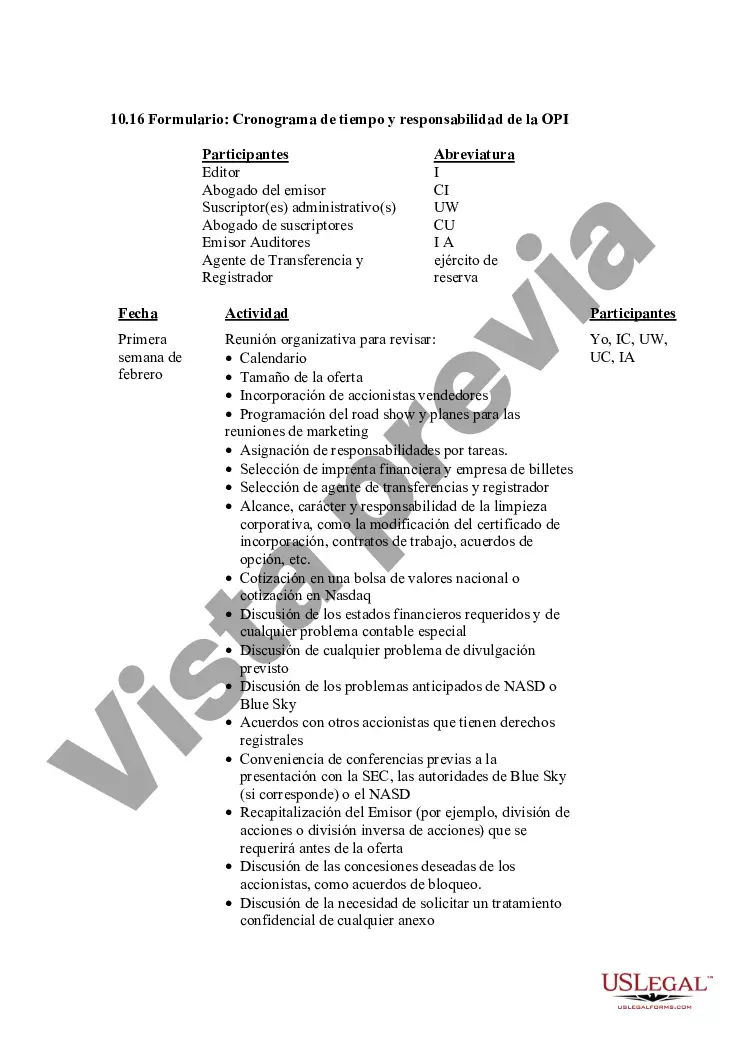

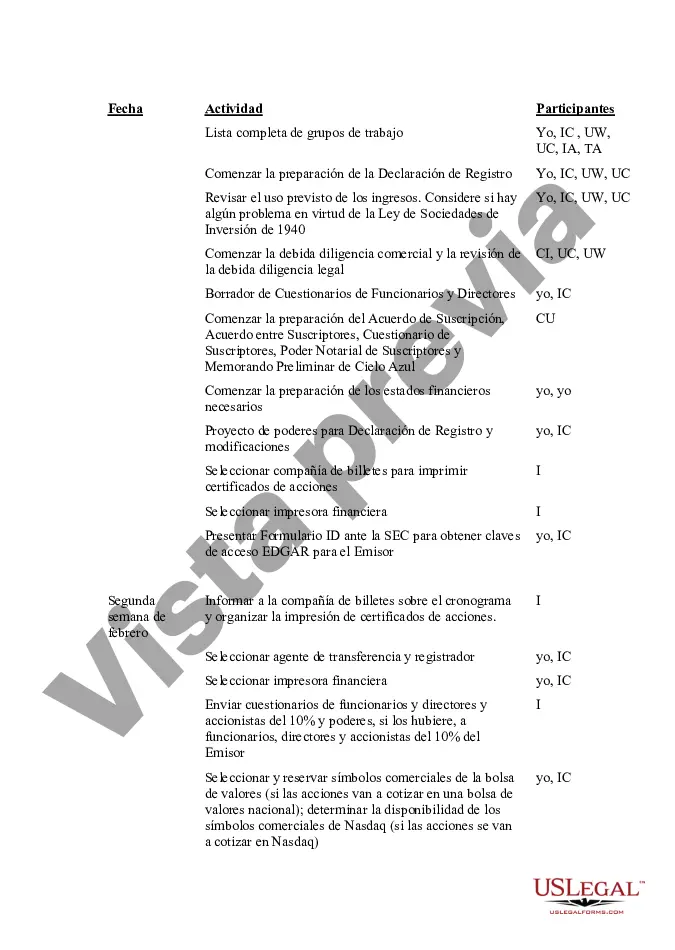

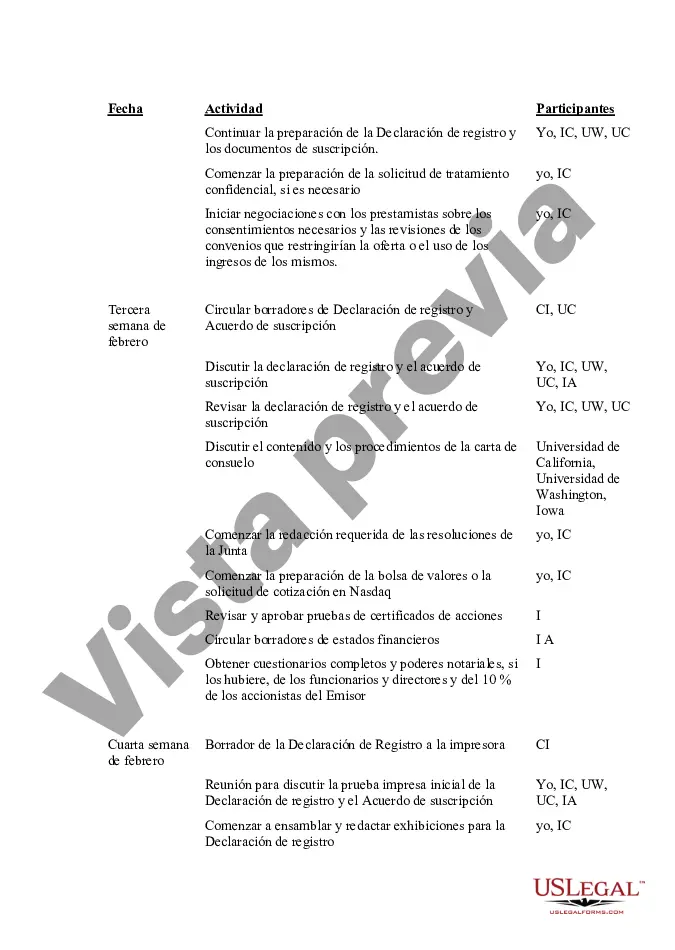

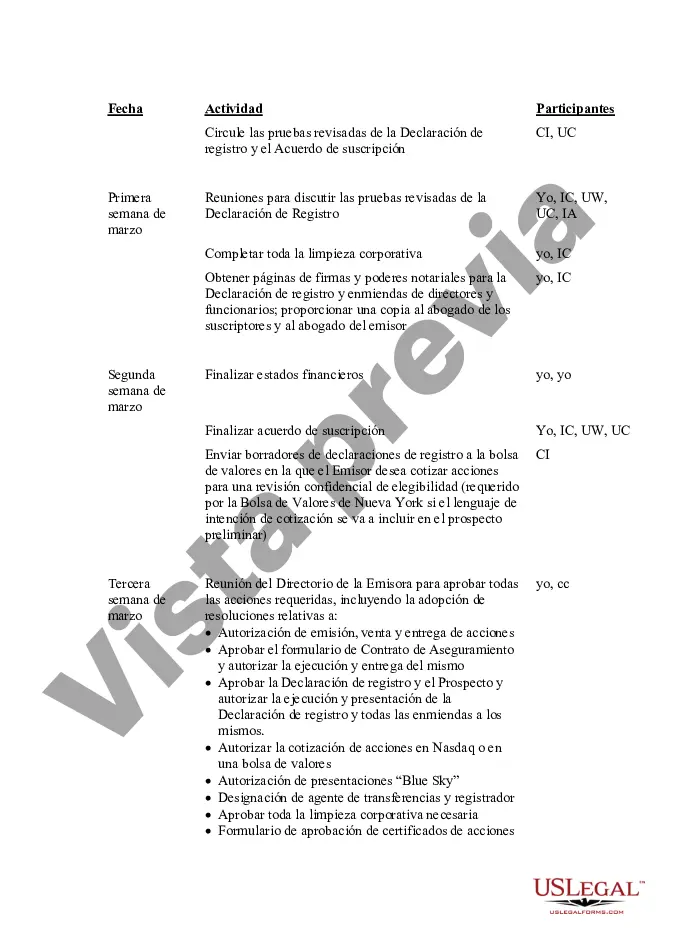

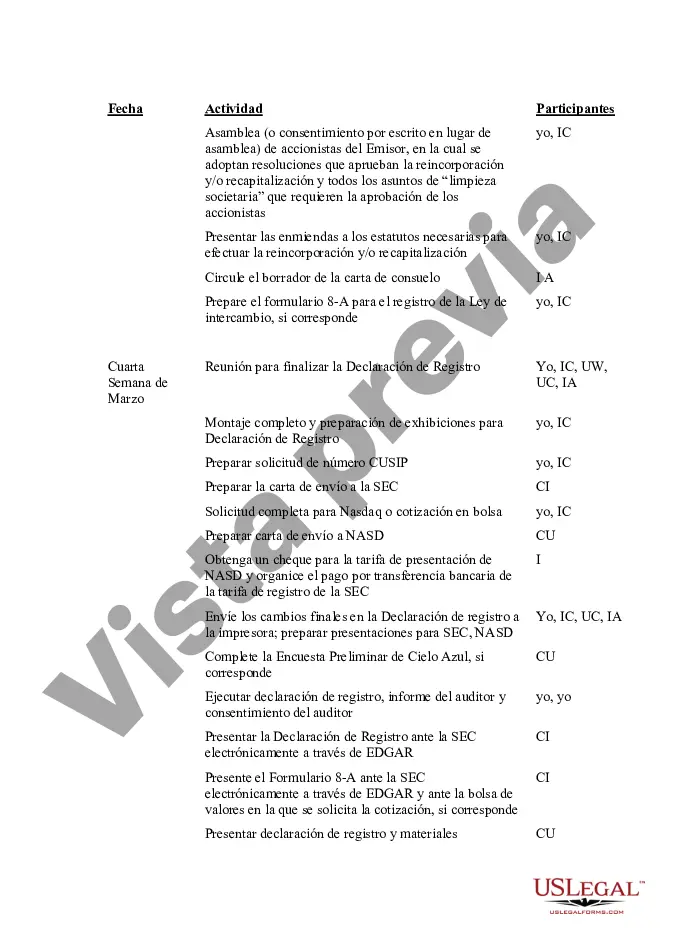

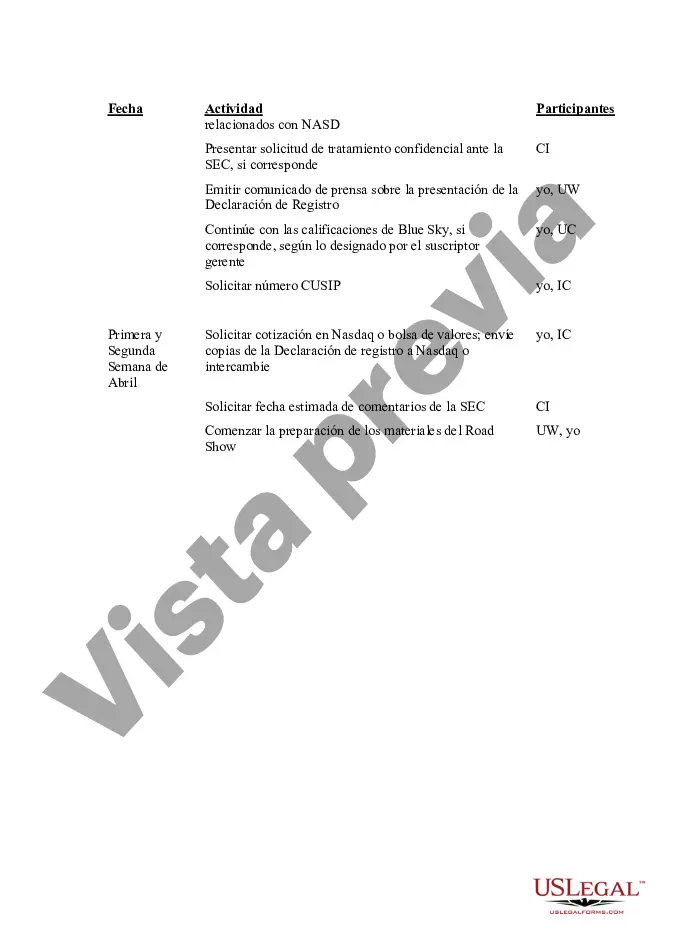

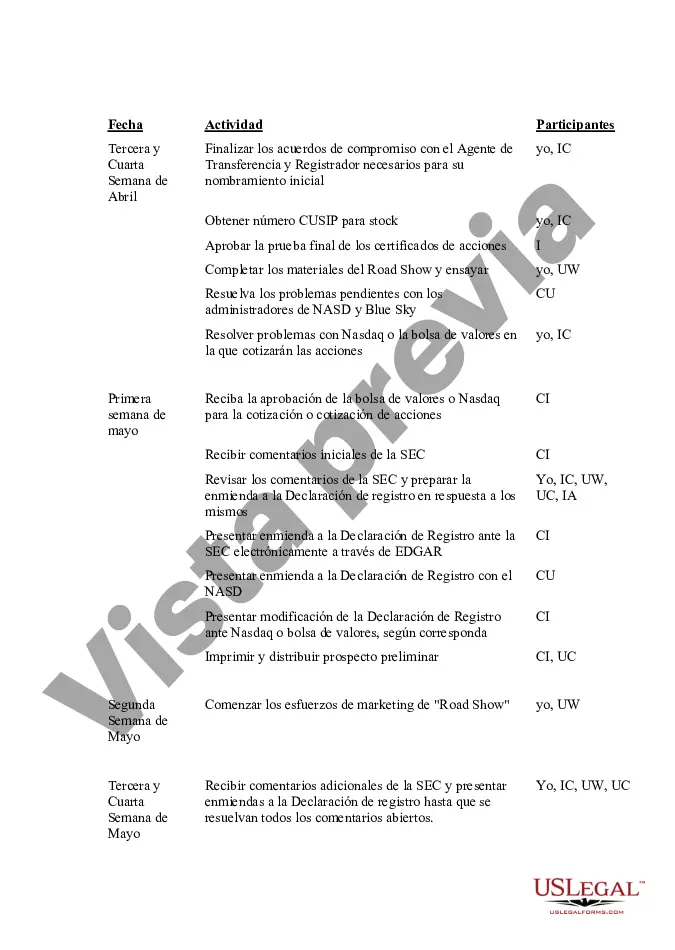

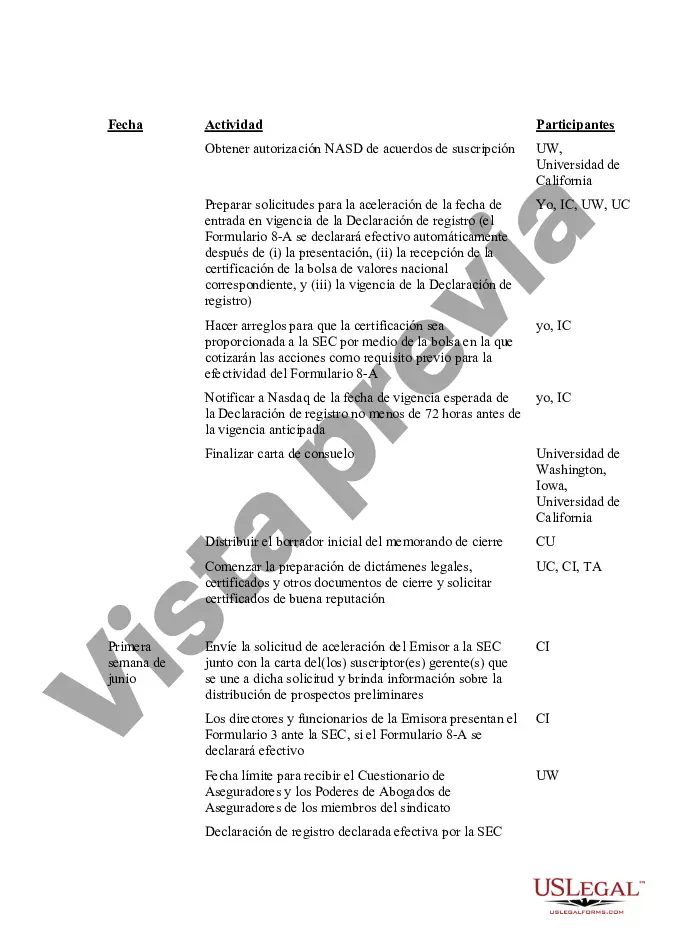

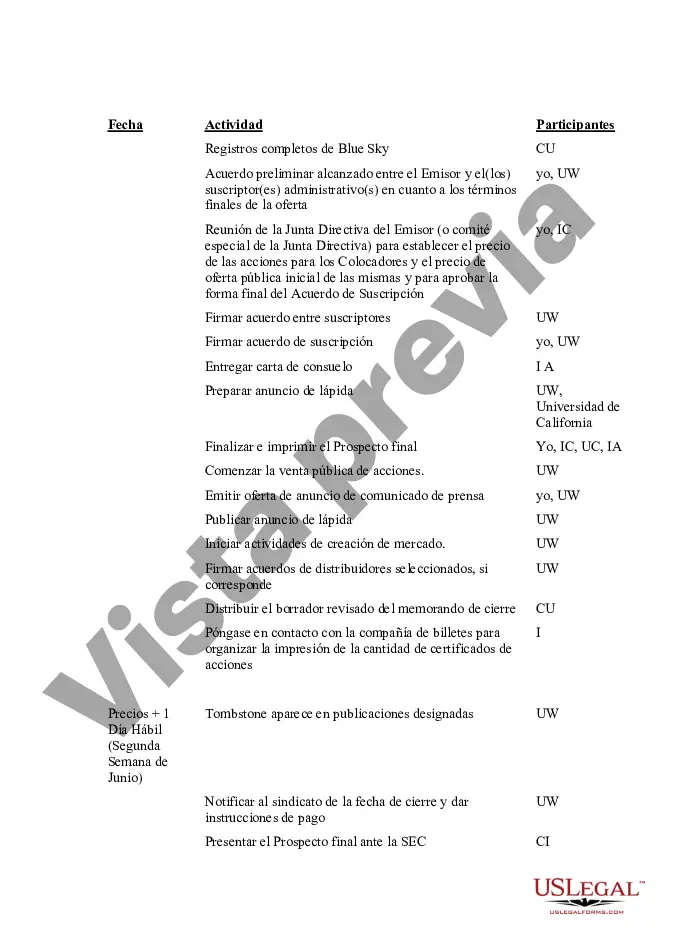

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Broward Florida IPO Time and Responsibility Schedule is a detailed plan that outlines the key milestones, timeframes, and responsibilities associated with the Initial Public Offering (IPO) process in Broward County, Florida. This comprehensive schedule is designed to ensure a smooth and efficient IPO experience while adhering to the regulatory requirements set by the Securities and Exchange Commission (SEC). The Broward Florida IPO Time and Responsibility Schedule encompasses several stages, each with its own set of tasks and deadlines. Here are the primary types of schedules associated with this process: 1. pre-IPO Preparation Schedule: This schedule outlines all the necessary steps prior to initiating the IPO process. These include conducting internal audits, assembling financial statements, preparing prospectus, engaging legal and accounting firms, appointing underwriters and auditors, and establishing an IPO working group within the company. 2. SEC Compliance Schedule: To comply with SEC regulations, companies need to carefully prepare and submit various documents and disclosures. This schedule details the timeline for drafting and submitting registration statements, including Form S-1 or Form F-1, and obtaining SEC reviews and comments. It also involves the planning and execution of SEC meetings and presentations. 3. Due Diligence Schedule: Conducting thorough due diligence is critical for IPO success. This schedule defines the timeline for reviewing all company operations, financial statements, internal controls, litigation risks, and any potential material uncertainties that need to be adequately addressed prior to the IPO. 4. Roadshow Schedule: The roadshow is a crucial part of the IPO process where the company presents its investment opportunity to potential investors. This schedule encompasses planning the roadshow itinerary, booking meetings with investors, preparing pitch materials, and coordinating the management team's availability for investor presentations. 5. Pricing and Listing Schedule: This schedule focuses on determining the IPO share price, finalizing the number of shares to be offered, and selecting the appropriate stock exchange for listing. It outlines the timing for underwriting agreements, pricing memoranda, and all necessary filings related to the IPO offering. 6. Post-IPO Schedule: Even after the IPO, there are ongoing responsibilities and obligations for the newly public company. This schedule includes tasks such as ensuring regulatory reporting compliance, investor relations activities, governance matters, financial reporting, and maintaining transparent communication with investors and stakeholders. By following the Broward Florida IPO Time and Responsibility Schedule, companies aiming to go public in Broward County can have a well-structured plan in place, enabling them to navigate the intricacies of the IPO process effectively. This schedule helps ensure all necessary steps are executed in a timely manner, enhancing the chances of a successful IPO and long-term sustainability for the newly public company.Broward Florida IPO Time and Responsibility Schedule is a detailed plan that outlines the key milestones, timeframes, and responsibilities associated with the Initial Public Offering (IPO) process in Broward County, Florida. This comprehensive schedule is designed to ensure a smooth and efficient IPO experience while adhering to the regulatory requirements set by the Securities and Exchange Commission (SEC). The Broward Florida IPO Time and Responsibility Schedule encompasses several stages, each with its own set of tasks and deadlines. Here are the primary types of schedules associated with this process: 1. pre-IPO Preparation Schedule: This schedule outlines all the necessary steps prior to initiating the IPO process. These include conducting internal audits, assembling financial statements, preparing prospectus, engaging legal and accounting firms, appointing underwriters and auditors, and establishing an IPO working group within the company. 2. SEC Compliance Schedule: To comply with SEC regulations, companies need to carefully prepare and submit various documents and disclosures. This schedule details the timeline for drafting and submitting registration statements, including Form S-1 or Form F-1, and obtaining SEC reviews and comments. It also involves the planning and execution of SEC meetings and presentations. 3. Due Diligence Schedule: Conducting thorough due diligence is critical for IPO success. This schedule defines the timeline for reviewing all company operations, financial statements, internal controls, litigation risks, and any potential material uncertainties that need to be adequately addressed prior to the IPO. 4. Roadshow Schedule: The roadshow is a crucial part of the IPO process where the company presents its investment opportunity to potential investors. This schedule encompasses planning the roadshow itinerary, booking meetings with investors, preparing pitch materials, and coordinating the management team's availability for investor presentations. 5. Pricing and Listing Schedule: This schedule focuses on determining the IPO share price, finalizing the number of shares to be offered, and selecting the appropriate stock exchange for listing. It outlines the timing for underwriting agreements, pricing memoranda, and all necessary filings related to the IPO offering. 6. Post-IPO Schedule: Even after the IPO, there are ongoing responsibilities and obligations for the newly public company. This schedule includes tasks such as ensuring regulatory reporting compliance, investor relations activities, governance matters, financial reporting, and maintaining transparent communication with investors and stakeholders. By following the Broward Florida IPO Time and Responsibility Schedule, companies aiming to go public in Broward County can have a well-structured plan in place, enabling them to navigate the intricacies of the IPO process effectively. This schedule helps ensure all necessary steps are executed in a timely manner, enhancing the chances of a successful IPO and long-term sustainability for the newly public company.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.