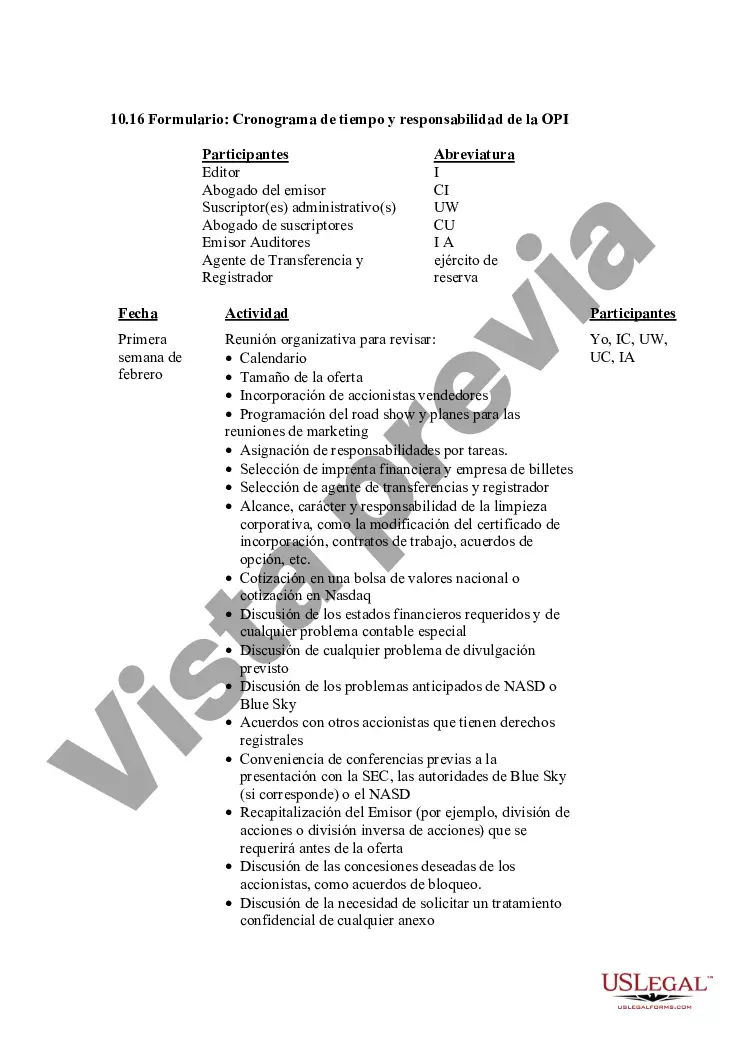

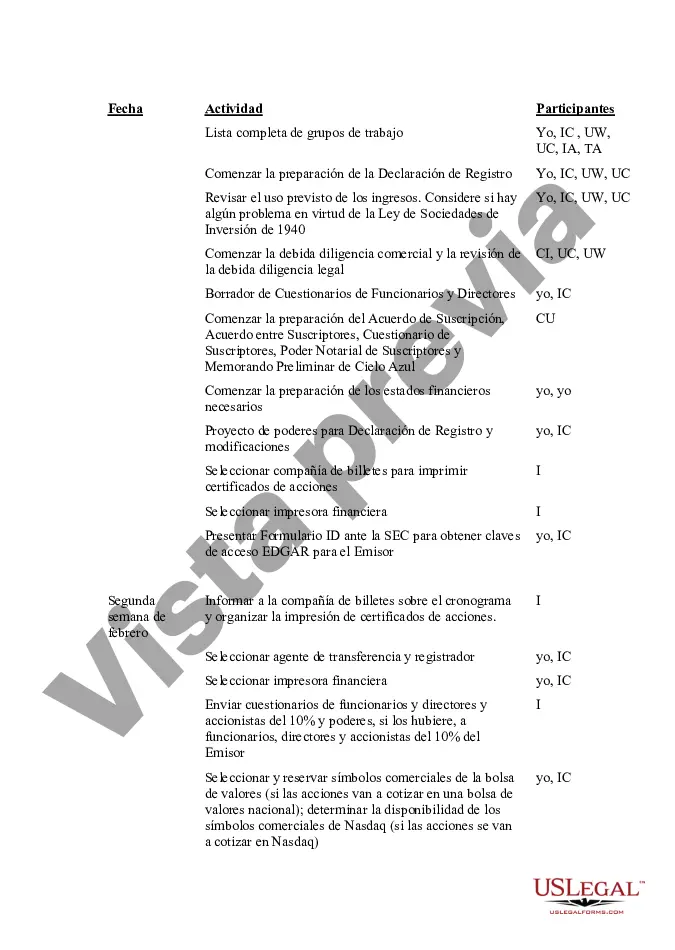

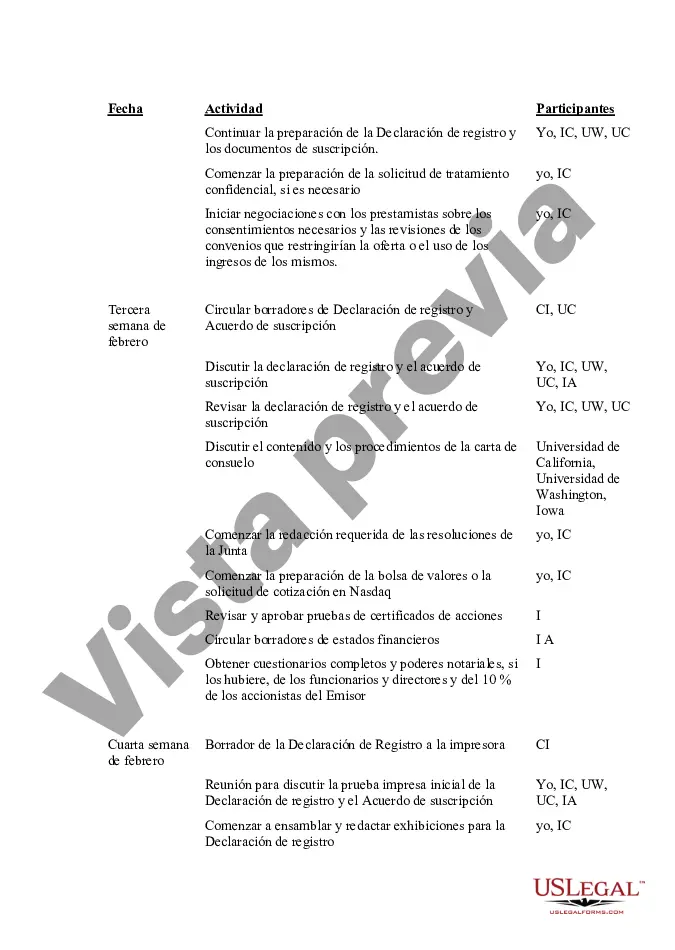

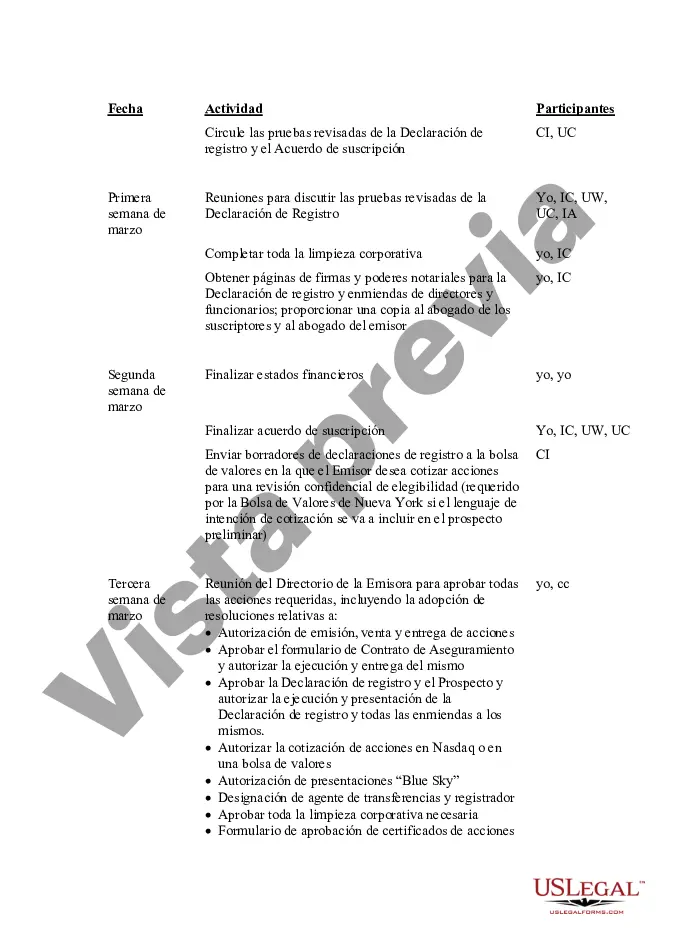

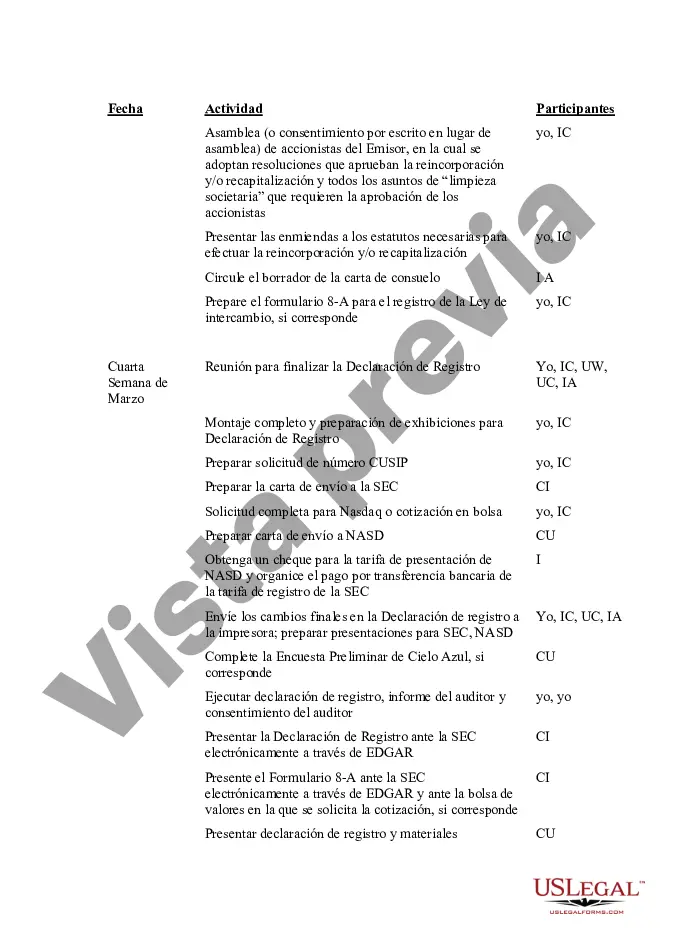

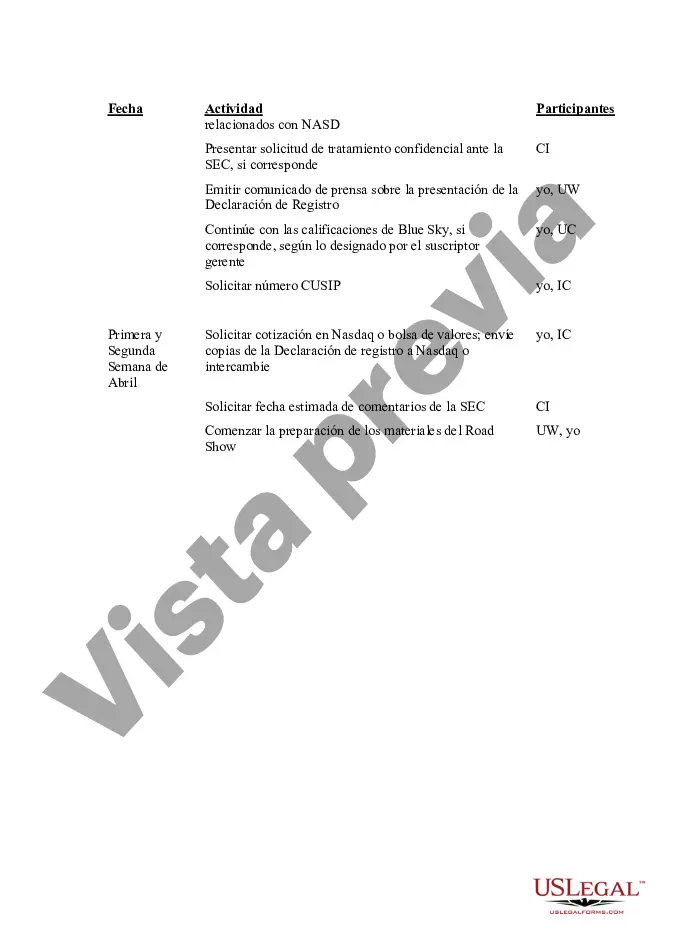

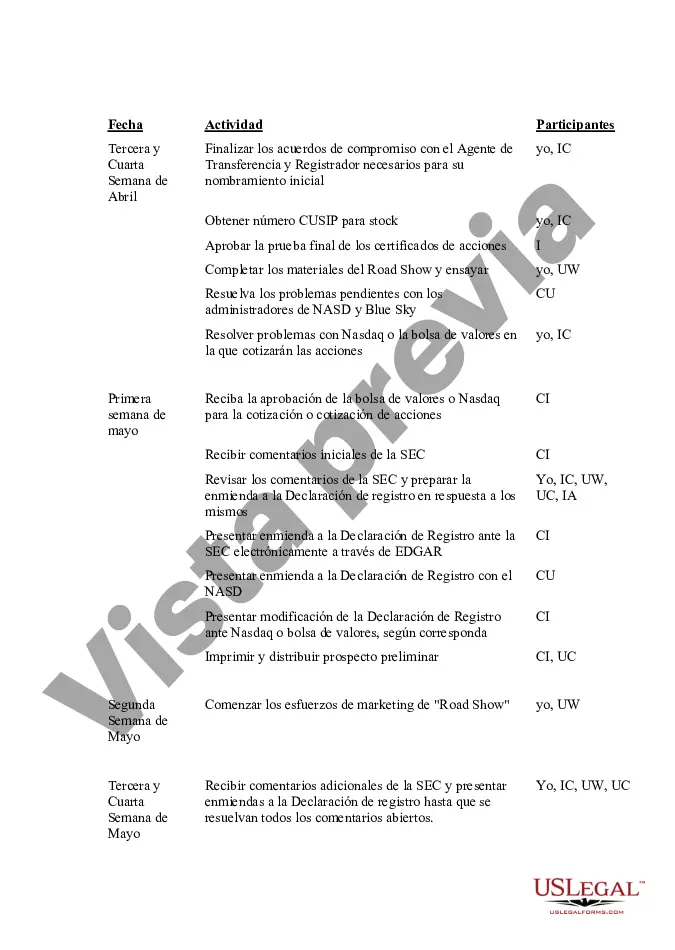

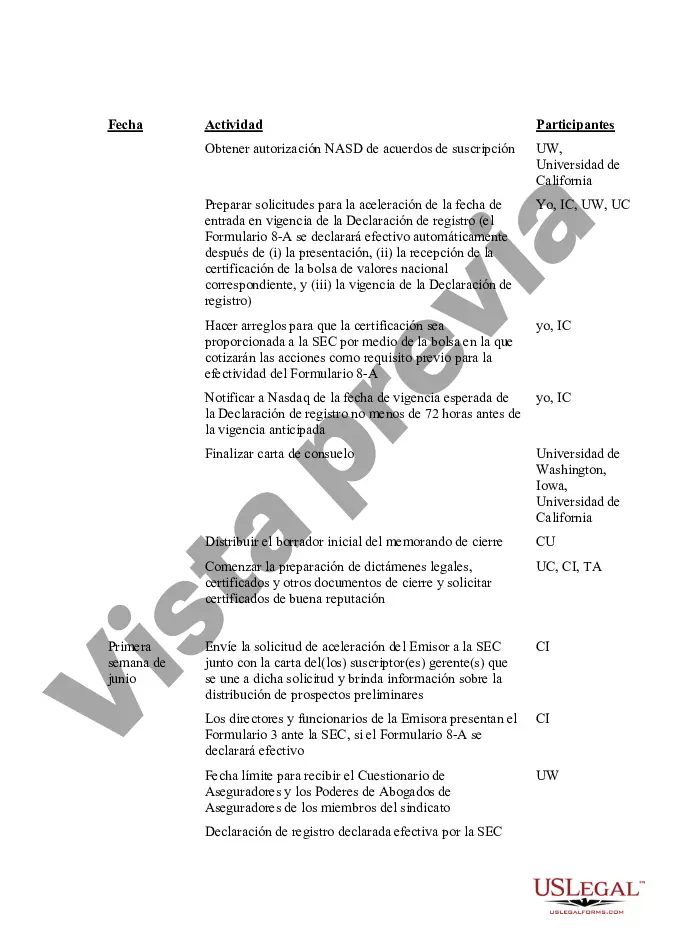

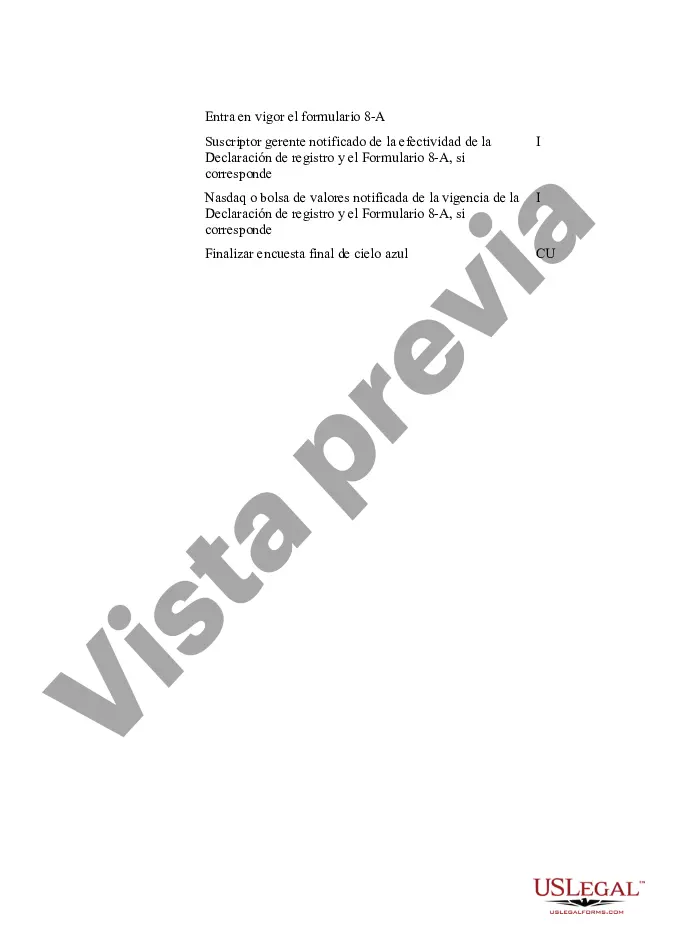

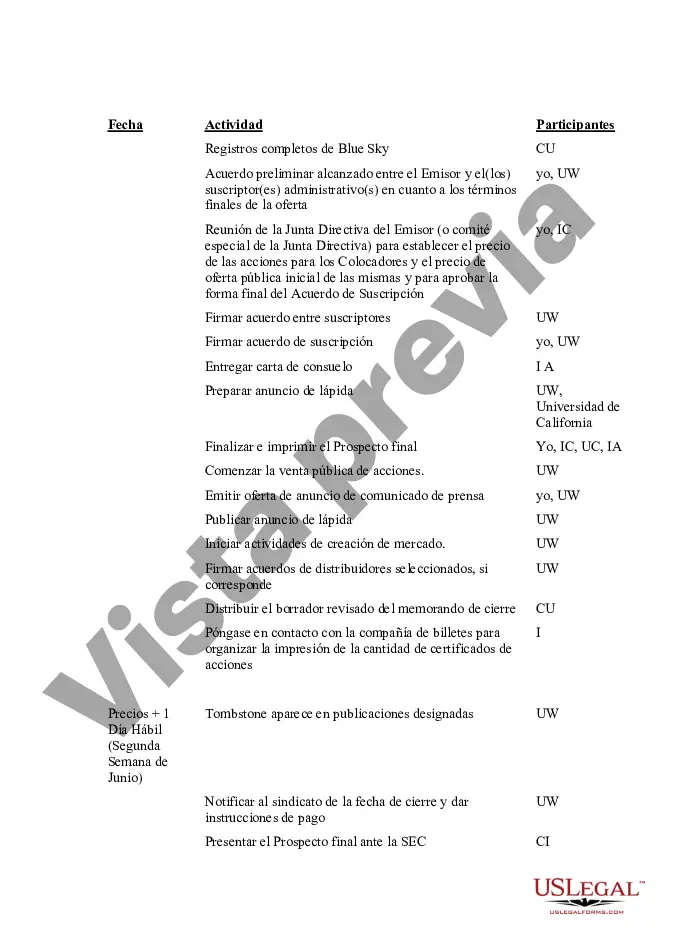

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Chicago Illinois IPO Time and Responsibility Schedule is a comprehensive roadmap outlining the key steps and obligations involved in launching an Initial Public Offering (IPO) in the city of Chicago, Illinois. This schedule provides valuable guidance to companies and investment banks seeking to go public in this vibrant financial hub. It underscores the importance of adhering to specific timeframes and fulfilling various responsibilities to ensure a smooth and successful IPO process. The Chicago Illinois IPO Time and Responsibility Schedule encompasses several distinct phases, each marked by specific milestones and actions. These stages include pre-IPO preparation, filing the registration statement, SEC review and approval, marketing and roadshows, and the ultimate pricing and listing of the company's shares on an exchange. During the pre-IPO preparation phase, companies need to conduct thorough internal assessments, engage legal and accounting professionals, and evaluate market conditions in Chicago and nationwide. This stage involves determining the right timing for going public and aligning internal operations with the rigorous requirements of becoming a publicly traded entity. Once the decision to proceed with an IPO is made, the registration statement must be prepared and filed with the Securities and Exchange Commission (SEC). This document is integral to the IPO process and contains vital information about the company's financials, operations, risk factors, and management. Following submission, the SEC conducts a thorough review, interacting with the company and its advisors to ensure compliance with regulatory standards. This stage may involve multiple rounds of comments and revisions. After the registration statement is approved by the SEC, the marketing phase commences. Investment banks play a crucial role in this stage by organizing roadshows and presenting the company's investment merits to potential investors. The timing of roadshows and the extent of marketing efforts are key factors that can significantly impact the success of the IPO. Regarding the different types of Chicago Illinois IPO Time and Responsibility Schedule, it's important to note that the schedule remains relatively consistent across various industries and sectors. However, the specifics and intricacies may vary depending on the nature of the company's operations and the regulatory requirements specific to its industry. Additionally, there may be variations in the timeline and responsibilities based on the size and complexity of the IPO. Therefore, it is essential for companies to collaborate closely with legal and financial advisors well-versed in the Chicago IPO landscape to ensure adherence to relevant regulations and best practices. In conclusion, the Chicago Illinois IPO Time and Responsibility Schedule serves as a dynamic guidebook for companies pursuing the exciting path of going public in the Windy City. It outlines the critical steps and obligations necessary to successfully navigate the IPO journey, while considering the unique characteristics and requirements of the Chicago market. Adhering to this schedule ensures a solid foundation for companies aiming to raise capital, enhance their visibility, and catapult their growth in the financial hub of Chicago, Illinois.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.