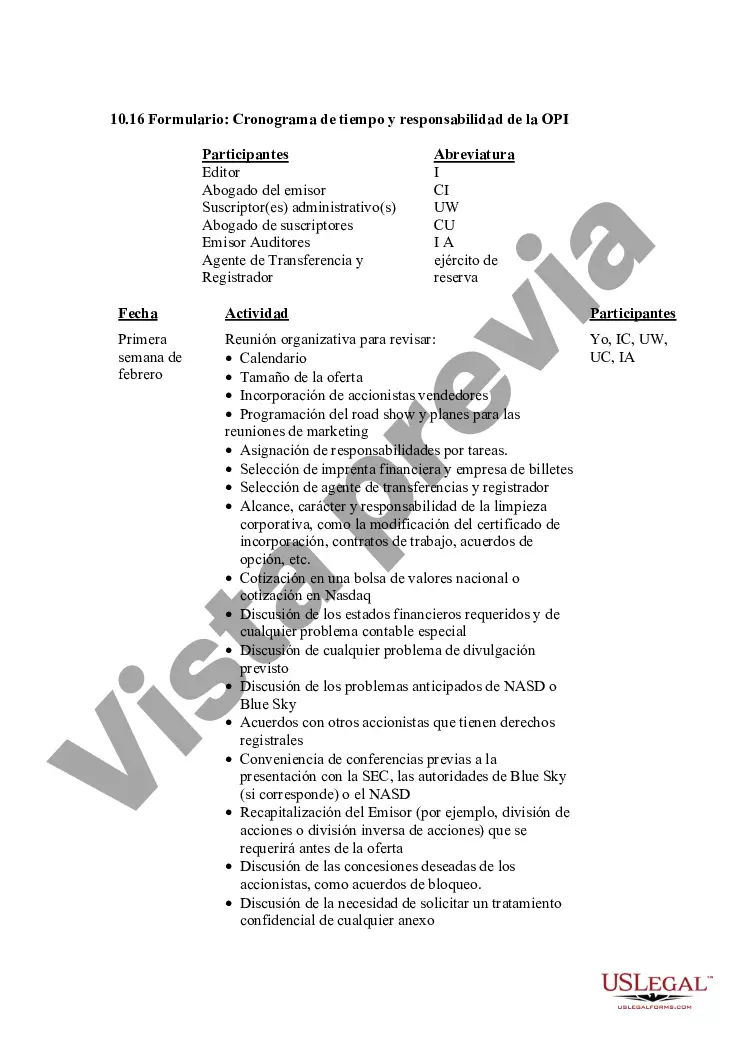

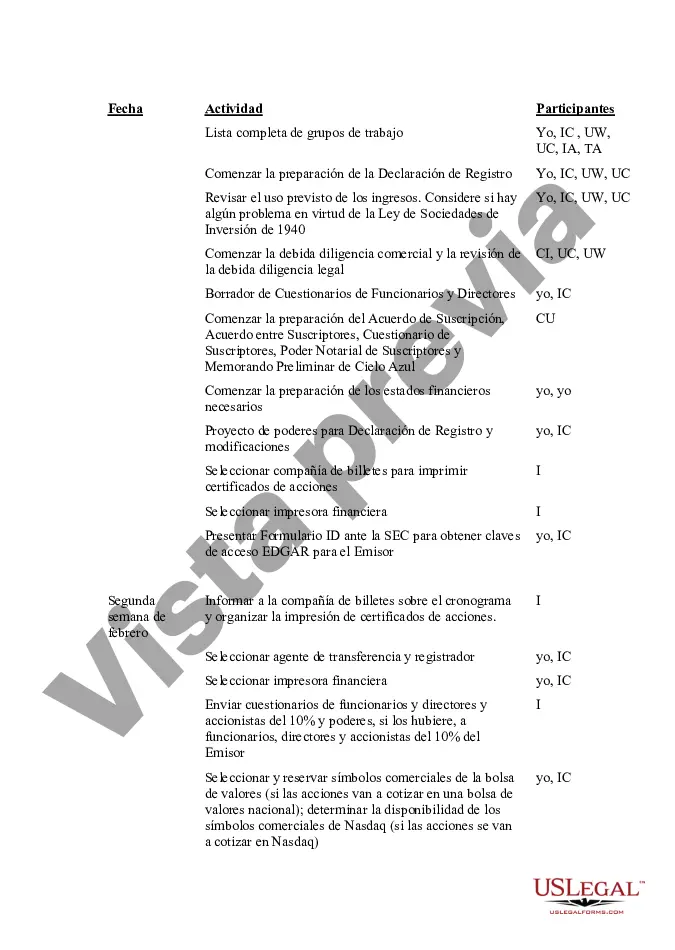

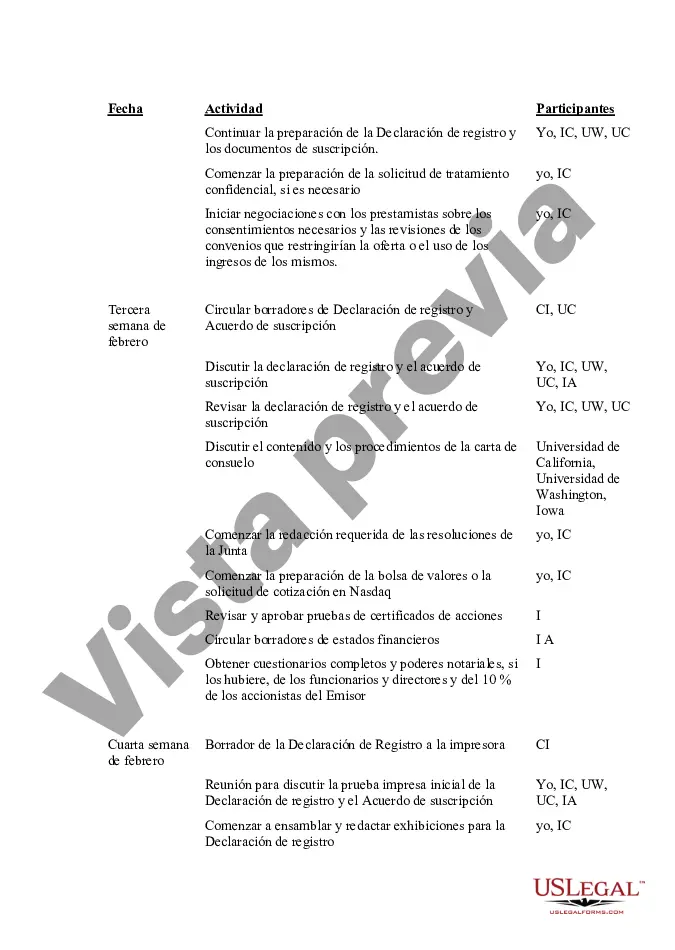

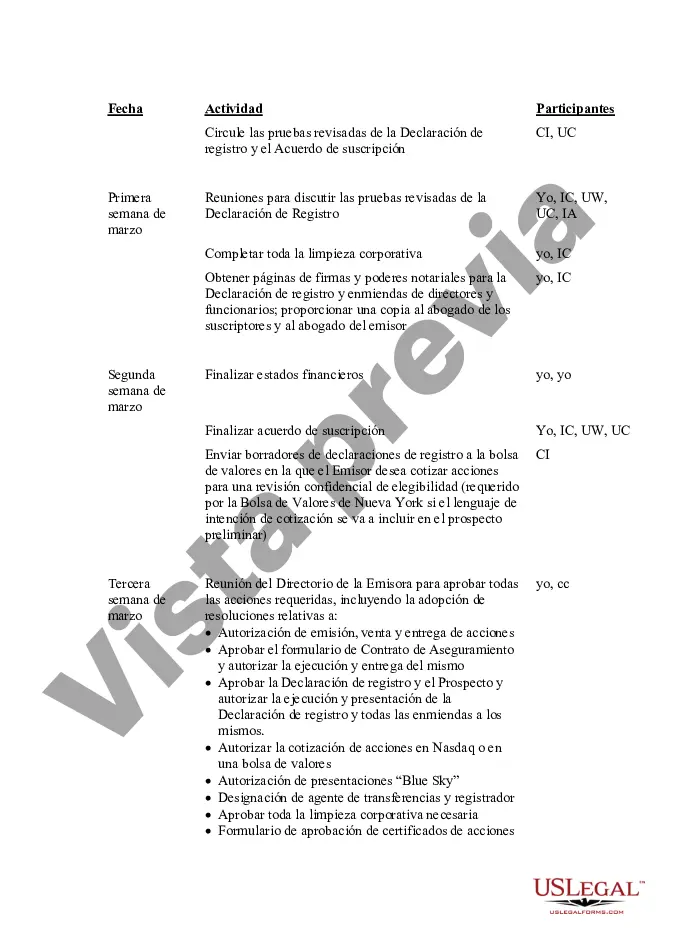

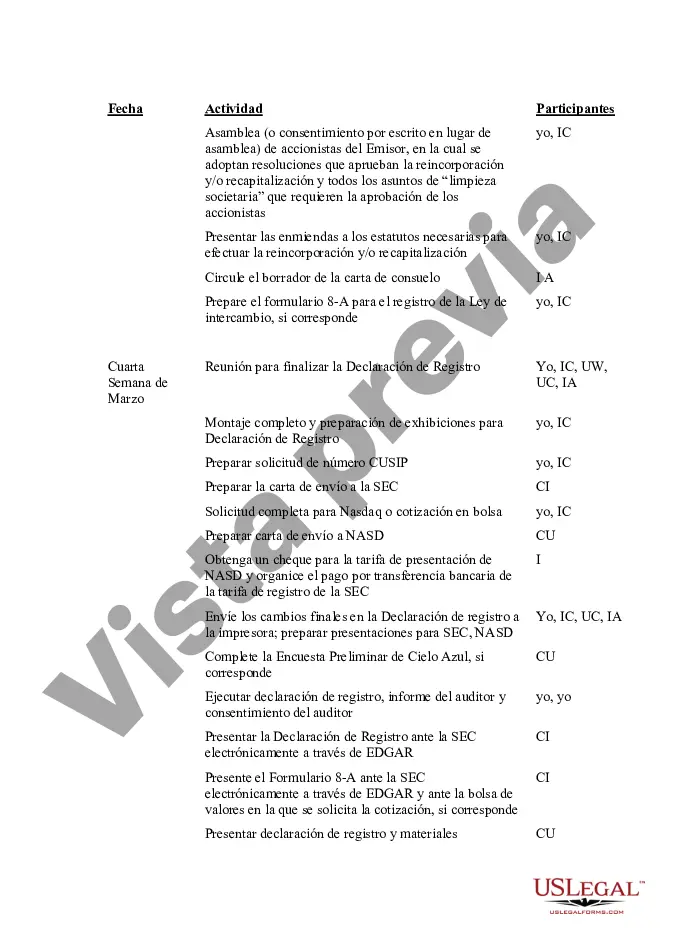

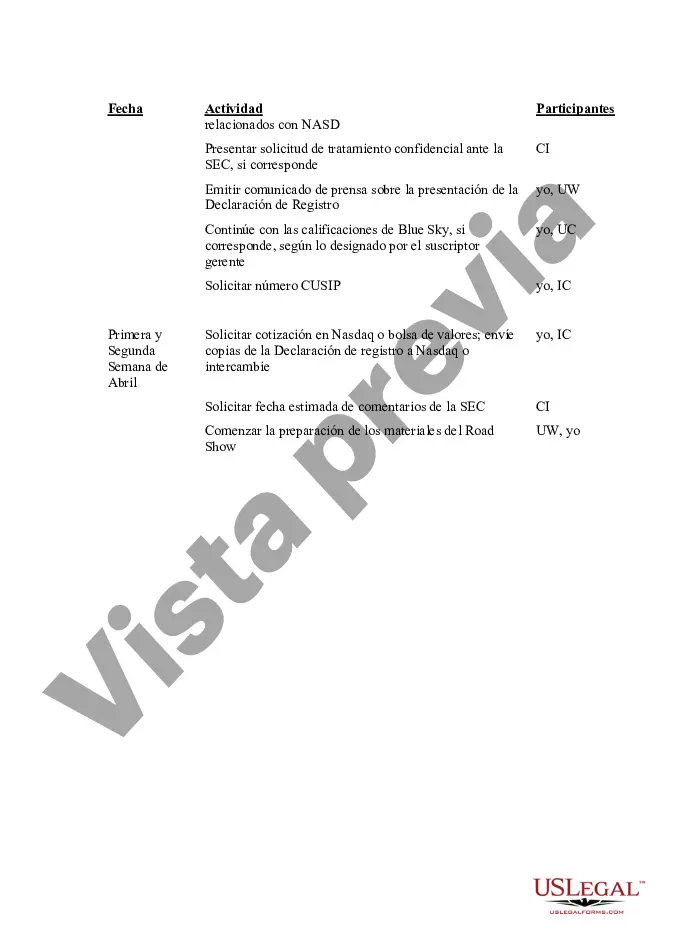

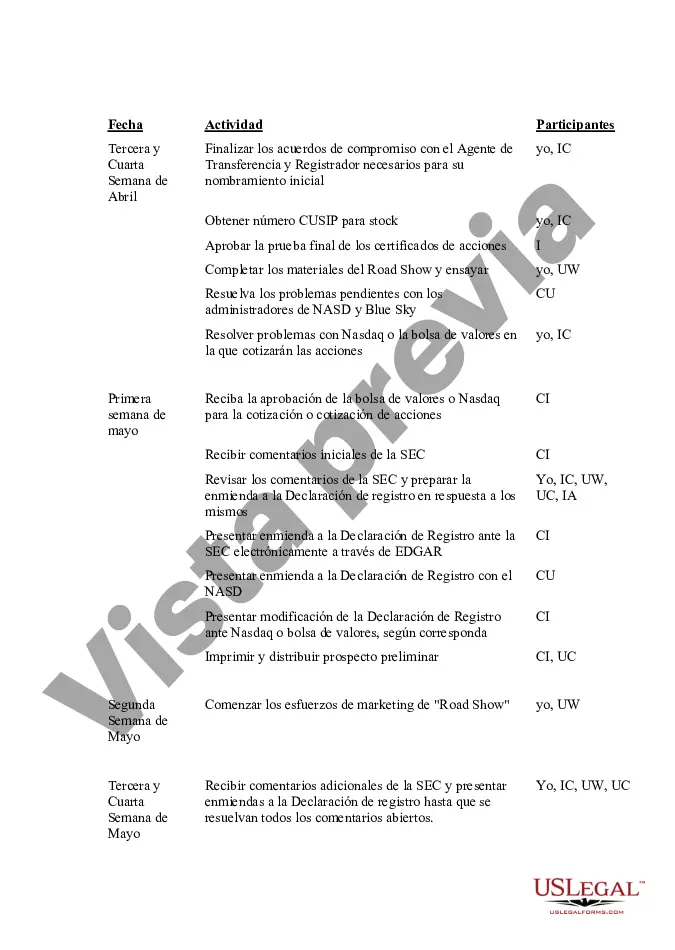

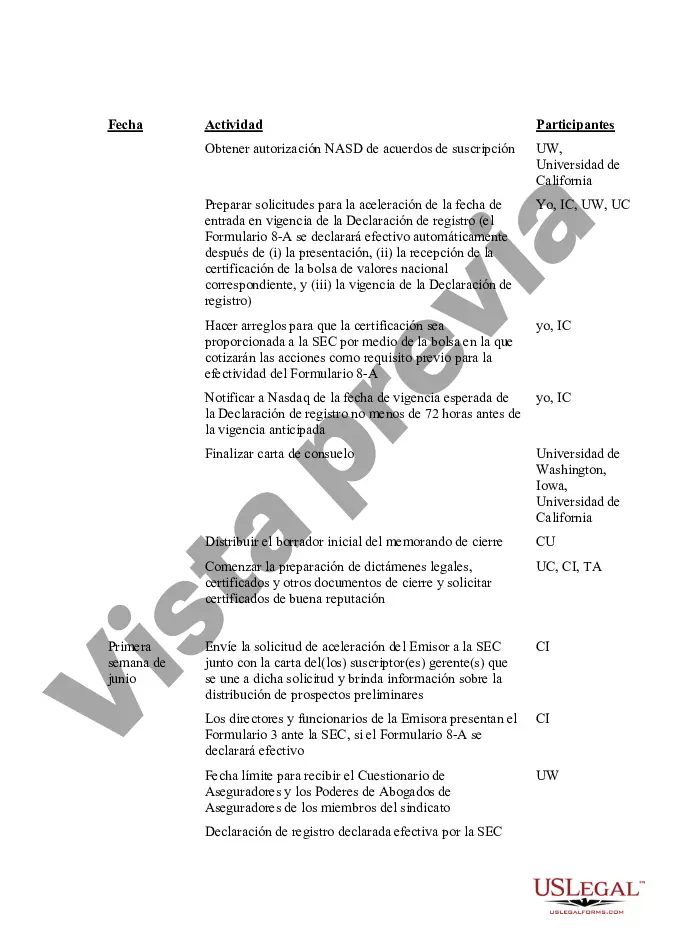

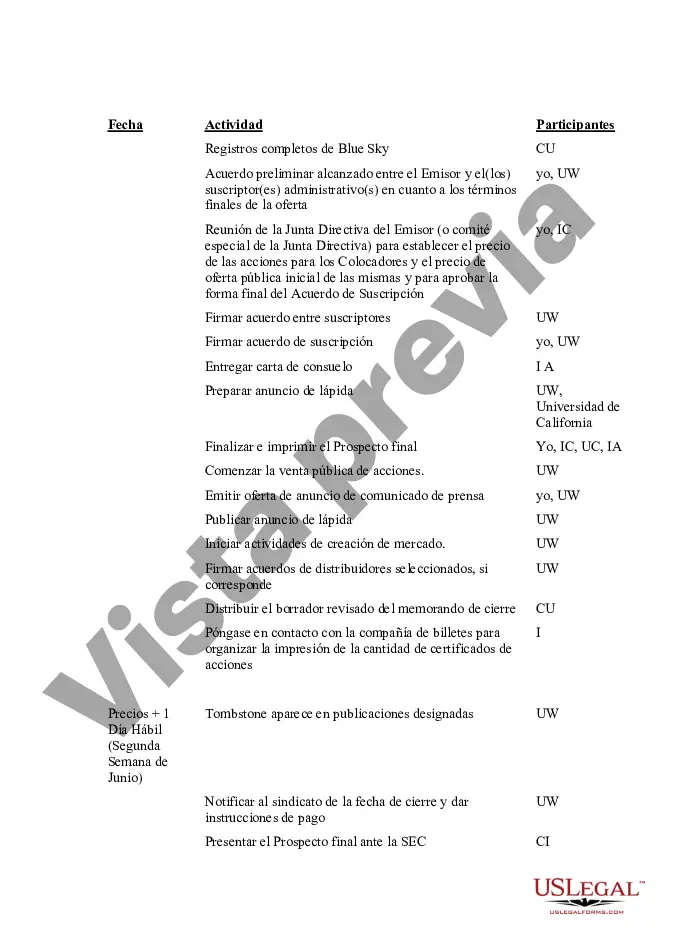

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Maricopa Arizona IPO Time and Responsibility Schedule is a comprehensive framework outlining the key milestones, timelines, and accountable parties involved in the initial public offering (IPO) process in Maricopa, Arizona. Designed to ensure a smooth and efficient transition of a private company to a publicly-traded entity, this schedule acts as a roadmap for different stakeholders involved in the IPO journey. The Maricopa Arizona IPO Time and Responsibility Schedule typically consists of the following stages: 1. pre-IPO Preparation: During this phase, companies engage in intricate planning, financial analysis, and organizational structuring to meet the regulatory requirements of going public. Key responsibilities include appointing IPO-focused teams, conducting due diligence, preparing financial statements, and selecting underwriters and legal advisors. 2. Document Preparation: To comply with regulatory standards, companies must prepare various documents such as the S-1 registration statement, which contains vital information about the company's financial performance, management, and risk factors. Other necessary documents include audited financial statements, board resolutions, contracts, and market analysis reports. This stage involves close collaboration between legal, accounting, and executive teams. 3. SEC Filing and Review: Once the documents are prepared, they must be submitted to the Securities and Exchange Commission (SEC) for review. The SEC carefully examines the contents, ensuring compliance with all disclosure requirements and regulations. In case of any deficiencies or inquiries, companies are given an opportunity to clarify and rectify the issues promptly. 4. Pricing and Roadshow: After SEC approval, the company determines the IPO price, which requires careful consideration of market conditions, competitive analysis, and investor sentiment. Simultaneously, the company embarks on a roadshow, where management presents the investment opportunity to potential institutional investors, finalizing allocations and building investor interest. 5. Closing and Listing: Once the pricing and roadshow phases are completed, final underwriting agreements are signed. The IPO proceeds are then collected, and shares are issued to new shareholders. The company's stock is subsequently listed on a stock exchange, providing liquidity to investors and enabling public trading. This stage involves coordination between legal, accounting, and banking teams. It is important to note that the Maricopa Arizona IPO Time and Responsibility Schedule may vary based on the unique circumstances and requirements of each company, as well as the broader market dynamics. Other types or variations of IPO schedules might include accelerated IPO timelines, direct listings, or different regulatory frameworks depending on the jurisdiction in Maricopa, Arizona. Ultimately, companies must adapt the schedule to their specific needs while adhering to relevant legal and regulatory obligations.Maricopa Arizona IPO Time and Responsibility Schedule is a comprehensive framework outlining the key milestones, timelines, and accountable parties involved in the initial public offering (IPO) process in Maricopa, Arizona. Designed to ensure a smooth and efficient transition of a private company to a publicly-traded entity, this schedule acts as a roadmap for different stakeholders involved in the IPO journey. The Maricopa Arizona IPO Time and Responsibility Schedule typically consists of the following stages: 1. pre-IPO Preparation: During this phase, companies engage in intricate planning, financial analysis, and organizational structuring to meet the regulatory requirements of going public. Key responsibilities include appointing IPO-focused teams, conducting due diligence, preparing financial statements, and selecting underwriters and legal advisors. 2. Document Preparation: To comply with regulatory standards, companies must prepare various documents such as the S-1 registration statement, which contains vital information about the company's financial performance, management, and risk factors. Other necessary documents include audited financial statements, board resolutions, contracts, and market analysis reports. This stage involves close collaboration between legal, accounting, and executive teams. 3. SEC Filing and Review: Once the documents are prepared, they must be submitted to the Securities and Exchange Commission (SEC) for review. The SEC carefully examines the contents, ensuring compliance with all disclosure requirements and regulations. In case of any deficiencies or inquiries, companies are given an opportunity to clarify and rectify the issues promptly. 4. Pricing and Roadshow: After SEC approval, the company determines the IPO price, which requires careful consideration of market conditions, competitive analysis, and investor sentiment. Simultaneously, the company embarks on a roadshow, where management presents the investment opportunity to potential institutional investors, finalizing allocations and building investor interest. 5. Closing and Listing: Once the pricing and roadshow phases are completed, final underwriting agreements are signed. The IPO proceeds are then collected, and shares are issued to new shareholders. The company's stock is subsequently listed on a stock exchange, providing liquidity to investors and enabling public trading. This stage involves coordination between legal, accounting, and banking teams. It is important to note that the Maricopa Arizona IPO Time and Responsibility Schedule may vary based on the unique circumstances and requirements of each company, as well as the broader market dynamics. Other types or variations of IPO schedules might include accelerated IPO timelines, direct listings, or different regulatory frameworks depending on the jurisdiction in Maricopa, Arizona. Ultimately, companies must adapt the schedule to their specific needs while adhering to relevant legal and regulatory obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.