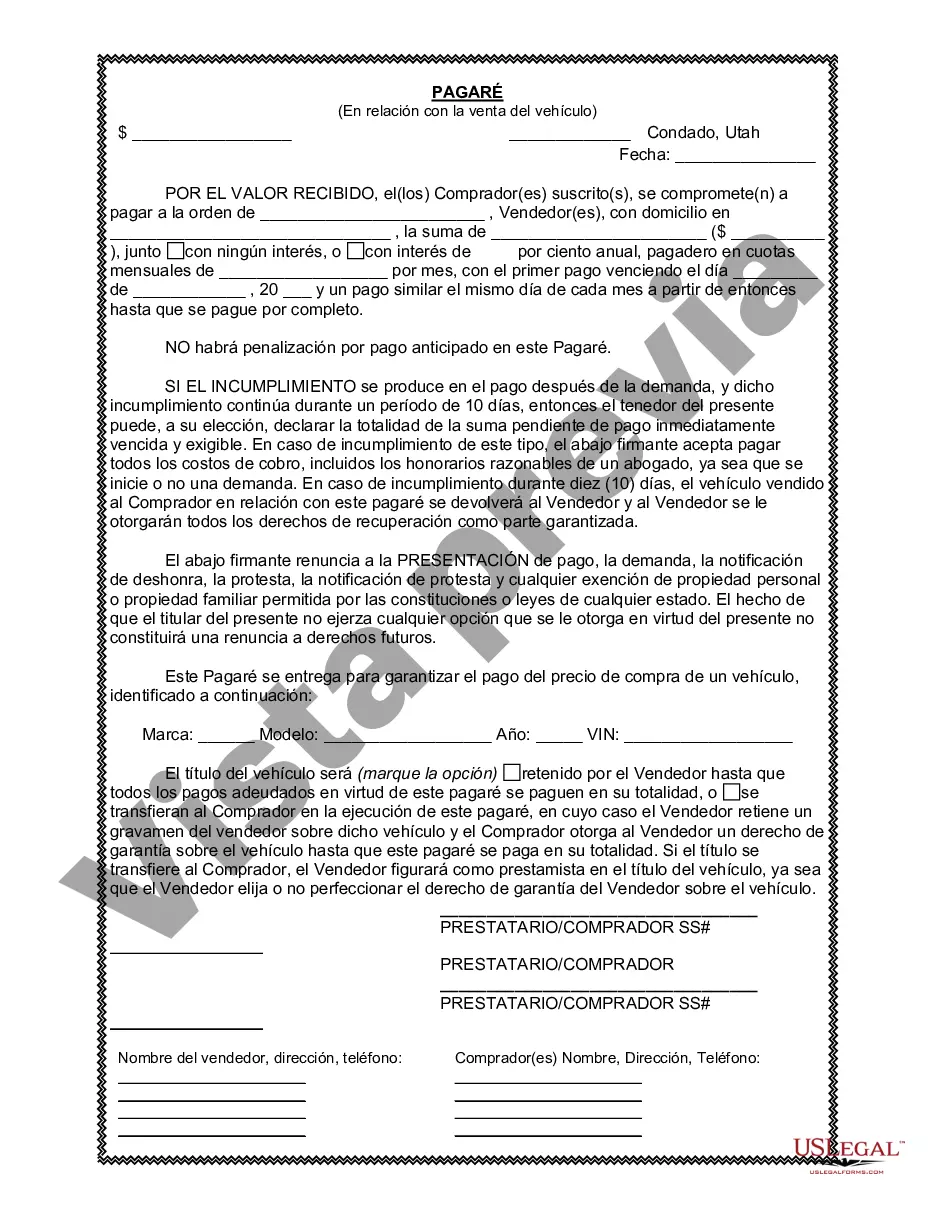

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

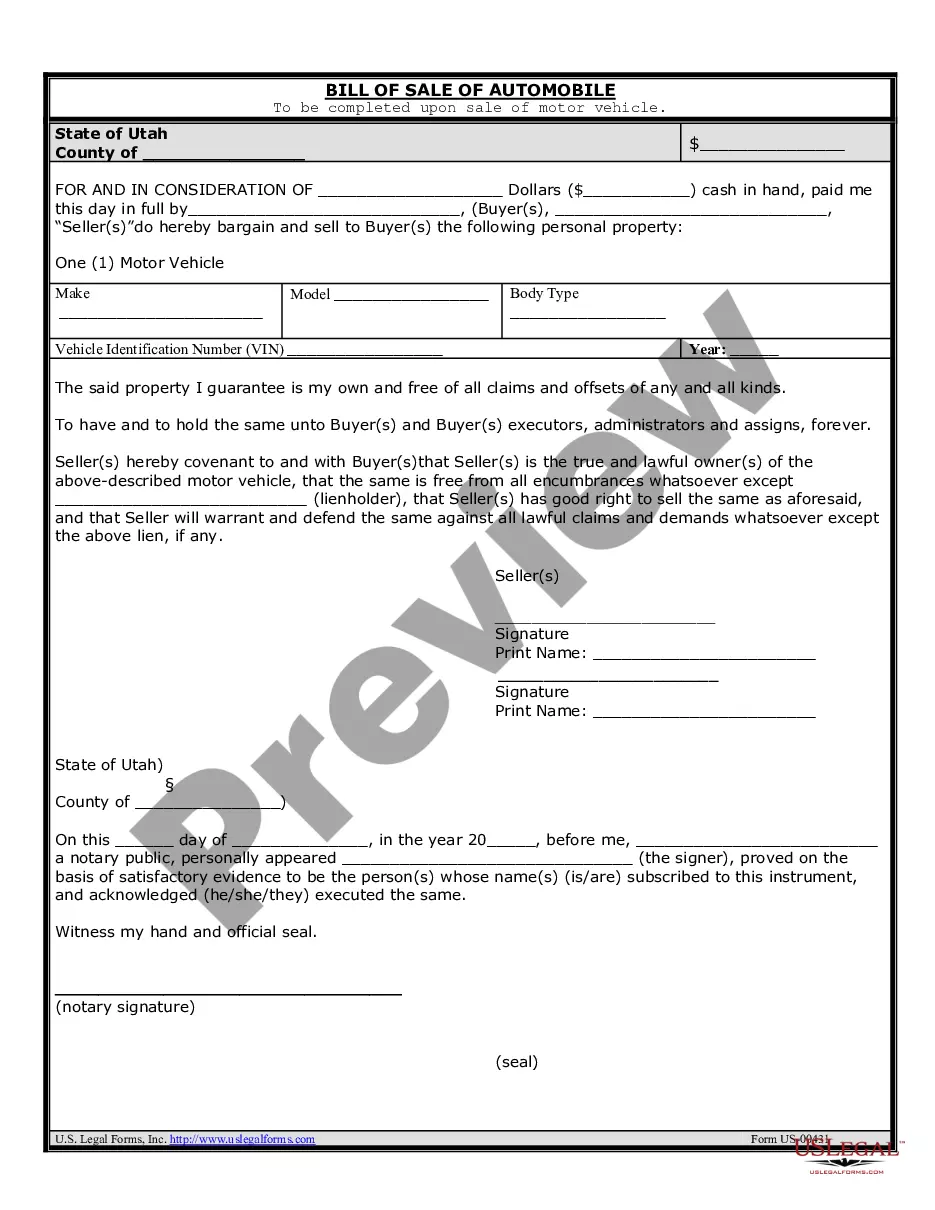

A West Jordan Utah promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller. In this scenario, the seller retains ownership of the vehicle until the buyer pays off the loan in full, at which point the seller transfers the vehicle's title to the buyer. The West Jordan Utah promissory note includes specific details about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN). It also covers the financial aspects of the transaction, including the purchase price, down payment (if any), interest rate, and the repayment schedule. Additionally, the note may include provisions for late fees, penalties, or repossession in case of default by the buyer. There are different types of West Jordan Utah promissory notes in connection with the sale of a vehicle or automobile, categorized based on the repayment terms and the involvement of a third-party lender. Some commonly used types include: 1. Simple Promissory Note: This is a basic agreement between the buyer and seller, where the buyer promises to pay the agreed-upon amount within a specified period. No third-party financing is involved in this type of note. 2. Conditionally Secured Promissory Note: This note includes a provision that gives the seller the right to repossess the vehicle if the buyer fails to make timely payments. The seller essentially holds a security interest in the vehicle until the buyer satisfies the loan. 3. Seller Financing Promissory Note: In this case, the seller acts as the lender and provides financing to the buyer. The note outlines the terms of the loan, including the interest rate, repayment schedule, and consequences of default. 4. Third-Party Financing Promissory Note: This type of note is used when a third-party lender, such as a bank or credit union, provides financing for the vehicle purchase. The note includes information about the terms of the loan, the lender's contact information, and any necessary borrower disclosures. It is crucial for both the buyer and seller to fully understand and agree upon the terms laid out in the West Jordan Utah promissory note. Consulting with legal professionals and obtaining proper documentation and disclosures ensure a smooth and legally protected transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.