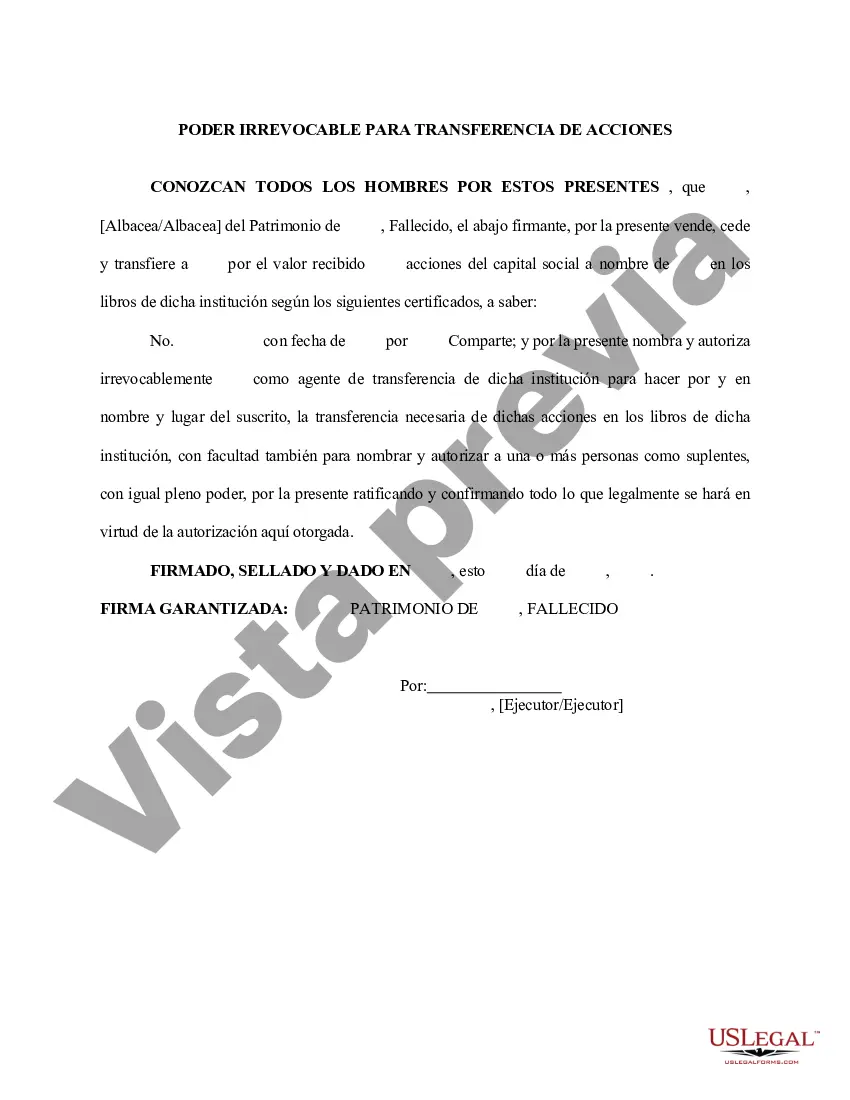

The Lima Arizona Irrevocable Power of Attorney for Transfer of Stock by Executor is a legal document that grants specific authority to an appointed individual, known as the executor, to manage and transfer stock holdings on behalf of the decedent's estate. This power of attorney is put in place when the executor requires the legal ability to handle the transfer of stock shares owned by the deceased individual. In Pima County, Arizona, the Irrevocable Power of Attorney for Transfer of Stock by Executor is designed to ensure a smooth transition of assets and streamline the stock transfer process. This document is typically used in probate cases, where the executor is responsible for settling the deceased person's estate, including liquidating or transferring their stock holdings. With the Lima Arizona Irrevocable Power of Attorney for Transfer of Stock by Executor, the executor gains the legal authority to sell, transfer, endorse, or assign stock certificates. This document must be signed by the executor, notarized, and submitted to the appropriate financial institutions and the stock registrar to initiate the transfer process accurately. Different types of Lima Arizona Irrevocable Power of Attorney for Transfer of Stock by Executor may include: 1. General Irrevocable Power of Attorney for Transfer of Stock by Executor: This document grants broad powers to the executor, allowing them to manage all aspects related to the transfer of stock by the deceased, including selling, transferring, and assigning stock certificates. 2. Limited Irrevocable Power of Attorney for Transfer of Stock by Executor: This type of power of attorney grants only specific powers to the executor, limiting their authority to perform certain actions related to the transfer of stocks. This could include only endorsing or assigning specific stock certificates. 3. Temporary Irrevocable Power of Attorney for Transfer of Stock by Executor: This power of attorney is limited to a specific period or until a specific event occurs. It allows the executor to manage and transfer stock holdings during this designated timeframe or until the specified triggering event takes place. When executing the Lima Arizona Irrevocable Power of Attorney for Transfer of Stock by Executor, it is crucial to consult with an attorney experienced in estate planning or probate law to ensure compliance with local regulations and to guarantee that the document adequately reflects the desires and intentions of the deceased individual. Properly completed, this power of attorney provides legal authority to the executor, allowing them to handle the stock transfer process efficiently and accurately within the constraints of the estate administration process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Poder irrevocable para la transferencia de acciones por parte del albacea - Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out Pima Arizona Poder Irrevocable Para La Transferencia De Acciones Por Parte Del Albacea?

Are you looking to quickly draft a legally-binding Pima Irrevocable Power of Attorney for Transfer of Stock by Executor or maybe any other document to manage your own or business affairs? You can select one of the two options: hire a professional to draft a legal paper for you or create it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific document templates, including Pima Irrevocable Power of Attorney for Transfer of Stock by Executor and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, carefully verify if the Pima Irrevocable Power of Attorney for Transfer of Stock by Executor is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were seeking by utilizing the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Pima Irrevocable Power of Attorney for Transfer of Stock by Executor template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the documents we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!