Salt Lake City Utah Default Certificate is an official document issued by the city of Salt Lake City, Utah, to certify the default status of a property or individual in terms of tax or other financial obligations. This certificate is typically required for various legal and financial transactions. The Salt Lake City Utah Default Certificate serves as proof that a particular property or individual has failed to fulfill their financial obligations, such as property taxes, utility bills, or liens. It outlines the outstanding debts, the amount owed, the due date, and any penalties or interest accrued. There are different types of Salt Lake City Utah Default Certificates, depending on the specific financial obligations in question. These may include: 1. Property Tax Default Certificate: This certificate is issued when a property owner fails to pay their property taxes on time. It indicates the amount of unpaid property taxes, any penalties or interest, and the consequences of continuous non-payment. 2. Utility Bill Default Certificate: This certificate is issued when a property owner or individual fails to pay their utility bills, such as water, electricity, or gas bills. It outlines the outstanding amount, the due date, and any additional charges. 3. Lien Default Certificate: This certificate denotes the existence of a lien on a property or individual due to non-payment of a debt, such as a mortgage, loan, or court-ordered judgment. It provides information about the lien holder, the amount owed, and the consequences of non-payment. 4. Business Tax Default Certificate: If a business owner fails to pay their business taxes on time, this certificate is issued. It indicates the outstanding business taxes, any penalties or interest, and the potential impact on the business's operations or legal status. 5. Special Assessment Default Certificate: This certificate is issued when a property owner defaults on paying special assessments levied by the city for specific infrastructure projects, such as street repairs or public park improvements. It specifies the outstanding amount, any penalties or interest, and the consequences of non-payment. It is crucial to address any Default Certificate promptly to avoid further legal repercussions. Property owners or individuals in default can seek assistance from the appropriate departments within the city of Salt Lake City to negotiate a payment plan or resolve any disputes surrounding the default status.

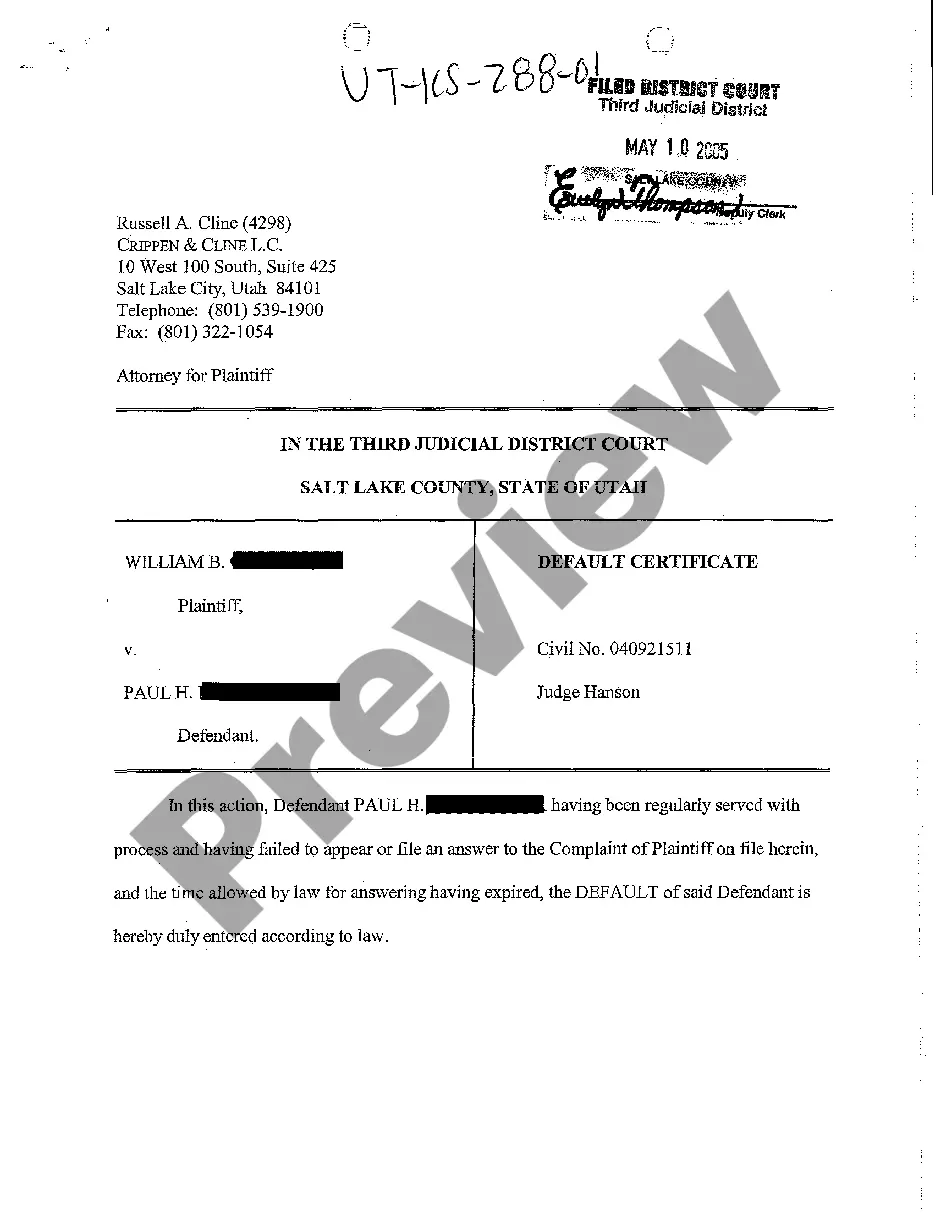

Salt Lake City Utah Default Certificate

State:

Utah

City:

Salt Lake City

Control #:

UT-KS-288-01

Format:

PDF

Instant download

This form is available by subscription

Description

A06 Default Certificate

Salt Lake City Utah Default Certificate is an official document issued by the city of Salt Lake City, Utah, to certify the default status of a property or individual in terms of tax or other financial obligations. This certificate is typically required for various legal and financial transactions. The Salt Lake City Utah Default Certificate serves as proof that a particular property or individual has failed to fulfill their financial obligations, such as property taxes, utility bills, or liens. It outlines the outstanding debts, the amount owed, the due date, and any penalties or interest accrued. There are different types of Salt Lake City Utah Default Certificates, depending on the specific financial obligations in question. These may include: 1. Property Tax Default Certificate: This certificate is issued when a property owner fails to pay their property taxes on time. It indicates the amount of unpaid property taxes, any penalties or interest, and the consequences of continuous non-payment. 2. Utility Bill Default Certificate: This certificate is issued when a property owner or individual fails to pay their utility bills, such as water, electricity, or gas bills. It outlines the outstanding amount, the due date, and any additional charges. 3. Lien Default Certificate: This certificate denotes the existence of a lien on a property or individual due to non-payment of a debt, such as a mortgage, loan, or court-ordered judgment. It provides information about the lien holder, the amount owed, and the consequences of non-payment. 4. Business Tax Default Certificate: If a business owner fails to pay their business taxes on time, this certificate is issued. It indicates the outstanding business taxes, any penalties or interest, and the potential impact on the business's operations or legal status. 5. Special Assessment Default Certificate: This certificate is issued when a property owner defaults on paying special assessments levied by the city for specific infrastructure projects, such as street repairs or public park improvements. It specifies the outstanding amount, any penalties or interest, and the consequences of non-payment. It is crucial to address any Default Certificate promptly to avoid further legal repercussions. Property owners or individuals in default can seek assistance from the appropriate departments within the city of Salt Lake City to negotiate a payment plan or resolve any disputes surrounding the default status.

Free preview

How to fill out Salt Lake City Utah Default Certificate?

If you’ve already utilized our service before, log in to your account and download the Salt Lake City Utah Default Certificate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Salt Lake City Utah Default Certificate. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!