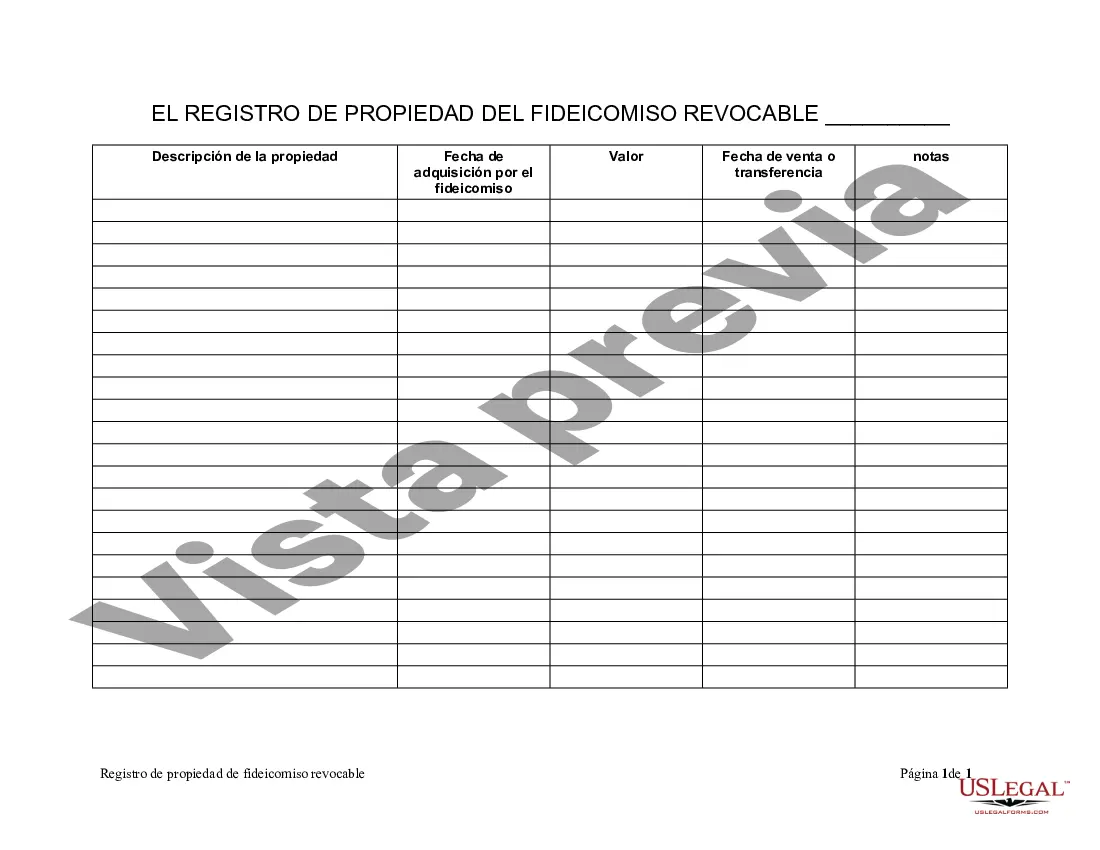

Salt Lake Utah Living Trust Property Record is a comprehensive documentation that encompasses vital information about a property held in a living trust in Salt Lake, Utah. This is legally binding record serves to maintain transparency, protect the trust, and ensure efficient management of the property. The Salt Lake Utah Living Trust Property Record typically includes various details, such as the property's legal description, ownership information, property tax records, mortgage details, liens, encumbrances, and any other relevant information related to the property held within the living trust. There may be different types of Salt Lake Utah Living Trust Property Records, based on the purpose or nature of the trust property. Some common types include: 1. Residential Property Record: This specifically pertains to properties used for residential purposes, such as single-family homes, condominiums, townhouses, or multifamily dwellings held within the living trust. 2. Commercial Property Record: This type of property record focuses on commercial properties held in the living trust, such as office buildings, retail spaces, industrial facilities, or vacant land intended for commercial use. 3. Investment Property Record: It pertains to properties held within the living trust for investment purposes, such as rental homes, apartment complexes, or vacant land held for future development. 4. Vacation Property Record: This type of record relates to properties designated for vacation or recreational use. It may include cabins, beach houses, or any other properties primarily used for leisure activities, all held within the living trust. 5. Agricultural Property Record: It encompasses properties used for agricultural purposes, such as farmland, vineyards, orchards, or livestock ranches held within the living trust. 6. Mixed-Use Property Record: This type of record involves properties that have a combination of residential, commercial, or other uses within a single property. It ensures that all aspects of the mixed-use property held within the living trust are adequately documented. It's essential to maintain accurate and up-to-date Salt Lake Utah Living Trust Property Records as they serve as a crucial reference in the event of property transactions, ownership changes, tax assessments, or legal disputes. These records offer a comprehensive overview of the living trust's property assets and play a vital role in managing and protecting the trust for the beneficiaries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Registro de propiedad de fideicomiso en vida - Utah Living Trust Property Record

Description

How to fill out Utah Registro De Propiedad De Fideicomiso En Vida?

If you have previously utilized our service, Log In to your account and retrieve the Salt Lake Utah Living Trust Property Record on your device by selecting the Download button. Ensure that your subscription is active. If it is not, renew it based on your payment plan.

If this is your initial experience with our service, follow these straightforward steps to obtain your file.

You have lifelong access to all documents you have purchased: they can be found in your profile in the My documents menu whenever you wish to reuse them. Leverage the US Legal Forms service to effortlessly find and save any template for your personal or professional use!

- Confirm you’ve located a suitable document. Review the description and utilize the Preview option, if available, to determine if it fulfills your requirements. If it does not meet your needs, use the Search tab above to find the appropriate one.

- Acquire the template. Select the Buy Now button and choose either a monthly or annual subscription plan.

- Create an account and process the payment. Enter your credit card information or use the PayPal option to finalize the transaction.

- Access your Salt Lake Utah Living Trust Property Record. Choose the file format for your document and store it on your device.

- Finalize your sample. Print it or utilize online editing tools to complete and sign it electronically.

Form popularity

FAQ

La propiedad fiduciaria es administrada por el fiduciario en caso en que se haya designado, y si ese no ha sido el caso, la administracion le corresponde al fiduciante. El fiduciario es un mero tenedor de la propiedad fiduciaria, quien la administrara hasta tanto deba restituirla al fideicomisario o beneficiario.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Se reconoce como un fideicomiso al contrato mediante el cual una persona a la que se le conoce como fideicomitente o fiduciante delega determinados bienes de su propiedad, a otra persona llamada fiduciario, para que esta administre de la mejor manera los bienes en beneficio de un tercero, llamado fideicomisario o

Existen varias razones por las que los fideicomisos son una buena alternativa para asegurar la correcta administracion de tus bienes en el futuro: Proteges tus activos de las malas intenciones.Cuidas a tus seres queridos.Resguardas tus activos.Puedes definir un plan para que tus activos generen rentas.

Es un producto financiero que ademas de ser parecido a un plan de ahorro, garantiza que el beneficiario, es decir tu hija o hijo, reciba el dinero acordado para continuar sus estudios en nivel superior aun cuando faltes.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Requisitos: Nombre y nacionalidad del fideicomitente. Nombre de la Institucion de credito (banco) que fungira como fiduciaria. Nombre y nacionalidad del fideicomisario y, si los hubiere, de los fideicomisarios en segundo lugar y de los fideicomisarios substitutos. Duracion del fideicomiso.

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.