The West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant is a legal document that outlines the terms and conditions for the private placement of equity securities in a defendant company located in West Valley City, Utah. This memorandum serves as an agreement between the company seeking capital and potential investors. It contains detailed information relevant to the investment process, ensuring the protection of both parties involved. Key terms and clauses included in the West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant may include: 1. Purpose: This section provides an overview of the purpose of the memorandum, emphasizing the intent to raise capital through private placement of equity securities. 2. Definitions: Here, relevant terminology is defined to ensure clarity and consistency throughout the document. Definitions may include terms like "equity securities," "defendant," "placement agent," and more. 3. Offering Details: This section provides specific details about the offering, such as the total number of equity securities to be offered, the price per share, the minimum investment amount required, and any applicable discounts or bonuses for early investors. 4. Risk Factors: A comprehensive rundown of potential risks associated with the investment opportunity is outlined in this section. Risks may include market volatility, regulatory changes, industry-specific risks, and the financial condition of the defendant. 5. Use of Proceeds: This clause describes how the funds raised through the private placement will be utilized by the defendant. It may outline specific purposes such as research and development, marketing efforts, debt repayment, or expansion plans. 6. Investor Representations: This section requires investors to provide statements confirming their eligibility to invest, their financial sophistication, and their understanding of the risks involved. 7. Share Transfer Restrictions: Terms related to the transfer of equity securities are specified here. These restrictions may include limitations on the resale or transfer of shares, rights of first refusal, and the need for the defendant's prior consent for any transfer. 8. Confidentiality and Non-Disclosure: To protect sensitive business information, this clause specifies that all proprietary information shared during the private placement process must remain confidential and cannot be disclosed to third parties. Examples of different types of West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant may include variations tailored for different company structures, such as Limited Liability Companies (LCS), partnerships, or corporations. Additionally, specific industry-focused variations might exist, such as memorandums designed for technology startups, healthcare companies, or real estate ventures.

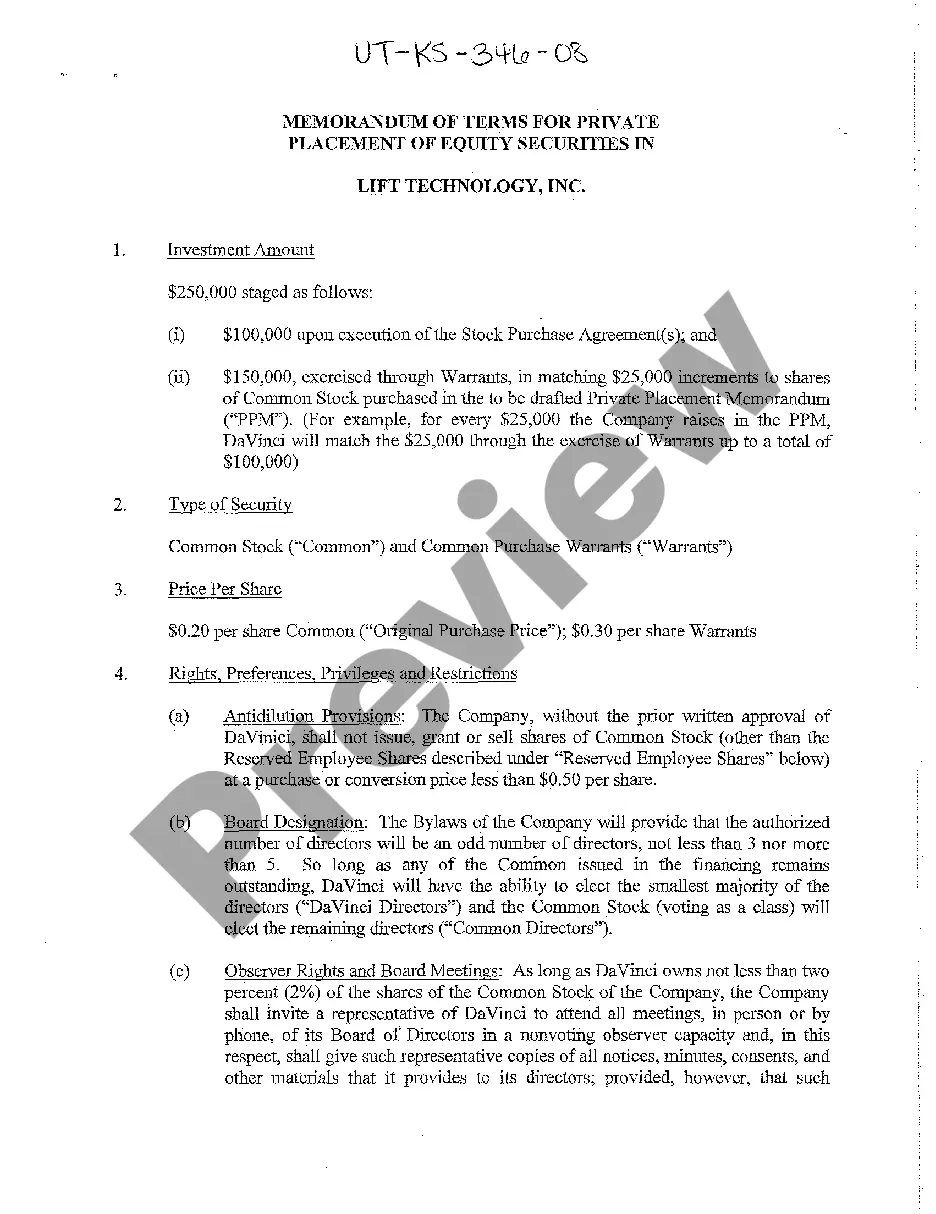

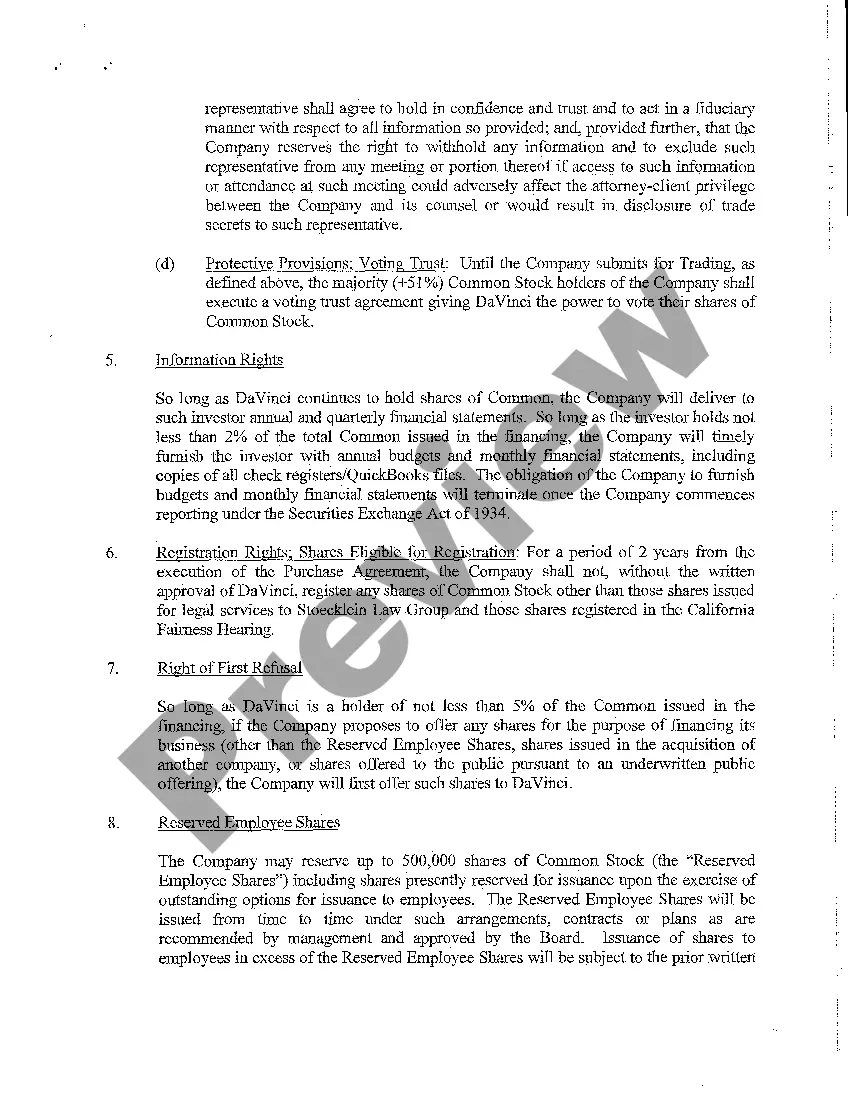

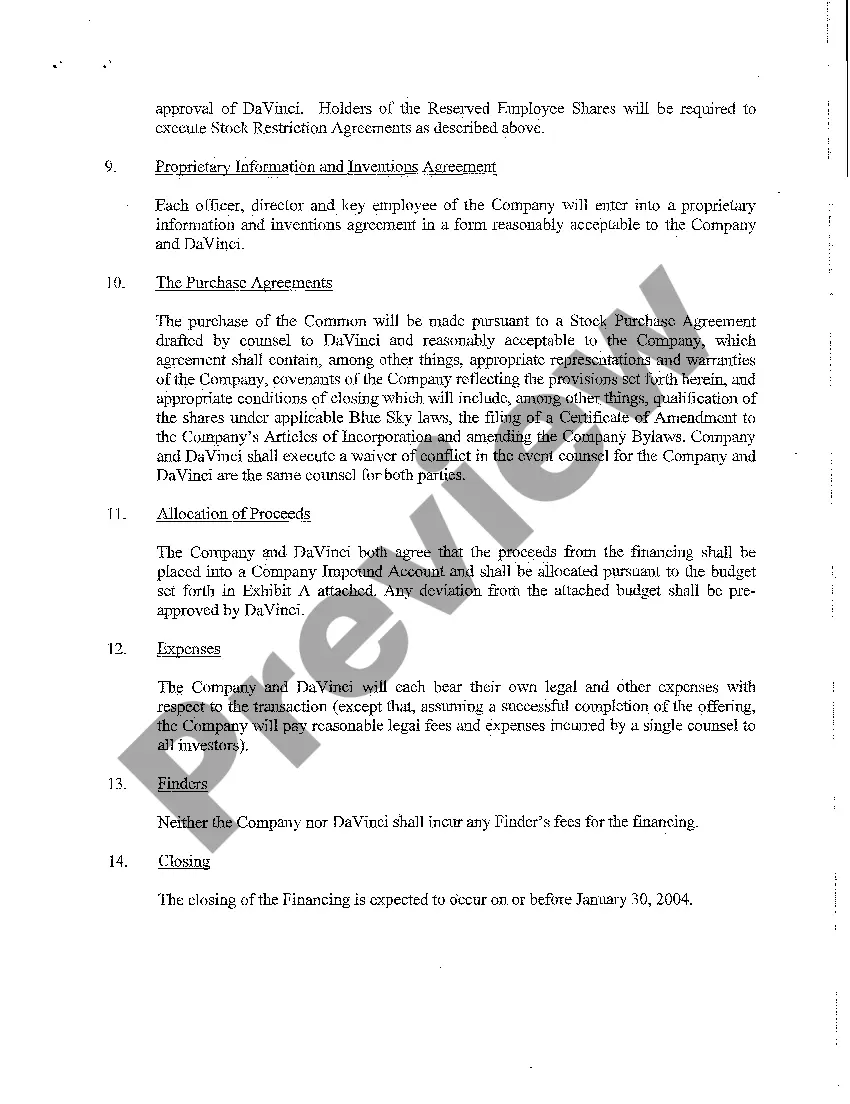

West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant

State:

Utah

City:

West Valley City

Control #:

UT-KS-346-08

Format:

PDF

Instant download

This form is available by subscription

Description

A08 Memorandum of Terms for Private Placement of Equity Securities in Defendant

The West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant is a legal document that outlines the terms and conditions for the private placement of equity securities in a defendant company located in West Valley City, Utah. This memorandum serves as an agreement between the company seeking capital and potential investors. It contains detailed information relevant to the investment process, ensuring the protection of both parties involved. Key terms and clauses included in the West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant may include: 1. Purpose: This section provides an overview of the purpose of the memorandum, emphasizing the intent to raise capital through private placement of equity securities. 2. Definitions: Here, relevant terminology is defined to ensure clarity and consistency throughout the document. Definitions may include terms like "equity securities," "defendant," "placement agent," and more. 3. Offering Details: This section provides specific details about the offering, such as the total number of equity securities to be offered, the price per share, the minimum investment amount required, and any applicable discounts or bonuses for early investors. 4. Risk Factors: A comprehensive rundown of potential risks associated with the investment opportunity is outlined in this section. Risks may include market volatility, regulatory changes, industry-specific risks, and the financial condition of the defendant. 5. Use of Proceeds: This clause describes how the funds raised through the private placement will be utilized by the defendant. It may outline specific purposes such as research and development, marketing efforts, debt repayment, or expansion plans. 6. Investor Representations: This section requires investors to provide statements confirming their eligibility to invest, their financial sophistication, and their understanding of the risks involved. 7. Share Transfer Restrictions: Terms related to the transfer of equity securities are specified here. These restrictions may include limitations on the resale or transfer of shares, rights of first refusal, and the need for the defendant's prior consent for any transfer. 8. Confidentiality and Non-Disclosure: To protect sensitive business information, this clause specifies that all proprietary information shared during the private placement process must remain confidential and cannot be disclosed to third parties. Examples of different types of West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant may include variations tailored for different company structures, such as Limited Liability Companies (LCS), partnerships, or corporations. Additionally, specific industry-focused variations might exist, such as memorandums designed for technology startups, healthcare companies, or real estate ventures.

Free preview

How to fill out West Valley City Utah Memorandum Of Terms For Private Placement Of Equity Securities In Defendant?

If you’ve already used our service before, log in to your account and download the West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your West Valley City Utah Memorandum of Terms for Private Placement of Equity Securities in Defendant. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!