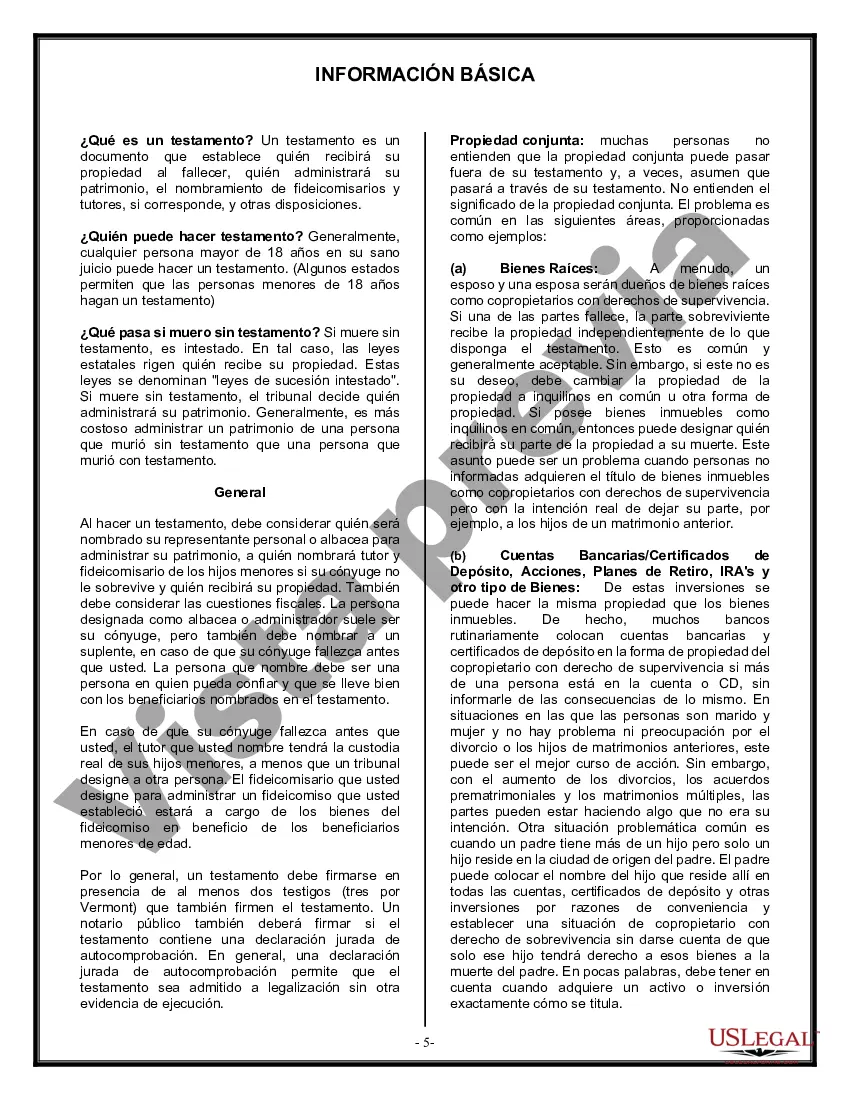

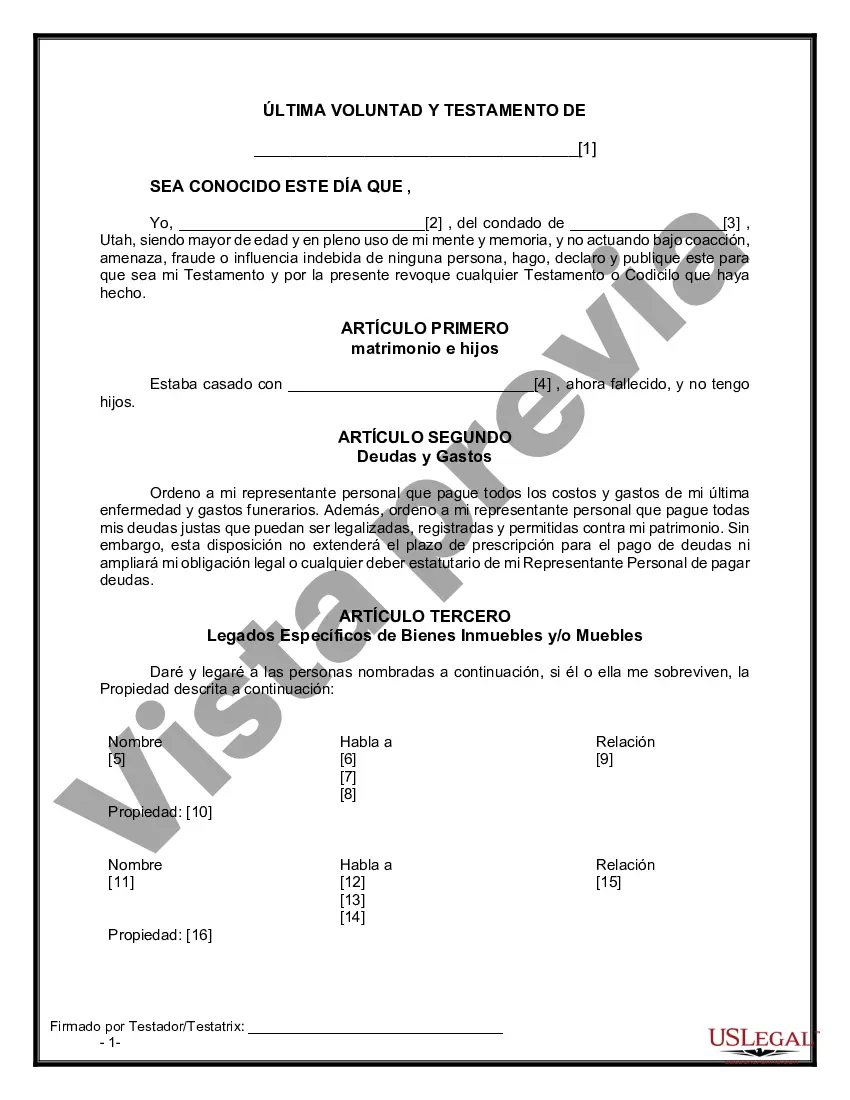

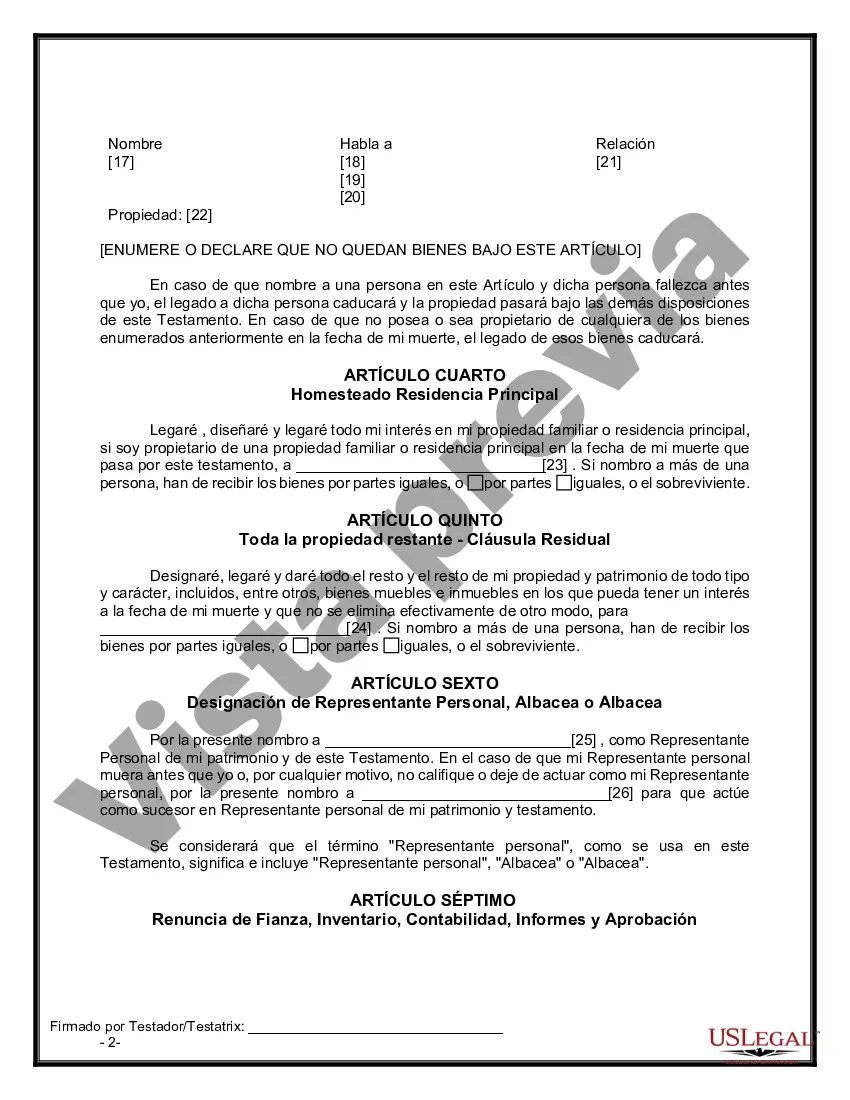

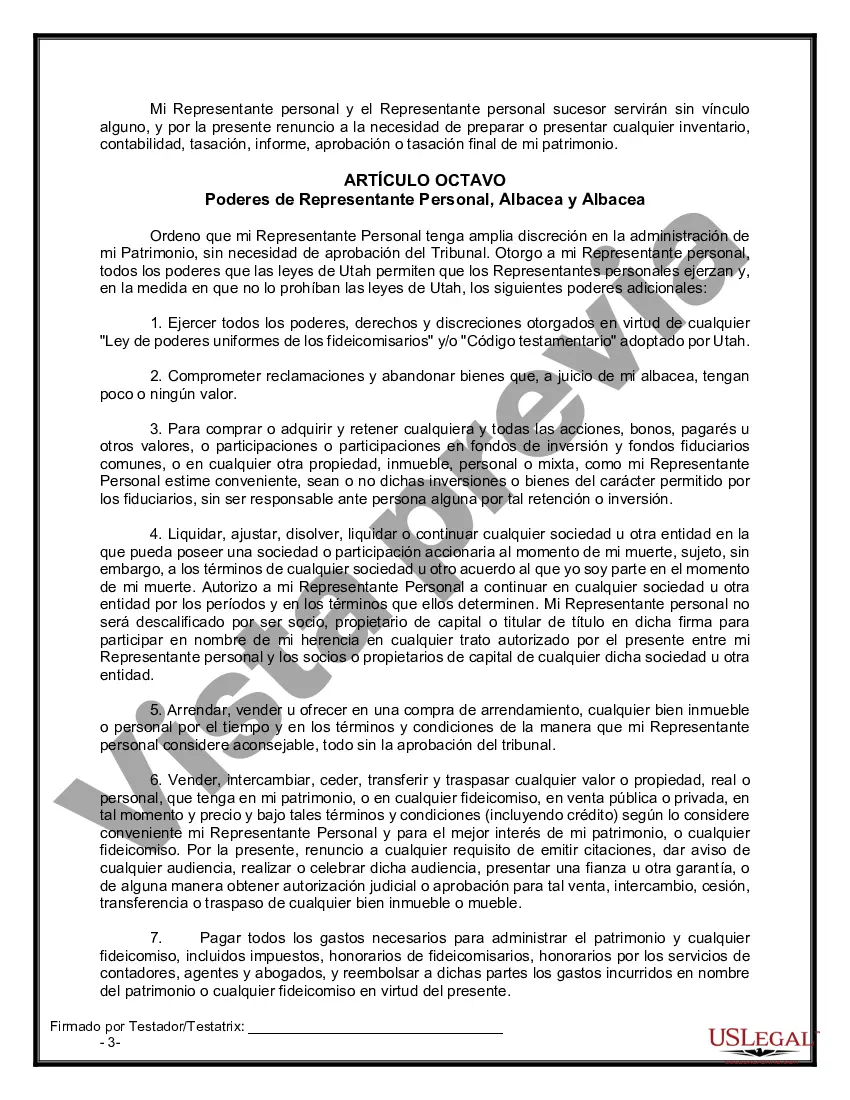

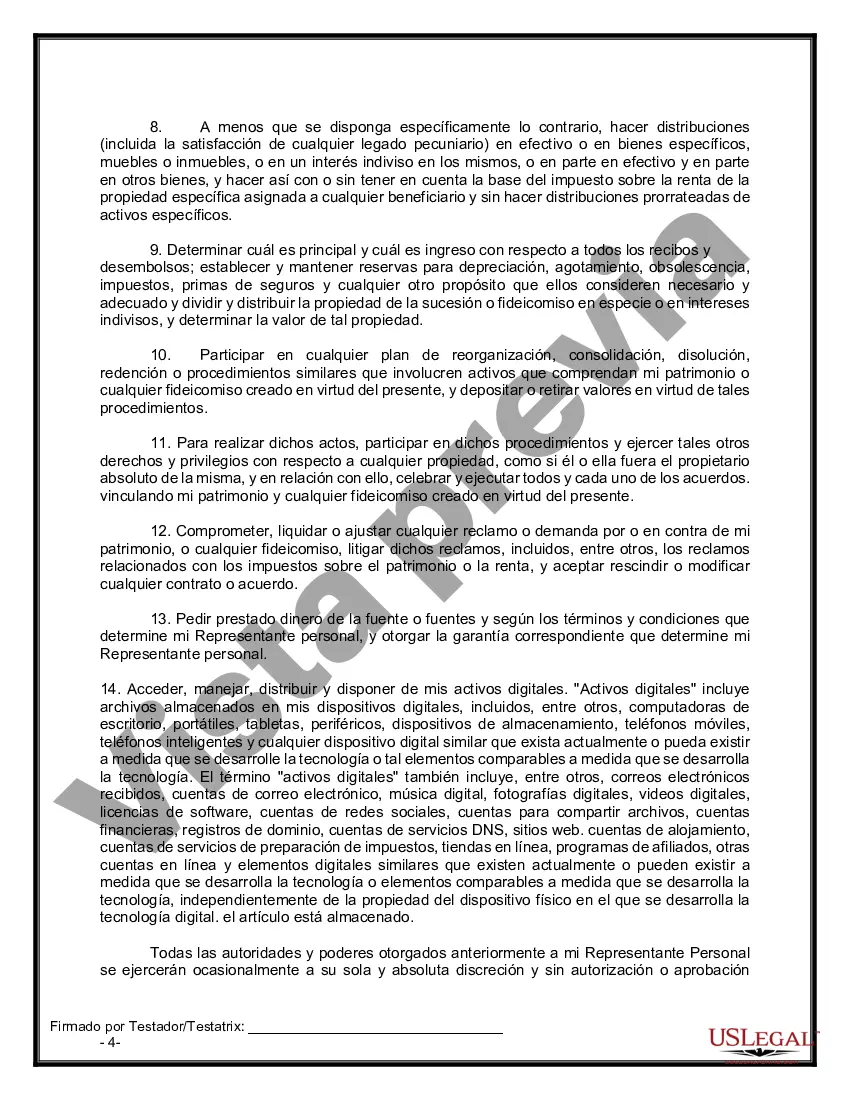

Description: The West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to outline their final wishes and distribute their assets upon their death. This comprehensive form covers all the essential components of a last will, empowering individuals to have control over how their estate will be managed and distributed after their passing. This specific West Jordan Utah legal last will form for a widow or widower with no children is designed to cater to the unique circumstances of individuals who find themselves in this situation. It acknowledges that without children, the distribution of assets may require different considerations and provisions compared to those with offspring. With this form, widows or widowers can provide clear instructions on how their assets should be divided among beneficiaries such as family members, friends, charitable organizations, or other loved ones. Some of the essential elements that may be included in the West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children are: 1. Personal Information: This section captures the vital information of the individual, including their full name, residence, date of birth, and any other relevant identification details. 2. Appointment of Executor: Granting the role of executor is a crucial decision for any individual creating a last will. This section allows the widow or widower to name a trusted person who will oversee the distribution of assets according to the instructions provided in the will. 3. Asset Distribution: This part of the form allows individuals to outline how they want their assets to be distributed after their death. It may include specific bequests to family members or friends, instructions for charitable donations, or any other desired allocations. 4. Debts and Taxes: The form typically requires individuals to address any outstanding debts or taxes and provide instructions on how these should be settled from their estate. 5. Residual Estate: In case there are any leftover assets after all specific provisions and bequests have been made, this section allows the individual to specify how these remaining assets should be distributed. 6. Testamentary Trust: If the individual wishes to establish a trust to manage their assets after their death, this section provides the opportunity to designate a trustee and outline the terms and conditions of the trust. Different West Jordan Utah Legal Last Will Forms for a Widow or Widower with no Children may exist depending on specific variations and preferences of individuals. Some variations may include the inclusion of additional provisions such as funeral arrangements, guardianship provisions for pets, or conditional bequests based on certain events. It is essential to consult with a qualified attorney familiar with Utah state laws to ensure the completed form meets all legal requirements and properly interprets the intentions of the individual. These legal professionals can help tailor the West Jordan Utah Legal Last Will Form to individual circumstances and draft provisions that accurately reflect the wishes and desires of the widow or widower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Jordan Utah Formulario de última voluntad legal para una viuda o viudo sin hijos - Utah Last Will for a Widow or Widower with no Children

State:

Utah

City:

West Jordan

Control #:

UT-WIL-01702

Format:

Word

Instant download

Description

Descarga en línea en formato Word. Formulario de testamento redactado profesionalmente con instrucciones.

Description: The West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to outline their final wishes and distribute their assets upon their death. This comprehensive form covers all the essential components of a last will, empowering individuals to have control over how their estate will be managed and distributed after their passing. This specific West Jordan Utah legal last will form for a widow or widower with no children is designed to cater to the unique circumstances of individuals who find themselves in this situation. It acknowledges that without children, the distribution of assets may require different considerations and provisions compared to those with offspring. With this form, widows or widowers can provide clear instructions on how their assets should be divided among beneficiaries such as family members, friends, charitable organizations, or other loved ones. Some of the essential elements that may be included in the West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children are: 1. Personal Information: This section captures the vital information of the individual, including their full name, residence, date of birth, and any other relevant identification details. 2. Appointment of Executor: Granting the role of executor is a crucial decision for any individual creating a last will. This section allows the widow or widower to name a trusted person who will oversee the distribution of assets according to the instructions provided in the will. 3. Asset Distribution: This part of the form allows individuals to outline how they want their assets to be distributed after their death. It may include specific bequests to family members or friends, instructions for charitable donations, or any other desired allocations. 4. Debts and Taxes: The form typically requires individuals to address any outstanding debts or taxes and provide instructions on how these should be settled from their estate. 5. Residual Estate: In case there are any leftover assets after all specific provisions and bequests have been made, this section allows the individual to specify how these remaining assets should be distributed. 6. Testamentary Trust: If the individual wishes to establish a trust to manage their assets after their death, this section provides the opportunity to designate a trustee and outline the terms and conditions of the trust. Different West Jordan Utah Legal Last Will Forms for a Widow or Widower with no Children may exist depending on specific variations and preferences of individuals. Some variations may include the inclusion of additional provisions such as funeral arrangements, guardianship provisions for pets, or conditional bequests based on certain events. It is essential to consult with a qualified attorney familiar with Utah state laws to ensure the completed form meets all legal requirements and properly interprets the intentions of the individual. These legal professionals can help tailor the West Jordan Utah Legal Last Will Form to individual circumstances and draft provisions that accurately reflect the wishes and desires of the widow or widower.

Free preview

How to fill out West Jordan Utah Formulario De última Voluntad Legal Para Una Viuda O Viudo Sin Hijos?

If you’ve already used our service before, log in to your account and save the West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your West Jordan Utah Legal Last Will Form for a Widow or Widower with no Children. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!