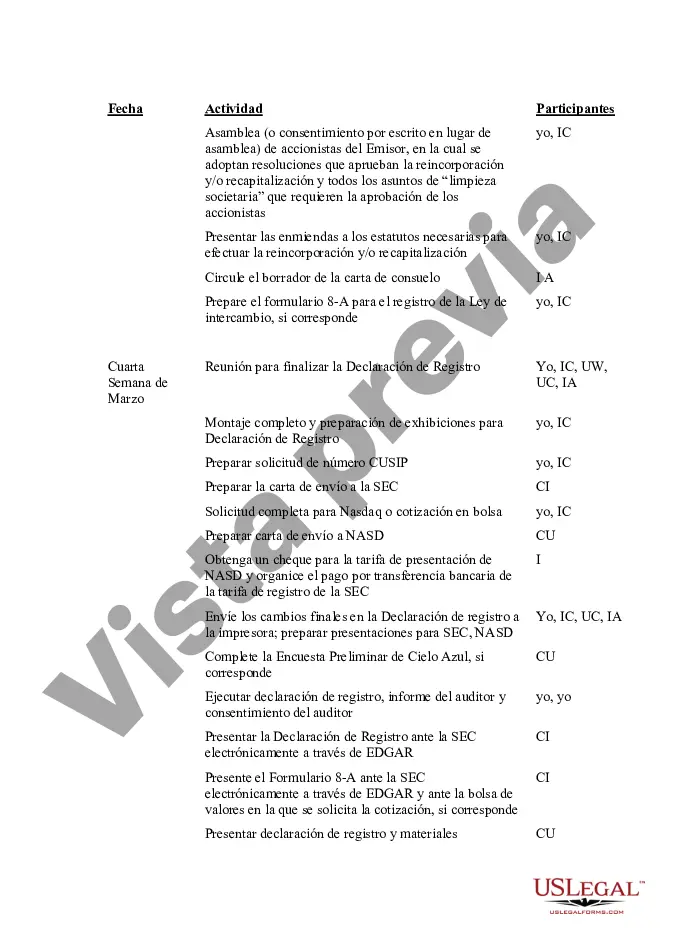

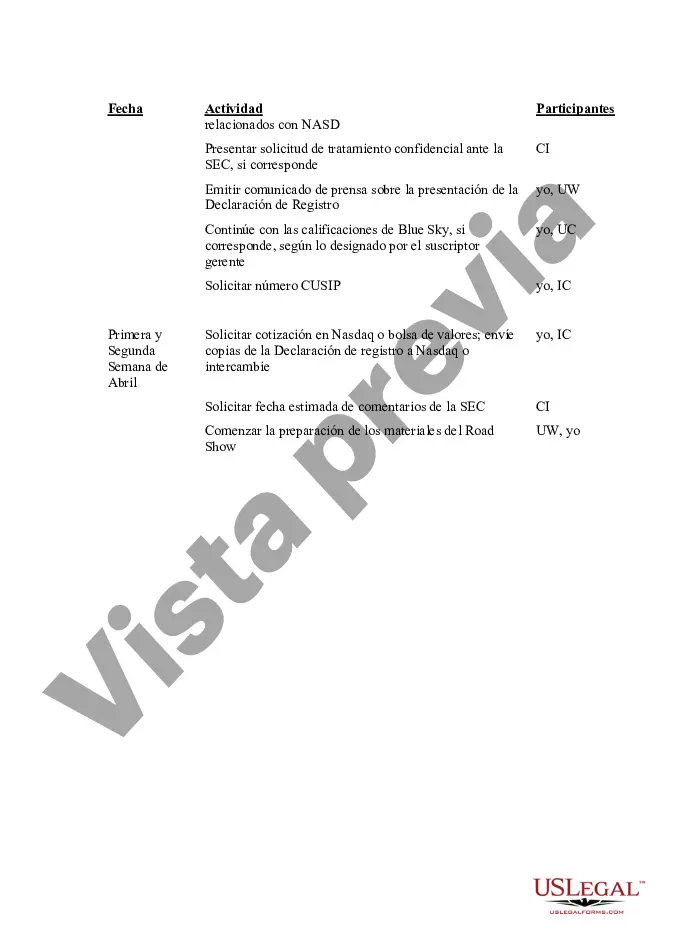

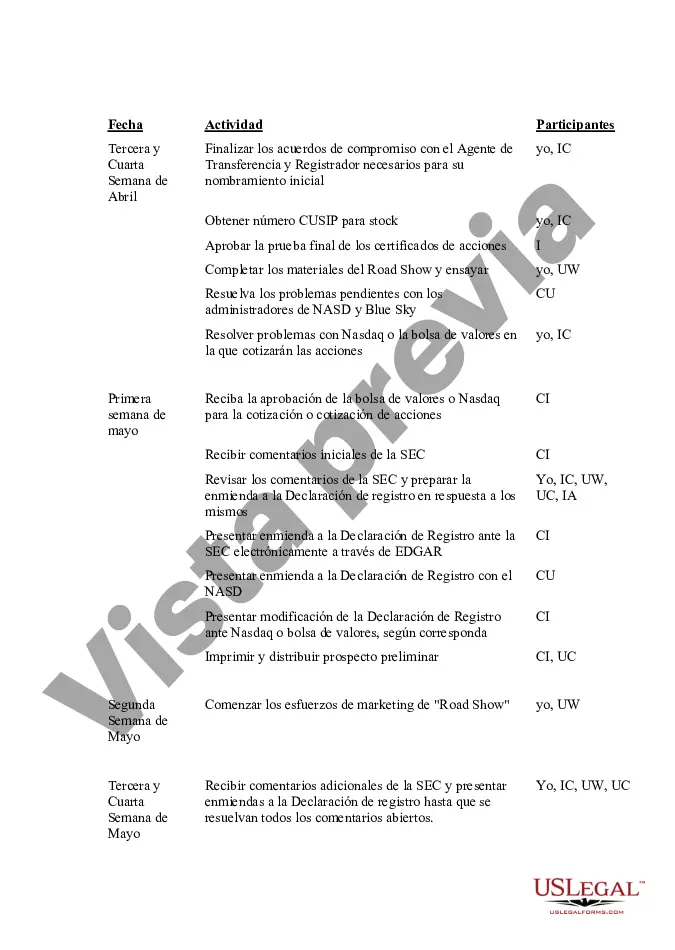

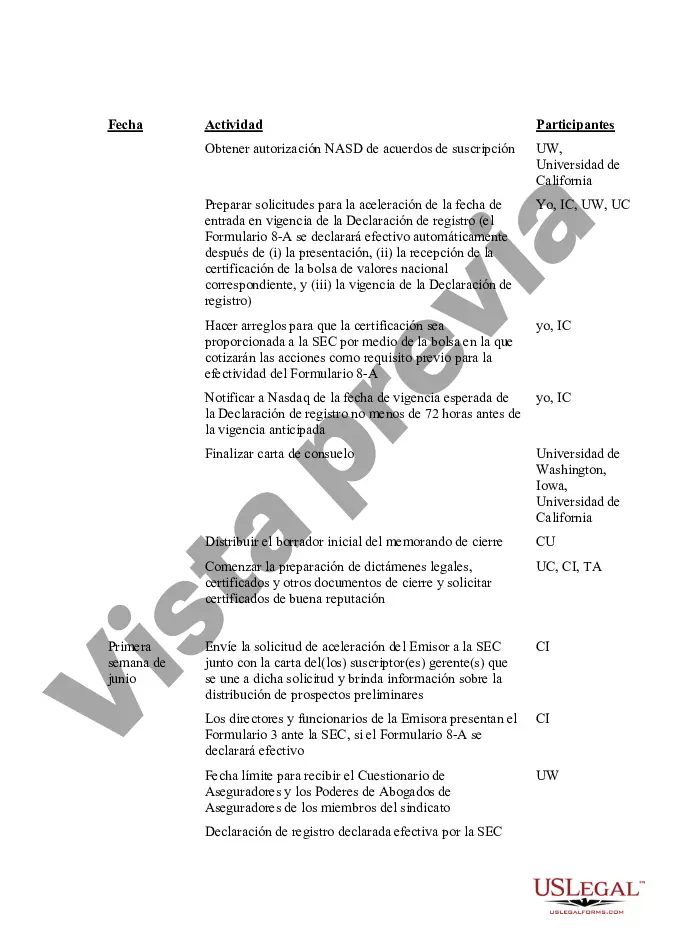

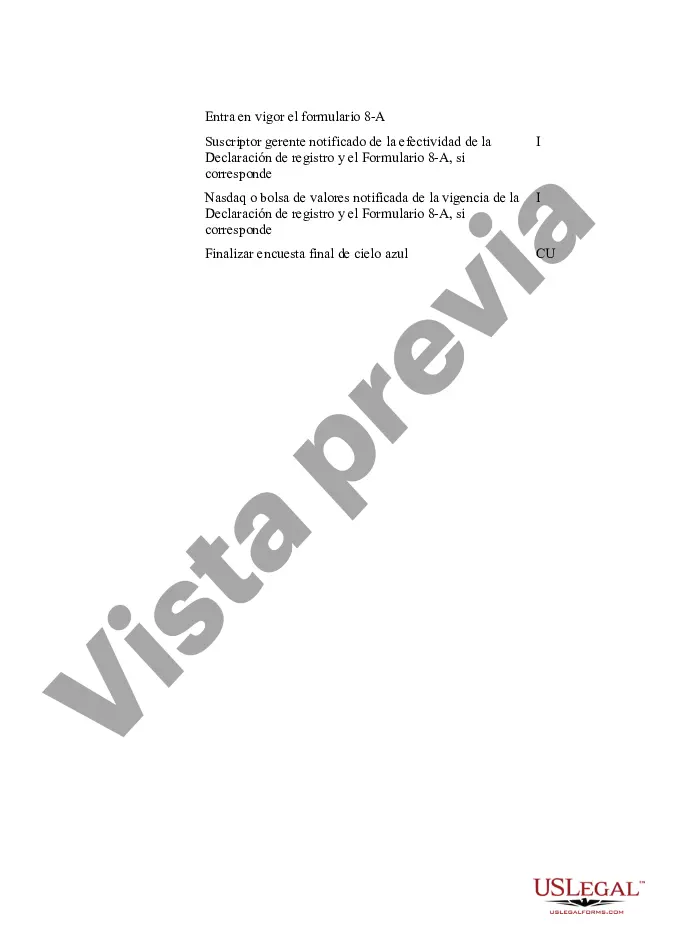

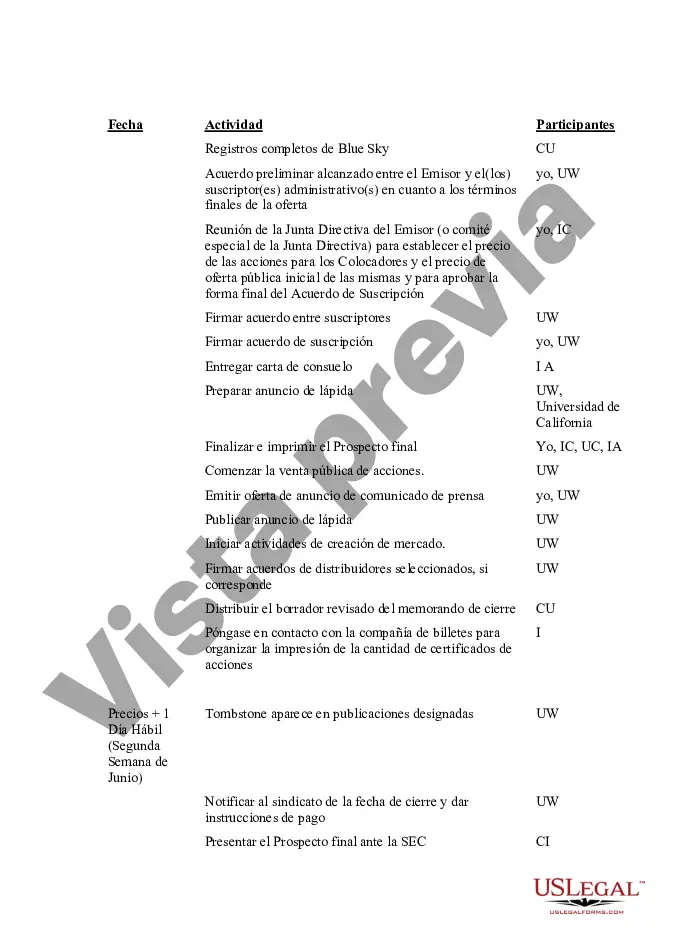

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Alameda California IPO Time and Responsibility Schedule: The Alameda, California IPO Time and Responsibility Schedule is a comprehensive timeline and plan that outlines the process and obligations involved in conducting an Initial Public Offering (IPO) in Alameda, California. This schedule is designed to ensure a smooth and efficient IPO process while adhering to regulatory guidelines and requirements set forth by the Securities and Exchange Commission (SEC) and other relevant authorities. The Alameda California IPO Time and Responsibility Schedule encompasses various stages and responsibilities to be undertaken by both the company going public and its legal and financial advisors. The schedule takes into account the unique features and considerations specific to Alameda, California, while also incorporating the general IPO process. Key steps and responsibilities included in the Alameda California IPO Time and Responsibility Schedule may involve: 1. pre-IPO Preparation: - Conducting due diligence and legal compliance review — Assembling the IPO team, including attorneys, accountants, and underwriters — Creating a comprehensive business plan and financial statements — Preparing the necessary documents, including prospectus and registration statement 2. SEC Filing and Review Period: — Filing the necessary documents with the SEC, including the Form S-1 — Engaging in discussions and responding to queries from the SEC during the review process — Ensuring compliance with SEC's disclosure requirements and accounting standards 3. Remarketing and Roadshow: — Engaging in pre-marketing activities, such as investor presentations and conferences — Conducting a roadshow to generate interest from potential investors — Finalizing the pricing and size of the offering based on investor demand 4. Pricing and Offering: — Setting the IPO price and finalizing the number of shares to be offered — Allocating shares to institutional and retail investors — Completing the offering and going public 5. Post-IPO Requirements: — Implementing necessary governance and reporting structures — Complying with ongoing SEC reporting obligations, such as filing Form 10-Q and Form 10-K — Managing investor relations and communication Different types of Alameda California IPO Time and Responsibility Schedules may vary based on the specific industry, size, and complexity of the company going public. For example, technology companies may have unique considerations related to intellectual property protection and licensing agreements, whereas healthcare companies may need to comply with additional regulatory requirements. By adhering to the Alameda California IPO Time and Responsibility Schedule, companies aiming to go public in Alameda, California can ensure a well-organized and regulatory-compliant process, enabling them to effectively raise capital and transition into the public markets.Alameda California IPO Time and Responsibility Schedule: The Alameda, California IPO Time and Responsibility Schedule is a comprehensive timeline and plan that outlines the process and obligations involved in conducting an Initial Public Offering (IPO) in Alameda, California. This schedule is designed to ensure a smooth and efficient IPO process while adhering to regulatory guidelines and requirements set forth by the Securities and Exchange Commission (SEC) and other relevant authorities. The Alameda California IPO Time and Responsibility Schedule encompasses various stages and responsibilities to be undertaken by both the company going public and its legal and financial advisors. The schedule takes into account the unique features and considerations specific to Alameda, California, while also incorporating the general IPO process. Key steps and responsibilities included in the Alameda California IPO Time and Responsibility Schedule may involve: 1. pre-IPO Preparation: - Conducting due diligence and legal compliance review — Assembling the IPO team, including attorneys, accountants, and underwriters — Creating a comprehensive business plan and financial statements — Preparing the necessary documents, including prospectus and registration statement 2. SEC Filing and Review Period: — Filing the necessary documents with the SEC, including the Form S-1 — Engaging in discussions and responding to queries from the SEC during the review process — Ensuring compliance with SEC's disclosure requirements and accounting standards 3. Remarketing and Roadshow: — Engaging in pre-marketing activities, such as investor presentations and conferences — Conducting a roadshow to generate interest from potential investors — Finalizing the pricing and size of the offering based on investor demand 4. Pricing and Offering: — Setting the IPO price and finalizing the number of shares to be offered — Allocating shares to institutional and retail investors — Completing the offering and going public 5. Post-IPO Requirements: — Implementing necessary governance and reporting structures — Complying with ongoing SEC reporting obligations, such as filing Form 10-Q and Form 10-K — Managing investor relations and communication Different types of Alameda California IPO Time and Responsibility Schedules may vary based on the specific industry, size, and complexity of the company going public. For example, technology companies may have unique considerations related to intellectual property protection and licensing agreements, whereas healthcare companies may need to comply with additional regulatory requirements. By adhering to the Alameda California IPO Time and Responsibility Schedule, companies aiming to go public in Alameda, California can ensure a well-organized and regulatory-compliant process, enabling them to effectively raise capital and transition into the public markets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.