Title: Comprehensive Guide: West Valley City Utah Financial Account Transfer to Living Trust Introduction: The process of transferring financial accounts to a living trust in West Valley City, Utah, offers individuals the opportunity to protect their assets, streamline inheritance procedures, and ensure the smooth transfer of wealth to their beneficiaries. In this comprehensive guide, we will delve into the details of different types of financial account transfers to living trusts, addressing their significance and the legal considerations involved. Types of West Valley City Utah Financial Account Transfer to Living Trust: 1. Checking and Savings Accounts: Securely transferring these accounts to a living trust allows for efficient management and uninterrupted access to funds for both the granter and beneficiaries. 2. Investment Accounts: From individual brokerage accounts to stocks, bonds, and mutual funds, transferring investment accounts to a living trust ensures that asset distribution follows predetermined provisions and minimizes the delays associated with probate. 3. Retirement Accounts: By designating a living trust as the beneficiary of an IRA (Individual Retirement Account), 401(k), or similar retirement accounts, individuals can control the posthumous distribution, maximize tax benefits, and potentially extend the tax-deferred growth for beneficiaries. 4. Marketable Securities: Transferring marketable securities such as stocks and bonds to a living trust streamlines the transfer process, eliminates the hassles of probate, and simplifies the management of these assets for the trustee. 5. Real Estate: While not classified as a financial account, transferring properties to a living trust is essential for a complete estate plan. West Valley City residents can transfer ownership of real estate into their trust, ensuring efficient property distribution and potential tax benefits. 6. Business Accounts: Business owners in West Valley City can transfer financial accounts associated with their enterprises to a living trust, providing continuity, protection, and clarity regarding business succession plans. Key Considerations and Benefits: 1. Probate Avoidance: Transferring financial accounts to a living trust helps bypass the time-consuming and costly probate process, allowing beneficiaries to access funds more quickly. 2. Privacy: Unlike probate, which is a public process, financial account transfers to a living trust offer greater privacy by keeping the transfer details confidential. 3. Incapacity Planning: Living trusts enable individuals to plan for potential incapacity, as they can appoint a successor trustee to manage their financial affairs seamlessly if they become unable to do so themselves. 4. Flexibility and Control: Individuals can modify or revoke the living trust during their lifetime, granting them the flexibility to adjust beneficiary designations and asset allocations as needed. 5. Estate Tax Planning: Carefully planned financial account transfers to a living trust can help mitigate estate taxes and provide potential benefits for high-net-worth individuals. Conclusion: In experiencing the peace of mind that comes with ensuring a smooth transfer of financial accounts to a living trust in West Valley City, Utah, individuals safeguard their assets, protect their beneficiaries, and simplify the estate settlement process. Familiarity with the various types of financial account transfers and their legal considerations empowers individuals to make informed decisions as they craft an effective estate plan. Seek guidance from a qualified estate planning attorney to navigate this process with confidence.

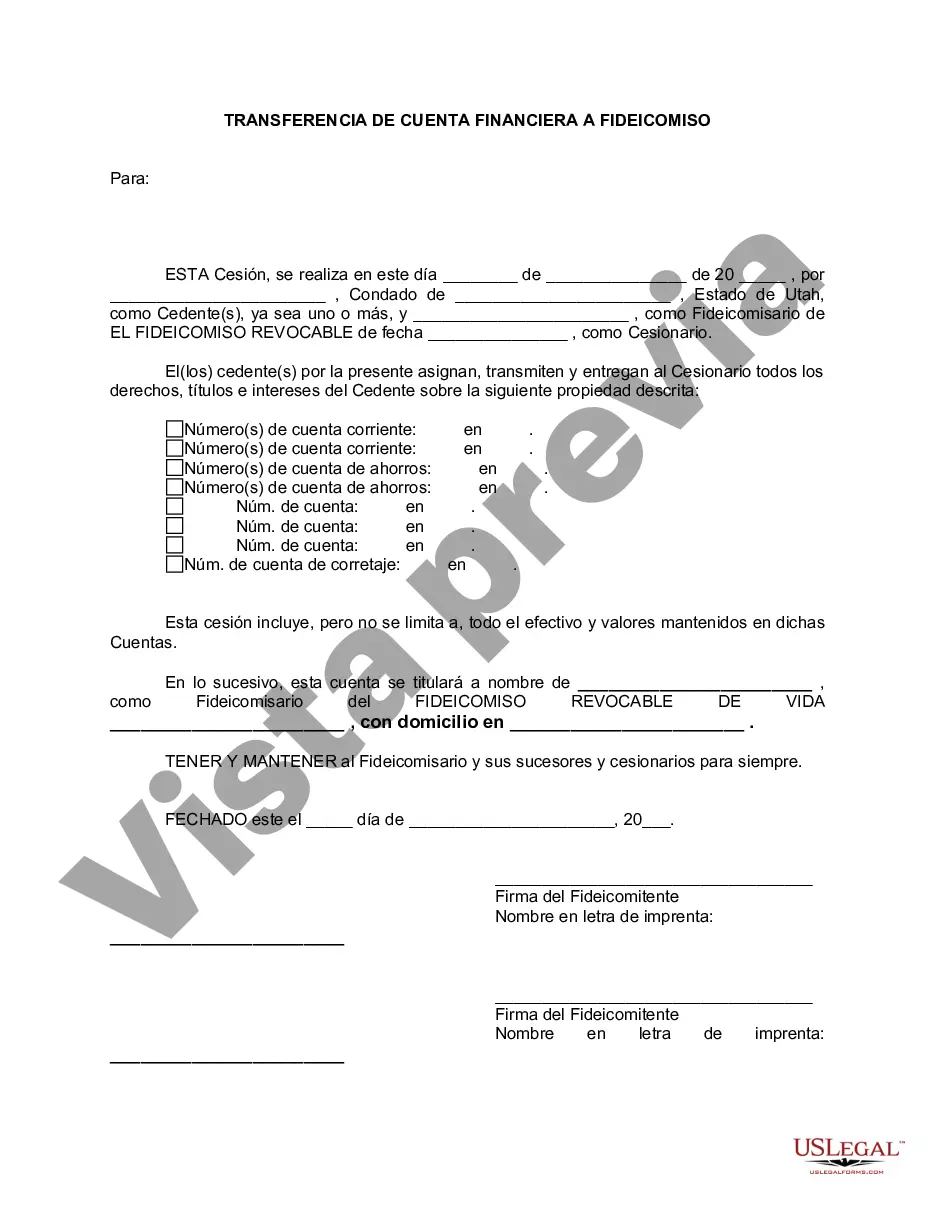

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Valley City Utah Transferencia de cuenta financiera a fideicomiso en vida - Utah Financial Account Transfer to Living Trust

Description

How to fill out West Valley City Utah Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are looking for a valid form template, it’s difficult to choose a better platform than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can get thousands of templates for company and personal purposes by categories and states, or keywords. Using our high-quality search option, getting the newest West Valley City Utah Financial Account Transfer to Living Trust is as elementary as 1-2-3. In addition, the relevance of each record is verified by a team of expert attorneys that regularly check the templates on our platform and update them in accordance with the latest state and county demands.

If you already know about our system and have an account, all you need to receive the West Valley City Utah Financial Account Transfer to Living Trust is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have opened the form you require. Read its description and utilize the Preview feature (if available) to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to find the proper file.

- Confirm your decision. Choose the Buy now button. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the form. Select the file format and save it to your system.

- Make changes. Fill out, revise, print, and sign the acquired West Valley City Utah Financial Account Transfer to Living Trust.

Every single form you save in your account does not have an expiry date and is yours forever. You can easily access them using the My Forms menu, so if you want to get an additional duplicate for enhancing or creating a hard copy, you can return and save it once again anytime.

Take advantage of the US Legal Forms extensive collection to get access to the West Valley City Utah Financial Account Transfer to Living Trust you were looking for and thousands of other professional and state-specific samples in one place!