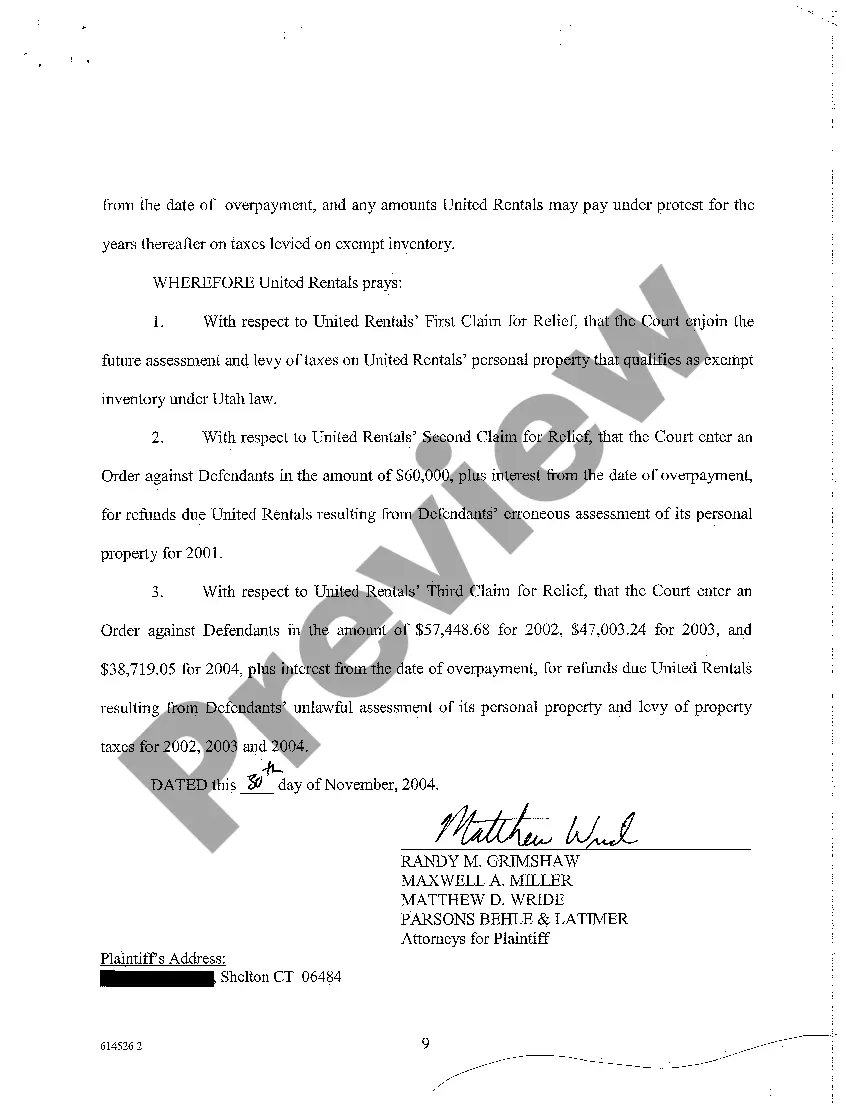

A Salt Lake City Utah Complaint for Declaratory and Injunctive Relief and for Refund of Illegally Assessed Taxes refers to a legal action initiated by a taxpayer against the tax authorities in Salt Lake City. This complaint aims to challenge the assessment of taxes that the plaintiff believes is illegal or incorrect. By seeking declaratory and injunctive relief, the taxpayer requests the court to issue a judgment clarifying the legality of the assessed taxes and to restrain the tax authorities from enforcing the collection of those taxes. There may be different types of Salt Lake City Utah Complaints for Declaratory and Injunctive Relief and for Refund of Illegally Assessed Taxes depending on the specific circumstances. These could include: 1. Residential Property Assessment Dispute: This type of complaint may arise when a residential property owner disputes the property tax assessment value set by the Salt Lake City tax authorities. The plaintiff may argue that the assessment is incorrect and seeks declaratory and injunctive relief to halt the collection process until the dispute is resolved. The taxpayer may also request a refund for any taxes already paid if they are found to be illegally assessed. 2. Commercial Property Assessment Dispute: Similarly to residential property disputes, this type of complaint focuses on challenging the tax authorities' assessment value for commercial properties within Salt Lake City. The commercial property owner may argue that the assessment is incorrect, seeking declaratory and injunctive relief while demanding a refund for any unlawfully assessed taxes. 3. Tax Rate Challenge: In certain cases, a taxpayer may dispute the tax rate set by the Salt Lake City government. This complaint challenges the tax authorities' legal right to impose such rates or suggests that the rates have been unlawfully modified. Declaratory and injunctive relief may be sought to prevent collection of taxes at the disputed rate and request a refund for taxes already paid. 4. Tax Exemption or Deduction Dispute: Taxpayers filing Salt Lake City Utah Complaints for Declaratory and Injunctive Relief and for Refund of Illegally Assessed Taxes may also claim that they are entitled to specific tax exemptions or deductions that were wrongfully denied. These individuals or entities aim to have the court clarify their eligibility for tax benefits and may request injunctive relief to halt the collection process until their case is resolved. If it is found that the taxpayers were indeed eligible for exemptions or deductions, a refund of the unlawfully assessed taxes may also be sought. In conclusion, a Salt Lake City Utah Complaint for Declaratory and Injunctive Relief and for Refund of Illegally Assessed Taxes is a legal action taken by a taxpayer to challenge the assessment, tax rate, or denial of exemptions or deductions by the local tax authorities. It can take various forms, depending on the specific circumstances and the nature of the taxpayer's claim.

Salt Lake City Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes

Description

How to fill out Salt Lake City Utah Complaint For Declaratory And Injunctive Relief And For Refund Of Illegally Assessed Taxes?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Salt Lake City Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Salt Lake City Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Salt Lake City Utah Complaint For Declaratory And Injunctive Relief and For Refund of Illegally Assessed Taxes. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!