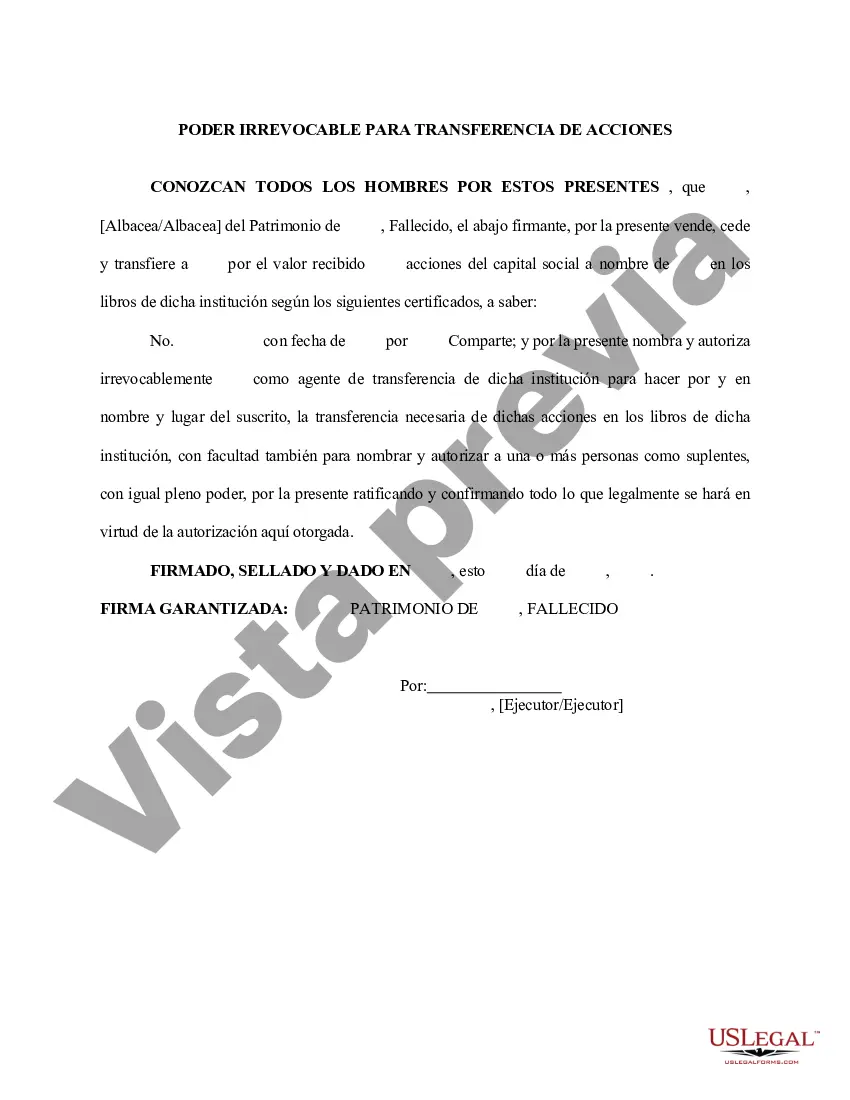

The Harris Texas Irrevocable Power of Attorney for Transfer of Stock by Executor is a legal document that grants authority to an appointed executor to manage and transfer stock ownership on behalf of a deceased individual. This power of attorney is specifically designed for individuals residing in Harris County, Texas, and is meant to facilitate the smooth transition of stock assets upon the death of the owner. This type of power of attorney is "irrevocable," meaning that once it is executed, it cannot be revoked or canceled unless certain conditions or events specified in the document occur. This ensures that the executor's authority remains intact throughout the entire process of transferring ownership of the stocks. The Harris Texas Irrevocable Power of Attorney for Transfer of Stock by Executor is crucial in cases where the deceased had substantial stock holdings. It empowers the executor, the person entrusted to handle the deceased's estate, to undertake all necessary actions to ensure the proper distribution of stocks. Some key components covered in this power of attorney include: 1. Appointment of Executor: The document must clearly identify and appoint an executor, who will be responsible for managing and carrying out the transfer of stocks. 2. Stock Transfer Authority: The power of attorney explicitly grants the executor the authority to sell, transfer, assign, or otherwise deal with the stocks owned by the deceased individual. 3. Stock Voting Rights: The power of attorney may extend the authority of the executor to exercise voting rights on behalf of the deceased individual's stocks during shareholder meetings or other corporate governance events. 4. Terms and Conditions: The document may outline specific terms and conditions that the executor must adhere to while executing their responsibilities. This may include timelines for stock transfers, restrictions on the sale of stocks, or any other requirements specified by the deceased. 5. Successor Executor Provision: In case the originally appointed executor is unable or unwilling to carry out their duties, the power of attorney may include provisions for appointing a successor executor. It is important to note that there may be variations or different types of Harris Texas Irrevocable Power of Attorney for Transfer of Stock by Executor, depending on the specific needs or preferences of the deceased individual. However, the primary purpose remains consistent — to authorize the executor to administer and transfer stock ownership in accordance with the deceased's wishes and applicable state laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Poder irrevocable para la transferencia de acciones por parte del albacea - Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out Harris Texas Poder Irrevocable Para La Transferencia De Acciones Por Parte Del Albacea?

If you need to find a trustworthy legal form provider to obtain the Harris Irrevocable Power of Attorney for Transfer of Stock by Executor, consider US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can select from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support make it easy to find and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to look for or browse Harris Irrevocable Power of Attorney for Transfer of Stock by Executor, either by a keyword or by the state/county the form is created for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Harris Irrevocable Power of Attorney for Transfer of Stock by Executor template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less expensive and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or execute the Harris Irrevocable Power of Attorney for Transfer of Stock by Executor - all from the convenience of your sofa.

Join US Legal Forms now!