Salt Lake Utah Financial Account Transfer to Living Trust: A Comprehensive Guide In Salt Lake City, Utah, individuals often turn to Living Trusts as an effective estate planning tool, enabling them to efficiently transfer their financial accounts upon their death. A Salt Lake Utah Financial Account Transfer to Living Trust ensures that your hard-earned assets are protected, managed, and distributed according to your wishes, without the need for probate court involvement. Types of Salt Lake Utah Financial Account Transfers to Living Trust: 1. Checking and Savings Accounts: Through a Salt Lake Utah Financial Account Transfer to a Living Trust, you can seamlessly transfer your checking and savings accounts held at various financial institutions into the trust. By doing so, you ensure that these assets are not subjected to lengthy probate processes and can be promptly accessed by your designated beneficiaries. 2. Investment Accounts: From Individual Retirement Accounts (IRAs) to brokerage accounts and mutual funds, transferring your investment accounts into a Salt Lake Utah Living Trust provides a streamlined process for managing your investments during your lifetime and distributing them upon your passing. This enables your beneficiaries to receive the assets without incurring significant tax burdens. 3. Real Estate Holdings: If you own property in Salt Lake City or other areas of Utah, a Financial Account Transfer to a Living Trust allows you to place these assets under the management of the trust. This ensures that the property's ownership is promptly transferred to the designated beneficiaries upon your demise, bypassing probate. 4. Business Interests: If you have an ownership stake in a Utah-based business, a Salt Lake Utah Financial Account Transfer to Living Trust can also help safeguard your business interests. By placing your shares or ownership rights into the trust, you can dictate how these assets will be handled after your passing, providing a smoother transition for your successors. Key Considerations for Salt Lake Utah Financial Account Transfer to Living Trust: 1. Establishing a Living Trust: Setting up a Living Trust requires the expertise of an experienced estate planning attorney in Salt Lake City. They will guide you through the process, ensuring the legal validity of your trust and helping you define how your financial accounts will be transferred into it accurately. 2. Designating Trustees and Beneficiaries: When creating a Living Trust, it is essential to designate trustees (individuals or institutions responsible for managing the trust) and beneficiaries (individuals who will receive the trust's assets). Choose trustworthy individuals who are capable of executing your intentions faithfully. 3. Updating the Trust: As your financial accounts change over time, it's important to ensure that your Living Trust remains up to date. Regularly review and update the trust documents, including account details, to reflect any modifications in your financial situation. 4. Consult Professionals: The process of Salt Lake Utah Financial Account Transfer to Living Trust can be complex, requiring legal and financial expertise. Consult with trusted professionals, such as attorneys specializing in estate planning and financial advisors, to navigate the nuances and maximize the benefits of a Living Trust. In summary, a Salt Lake Utah Financial Account Transfer to Living Trust allows individuals in Salt Lake City and throughout Utah to protect and manage their financial accounts during their lifetime while ensuring a smooth transfer to beneficiaries. Whether it's checking and savings accounts, investment accounts, real estate holdings, or business interests, a Living Trust provides a comprehensive solution for effective estate planning. Seek professional guidance to ensure your Living Trust accurately reflects your intent and covers all relevant assets.

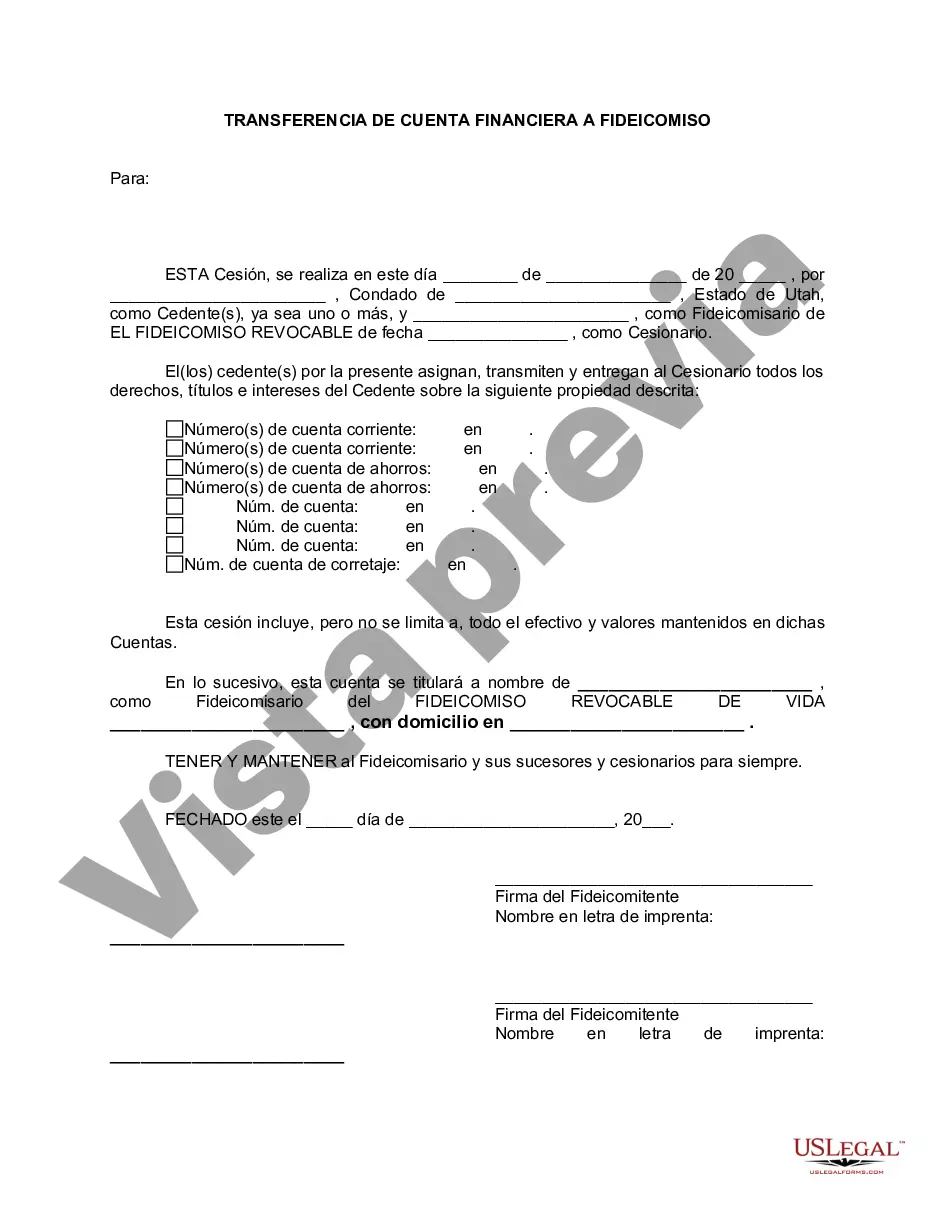

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Transferencia de cuenta financiera a fideicomiso en vida - Utah Financial Account Transfer to Living Trust

Description

How to fill out Salt Lake Utah Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any law education to draft this sort of paperwork cfrom the ground up, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes in handy. Our service offers a huge collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the Salt Lake Utah Financial Account Transfer to Living Trust or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Salt Lake Utah Financial Account Transfer to Living Trust quickly using our trustworthy service. If you are already an existing customer, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are unfamiliar with our library, ensure that you follow these steps prior to downloading the Salt Lake Utah Financial Account Transfer to Living Trust:

- Ensure the template you have chosen is good for your area considering that the rules of one state or area do not work for another state or area.

- Review the document and read a short outline (if provided) of cases the document can be used for.

- If the form you chosen doesn’t meet your requirements, you can start again and look for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment method and proceed to download the Salt Lake Utah Financial Account Transfer to Living Trust once the payment is through.

You’re good to go! Now you can proceed to print the document or fill it out online. In case you have any problems getting your purchased documents, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.