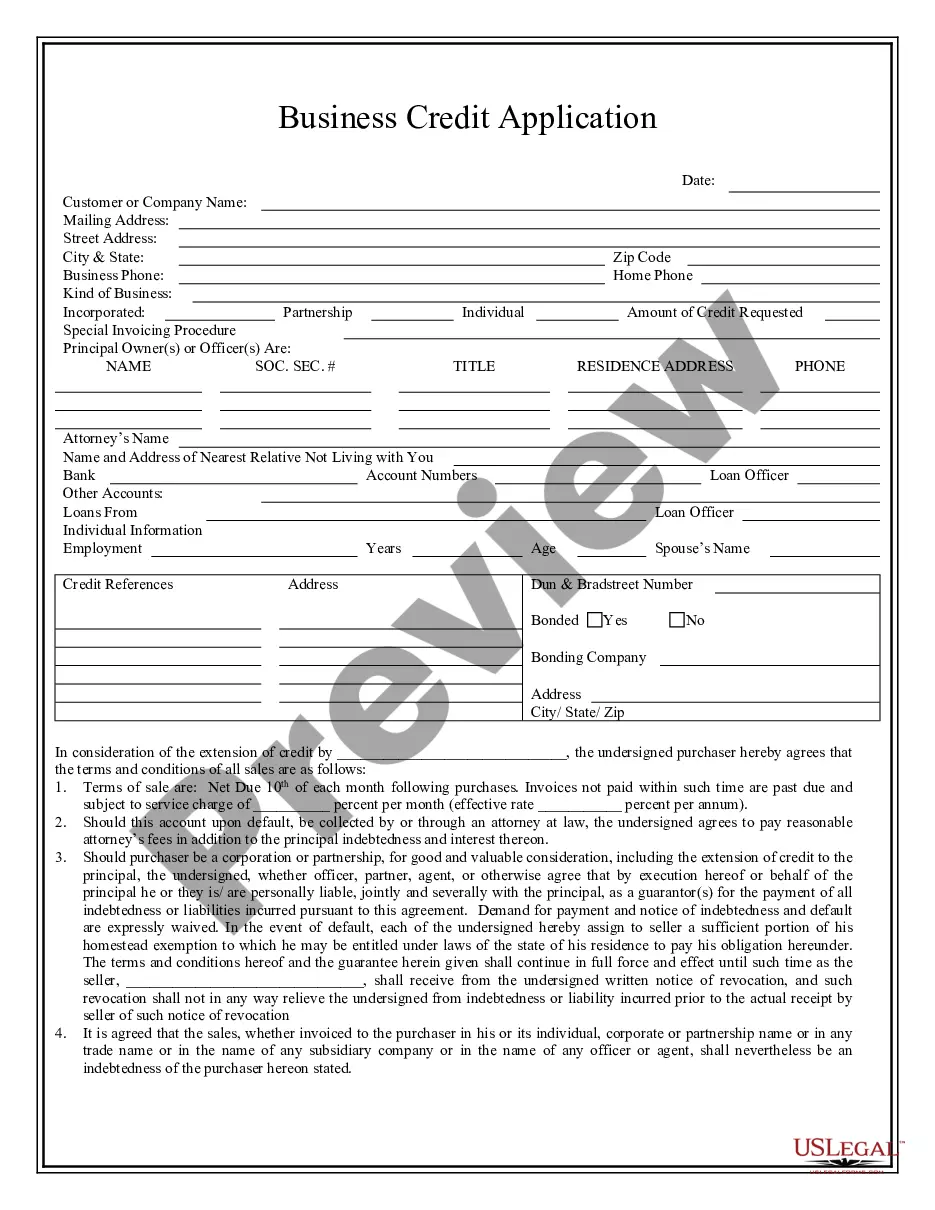

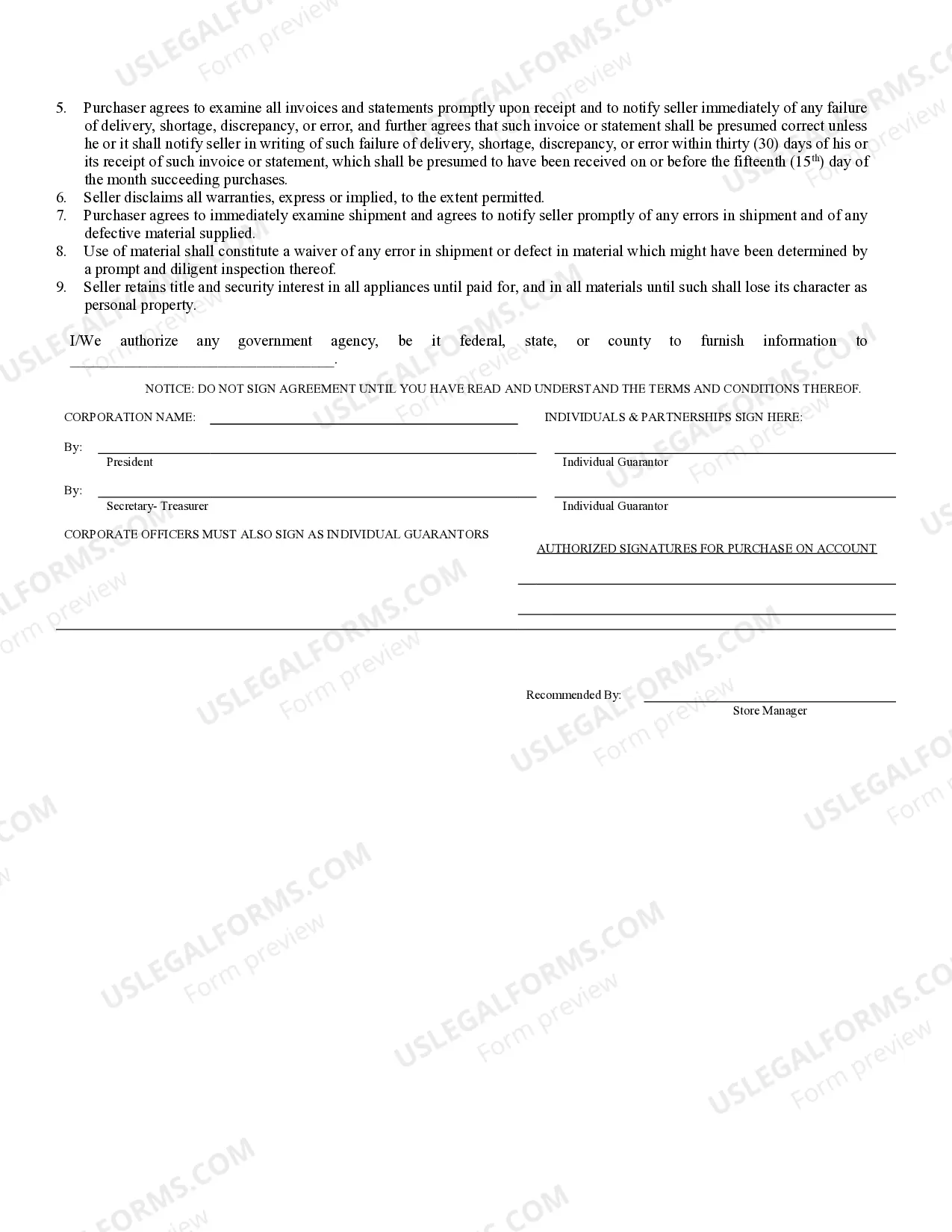

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Fairfax Virginia Business Credit Application is a crucial step for businesses in Fairfax, Virginia, seeking financial assistance to support their operations and growth. This application serves as a formal request to financial institutions or lenders for credit facilities or loans tailored specifically for businesses operating in Fairfax, Virginia. The application process involves providing detailed information and documentation to evaluate the creditworthiness and financial stability of the business. Keywords: Fairfax Virginia, business credit application, financial assistance, operations, growth, formal request, financial institutions, lenders, credit facilities, loans, creditworthiness, financial stability. There may not be specific types of Fairfax Virginia Business Credit Applications, but there can be various categories or types of business credit applications that businesses in Fairfax, Virginia can apply for. These may include: 1. Small Business Administration (SBA) Loans: These loans are offered through the U.S. Small Business Administration and provide financial assistance to eligible businesses in Fairfax, Virginia. SBA loans often require a comprehensive credit application process. 2. Traditional Bank Loans: Many local and national banks in Fairfax, Virginia offer business loans tailored to the needs of businesses. Each bank may have its own credit application process and requirements. 3. Line of Credit Applications: Businesses in Fairfax, Virginia can apply for a line of credit, which acts as a flexible source of financing. This type of application typically involves demonstrating creditworthiness and providing information about the business's financial health. 4. Vendor Credit Application: Some businesses rely on vendors for goods or services on credit. In these cases, a vendor credit application may be required to establish a credit relationship with the vendor. 5. Business Credit Card Applications: Fairfax businesses may also apply for business credit cards offered by various banking institutions. These cards provide a revolving line of credit for business expenses, and the application process generally includes providing business financial details and personal guarantees. 6. Equipment Financing Applications: Businesses looking to acquire machinery, vehicles, or equipment can apply for equipment financing. The application process typically includes providing information about the equipment and its purchase price. It's important for businesses in Fairfax, Virginia to carefully read and complete the credit application forms, ensuring accuracy and providing all necessary information and supporting documentation to increase their chances of securing credit facilities and loans.Fairfax Virginia Business Credit Application is a crucial step for businesses in Fairfax, Virginia, seeking financial assistance to support their operations and growth. This application serves as a formal request to financial institutions or lenders for credit facilities or loans tailored specifically for businesses operating in Fairfax, Virginia. The application process involves providing detailed information and documentation to evaluate the creditworthiness and financial stability of the business. Keywords: Fairfax Virginia, business credit application, financial assistance, operations, growth, formal request, financial institutions, lenders, credit facilities, loans, creditworthiness, financial stability. There may not be specific types of Fairfax Virginia Business Credit Applications, but there can be various categories or types of business credit applications that businesses in Fairfax, Virginia can apply for. These may include: 1. Small Business Administration (SBA) Loans: These loans are offered through the U.S. Small Business Administration and provide financial assistance to eligible businesses in Fairfax, Virginia. SBA loans often require a comprehensive credit application process. 2. Traditional Bank Loans: Many local and national banks in Fairfax, Virginia offer business loans tailored to the needs of businesses. Each bank may have its own credit application process and requirements. 3. Line of Credit Applications: Businesses in Fairfax, Virginia can apply for a line of credit, which acts as a flexible source of financing. This type of application typically involves demonstrating creditworthiness and providing information about the business's financial health. 4. Vendor Credit Application: Some businesses rely on vendors for goods or services on credit. In these cases, a vendor credit application may be required to establish a credit relationship with the vendor. 5. Business Credit Card Applications: Fairfax businesses may also apply for business credit cards offered by various banking institutions. These cards provide a revolving line of credit for business expenses, and the application process generally includes providing business financial details and personal guarantees. 6. Equipment Financing Applications: Businesses looking to acquire machinery, vehicles, or equipment can apply for equipment financing. The application process typically includes providing information about the equipment and its purchase price. It's important for businesses in Fairfax, Virginia to carefully read and complete the credit application forms, ensuring accuracy and providing all necessary information and supporting documentation to increase their chances of securing credit facilities and loans.