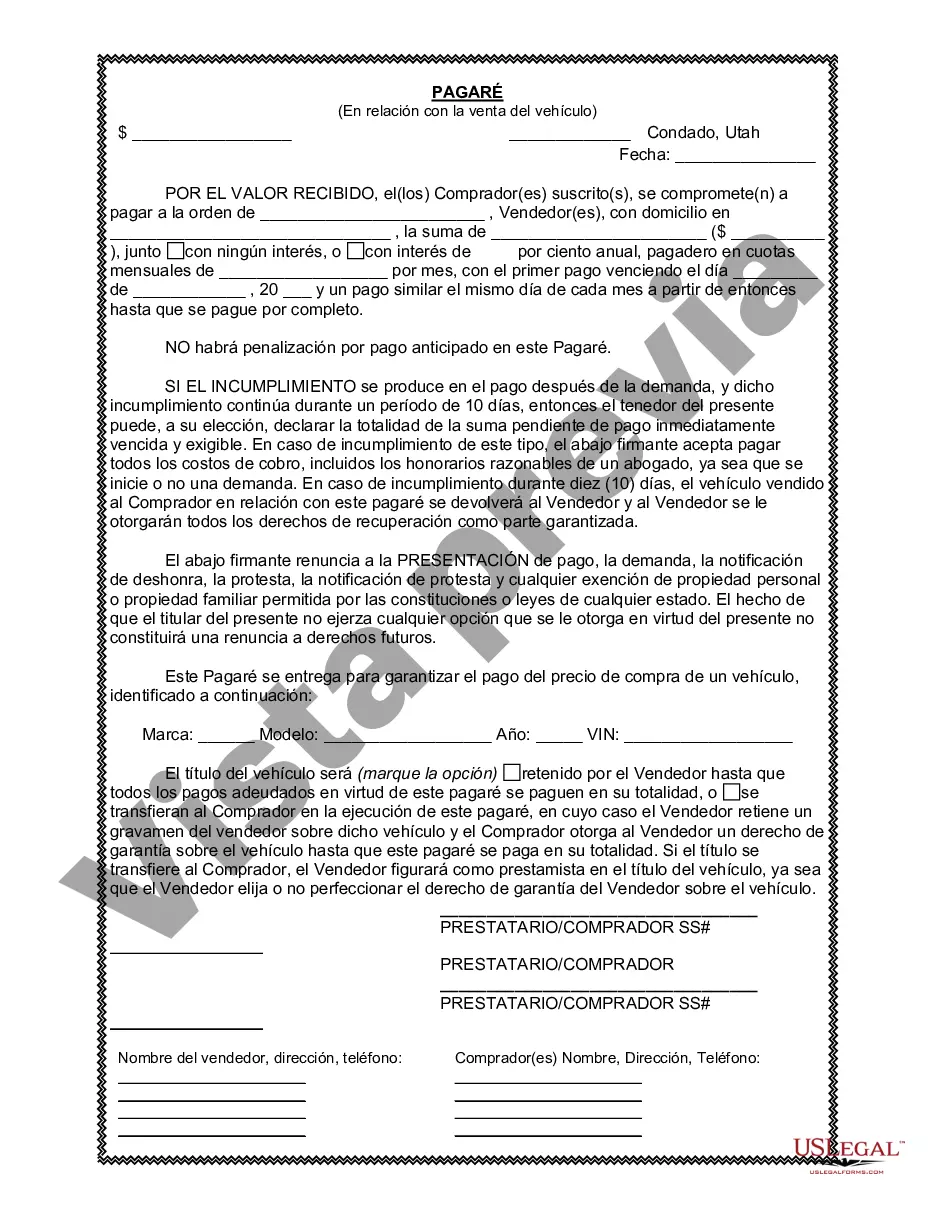

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

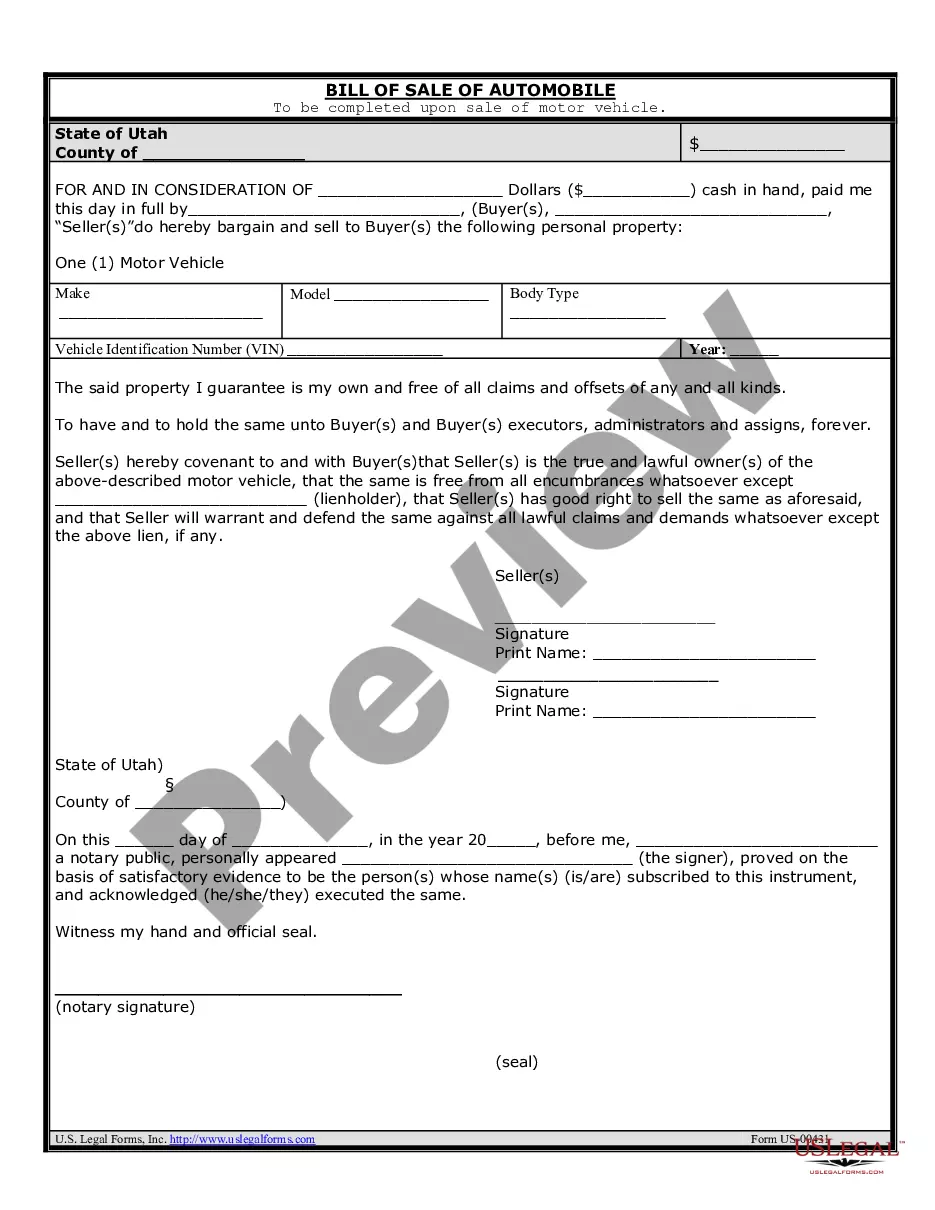

A Provo Utah Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between a seller and a buyer. This note serves as evidence of the debt owed by the buyer to the seller and provides a clear understanding of the repayment schedule and other important details related to the loan. The Provo Utah Promissory Note for the sale of a vehicle typically includes the following key elements: 1. Parties Involved: The note clearly specifies the names and contact information of both the seller (lender) and the buyer (borrower) involved in the transaction, ensuring the document's authenticity and enforceability. 2. Vehicle Description: The promissory note includes a detailed description of the vehicle being sold, including the make, model, year, Vehicle Identification Number (VIN), and any other relevant details to identify the specific automobile. 3. Loan Amount: The note states the total amount of the loan, which is the purchase price of the vehicle minus any down payment or trade-in value agreed upon during the sale. It also incorporates any additional costs associated with the purchase, such as taxes or fees. 4. Interest Rate: The note outlines the interest rate applied to the loan. Interest rates may be fixed or variable, depending on the agreement made between the buyer and seller. It is crucial to specify the interest calculation method, whether it be simple interest or compound interest. 5. Repayment Terms: The note details the agreed-upon repayment schedule, including the frequency (monthly, quarterly, etc.) and the due date for each payment. It may also mention the period of time the borrower has to repay the loan in full (loan term). 6. Late Payment and Default: The consequences of late payments or default are explicitly stated in the promissory note. These consequences may include late fees, additional interest, repossession of the vehicle, or legal action to collect the remaining balance. 7. Signatures and Witnesses: The note requires both the seller and buyer to sign and date the document to indicate their agreement to the terms and conditions. In some cases, witnesses may be required to validate the authenticity of the signatures. Different types of Provo Utah Promissory Note in connection with the sale of a vehicle may include additional clauses or variations depending on the unique circumstances of the transaction. These could involve specific provisions concerning loan acceleration, prepayment penalties, collateral details (e.g., lien and security interest), or any other agreed-upon terms between the parties involved. It is essential to consult with legal professionals or use trusted templates to ensure the completeness, accuracy, and compliance of any promissory note used in a vehicle sale in Provo, Utah.A Provo Utah Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between a seller and a buyer. This note serves as evidence of the debt owed by the buyer to the seller and provides a clear understanding of the repayment schedule and other important details related to the loan. The Provo Utah Promissory Note for the sale of a vehicle typically includes the following key elements: 1. Parties Involved: The note clearly specifies the names and contact information of both the seller (lender) and the buyer (borrower) involved in the transaction, ensuring the document's authenticity and enforceability. 2. Vehicle Description: The promissory note includes a detailed description of the vehicle being sold, including the make, model, year, Vehicle Identification Number (VIN), and any other relevant details to identify the specific automobile. 3. Loan Amount: The note states the total amount of the loan, which is the purchase price of the vehicle minus any down payment or trade-in value agreed upon during the sale. It also incorporates any additional costs associated with the purchase, such as taxes or fees. 4. Interest Rate: The note outlines the interest rate applied to the loan. Interest rates may be fixed or variable, depending on the agreement made between the buyer and seller. It is crucial to specify the interest calculation method, whether it be simple interest or compound interest. 5. Repayment Terms: The note details the agreed-upon repayment schedule, including the frequency (monthly, quarterly, etc.) and the due date for each payment. It may also mention the period of time the borrower has to repay the loan in full (loan term). 6. Late Payment and Default: The consequences of late payments or default are explicitly stated in the promissory note. These consequences may include late fees, additional interest, repossession of the vehicle, or legal action to collect the remaining balance. 7. Signatures and Witnesses: The note requires both the seller and buyer to sign and date the document to indicate their agreement to the terms and conditions. In some cases, witnesses may be required to validate the authenticity of the signatures. Different types of Provo Utah Promissory Note in connection with the sale of a vehicle may include additional clauses or variations depending on the unique circumstances of the transaction. These could involve specific provisions concerning loan acceleration, prepayment penalties, collateral details (e.g., lien and security interest), or any other agreed-upon terms between the parties involved. It is essential to consult with legal professionals or use trusted templates to ensure the completeness, accuracy, and compliance of any promissory note used in a vehicle sale in Provo, Utah.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.