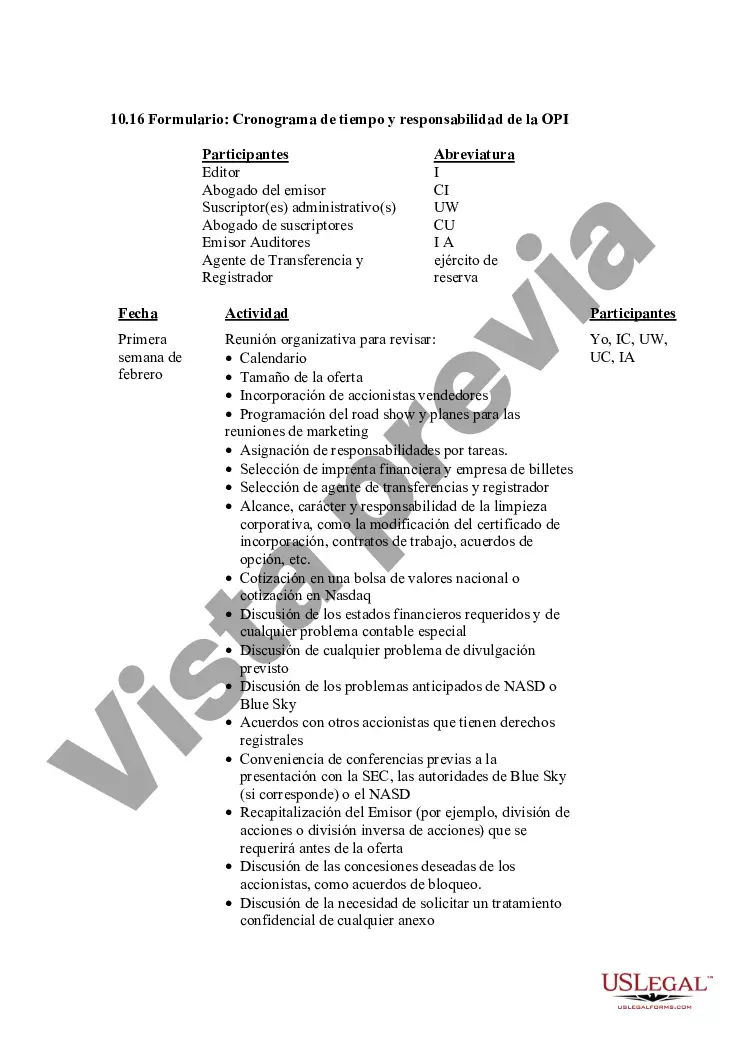

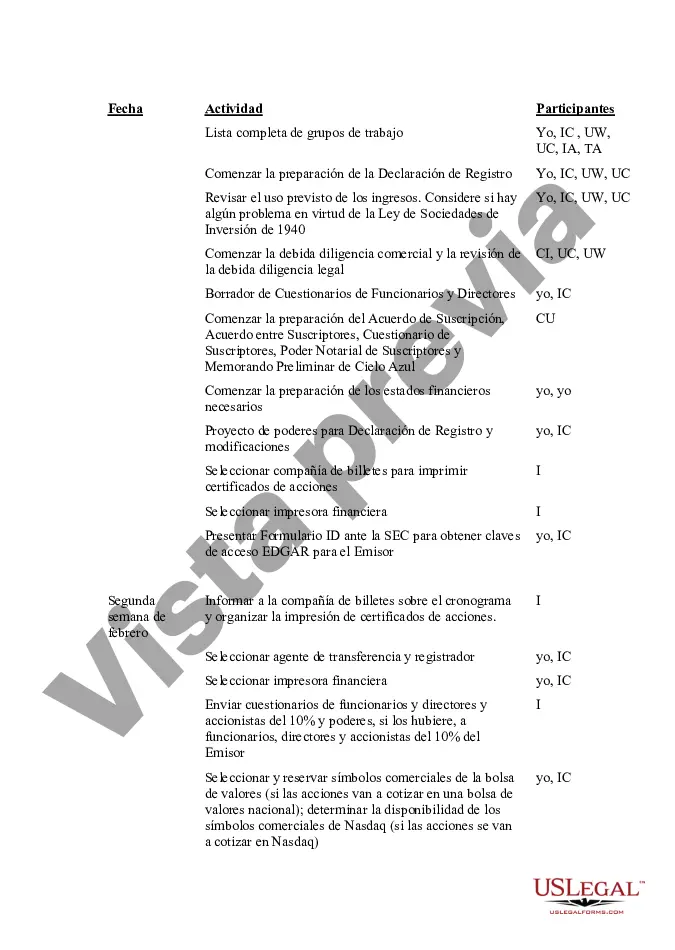

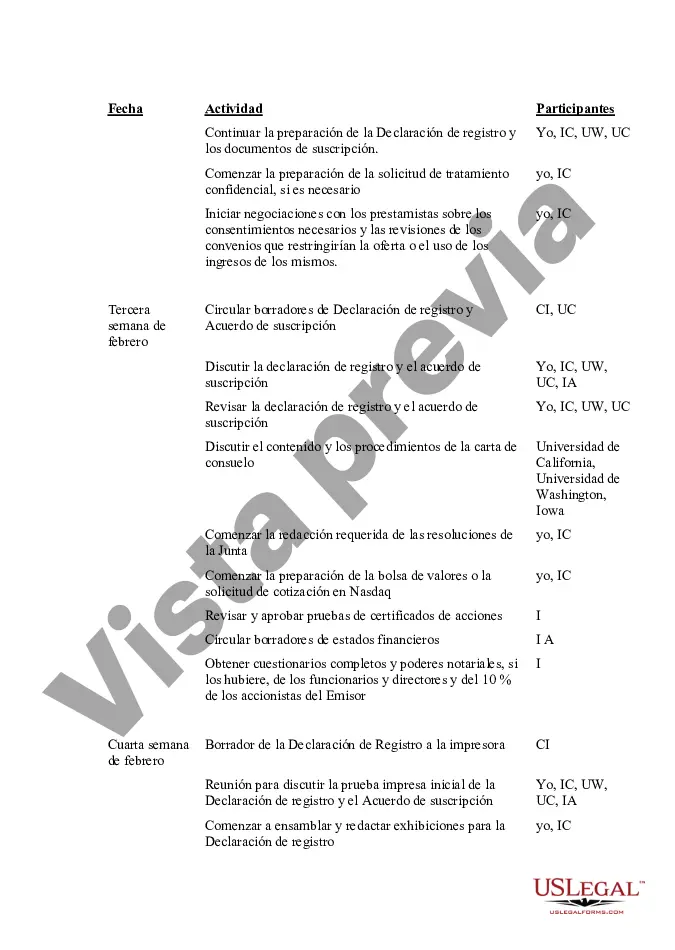

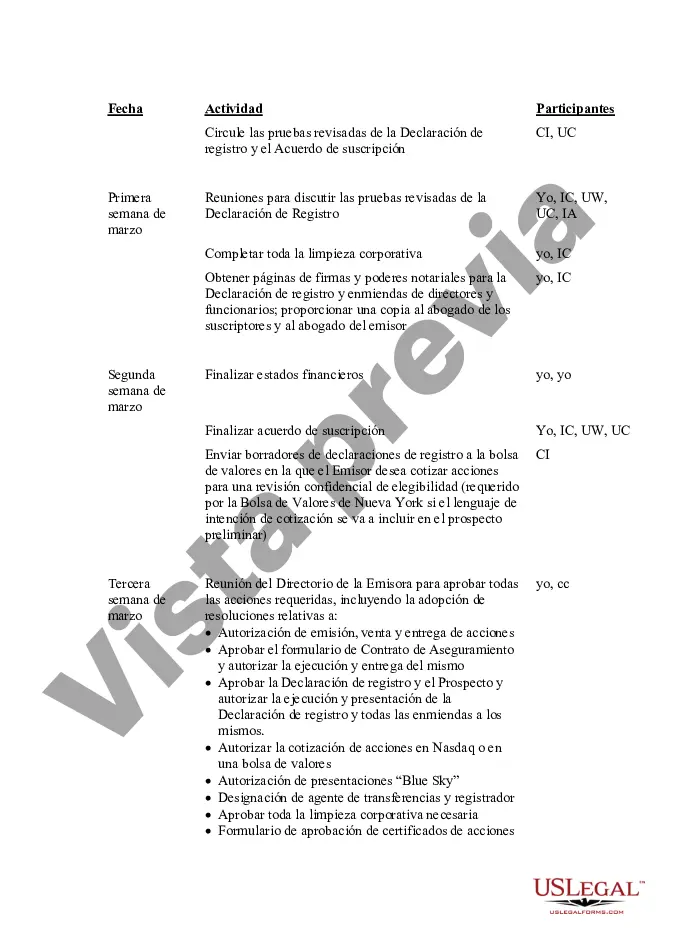

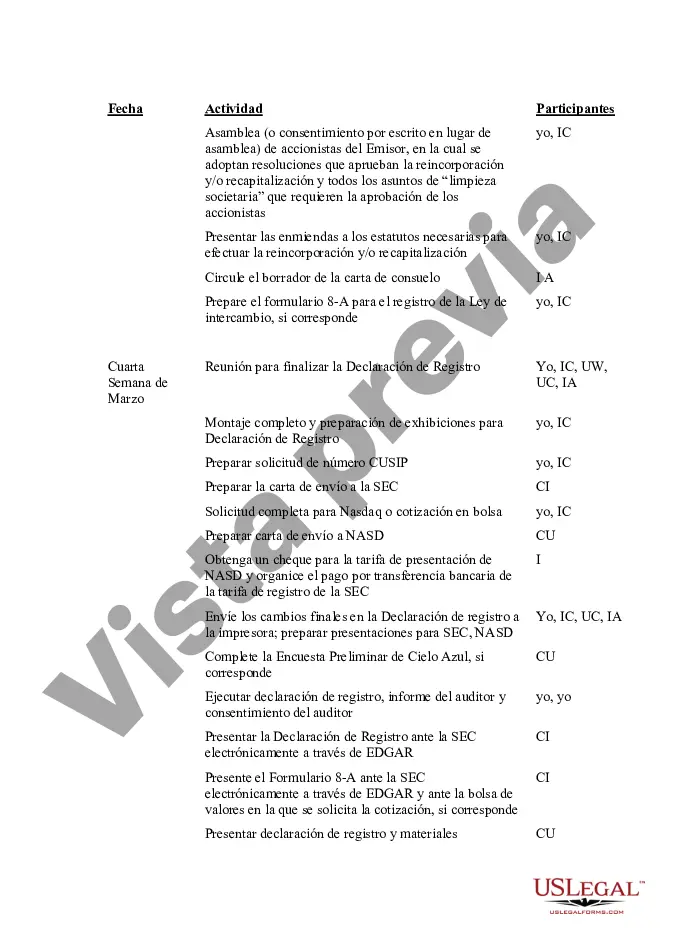

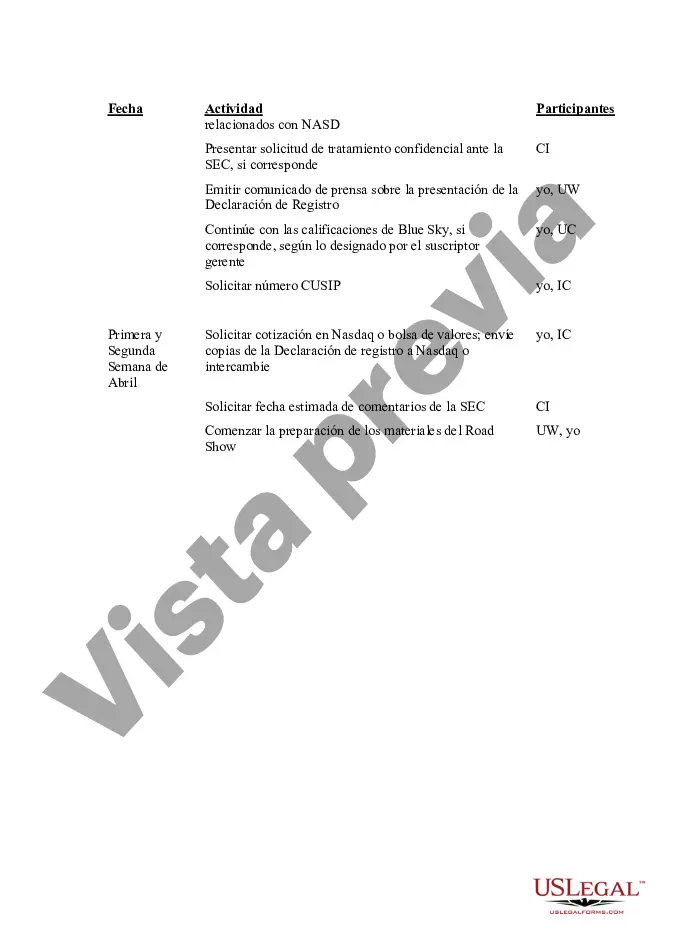

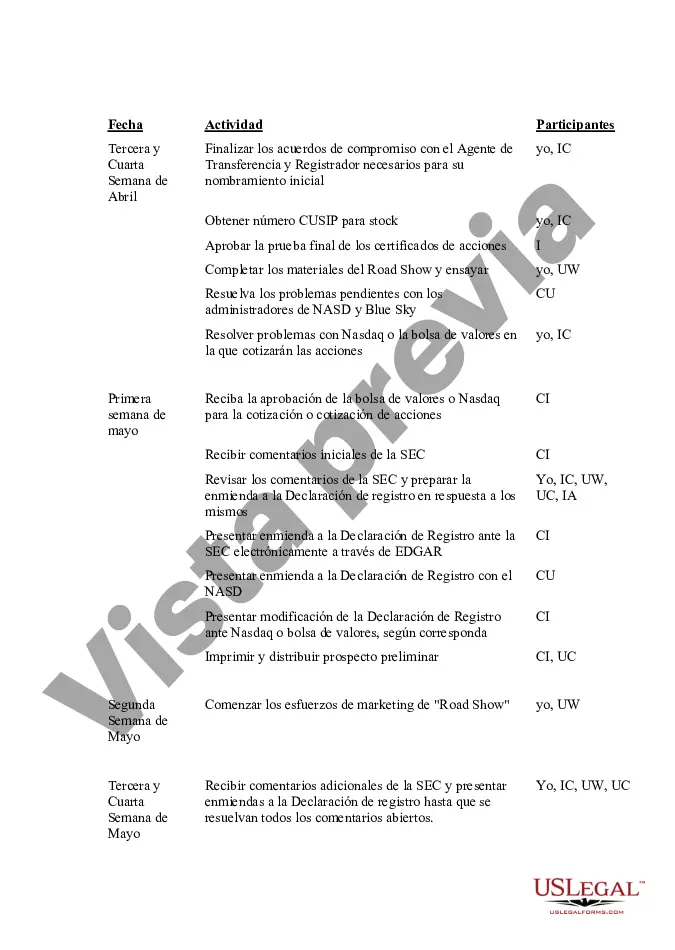

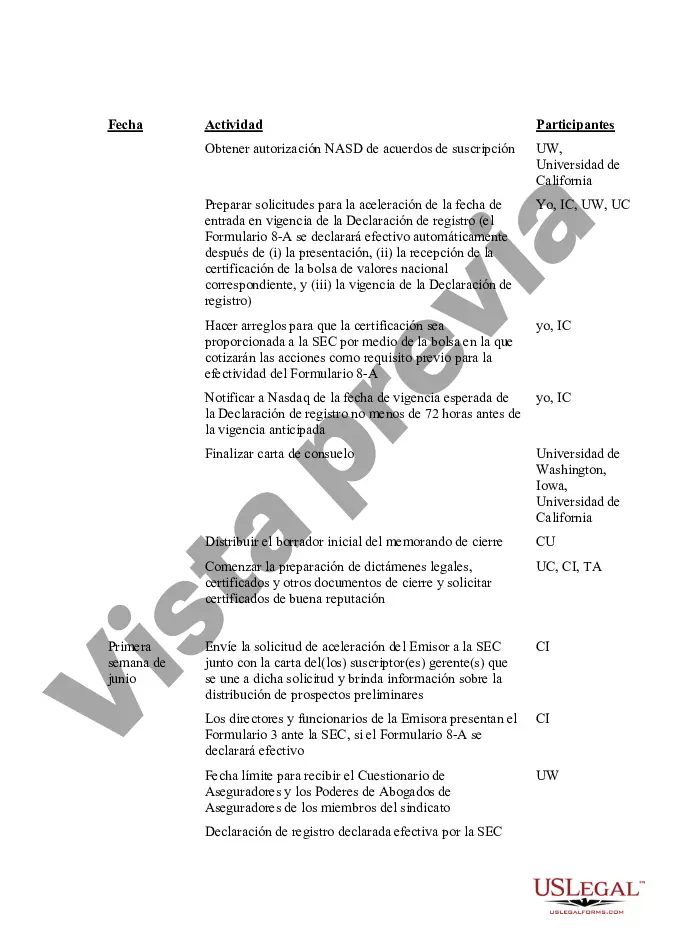

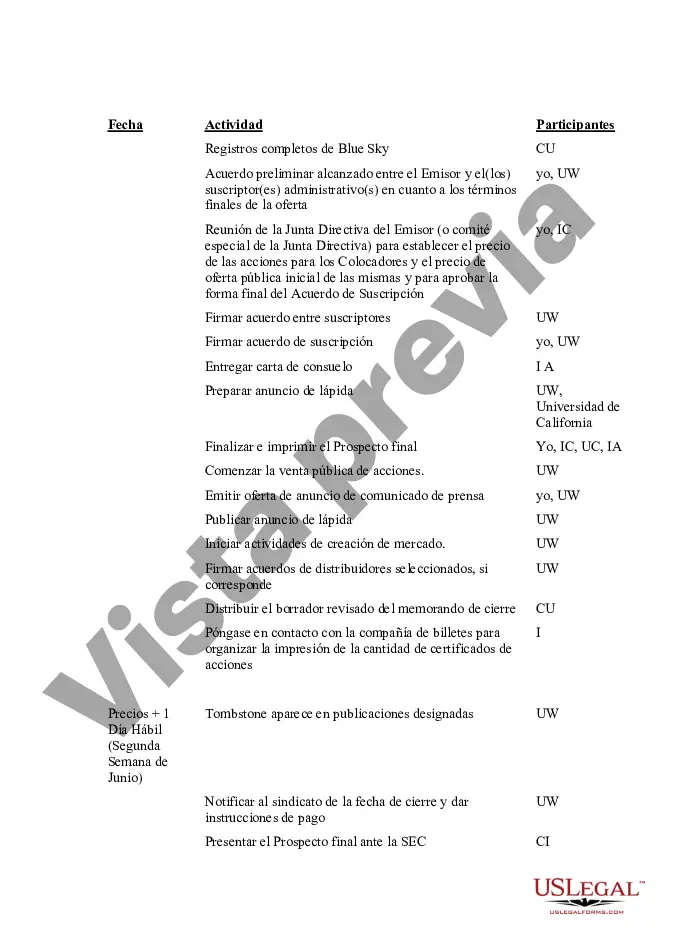

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

The Allegheny Pennsylvania IPO Time and Responsibility Schedule serves as a well-structured framework outlining the timeline and roles involved in the Initial Public Offering (IPO) process. This schedule ensures a streamlined and organized approach to executing an IPO in Allegheny County, Pennsylvania. It primarily focuses on the timeframes for various tasks and the responsibilities assigned to different entities involved in the process. The time and responsibility schedule for the Allegheny Pennsylvania IPO can be divided into several key stages, each encompassing distinct sets of tasks and responsibilities. These stages may include: 1. Preparatory Phase: Prior to the IPO, this phase involves engaging in thorough planning and preparation. It encompasses tasks such as financial audits, market analysis, legal compliance, and the selection of underwriters. 2. Filing and Registration: In this stage, the company files its IPO registration statement with the relevant regulatory authorities, such as the Securities and Exchange Commission (SEC). It includes activities like drafting the prospectus, crafting the S-1 filing, gathering required documents, and preparing for due diligence. 3. Marketing and Roadshow: Once the registration statement becomes effective, companies enter the marketing and roadshow phase. This stage entails promoting the IPO to potential investors, conducting roadshows, and refining investor presentations. It is crucial for generating interest and achieving the desired valuation. 4. Pricing and Finalization: During this stage, the IPO price range is determined, along with the final allocation of shares to investors. The underwriters play a significant role in pricing negotiations, and legal paperwork is finalized, including the underwriting agreement and agreements with other parties involved. 5. Listing and Trading: After the IPO is priced, the listing and trading process begins. The stock is listed on the chosen stock exchange, and trading commences. Ongoing compliance with regulations, maintaining communication with shareholders, and investor relations become key responsibilities. Throughout this process, various stakeholders assume distinctive responsibilities. Key participants typically include the company's management team, legal counsel, investment banks acting as underwriters, accountants, auditors, regulatory authorities, and the stock exchange. In summary, the Allegheny Pennsylvania IPO Time and Responsibility Schedule provides a comprehensive framework detailing the sequential tasks, durations, and responsibilities associated with executing an IPO in Allegheny County, Pennsylvania. It ensures a systematic approach to guide companies and relevant entities through the complex process, ultimately leading to a successful public offering.

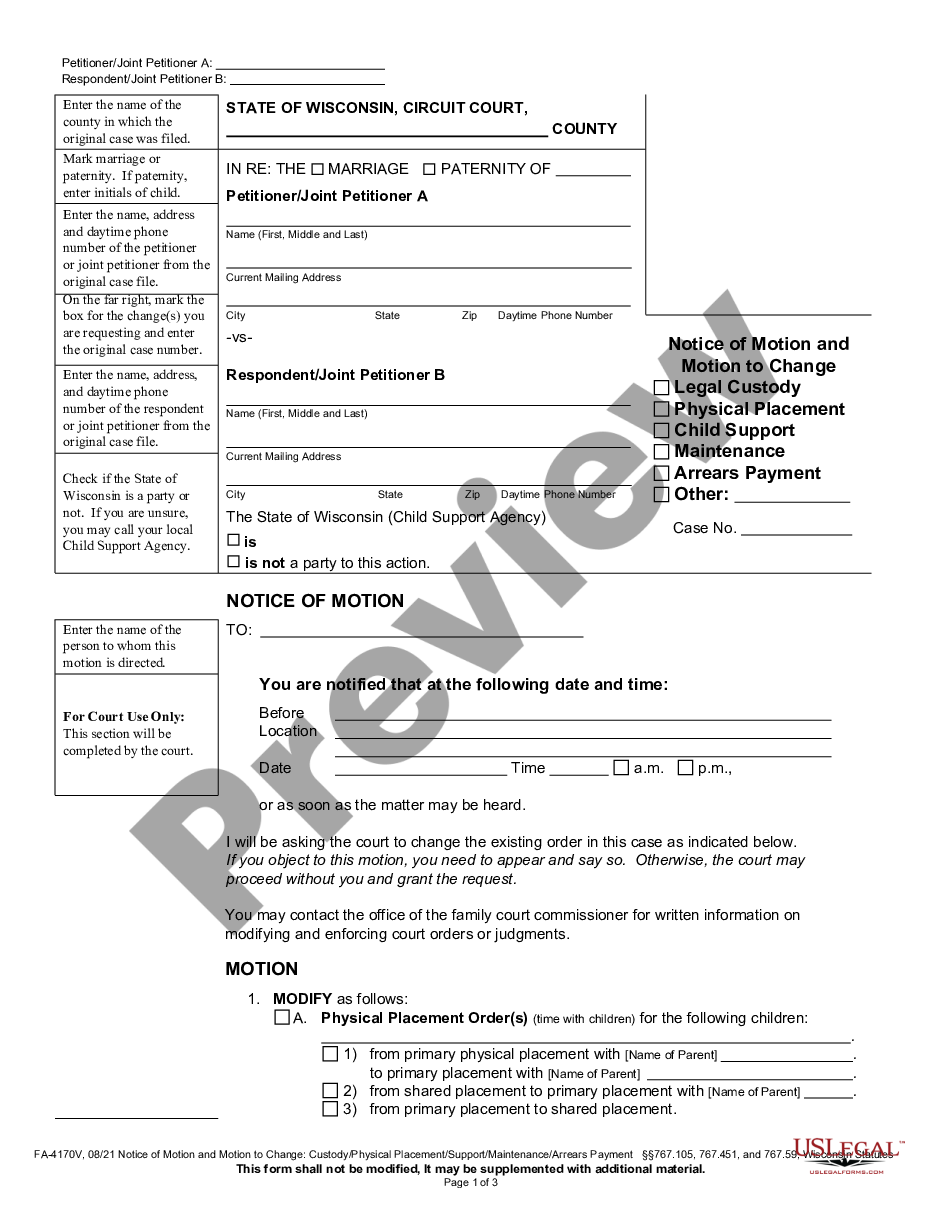

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.