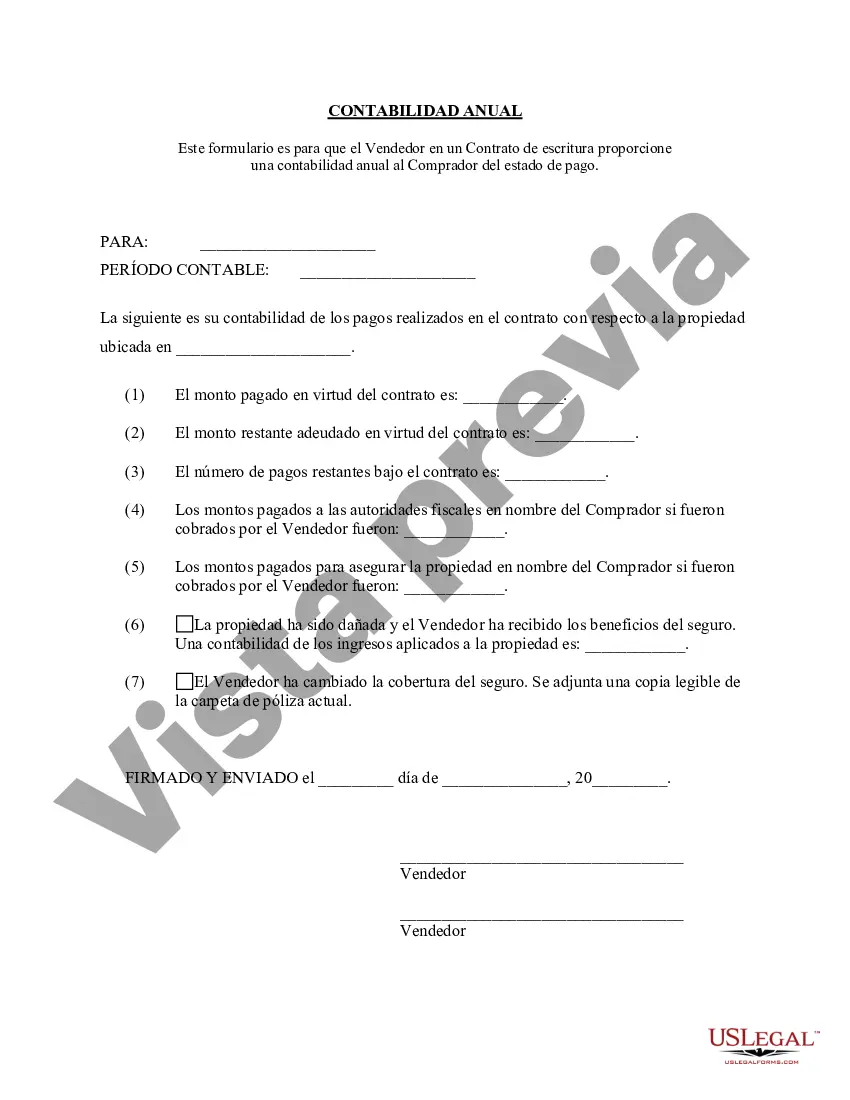

The West Valley City Utah Contract for Deed Seller's Annual Accounting Statement is a crucial document used in real estate transactions. This statement provides an in-depth overview of the financial aspects of a contract for deed agreement, outlining the financial activities and obligations carried out by the seller throughout the year. By offering transparency and accountability, this statement ensures that both the buyer and seller have a clear understanding of the financial status of the contract. Key components of the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement include: 1. Contract Details: This section includes essential information such as the names and contact details of both the buyer and seller, the property address, and the date of the contract. 2. Annual Income Report: The seller's annual accounting statement incorporates a comprehensive breakdown of the income generated from the contract for deed during the stated time period. This includes payments made by the buyer in the form of principal, interest, and any other relevant fees. 3. Expense Report: Sellers are required to provide an itemized expense report, including any expenses related to property taxes, insurance, repairs, or maintenance incurred throughout the year. These costs are subtracted from the income to determine the net profit. 4. Account Balance: This section outlines the financial standing of the contract for deed arrangement. It includes the opening and closing account balances, providing a clear picture of any outstanding amounts owed by the buyer or seller. 5. Delinquency and Overdue Payments: In case of any delinquencies or overdue payments, the annual accounting statement details the amounts outstanding, along with any associated penalties or interest charges. Transparency in this regard ensures that the buyer stays informed about any potential liabilities. Different types of the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement may include variations specific to the terms agreed upon by the buyer and seller. These may include additional provisions relating to the calculation of interest, handling of late payments, or any specific agreements reached when structuring the contract for deed. In conclusion, the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement plays a vital role in facilitating transparency and maintaining financial accountability in a contract for deed agreement. By providing a detailed overview of income, expenses, and account balances, this document ensures that both parties have a clear understanding of the financial status and obligations associated with the contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Valley City Utah Contrato de Escrituración Estado Contable Anual del Vendedor - Utah Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out West Valley City Utah Contrato De Escrituración Estado Contable Anual Del Vendedor?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person with no legal background to draft this sort of paperwork from scratch, mainly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our service offers a massive library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you want the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement in minutes employing our trusted service. In case you are presently an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, in case you are a novice to our platform, ensure that you follow these steps before obtaining the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement:

- Be sure the form you have found is specific to your location because the regulations of one state or county do not work for another state or county.

- Preview the form and read a short description (if provided) of cases the document can be used for.

- If the one you picked doesn’t meet your needs, you can start again and look for the needed document.

- Click Buy now and pick the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the West Valley City Utah Contract for Deed Seller's Annual Accounting Statement as soon as the payment is through.

You’re all set! Now you can go ahead and print the form or complete it online. In case you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.