Miami-Dade Florida Irrevocable Power of Attorney for Transfer of Stock by Executor is a legal document that grants authority to the executor of an estate to manage and transfer stocks on behalf of the deceased individual. This power of attorney enables the executor to act with the highest level of fiduciary responsibility and make informed decisions regarding stock holdings, ensuring that the deceased's wishes are fulfilled and the estate administration process is carried out smoothly. When it comes to the types of Miami-Dade Florida Irrevocable Power of Attorney for Transfer of Stock by Executor, there are a few variations to consider. Each type serves a specific purpose, depending on the unique circumstances of the estate and the wishes of the deceased: 1. Limited Power of Attorney: This type of power of attorney grants the executor specific and limited authority to transfer particular stocks or handle specific stock-related matters. It is commonly used when there are only a few stocks involved or when the deceased has specific instructions regarding certain holdings. 2. General Power of Attorney: A general power of attorney for transfer of stock provides the executor with broader authority to manage and deal with all stocks held by the deceased individual. This type is often preferred when the deceased had a diverse portfolio or when there is no specific instruction regarding stock holdings. 3. Durable Power of Attorney: A durable power of attorney remains valid even if the executor becomes mentally incapacitated or physically disabled. This type ensures that the authority to transfer stocks by the executor remains intact, regardless of any personal circumstances that may arise. 4. Springing Power of Attorney: A springing power of attorney becomes effective only upon the occurrence of a specified event, such as the executor's incapacity or the completion of probate proceedings. This type allows for a specific triggering event before the executor gains the authority to transfer stocks. 5. Statutory Power of Attorney: This type of power of attorney follows the provisions outlined in the Florida Statutes, ensuring compliance with the legal requirements in Miami-Dade County for the transfer of stocks. It provides a standardized format for the document and grants the applicable powers as prescribed by the state laws. When creating a Miami-Dade Florida Irrevocable Power of Attorney for Transfer of Stock by Executor, it is essential to consult with an experienced attorney to ensure compliance with local laws, align the document with the deceased's wishes, and protect the executor from any potential legal issues.

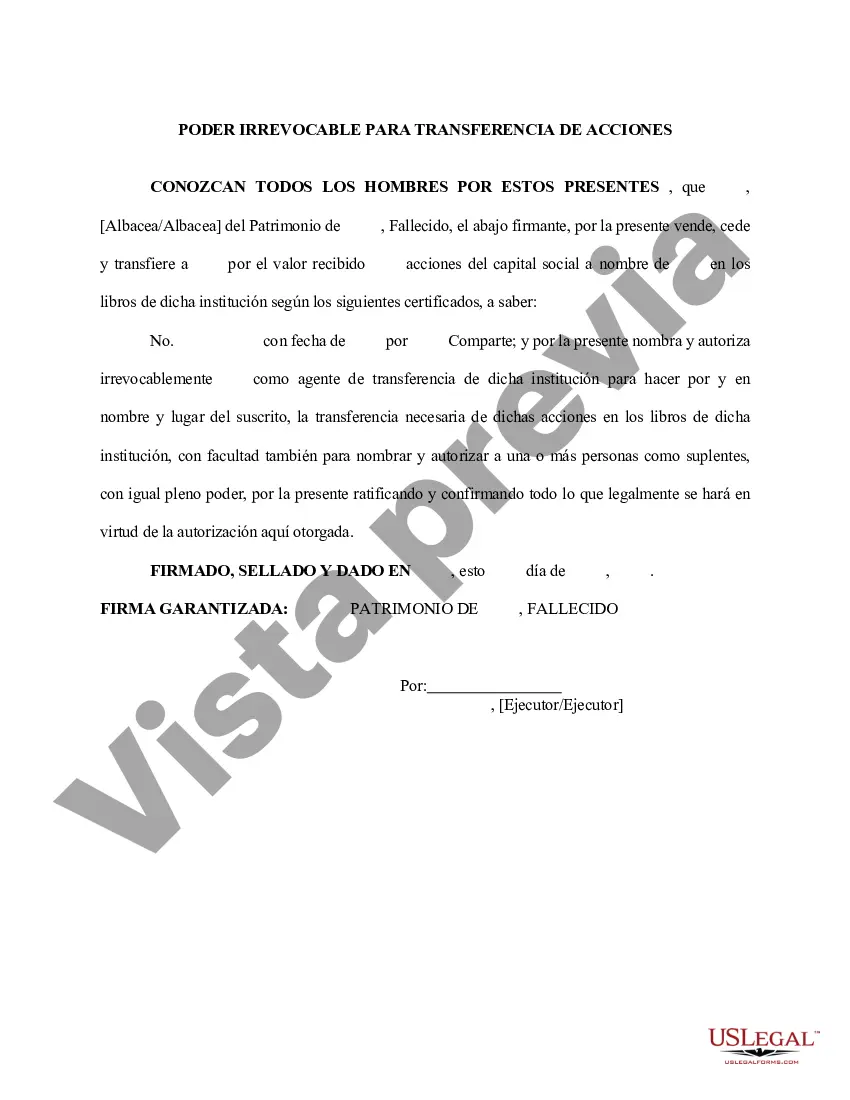

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Poder irrevocable para la transferencia de acciones por parte del albacea - Irrevocable Power of Attorney for Transfer of Stock by Executor

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-XS-0020

Format:

Word

Instant download

Description

This is a multi-state form covering the subject matter of the title and is an Irrevocable Power of Attorney for Transfer of Stock by Executor.

Miami-Dade Florida Irrevocable Power of Attorney for Transfer of Stock by Executor is a legal document that grants authority to the executor of an estate to manage and transfer stocks on behalf of the deceased individual. This power of attorney enables the executor to act with the highest level of fiduciary responsibility and make informed decisions regarding stock holdings, ensuring that the deceased's wishes are fulfilled and the estate administration process is carried out smoothly. When it comes to the types of Miami-Dade Florida Irrevocable Power of Attorney for Transfer of Stock by Executor, there are a few variations to consider. Each type serves a specific purpose, depending on the unique circumstances of the estate and the wishes of the deceased: 1. Limited Power of Attorney: This type of power of attorney grants the executor specific and limited authority to transfer particular stocks or handle specific stock-related matters. It is commonly used when there are only a few stocks involved or when the deceased has specific instructions regarding certain holdings. 2. General Power of Attorney: A general power of attorney for transfer of stock provides the executor with broader authority to manage and deal with all stocks held by the deceased individual. This type is often preferred when the deceased had a diverse portfolio or when there is no specific instruction regarding stock holdings. 3. Durable Power of Attorney: A durable power of attorney remains valid even if the executor becomes mentally incapacitated or physically disabled. This type ensures that the authority to transfer stocks by the executor remains intact, regardless of any personal circumstances that may arise. 4. Springing Power of Attorney: A springing power of attorney becomes effective only upon the occurrence of a specified event, such as the executor's incapacity or the completion of probate proceedings. This type allows for a specific triggering event before the executor gains the authority to transfer stocks. 5. Statutory Power of Attorney: This type of power of attorney follows the provisions outlined in the Florida Statutes, ensuring compliance with the legal requirements in Miami-Dade County for the transfer of stocks. It provides a standardized format for the document and grants the applicable powers as prescribed by the state laws. When creating a Miami-Dade Florida Irrevocable Power of Attorney for Transfer of Stock by Executor, it is essential to consult with an experienced attorney to ensure compliance with local laws, align the document with the deceased's wishes, and protect the executor from any potential legal issues.