Provo Utah Contrato de Escrituración Estado Contable Anual del Vendedor - Utah Contract for Deed Seller's Annual Accounting Statement

State:

Utah

City:

Provo

Control #:

UT-00470-4

Format:

Word

Instant download

Description

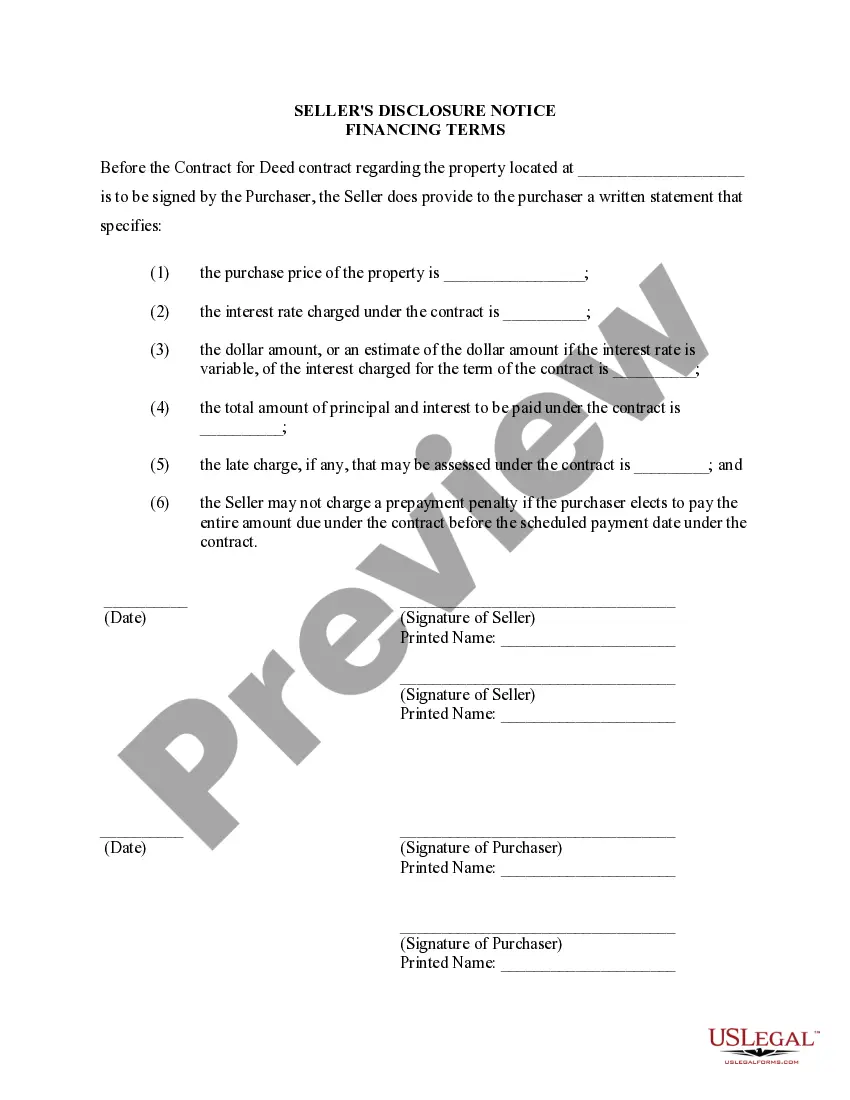

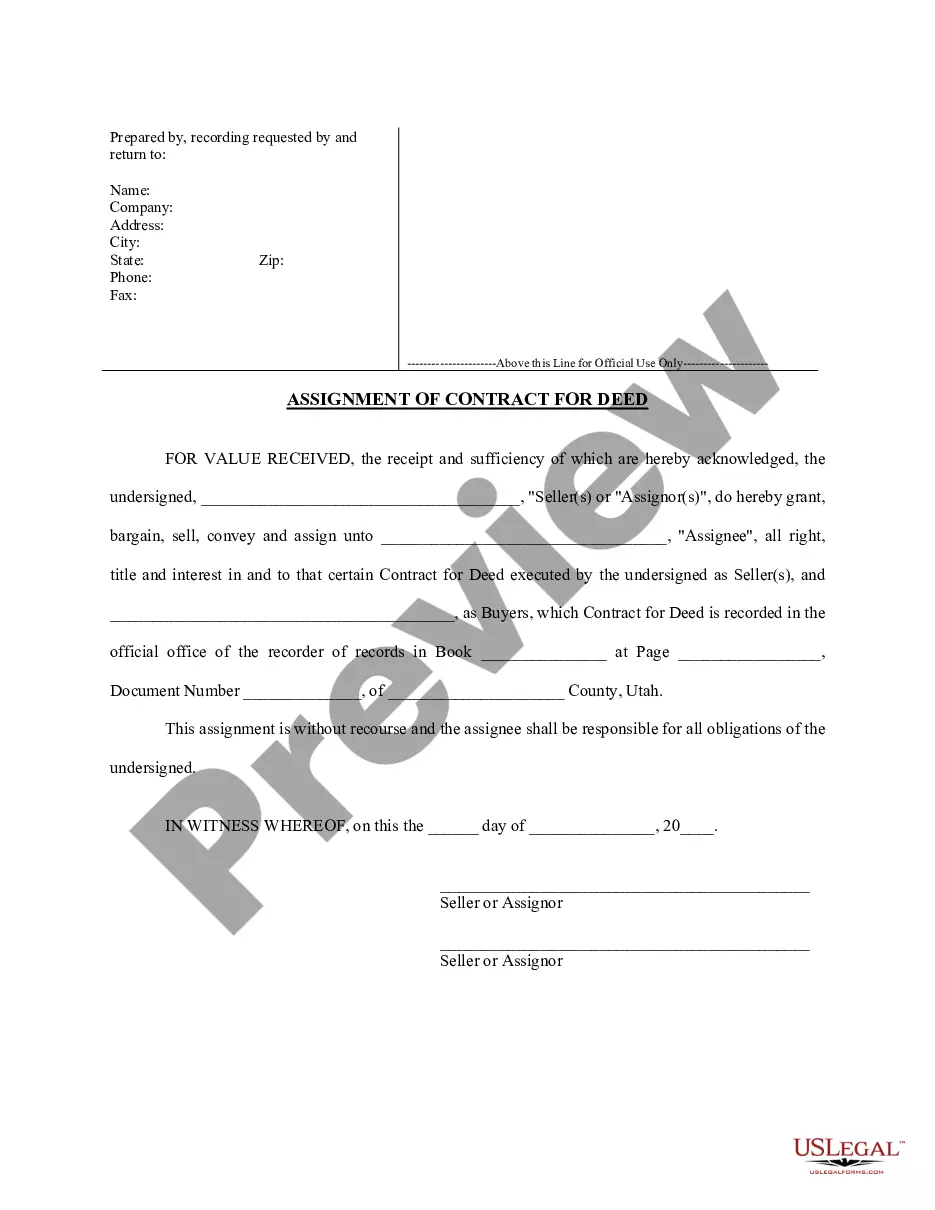

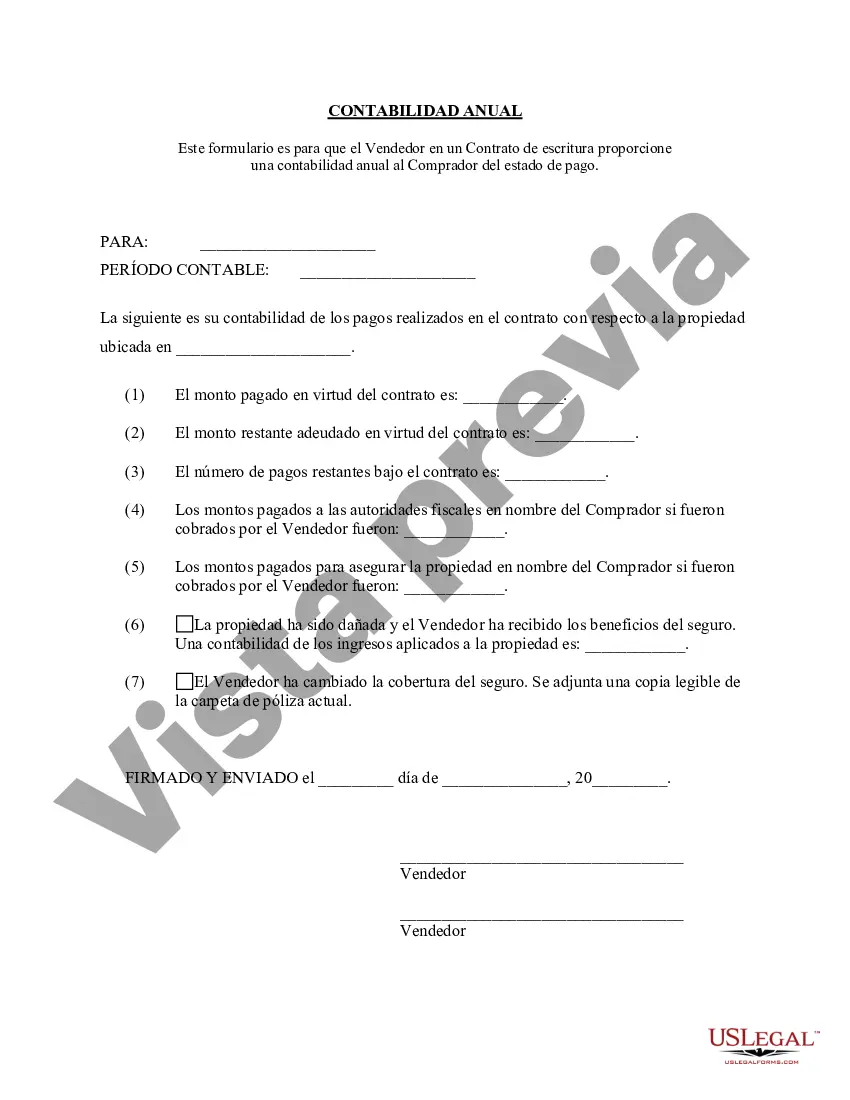

Declaración por escrito notificando al Comprador el número y monto de los pagos realizados hacia el contrato por el capital e intereses de la escritura.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Utah Contrato De Escrituración Estado Contable Anual Del Vendedor?

If you’ve previously employed our service, Log In to your account and store the Provo Utah Contract for Deed Seller's Annual Accounting Statement on your device by selecting the Download button. Ensure that your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these uncomplicated steps to obtain your document.

You have lifelong access to every document you have bought: you can find it in your profile within the My documents menu whenever you want to retrieve it again. Utilize the US Legal Forms service to swiftly discover and save any template for your personal or professional needs!

- Confirm you’ve located the correct document. Review the description and utilize the Preview option, if available, to verify if it fulfills your needs. If it doesn’t meet your expectations, employ the Search tab above to find the appropriate one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Provide your credit card information or use the PayPal option to finalize the purchase.

- Receive your Provo Utah Contract for Deed Seller's Annual Accounting Statement. Choose the file format for your document and download it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it electronically.