A Provo Utah Living Trust for Husband and Wife with No Children is a legal document that outlines the estate planning objectives of a married couple who do not have any children. It provides a comprehensive framework for managing and distributing their assets during their lifetime and after their demise. This type of living trust offers various benefits, including avoiding probate, reducing estate taxes, maintaining privacy, and ensuring a hassle-free transfer of assets. Here are the different types of Provo Utah Living Trusts for Husband and Wife with No Children: 1. Revocable Living Trust: This type of trust allows the husband and wife to retain control over their assets during their lifetime. They can modify or revoke the trust at any time if their circumstances change. A revocable living trust helps in avoiding probate and ensures the smooth transfer of assets to the surviving spouse or designated beneficiaries upon death. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be altered or revoked once it is established. It offers several benefits such as asset protection, estate tax reduction, and Medicaid planning. An irrevocable trust provides a solid asset protection strategy and allows the couple to preserve their wealth for the future. 3. A-B Trust: This type of trust, also known as a bypass trust or credit shelter trust, is designed to maximize estate tax exemptions for both spouses. Upon the death of the first spouse, the trust splits into two parts — the A portioapportionedoherehe A portion, also known as the marital trust, allows the surviving spouse to have access to income and assets for their lifetime. The B portion, known as the bypass trust, preserves the deceased spouse's estate tax exemption. 4. Q-TIP Trust: A Q-TIP (Qualified Terminable Interest Property) trust allows the surviving spouse to receive income from the deceased spouse's assets while preserving the control of the distribution to designated beneficiaries ultimately chosen by both spouses. This trust is beneficial when the surviving spouse remarries, as it ensures that assets ultimately go to the children or other intended beneficiaries. 5. Charitable Remainder Trust: This type of trust allows the couple to contribute a portion of their assets to a charitable organization, generating income for themselves or their chosen beneficiaries for a specified period. After the termination of the trust, the remaining assets are donated to the designated charity, providing an opportunity for philanthropy and potential tax benefits. In summary, a Provo Utah Living Trust for Husband and Wife with No Children offers a flexible and efficient way to manage and distribute assets, preserve wealth, and minimize potential conflicts or expenses associated with estate planning. Depending on the couple's specific goals and circumstances, they can choose from various types of living trusts to ensure their estate is handled according to their wishes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Provo Utah Fideicomiso en vida para esposo y esposa sin hijos - Utah Living Trust for Husband and Wife with No Children

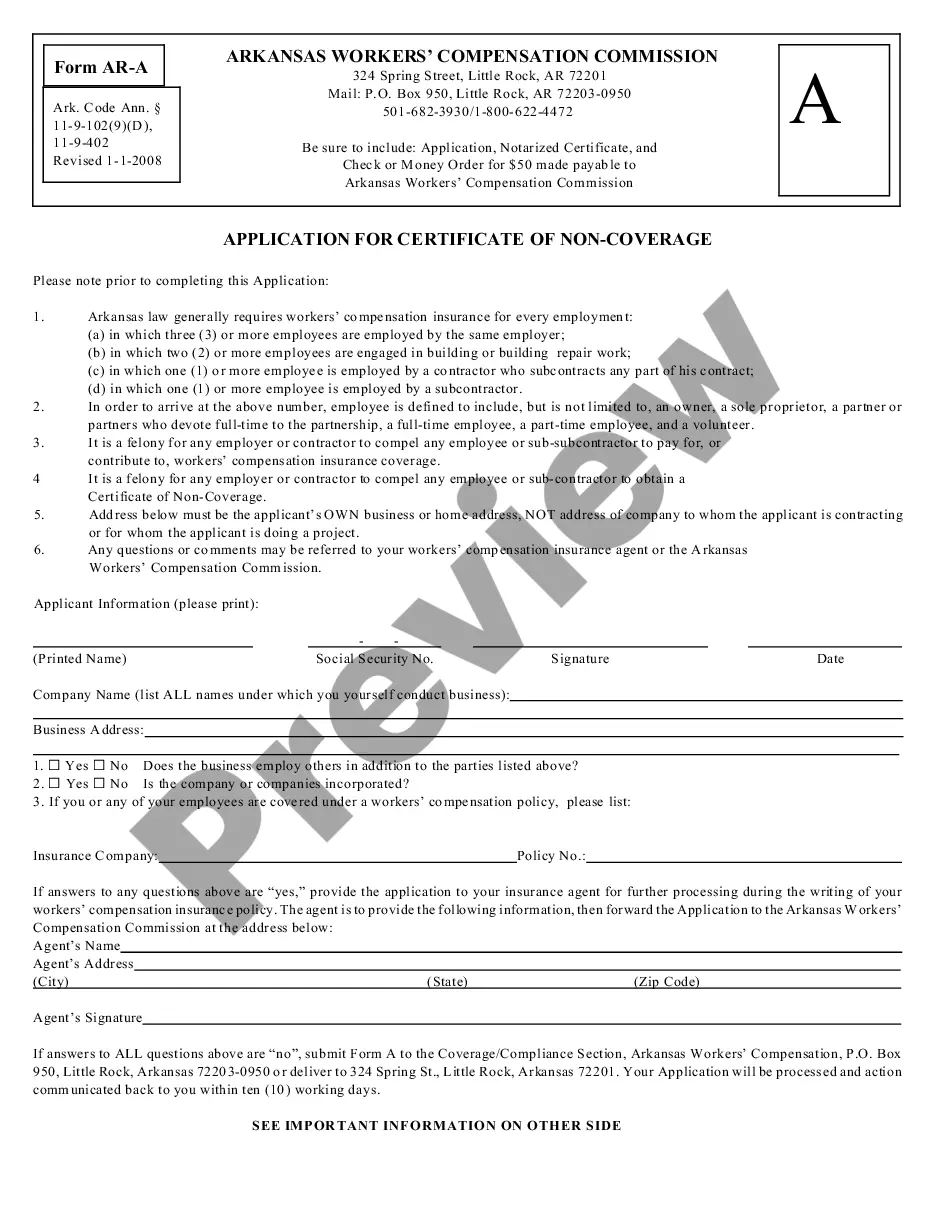

Description

How to fill out Provo Utah Fideicomiso En Vida Para Esposo Y Esposa Sin Hijos?

Are you looking for a reliable and affordable legal forms supplier to buy the Provo Utah Living Trust for Husband and Wife with No Children? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Provo Utah Living Trust for Husband and Wife with No Children conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is intended for.

- Restart the search in case the template isn’t suitable for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Provo Utah Living Trust for Husband and Wife with No Children in any provided format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal papers online once and for all.