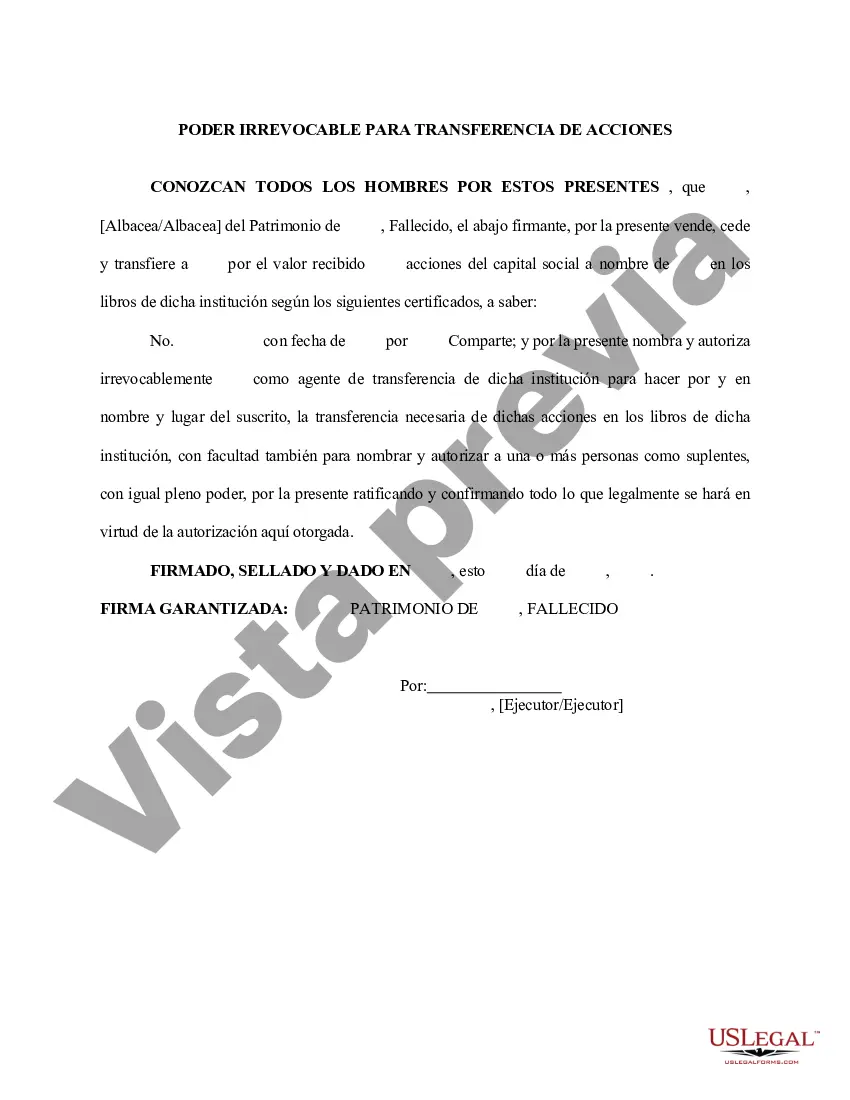

Maricopa Arizona Irrevocable Power of Attorney for Transfer of Stock by Executor is a legal document that grants an executor the authority to transfer stock on behalf of the deceased shareholder. This type of power of attorney is crucial in ensuring a smooth transfer of assets and minimizing delays or complications during the probate process. The Maricopa Arizona Irrevocable Power of Attorney for Transfer of Stock by Executor provides the executor with the legal power to act on behalf of the deceased shareholder, allowing them to carry out stock transactions, such as selling or transferring shares, as required. This document is specifically tailored for use in Maricopa, Arizona, and adheres to the local laws and regulations. By having an irrevocable power of attorney in place, the nominated executor is empowered to make decisions and take action in regard to the transfer of stock, without the need for court approval. This streamlines the process, ensuring efficient handling of the deceased shareholder's portfolio and mitigating potential delays. It is important to note that while an irrevocable power of attorney grants significant authority, it cannot be changed or revoked without the express consent of the deceased shareholder if they are still alive. After their passing, the power to modify or terminate the power of attorney rests with the probate court. The Maricopa Arizona Irrevocable Power of Attorney for Transfer of Stock by Executor may have different variations depending on the specific circumstances or preferences of the deceased shareholder. Some possible variations of this document could include provisions for specific restrictions or permissions related to the transfer of particular stocks or the handling of specific financial accounts. In conclusion, the Maricopa Arizona Irrevocable Power of Attorney for Transfer of Stock by Executor is a crucial legal tool that empowers the designated executor to effectively handle the transfer of stock on behalf of a deceased shareholder. By streamlining the process and minimizing potential complications, this document ensures the efficient and accurate management of the deceased's assets in accordance with their wishes and the local laws in Maricopa, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Poder irrevocable para la transferencia de acciones por parte del albacea - Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out Maricopa Arizona Poder Irrevocable Para La Transferencia De Acciones Por Parte Del Albacea?

Drafting papers for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Maricopa Irrevocable Power of Attorney for Transfer of Stock by Executor without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Maricopa Irrevocable Power of Attorney for Transfer of Stock by Executor on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Maricopa Irrevocable Power of Attorney for Transfer of Stock by Executor:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a few clicks!