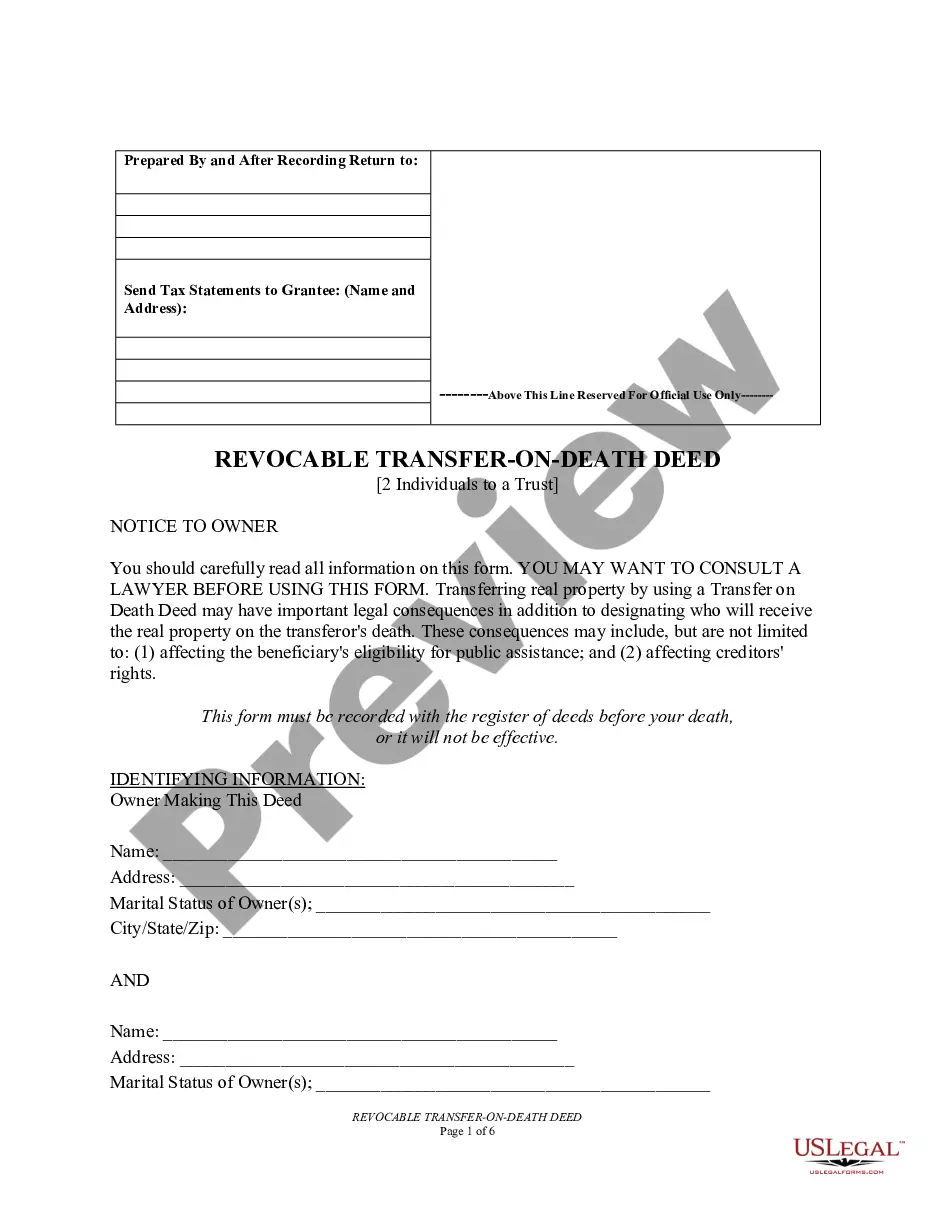

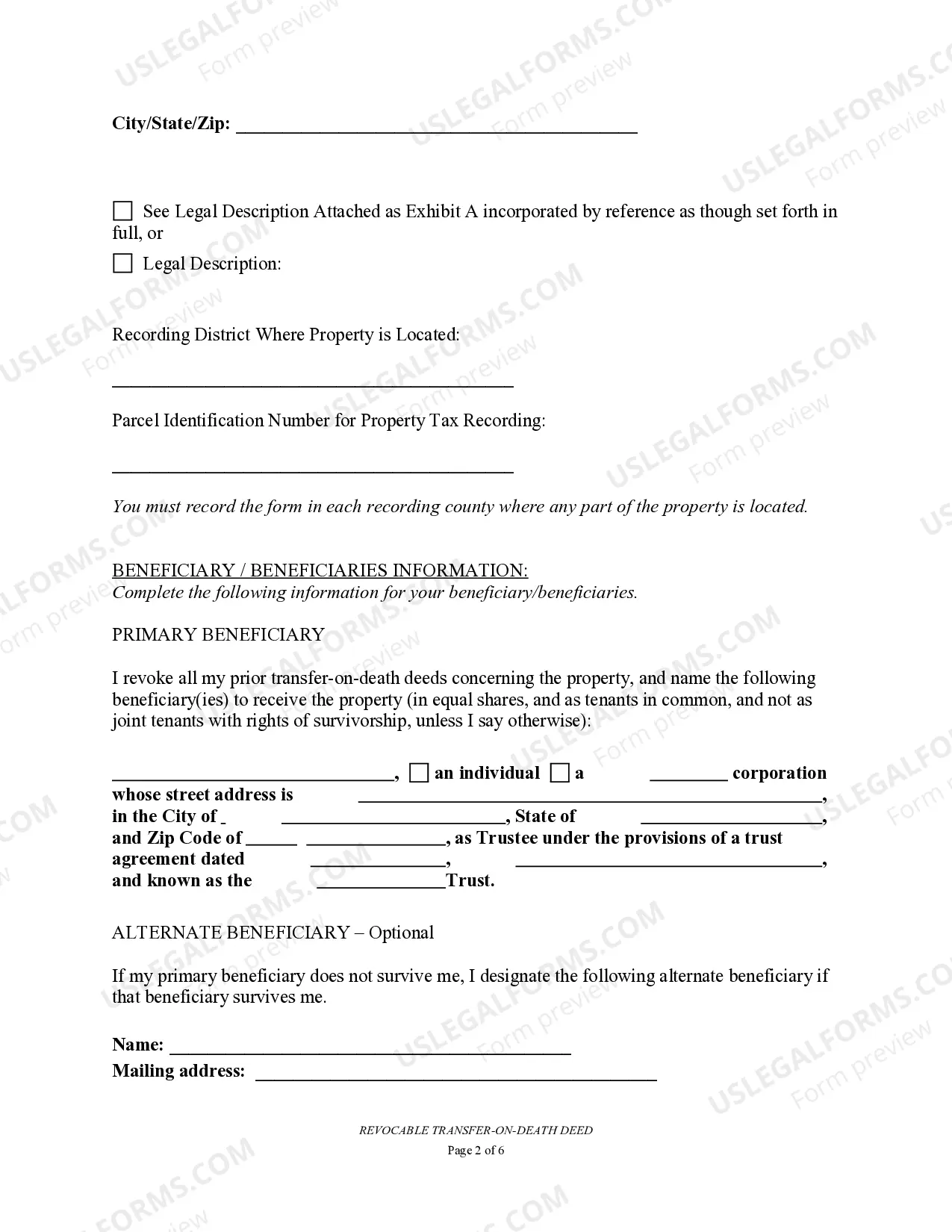

A transfer on death deed, also known as a TOD beneficiary deed, is a legal instrument that allows individuals in Salt Lake City, Utah, to transfer property to a designated beneficiary upon their death, without the need for probate. This type of deed is particularly useful for couples or individuals who wish to ensure that their property is smoothly transferred to a trust upon their passing. In Salt Lake City, there are several types of Transfer on Death Deeds or TOD — Beneficiary Deeds for Two Individuals to a Trust, including: 1. Joint Tenancy with Rights of Survivorship: This form of TOD deed is commonly used by couples (married or unmarried) who jointly own property and want to ensure that the surviving spouse or partner becomes the sole owner upon the death of one party. When one owner passes away, their interest automatically passes to the surviving owner without the need for probate. 2. Tenants in Common: This TOD deed allows two individuals to each have a separate and distinct share in a property, which can be transferred to a trust or designated beneficiary upon their death. If one owner passes away, their share will not automatically transfer to the surviving owner but instead will be distributed according to their will or trust. 3. Life Estate: This type of TOD deed grants someone (typically the individual transferring the property) the right to live on the property for the remainder of their life, known as a life estate. Once the life tenant passes away, the property will transfer to the designated beneficiary or trust. 4. Community Property with Right of Survivorship: This TOD deed option is only available to married couples. It allows them to designate their property as community property with the right of survivorship, ensuring that the surviving spouse becomes the sole owner automatically upon one spouse's death. Using a Salt Lake City Transfer on Death Deed or TOD — Beneficiary Deed for Two Individuals to a Trust is a practical and efficient way to ensure that your property transfers smoothly upon your death. By specifying the type of TOD deed that suits your needs, you can safeguard your property and provide for your loved ones without the burdens of probate.

Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust

Description

How to fill out Utah Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To A Trust?

Utilize the US Legal Forms and gain immediate access to any form template you need. Our convenient platform with thousands of document templates enables you to discover and acquire almost any document sample you may require.

You can download, fill out, and endorse the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust in mere minutes, rather than spending hours online searching for the correct template.

Using our catalog is an excellent method to enhance the security of your document submissions. Our qualified attorneys routinely examine all the paperwork to ensure that the forms are suitable for a specific area and in accordance with new laws and regulations.

How can you obtain the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust? If you already possess a subscription, simply Log In to your account. The Download option will appear on all the documents you browse.

US Legal Forms is among the most comprehensive and reliable template libraries available online. We are always eager to assist you with any legal process, even if it’s simply downloading the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust.

Feel free to take advantage of our services and make your document experience as effortless as possible!

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven't created a profile yet, follow the steps mentioned below.

- Locate the template you need. Ensure it's the template you were looking for: check its title and description, and use the Preview option if available. Otherwise, utilize the Search feature to find the one you require.

- Initiate the saving process. Click Buy Now and choose the pricing plan that works best for you. After that, create an account and pay for your order using a credit card or PayPal.

- Store the document. Select the format to obtain the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust and modify, complete, or sign it to suit your needs.

Form popularity

FAQ

Writing a beneficiary deed involves carefully following state requirements to ensure validity. You need to include key property details, the names of beneficiaries, and clear instructions on when the transfer will occur. Resourceful tools like US Legal Forms can provide templates specifically designed for the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust, making the process easier.

The best way to leave property upon death varies based on individual circumstances, but utilizing a transfer on death deed can be effective. This method allows for direct transfer while avoiding probate, making the process smoother for beneficiaries. Exploring the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust can offer an ideal solution.

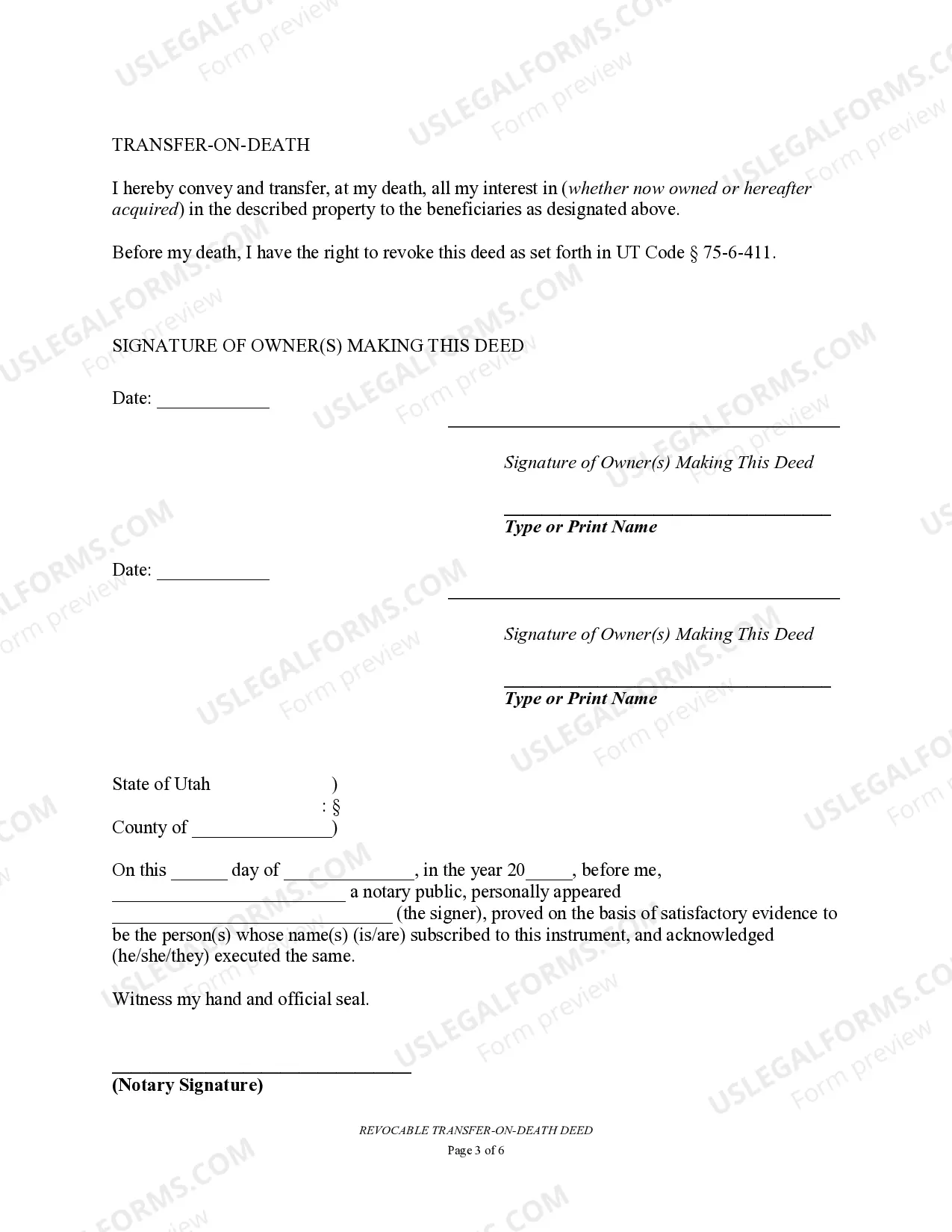

Yes, Utah does allow for the execution of transfer on death deeds. This legislation provides a straightforward way for individuals to transfer property without the delays of probate. The Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust is a practical option for many residents looking to simplify their estate plans.

While beneficiary deeds can simplify property transfer, there are some downsides to consider. They may not eliminate potential disputes among heirs and can have implications for Medicaid eligibility. Thoroughly understanding the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust is essential, and platforms like US Legal Forms provide valuable information.

Choosing between a transfer on death deed and a beneficiary deed often depends on your specific situation. Both provide a way to transfer property upon death without going through probate. The Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust allows flexibility, so consider your priorities before making a decision.

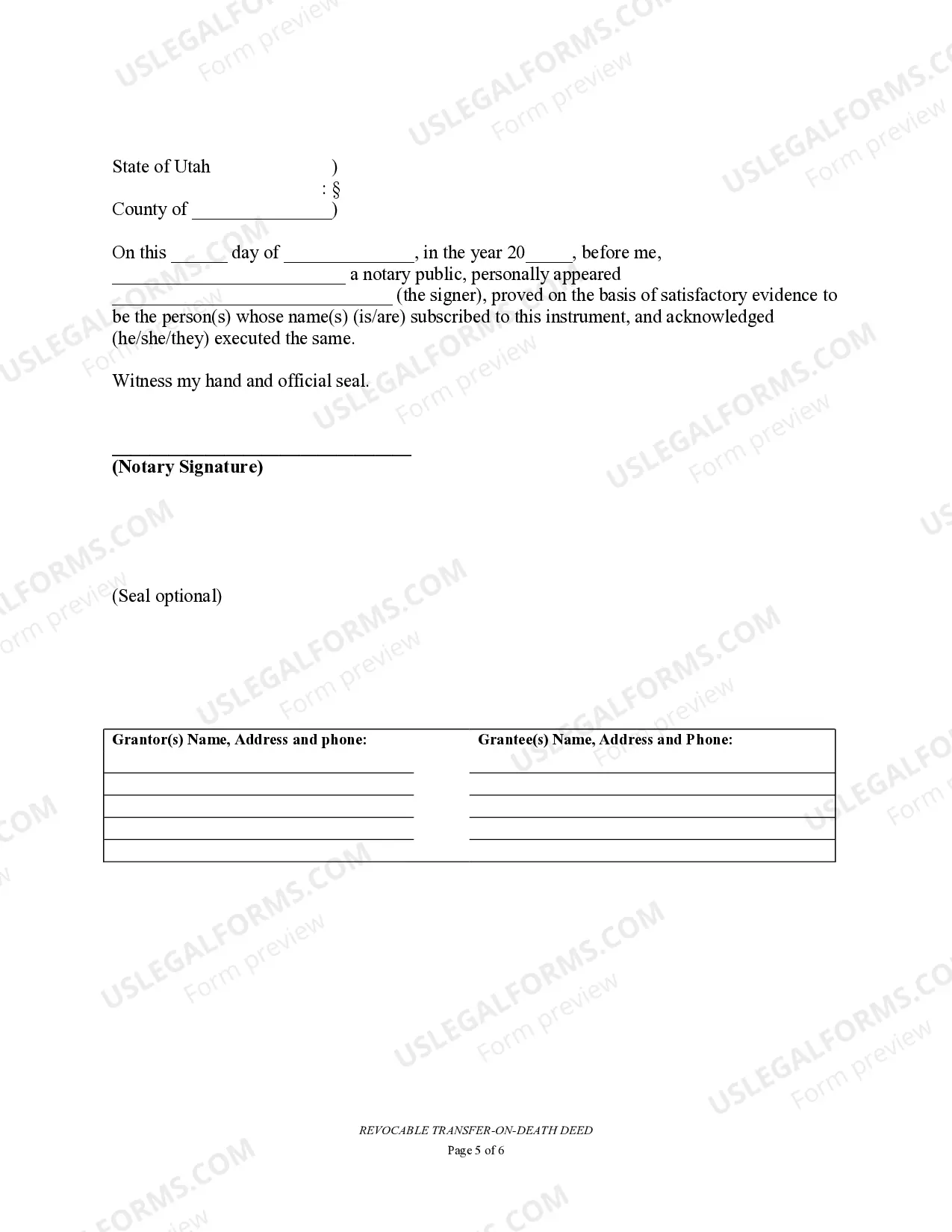

While it is not mandatory to hire a lawyer for a transfer on death deed, it is advisable to seek legal advice to avoid mistakes. A lawyer can help you understand the implications of the Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. Utilizing resources from US Legal Forms can also simplify this process.

You do not necessarily need a lawyer to create a beneficiary deed in Salt Lake Utah. However, consulting with a professional can ensure that the document meets all legal requirements. Using a reliable platform like US Legal Forms can also help guide you in drafting a comprehensive Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust.

Yes, Utah offers a Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. This legal document allows property owners to transfer their property to a designated beneficiary without the need for probate. It is a simple and effective way to ensure that your property goes to the people you choose after your passing. For more information on how to create a TOD deed, you can use the services provided by uslegalforms, which can guide you through the process.

A Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust does not inherently avoid capital gains tax. When you pass property through a TOD, the beneficiaries may still face capital gains tax based on the property's value increase. However, the step-up in basis at death can significantly reduce tax liability. It's useful to consult with tax advisors for comprehensive understanding regarding any potential tax implications.

A Salt Lake Utah Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust has limitations, including the lack of control after your passing. If circumstances change or if the beneficiary dies before you, the deed could create complications. Also, the property will not be considered part of the estate, potentially affecting your wishes regarding other assets. Consulting with legal professionals can clarify these concerns.