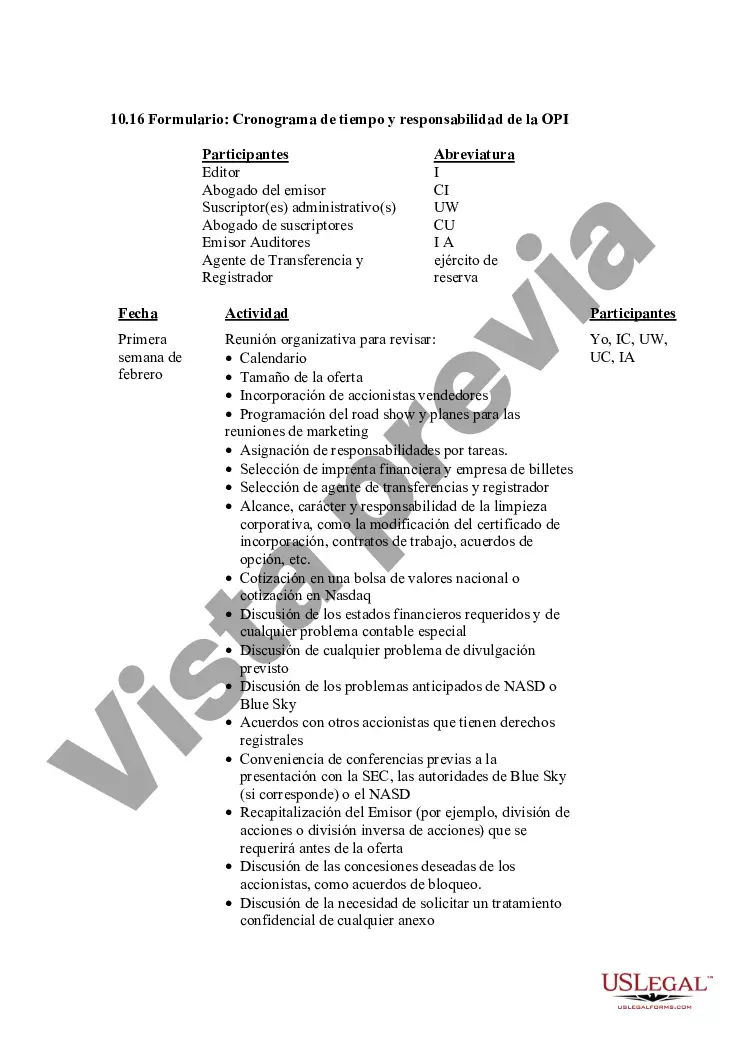

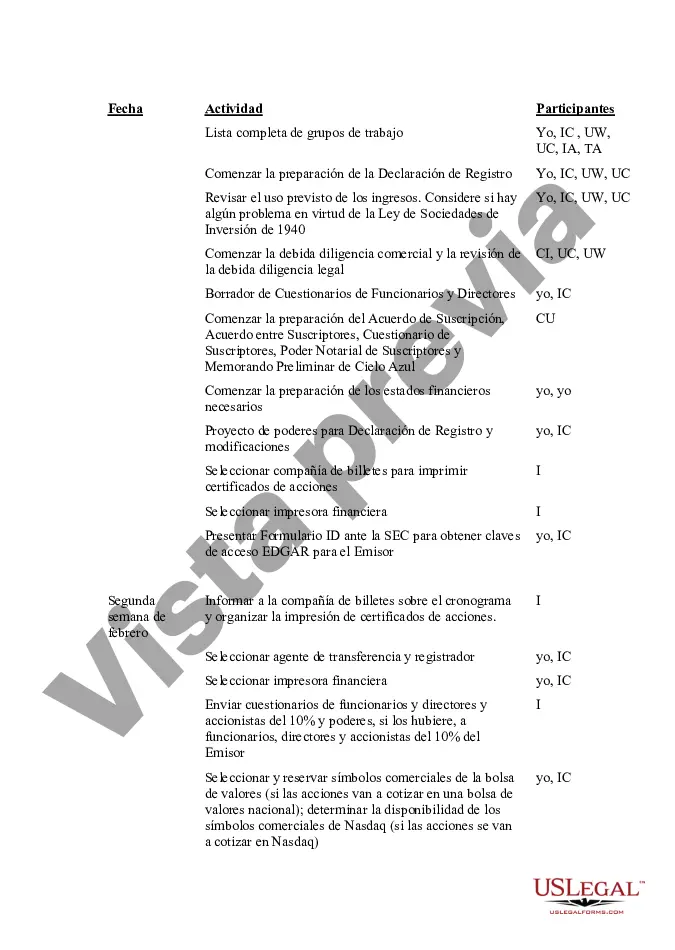

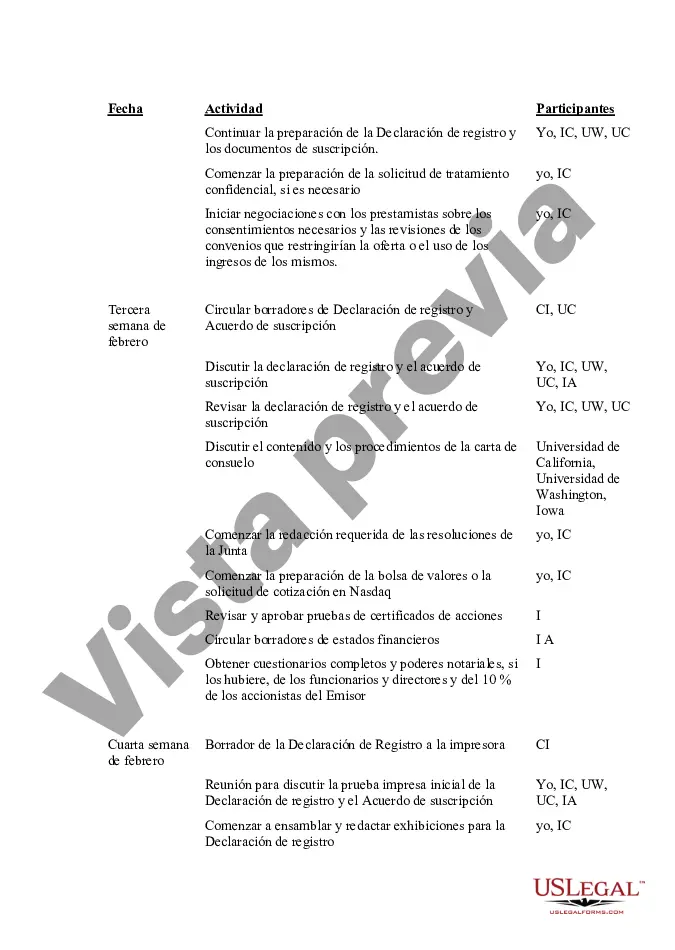

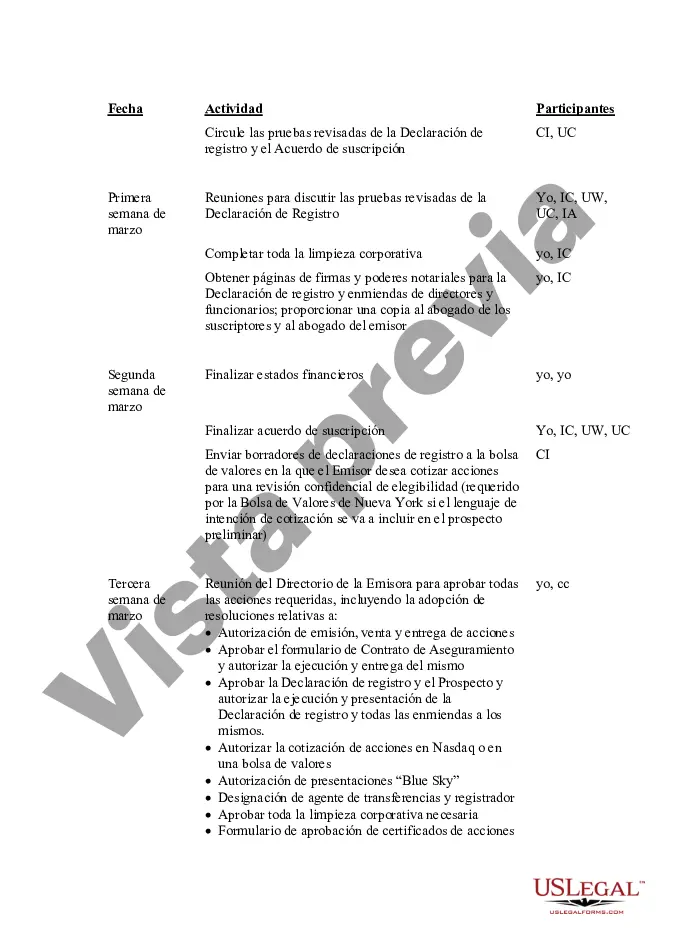

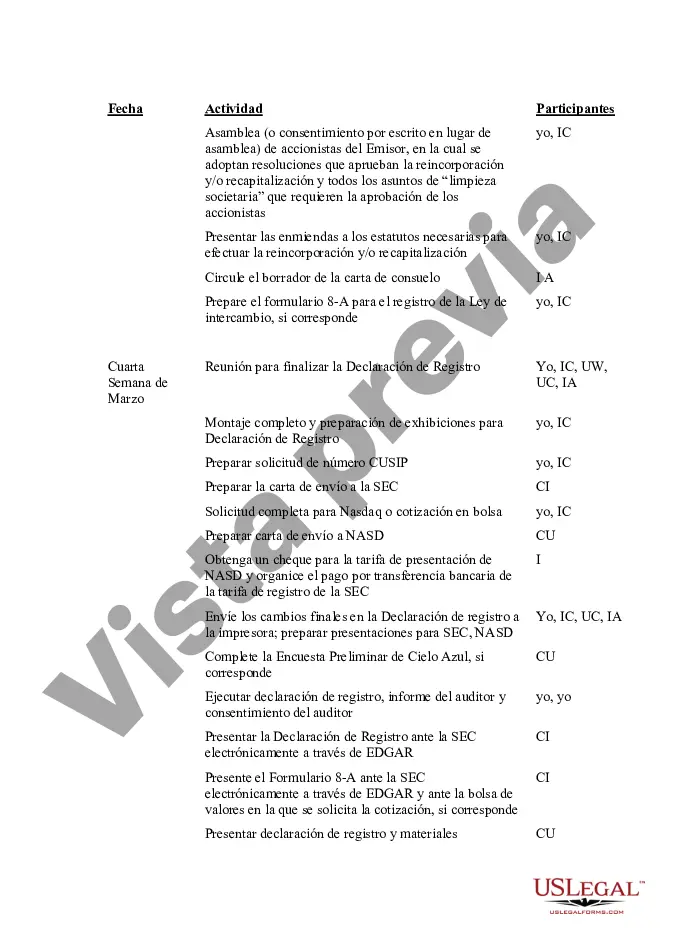

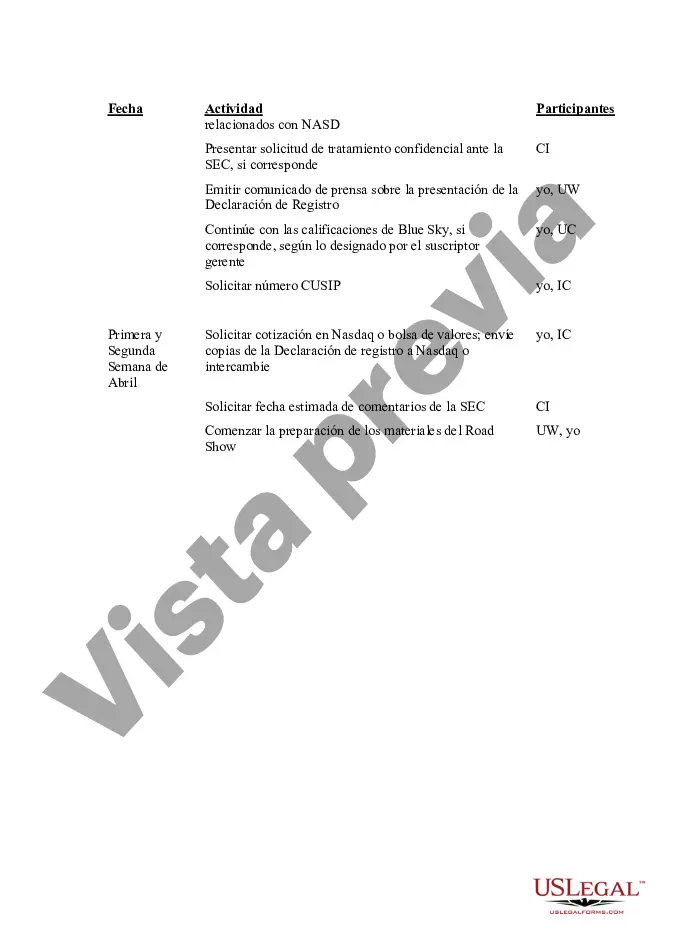

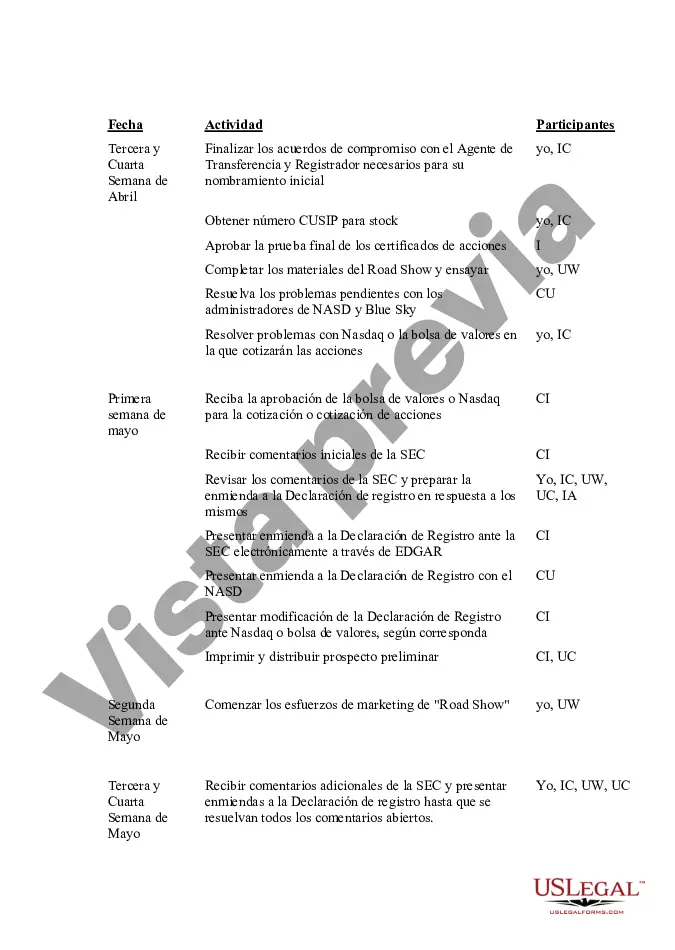

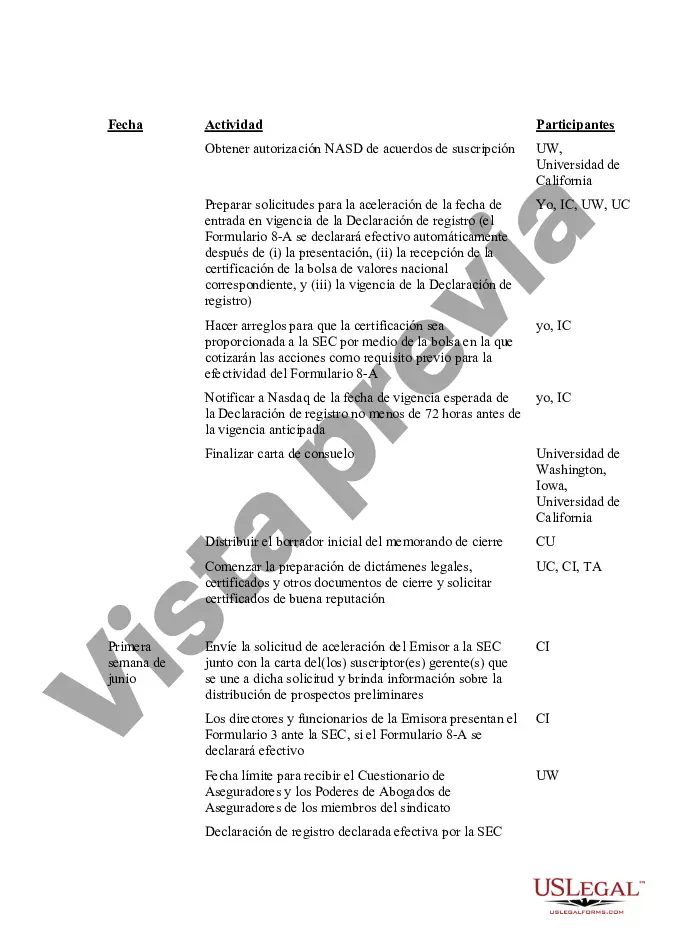

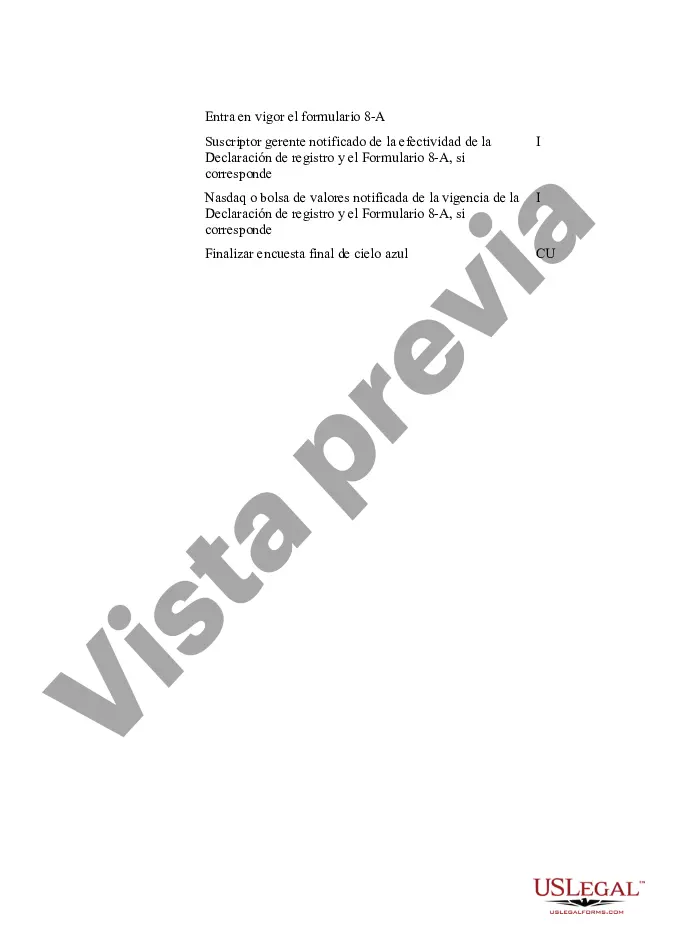

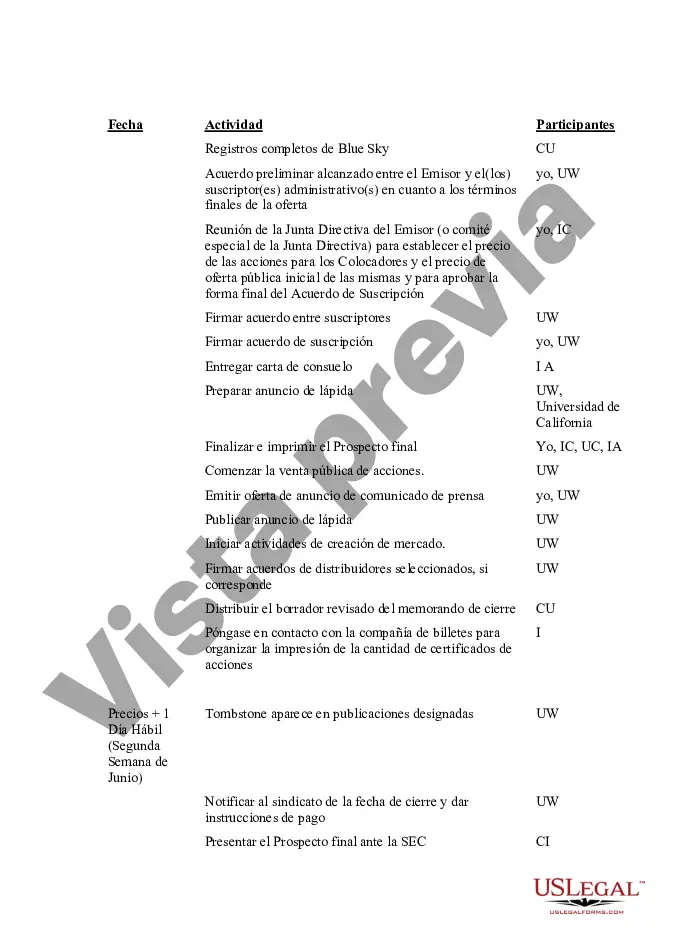

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Los Angeles California IPO Time and Responsibility Schedule: The Los Angeles California IPO Time and Responsibility Schedule outlines the crucial timeframes and duties involved in the initial public offering (IPO) process within the state of California. This comprehensive schedule serves as a guideline for businesses and entities planning to go public in Los Angeles, ensuring a smooth and compliant transition to the publicly traded market. Types of Los Angeles California IPO Time and Responsibility Schedule: 1. pre-IPO Preparation Schedule: The Pre-IPO Preparation Schedule caters to businesses and entities in Los Angeles that are in the early stages of contemplating an initial public offering. This schedule highlights the necessary steps to be taken prior to registering for an IPO, such as financial audits, legal compliance, and strategic planning. 2. SEC Filing Schedule: The SEC Filing Schedule pertains to the time-sensitive filing requirements mandated by the U.S. Securities and Exchange Commission (SEC). It encompasses submitting various documents, including the registration statement (Form S-1) and other relevant materials, within specific deadlines. Adhering to this schedule is crucial for ensuring compliance and avoiding regulatory penalties. 3. Roadshow and Investor Relations Schedule: The Roadshow and Investor Relations Schedule concentrates on the crucial period leading up to the IPO, where companies present their investment potential to prospective investors. This schedule outlines the timeframes for organizing roadshows, investor meetings, and engaging in marketing activities. It includes responsibilities related to pitch deck creation, legal compliance, and coordination with underwriters. 4. Quiet Period Schedule: The Quiet Period Schedule refers to the period after a registration statement is filed with the SEC, but before the IPO pricing is determined. During this stage, companies are restricted from engaging in promotional activities or providing forward-looking statements. This schedule emphasizes the responsibilities of issuers and their representatives to ensure strict adherence to these limitations. 5. Post-IPO Disclosure Schedule: The Post-IPO Disclosure Schedule focuses on the ongoing responsibilities and required disclosures of companies that have successfully gone public. It includes deadlines for periodic financial reporting, updates to prospectus information, and compliance with SEC filing requirements. Maintaining accurate and timely disclosures is crucial for maintaining regulatory compliance and investor confidence. By following the Los Angeles California IPO Time and Responsibility Schedule, businesses can navigate the complexities of the IPO process more efficiently and effectively. It provides a framework for streamlining tasks, adhering to legal obligations, and ultimately achieving a successful transition to the public markets.Los Angeles California IPO Time and Responsibility Schedule: The Los Angeles California IPO Time and Responsibility Schedule outlines the crucial timeframes and duties involved in the initial public offering (IPO) process within the state of California. This comprehensive schedule serves as a guideline for businesses and entities planning to go public in Los Angeles, ensuring a smooth and compliant transition to the publicly traded market. Types of Los Angeles California IPO Time and Responsibility Schedule: 1. pre-IPO Preparation Schedule: The Pre-IPO Preparation Schedule caters to businesses and entities in Los Angeles that are in the early stages of contemplating an initial public offering. This schedule highlights the necessary steps to be taken prior to registering for an IPO, such as financial audits, legal compliance, and strategic planning. 2. SEC Filing Schedule: The SEC Filing Schedule pertains to the time-sensitive filing requirements mandated by the U.S. Securities and Exchange Commission (SEC). It encompasses submitting various documents, including the registration statement (Form S-1) and other relevant materials, within specific deadlines. Adhering to this schedule is crucial for ensuring compliance and avoiding regulatory penalties. 3. Roadshow and Investor Relations Schedule: The Roadshow and Investor Relations Schedule concentrates on the crucial period leading up to the IPO, where companies present their investment potential to prospective investors. This schedule outlines the timeframes for organizing roadshows, investor meetings, and engaging in marketing activities. It includes responsibilities related to pitch deck creation, legal compliance, and coordination with underwriters. 4. Quiet Period Schedule: The Quiet Period Schedule refers to the period after a registration statement is filed with the SEC, but before the IPO pricing is determined. During this stage, companies are restricted from engaging in promotional activities or providing forward-looking statements. This schedule emphasizes the responsibilities of issuers and their representatives to ensure strict adherence to these limitations. 5. Post-IPO Disclosure Schedule: The Post-IPO Disclosure Schedule focuses on the ongoing responsibilities and required disclosures of companies that have successfully gone public. It includes deadlines for periodic financial reporting, updates to prospectus information, and compliance with SEC filing requirements. Maintaining accurate and timely disclosures is crucial for maintaining regulatory compliance and investor confidence. By following the Los Angeles California IPO Time and Responsibility Schedule, businesses can navigate the complexities of the IPO process more efficiently and effectively. It provides a framework for streamlining tasks, adhering to legal obligations, and ultimately achieving a successful transition to the public markets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.