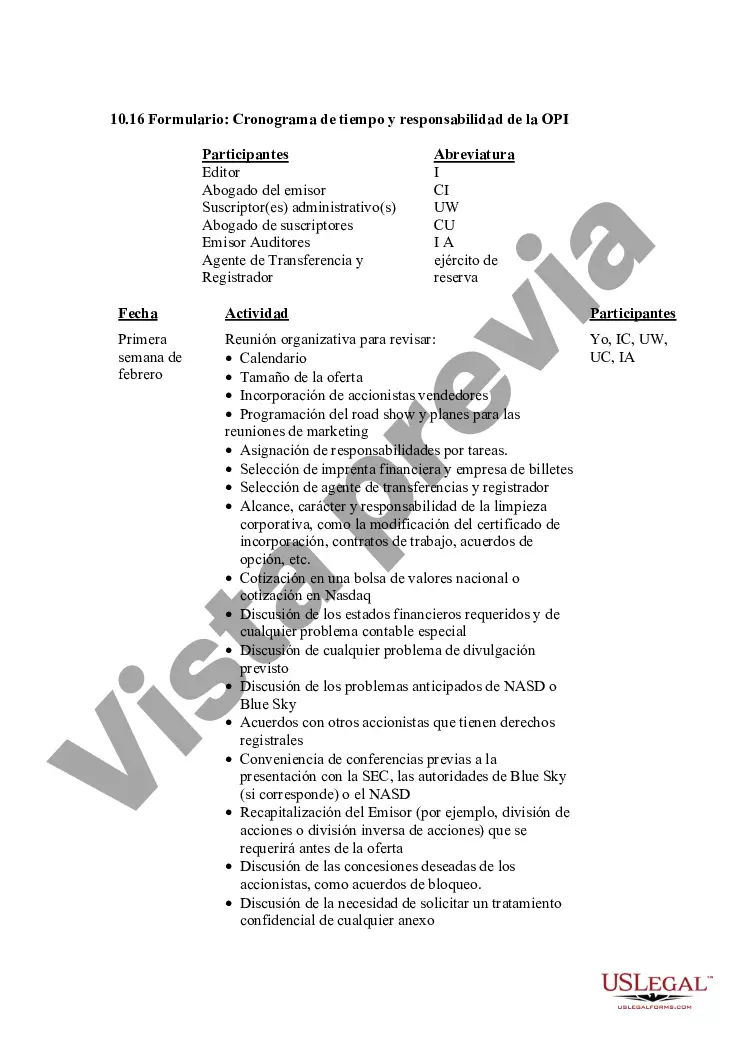

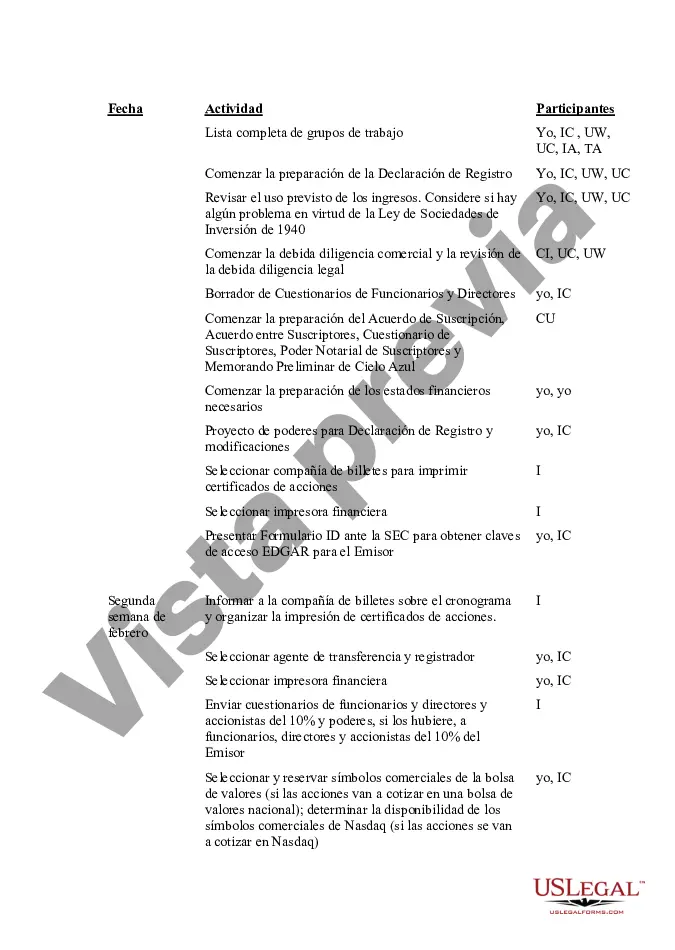

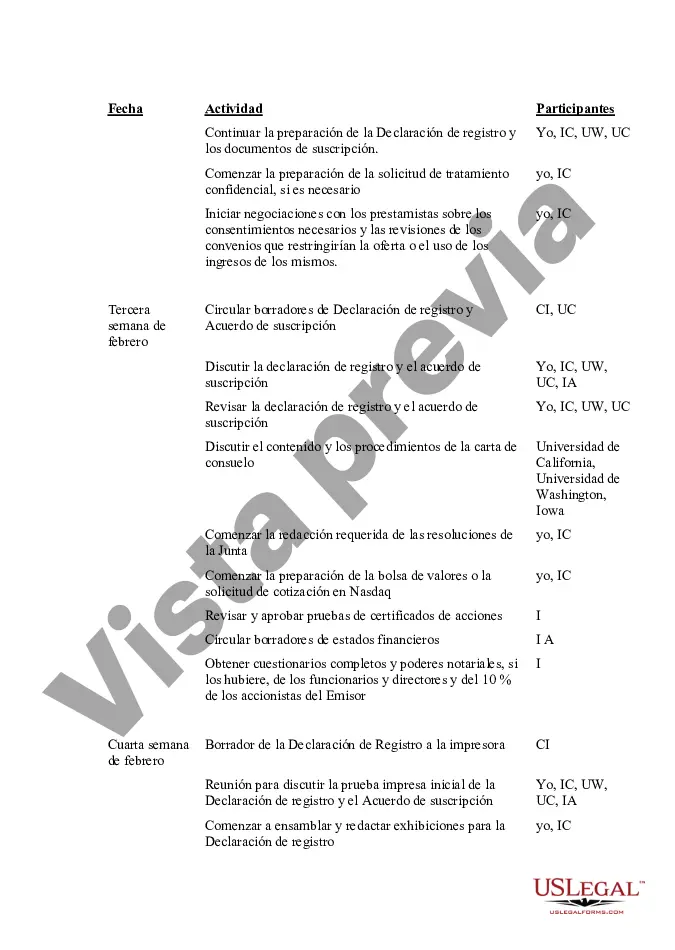

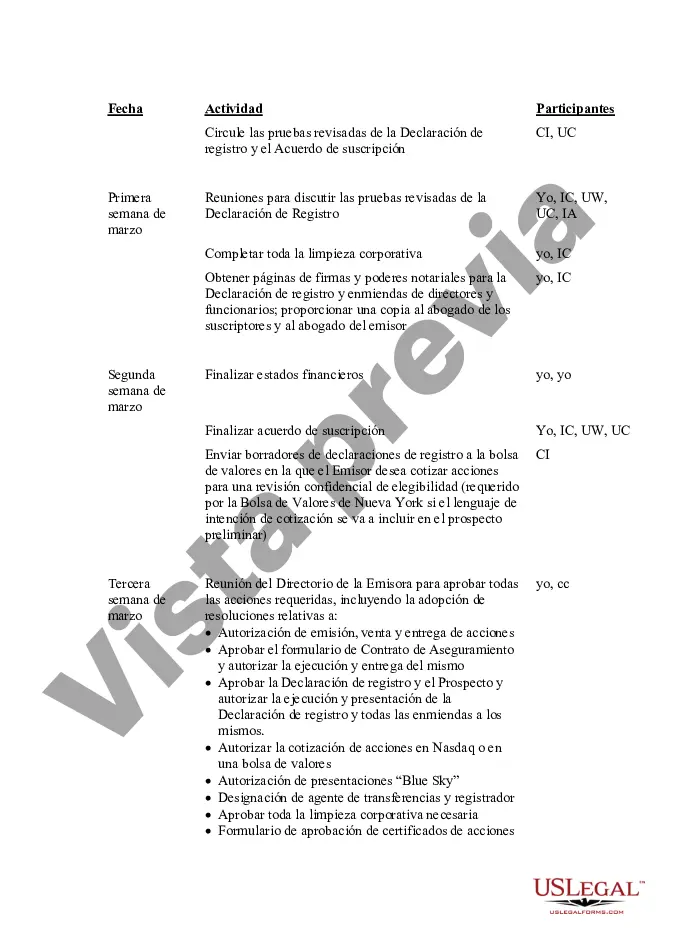

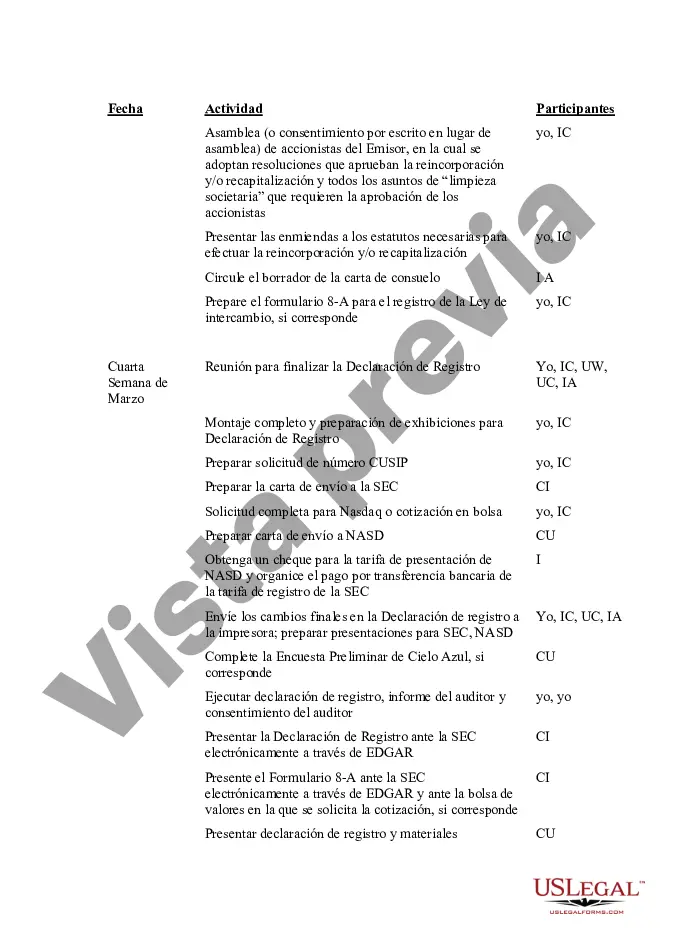

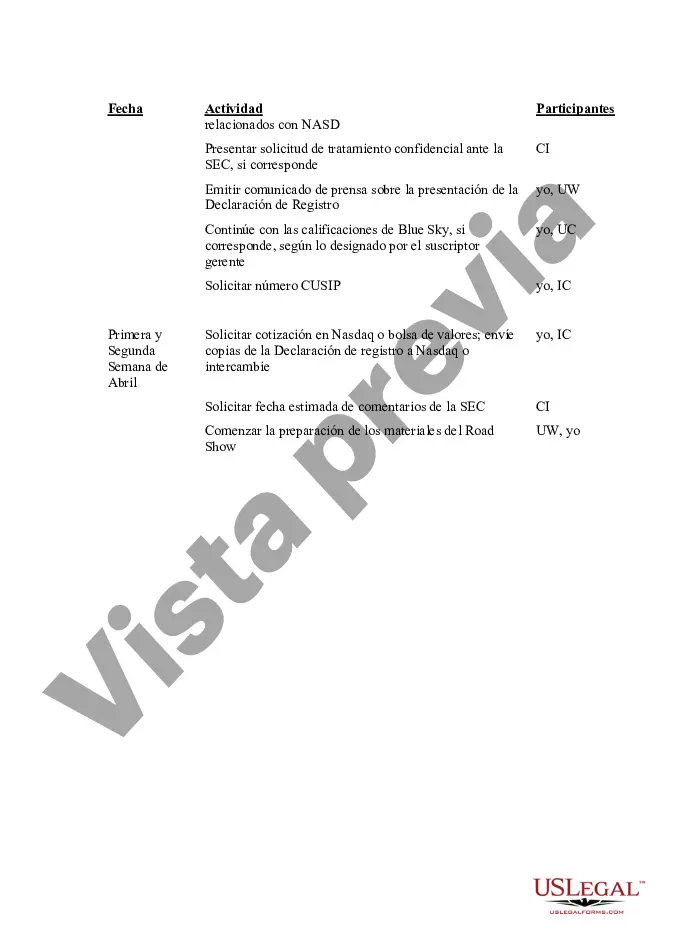

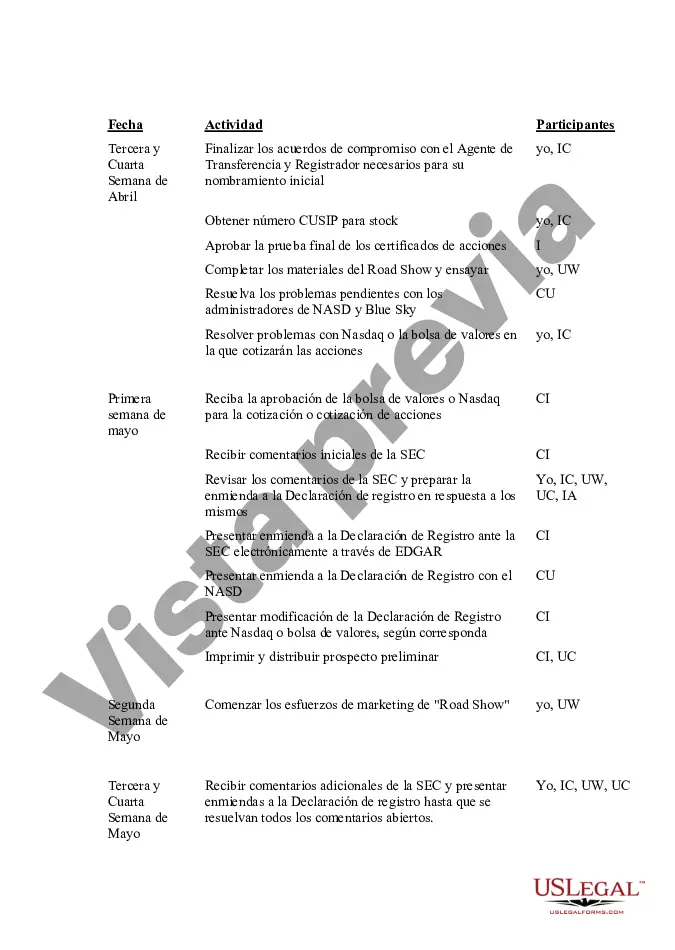

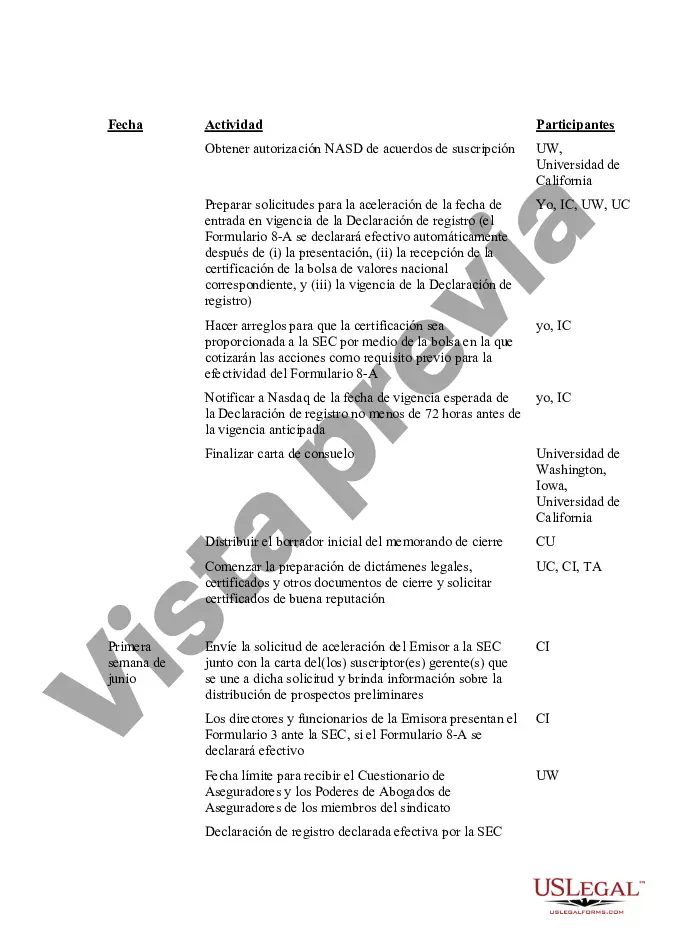

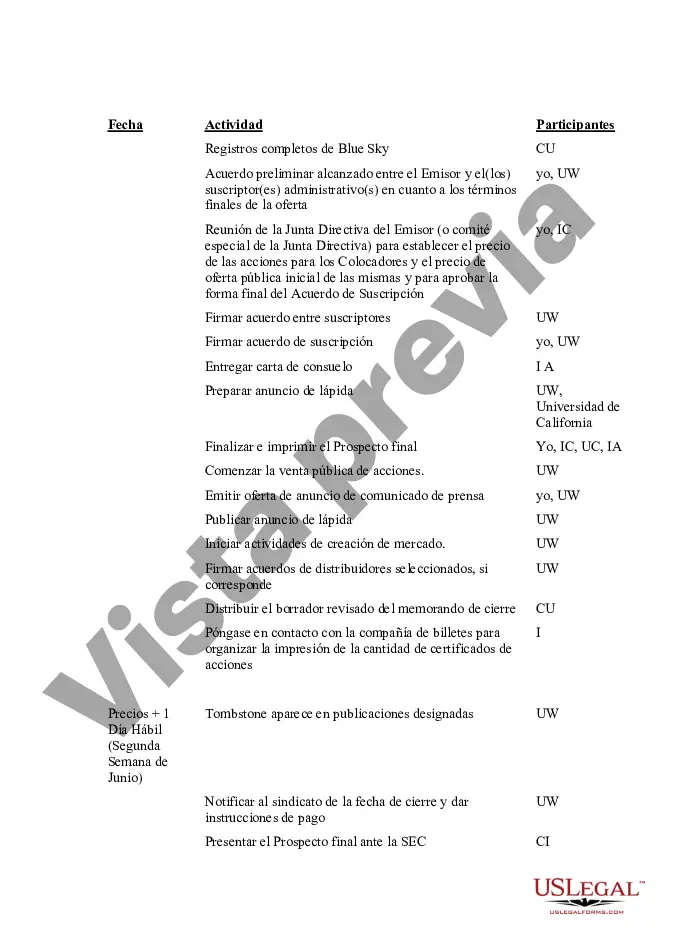

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Cook Illinois, a leading transportation company, has established an IPO Time and Responsibility Schedule to streamline the process of going public. This schedule outlines the critical steps and key roles in the initial public offering (IPO) journey, ensuring a systematic approach and effective management of tasks. By adhering to this schedule, Cook Illinois can maximize efficiency, minimize errors, and meet regulatory requirements. The IPO Time and Responsibility Schedule consists of various stages, each with its own set of activities and milestones. These stages include pre-IPO preparations, filing with regulatory bodies, pricing and allocation, and post-offering activities. During the pre-IPO preparations, internal teams collaborate to compile financial statements, conduct due diligence, and ensure compliance with rules and regulations. This phase also involves appointing underwriters and legal advisors, who play a critical role in guiding the company through the IPO process. The filing stage requires meticulous documentation and submission to regulatory bodies such as the Securities and Exchange Commission (SEC). Cook Illinois must accurately disclose financial information, business strategies, and potential risks to provide transparency to potential investors. Once the filing is complete, the pricing and allocation stage begins. Underwriters analyze market conditions, investor interest, and company valuations to determine the IPO share price. This stage requires coordination between Cook Illinois and underwriters to finalize the allocation of shares to institutional and retail investors. After the IPO launch, Cook Illinois enters the post-offering activities stage. This phase involves investor education programs, roadshows, and releasing periodic financial reports to keep stakeholders informed about the company's performance. Additionally, Cook Illinois stays vigilant in complying with post-IPO regulatory requirements, such as filing quarterly and annual reports. Different variations of Cook Illinois IPO Time and Responsibility Schedule may exist, depending on factors like company size, industry, and legal jurisdiction. Each variant may involve specific nuances and additional tasks tailored to meet the unique requirements of Cook Illinois or other companies navigating the IPO process. In summary, the Cook Illinois IPO Time and Responsibility Schedule is a crucial framework that guides the company through the complex process of going public. It ensures a coordinated approach, responsibility delegation, and adherence to timelines. By following this schedule, Cook Illinois can effectively complete the necessary steps in its IPO journey while ensuring transparency and compliance with regulatory bodies.Cook Illinois, a leading transportation company, has established an IPO Time and Responsibility Schedule to streamline the process of going public. This schedule outlines the critical steps and key roles in the initial public offering (IPO) journey, ensuring a systematic approach and effective management of tasks. By adhering to this schedule, Cook Illinois can maximize efficiency, minimize errors, and meet regulatory requirements. The IPO Time and Responsibility Schedule consists of various stages, each with its own set of activities and milestones. These stages include pre-IPO preparations, filing with regulatory bodies, pricing and allocation, and post-offering activities. During the pre-IPO preparations, internal teams collaborate to compile financial statements, conduct due diligence, and ensure compliance with rules and regulations. This phase also involves appointing underwriters and legal advisors, who play a critical role in guiding the company through the IPO process. The filing stage requires meticulous documentation and submission to regulatory bodies such as the Securities and Exchange Commission (SEC). Cook Illinois must accurately disclose financial information, business strategies, and potential risks to provide transparency to potential investors. Once the filing is complete, the pricing and allocation stage begins. Underwriters analyze market conditions, investor interest, and company valuations to determine the IPO share price. This stage requires coordination between Cook Illinois and underwriters to finalize the allocation of shares to institutional and retail investors. After the IPO launch, Cook Illinois enters the post-offering activities stage. This phase involves investor education programs, roadshows, and releasing periodic financial reports to keep stakeholders informed about the company's performance. Additionally, Cook Illinois stays vigilant in complying with post-IPO regulatory requirements, such as filing quarterly and annual reports. Different variations of Cook Illinois IPO Time and Responsibility Schedule may exist, depending on factors like company size, industry, and legal jurisdiction. Each variant may involve specific nuances and additional tasks tailored to meet the unique requirements of Cook Illinois or other companies navigating the IPO process. In summary, the Cook Illinois IPO Time and Responsibility Schedule is a crucial framework that guides the company through the complex process of going public. It ensures a coordinated approach, responsibility delegation, and adherence to timelines. By following this schedule, Cook Illinois can effectively complete the necessary steps in its IPO journey while ensuring transparency and compliance with regulatory bodies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.