Register a foreign corporation in Utah.

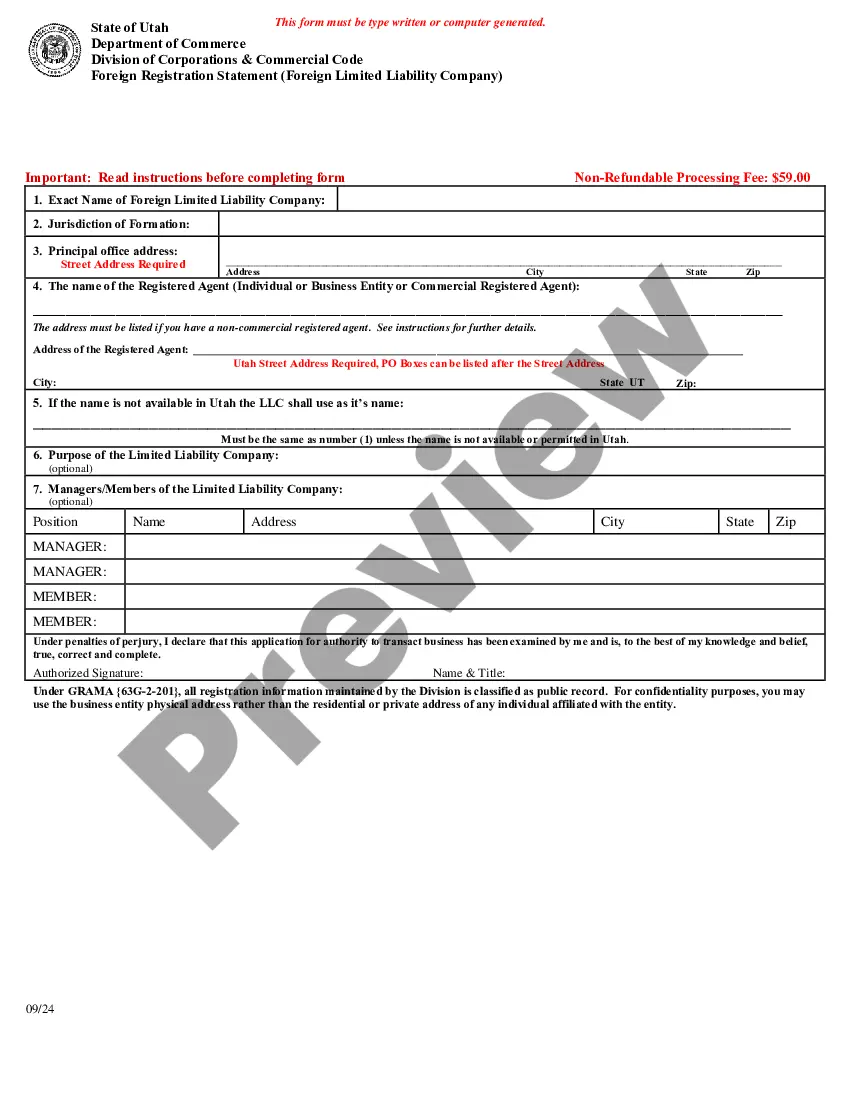

West Jordan Utah Registration of Foreign Corporation refers to the legal process of a foreign corporation establishing itself and obtaining the necessary permits to conduct business in West Jordan, Utah. This registration is essential for any foreign corporation wishing to operate within the city's jurisdiction. To complete the West Jordan Utah Registration of Foreign Corporation, several steps must be followed. Firstly, the foreign corporation must file an application with the Utah Division of Corporations and Commercial Code (UDC CC). This application typically requires essential details such as the foreign corporation's name, jurisdiction of formation, principal office address, registered agent information, and details about the corporation's activities. A filing fee is usually associated with the application. Upon submission of the application, the UDC CC reviews the documents to ensure they comply with Utah state laws. If all requirements are met, the foreign corporation's registration is approved. Once registered, the foreign corporation is considered authorized to conduct business in West Jordan, Utah, and is subject to local regulations, taxes, and reporting obligations. It is worth mentioning that there are multiple types of foreign corporation registrations available in West Jordan, Utah. These include: 1. West Jordan Utah Registration of Foreign Business Corporation: This type of registration is necessary for foreign corporations primarily engaged in business activities, such as manufacturing, selling products, or offering services in West Jordan, Utah. 2. West Jordan Utah Registration of Foreign Nonprofit Corporation: Nonprofit foreign corporations aiming to operate within West Jordan should complete this type of registration. Nonprofits may refer to charitable, religious, educational, or scientific organizations. 3. West Jordan Utah Registration of Foreign Professional Corporation: Foreign corporations that provide professional services, such as legal, medical, or accounting services in West Jordan, must obtain this specific registration. It ensures compliance with the regulations governing such professions. 4. West Jordan Utah Registration of Foreign Limited Liability Company (LLC): If a foreign corporation operates as an LLC and wishes to conduct business activities in West Jordan, registering under this category is necessary. The LLC structure provides limited liability protection to its owners, known as members. In conclusion, the West Jordan Utah Registration of Foreign Corporation is an imperative legal process that enables foreign corporations to establish their presence and conduct business activities in West Jordan. By following the appropriate registration procedures, foreign corporations can ensure compliance with state laws and enjoy the benefits of operating within the city. Whether a foreign business, nonprofit, professional corporation, or LLC, each type of corporation has specific registration requirements to fulfill.

West Jordan Utah Registration of Foreign Corporation refers to the legal process of a foreign corporation establishing itself and obtaining the necessary permits to conduct business in West Jordan, Utah. This registration is essential for any foreign corporation wishing to operate within the city's jurisdiction. To complete the West Jordan Utah Registration of Foreign Corporation, several steps must be followed. Firstly, the foreign corporation must file an application with the Utah Division of Corporations and Commercial Code (UDC CC). This application typically requires essential details such as the foreign corporation's name, jurisdiction of formation, principal office address, registered agent information, and details about the corporation's activities. A filing fee is usually associated with the application. Upon submission of the application, the UDC CC reviews the documents to ensure they comply with Utah state laws. If all requirements are met, the foreign corporation's registration is approved. Once registered, the foreign corporation is considered authorized to conduct business in West Jordan, Utah, and is subject to local regulations, taxes, and reporting obligations. It is worth mentioning that there are multiple types of foreign corporation registrations available in West Jordan, Utah. These include: 1. West Jordan Utah Registration of Foreign Business Corporation: This type of registration is necessary for foreign corporations primarily engaged in business activities, such as manufacturing, selling products, or offering services in West Jordan, Utah. 2. West Jordan Utah Registration of Foreign Nonprofit Corporation: Nonprofit foreign corporations aiming to operate within West Jordan should complete this type of registration. Nonprofits may refer to charitable, religious, educational, or scientific organizations. 3. West Jordan Utah Registration of Foreign Professional Corporation: Foreign corporations that provide professional services, such as legal, medical, or accounting services in West Jordan, must obtain this specific registration. It ensures compliance with the regulations governing such professions. 4. West Jordan Utah Registration of Foreign Limited Liability Company (LLC): If a foreign corporation operates as an LLC and wishes to conduct business activities in West Jordan, registering under this category is necessary. The LLC structure provides limited liability protection to its owners, known as members. In conclusion, the West Jordan Utah Registration of Foreign Corporation is an imperative legal process that enables foreign corporations to establish their presence and conduct business activities in West Jordan. By following the appropriate registration procedures, foreign corporations can ensure compliance with state laws and enjoy the benefits of operating within the city. Whether a foreign business, nonprofit, professional corporation, or LLC, each type of corporation has specific registration requirements to fulfill.