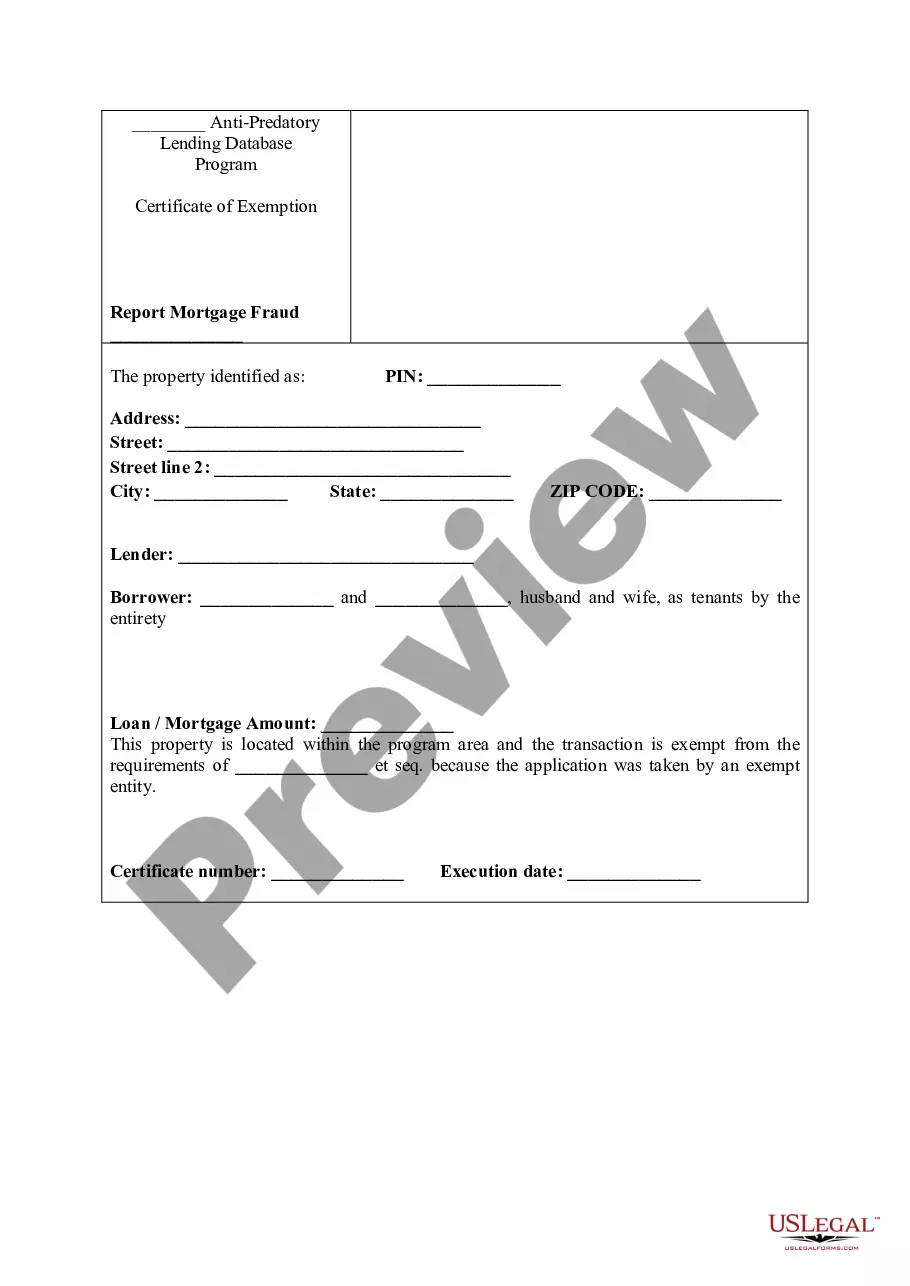

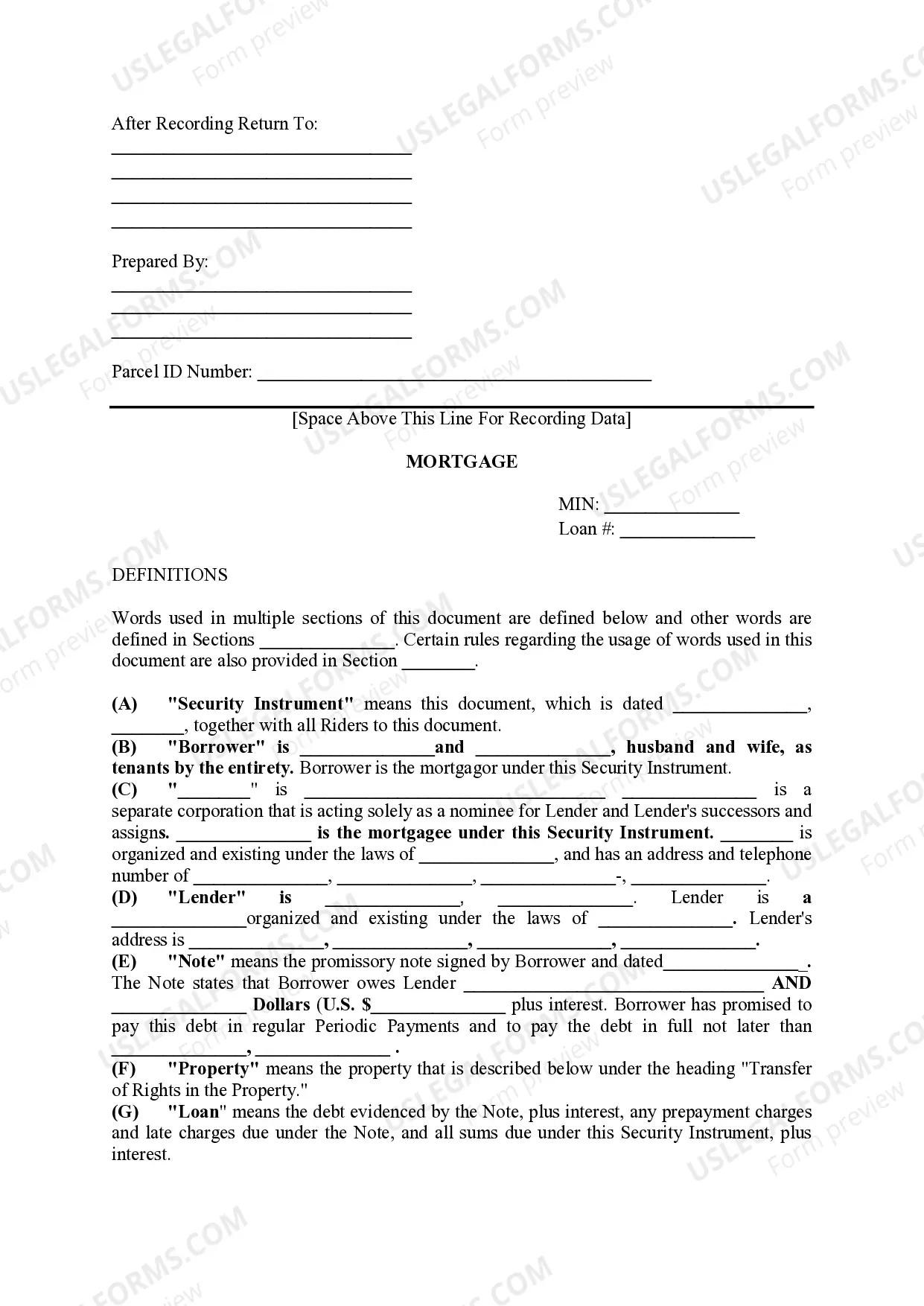

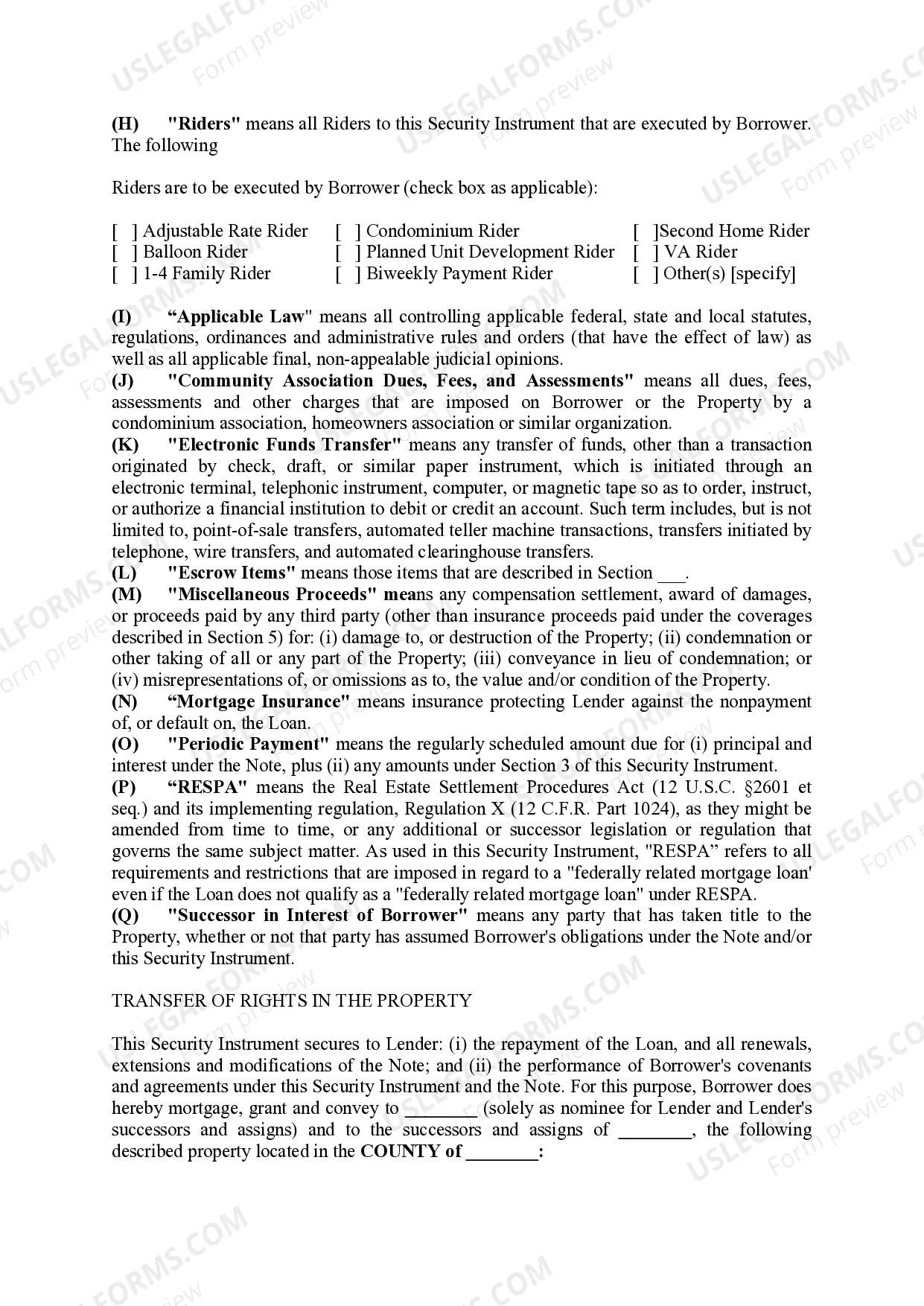

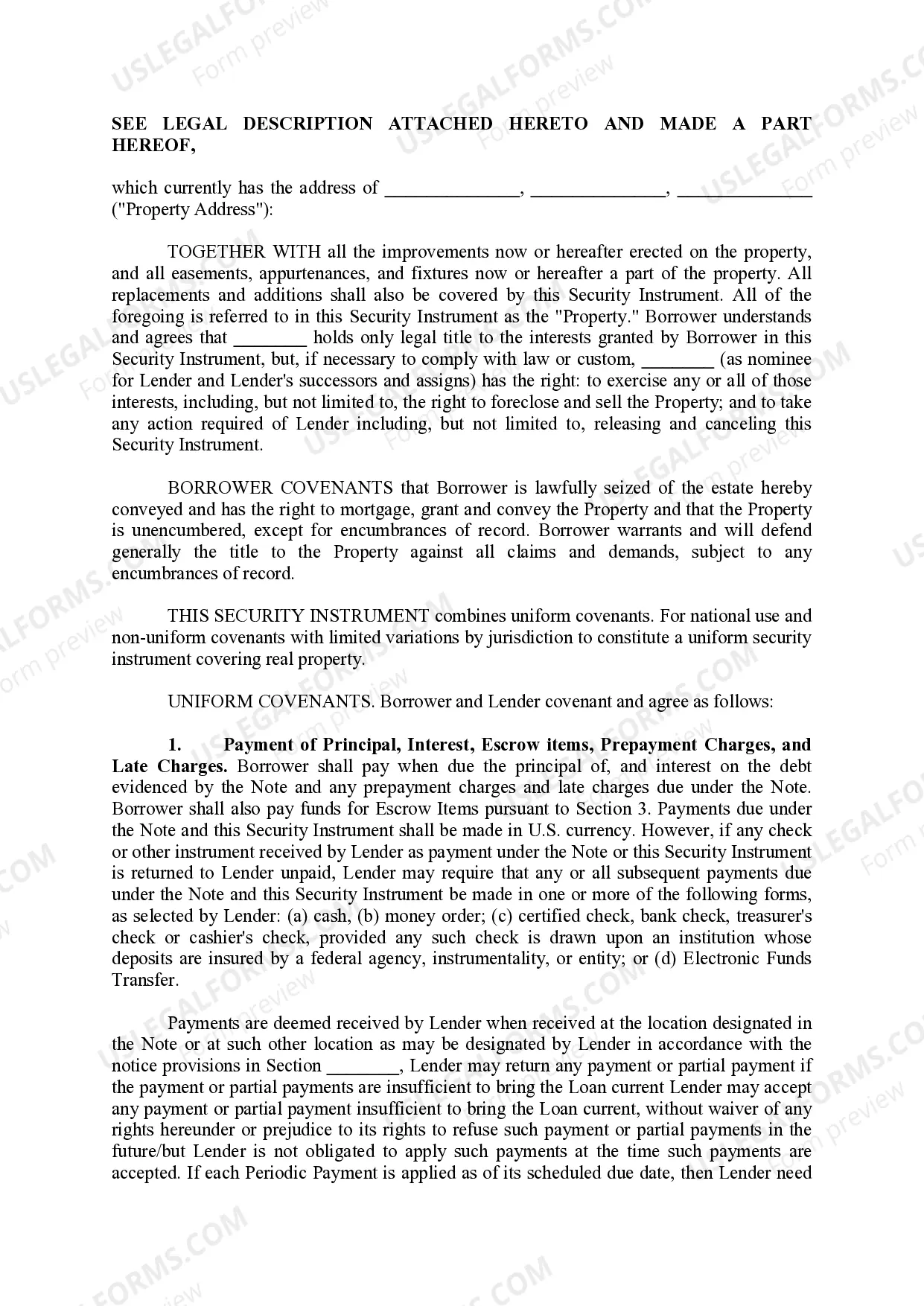

A West Valley City Utah Mortgage Security Agreement refers to a legal document that is commonly used in real estate transactions in West Valley City, Utah. This agreement is primarily intended to protect the lender's interest when providing a loan to a borrower for the purpose of purchasing or refinancing a property. By entering into this agreement, the borrower offers their property as collateral to secure the loan. Keywords: West Valley City Utah, Mortgage Security Agreement, real estate transactions, legal document, protect lender's interest, loan, borrower, property, collateral. There are a few different types of West Valley City Utah Mortgage Security Agreements that can be classified based on their specific purposes or terms: 1. Residential Mortgage Security Agreement: This type of agreement is used when the property being financed is a residential property, such as a house or a condominium. The borrower pledges their residential property as collateral to secure the loan. 2. Commercial Mortgage Security Agreement: When the property being financed is a commercial property, such as an office building, retail space, or warehouse, a commercial mortgage security agreement is used. This agreement ensures that the lender has a legal interest in the commercial property until the loan is fully repaid. 3. Refinancing Mortgage Security Agreement: This type of agreement is used when a borrower seeks to refinance their existing mortgage with a new loan. The refinancing mortgage security agreement allows the lender to replace the original mortgage with a new one and secure their loan with the property. 4. Second Mortgage Security Agreement: In situations where a borrower has an existing mortgage on their property, they may choose to take a second mortgage. This agreement allows the lender to have a secondary lien on the property, creating a priority order for repayment in case of default. 5. Construction Mortgage Security Agreement: When a borrower intends to use the loan for the construction or renovation of a property, a construction mortgage security agreement is used. This agreement ensures that the lender has a legal claim on the property until the construction is completed or the loan is fully repaid. In conclusion, a West Valley City Utah Mortgage Security Agreement is a crucial legal document in real estate transactions. It serves to protect the lender's interest in establishing a borrower's property as collateral for the loan. Different types of agreements exist, such as residential, commercial, refinancing, second, and construction mortgage security agreements, each tailored to specific purposes and conditions.

Cdcu Down Payment Assistance

Description

How to fill out West Valley City Utah Mortgage Security Agreement?

Do you need a trustworthy and inexpensive legal forms supplier to get the West Valley City Utah Mortgage Security Agreement? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the West Valley City Utah Mortgage Security Agreement conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the document is intended for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the West Valley City Utah Mortgage Security Agreement in any provided file format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time researching legal paperwork online for good.